The extent of new business creation in California can be a useful gauge of the health of the state’s economy. Past research suggests that new businesses account for a sizable share of job creation and also are more sensitive to swings in economic conditions than older businesses. Our own analysis of business formation data in California suggests that it typically has been a leading indicator of changes in unemployment.

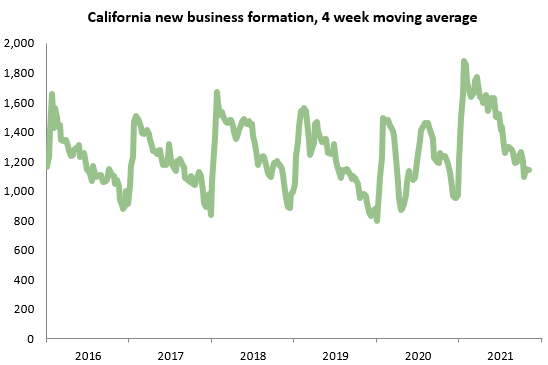

This graph shows U.S. Census data for the four-week average of new business creation since 2016, considering only those businesses that report having planned wages as opposed to shell corporations or holding companies. The standard pattern within a year is for a surge of new business formation at the beginning, then gradual declines as the year goes on. So far 2021 has seen a similar pattern to 2019, although with significantly more firms than usual being created in each week of the year.

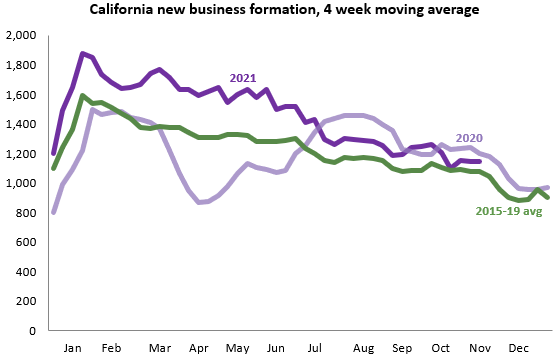

The next graph shows the four-week average growth rate in 2021 relative to both the 2020 figure and the 2015-19 average for the same weeks, and shows that 2021 has consistently outpaced the recent average albeit by narrowing margins as the year has gone on. The pace of business formation over the summer was slower in 2021 than in 2020, as the reopening of the economy in the summer of 2020 saw a flurry of business creation in response to the disruption caused by the pandemic. The most recent weeks show 2021 running below 2020 but still modestly above the 2015-19 average.