Background. In November 2016, California voters approved Proposition 64, which legalized the nonmedical use of cannabis. Proposition 64 created two excise taxes on cannabis: a retail excise tax and a cultivation tax. Chapter 56, Statutes of 2022 (AB 195, Committee on Budget) eliminated the cultivation tax on July 1, 2022.

Preliminary Total for Third Quarter of 2023: $157 Million. The administration currently estimates that retail excise tax revenue was $157 million in the third quarter of calendar year 2023 (July through September). The revised estimate for the second quarter of 2023 (April through June) is now $165 million, up 5 percent from the $157 million preliminary estimate announced in August.

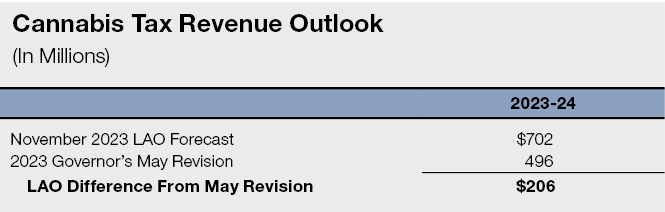

Current LAO Estimate for 2023-24: $702 Million. We currently project cannabis tax revenues of $702 million in 2023-24. As shown in the figure below, this forecast is $206 million above the budget package assumption for 2023-24.