Background. In November 2016, California voters approved Proposition 64, which legalized the nonmedical use of cannabis. Proposition 64 created two excise taxes on cannabis: a retail excise tax and a cultivation tax. Chapter 56, Statutes of 2022 (AB 195, Committee on Budget) eliminated the cultivation tax on July 1, 2022.

Preliminary Total for First Quarter of 2024: $153 Million. The administration currently estimates that retail excise tax revenue was $153 million in the first of calendar year 2024. The revised estimate for the fourth quarter of 2023 is now $159 million, up slightly from the $157 million preliminary estimate announced in February.

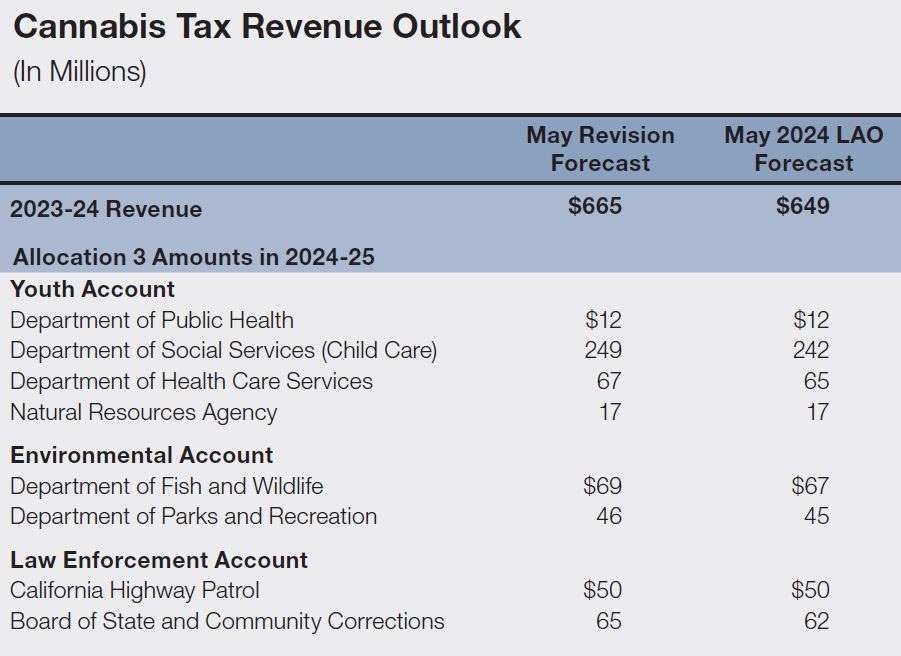

Current LAO Forecast for 2023-24: $649 Million. We currently project cannabis tax revenues of $649 million in 2023-24. This forecast is $16 million below the May Revision forecast. As shown in the figure below, the resulting 2024-25 revenue allocations are very similar to the administration’s May projections. Looking further ahead, our preliminary revenue projection for 2024-25 is $727 million, which is $32 million above the May Revision forecast for 2024-25.