Home prices are important to the California economy for a number of reasons. In the short and medium terms, home price increases often drive construction activity, which in turn spurs employment growth in a wide range of sectors. In the longer term, chronically high housing costs have hurt the state’s business climate and been a key reason California loses residents to other states on net in most years.

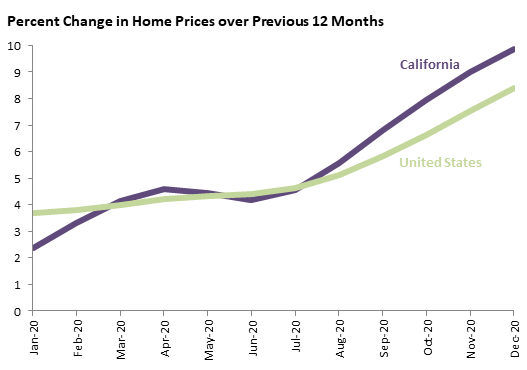

December 2020 data show that home price growth has accelerated even more in California than nationwide in recent months. Both are up sharply: the typical home in California has appreciated 9.9 percent since December 2019, while the national figure is 8.4 percent. Both of these represent the highest 12-month growth rates since 2014. Low mortgage interest rates that make monthly mortgage payments more affordable (all else equal) have contributed to the price increases, and the pandemic-driven shift to remote work may be affecting prices more in California than in most other states.

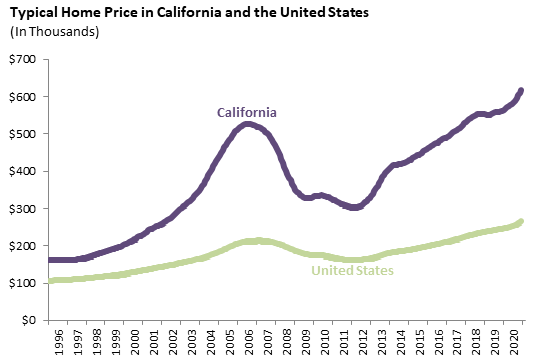

The slower home price growth that prevailed in 2018 and 2019 made a minor dent in the affordability gap between the state and the rest of the country. Housing in California has always been relatively expensive, and the gap has widened considerably since 2012. Previous recessions have had disparate effects on home prices: they were largely unaffected by the collapse of the dot-com bubble in 2001, while in the late 2000s the collapse of the housing bubble was the single biggest factor that led to the financial crisis. Recent evidence shows the affordability gap widening again.

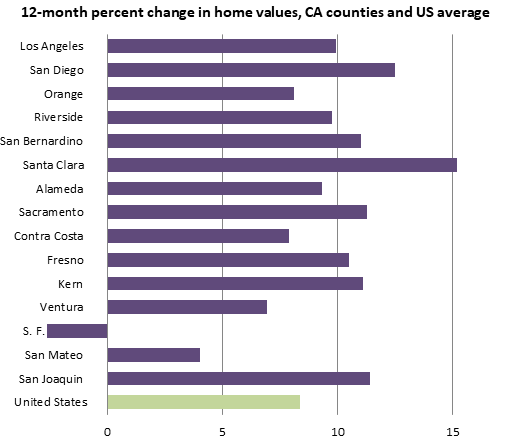

The graph below shows appreciation over the past 12 months for the state’s 15 largest counties, and suggests that the shift to remote work has been a key factor in recent price changes. San Francisco has long been northern California’s largest business hub, and historically a large share of its work force has commuted in from other counties. With remote work becoming more common, there is less of a premium on living close to the office and as such home prices in San Francisco have declined while prices in most counties from which large numbers of people commute into San Francisco have risen significantly. San Francisco’s average home price is down 2.6 percent over the past year, neighboring San Mateo is up just 4.0 percent, and every other large county in the state is up at least 7 percent.