LAO Contacts

- In-Home Supportive Services

- SSI/SSP

- CalWORKs

- Overall Human Services Issues

February 28, 2017

The 2017-18 Budget

Analysis of the Human Services Budget

CalWORKs

The California Work Opportunity and Responsibility to Kids (CalWORKs) program was created in 1997 in response to the 1996 federal welfare reform legislation that created the federal Temporary Assistance for Needy Families (TANF) program. CalWORKs provides cash grants and employment services to families whose income is inadequate to meet their basic needs. The CalWORKs program is administered locally by counties and overseen by the state Department of Social Services (DSS).

Cash Assistance. Grant amounts vary across the state and are adjusted for family size, income, and other factors. For example, a family of three in a high-cost county that has no other income currently receives a cash grant of $714 per month. After accounting for the variety of individual family circumstances, families enrolled in CalWORKs are estimated to receive an average grant of $534 per month during 2016‑17. Families enrolled in CalWORKs are generally also eligible for food assistance through the CalFresh program and health coverage through Medi-Cal.

Work Requirement. As a condition of receiving aid, able-bodied adults are generally subject to a work requirement, meaning that they must be employed or participate in specified activities—known as “welfare-to-work activities”—intended to lead to employment. CalWORKs cases that include individuals subject to the work requirement are entitled to receive services to help meet this requirement, including subsidized child care and reimbursement for transportation and certain other expenses.

Funding. CalWORKs is funded through a combination of California’s federal TANF block grant allocation ($3.7 billion annually), the state General Fund, realignment funds, and other county funds. In order to receive its annual TANF allocation, the state is required to spend a maintenance of effort (MOE) amount from state and local funds (including realignment and other county funds) to provide services for families eligible for CalWORKs. In recent years, this MOE amount has been $2.9 billion. Aside from funding for cash grants, counties receive various funding allocations from the state to administer CalWORKs. As will be discussed in greater detail below, the largest of these—referred to as the “single allocation”—provides funding for employment services, eligibility determination and other administrative costs, and child care subsidies.

Below, we provide an overview of the Governor’s 2017‑18 CalWORKs proposal and highlight issues related to the use of TANF funding in the state budget and funding for the CalWORKs single allocation.

Budget Overview

Trends in Total Funding. As shown in Figure 1, the Governor’s budget proposes $5.1 billion in total funding for the CalWORKs program in 2017‑18, a net decrease of $127 million (2 percent) relative to estimated current-year funding. This decrease reflects the net effect of two main adjustments. First, funding for cash assistance, services, and program administration is reduced to reflect a projected decline in caseload. Second, this reduction is partially offset by an increase in grant costs due to a full year of implementing the repeal of the maximum family grant (MFG) rule and a 1.43 percent grant increase provided effective October 2016. The net effect of these adjustments is an increase in grant costs of $76 million and a reduction of $198 million in the county single allocation.

Figure 1

CalWORKs Budget Summary

All Funds (Dollars in Millions)

|

2016-17 |

2017-18 |

Change From 2016-17 |

||

|

Amount |

Percent |

|||

|

Cash grants |

$2,969 |

$3,045 |

$76 |

3% |

|

Single Allocation |

||||

|

Employment services |

968 |

882 |

-86 |

-9 |

|

Eligibility determination and administration |

458 |

379 |

-79 |

-17 |

|

Stage 1 child care |

416 |

384 |

-32 |

-8 |

|

Cal-Learn case management |

20 |

19 |

-1 |

-5 |

|

Subtotals, Single Allocation |

($1,862) |

($1,664) |

(-$198) |

(-11%) |

|

Other County Allocations |

||||

|

Mental health/substance abuse services |

$127 |

$127 |

— |

— |

|

Expanded subsidized employment |

138 |

134 |

-$4 |

-3% |

|

Housing Support Program |

47 |

47 |

— |

— |

|

Family Stabilization Program |

40 |

40 |

— |

— |

|

Subtotals, Other County Allocations |

($352) |

($348) |

(-$4) |

(-1%) |

|

Othera |

$20 |

$19 |

-$1 |

-5% |

|

Totals |

$5,203 |

$5,076 |

-$127 |

-2% |

|

aPrimarily includes various state-level contracts. |

||||

Caseload Expected to Continue to Decline. The Governor’s budget updates previous caseload projections and assumes that an average of 463,540 families will receive CalWORKs assistance each month during 2016‑17. This updated projection reflects a roughly 7 percent decline relative to the prior year and a nearly 5 percent decline from previous projections for 2016‑17. The Governor’s budget further projects that an average of 459,173 families will receive CalWORKs assistance each month during 2017‑18, a decline of 1 percent relative to updated projections for 2016‑17.

Shifts in Funding Sources. As shown in Figure 2, within the total funding amount for CalWORKs, the budget proposes $450 million from the General Fund, a decrease of $232 million (34 percent) relative to current-year levels. Federal TANF funding proposed to be spent in CalWORKs is also down by $131 million. The decrease in General Fund and federal TANF support budgeted in CalWORKs primarily reflects (1) lower total funding requirements due to declining caseloads and (2) the availability of additional funding from other sources—specifically a one-time increase in realignment funds. With the expansion of Medi-Cal under the Patient Protection and Affordable Care Act, some individuals who previously received care in realignment-funded county indigent health programs instead are enrolled in state and federally funded Medi-Cal, reducing county costs and increasing state costs. Each year, realignment funds in the amount of estimated county savings are redirected to be spent in CalWORKs, to offset General Fund spending. The one-time funds in the Governor’s budget reflect a true-up to account for higher-than-estimated county savings in 2014‑15.

Figure 2

CalWORKs Funding Sources

(Dollars in Millions)

|

2016-17 |

2017-18 |

Change From 2016-17 |

||

|

Amount |

Percent |

|||

|

Federal TANF block grant funds |

$2,428 |

$2,297 |

-$131 |

-5% |

|

General Fund |

682 |

450 |

-232 |

-34 |

|

Realignment funds from local indigent health savings |

586 |

812 |

226 |

39 |

|

Realignment funds dedicated to grant increases |

319 |

331 |

12 |

4 |

|

Other county/realignment funds |

1,188 |

1,186 |

-2 |

—a |

|

Totals |

$5,203 |

$5,076 |

-$127 |

-2% |

|

aNegligible amount. TANF = Temporary Assistance for Needy Families. |

||||

TANF Funding in the State Budget

State Has Significant Flexibility in the Allocation of TANF Block Grant Funds. As shown in Figure 3, a majority of the state’s available TANF block grant funds (about 58 percent in 2017‑18) is used to support the CalWORKs program. These funds, however, are also used to support a variety of other programs in the state budget, such as student financial aid, Child Welfare Services, and community-based services for individuals with developmental disabilities. Federal law provides states significant flexibility in how TANF block grant funds may be spent. First, TANF block grant funds may be used to meet any of the four purposes of the TANF program defined in federal law, displayed in Figure 4. Second, TANF block grant funds may be used to support activities that were allowable under TANF’s predecessor program, Aid to Dependent Families with Children. For example, “emergency assistance” expenditures in Child Welfare Services fit this criterion. Finally, the state may transfer a portion of the TANF block grant funds received each year to certain other federal block grants, such as the Title XX Social Services Block Grant, to be expended according to the rules of the block grant receiving the transfer. (In the case of Title XX, funds may be used for a variety of purposes, including community-based services provided through the Department of Developmental Services for individuals with developmental disabilities.)

Figure 3

TANF Block Grant Spendinga

(In Millions)

|

2016-17 |

2017-18 |

Change From 2016-17 |

|

|

CalWORKs program |

$2,428 |

$2,297 |

-$131 |

|

Cal Grants student financial aid |

926 |

926 |

— |

|

Child Welfare Services |

359 |

366 |

7 |

|

CDE Stage 2 child care |

10 |

130 |

120 |

|

Transfer to Tribal TANF programs |

84 |

86 |

2 |

|

DDS regional centers |

77 |

77 |

— |

|

Automation projects |

63 |

53 |

-10 |

|

State administration costs |

31 |

31 |

— |

|

CDE and CCC contracts for services to CalWORKs recipients |

18 |

18 |

— |

|

Total Proposed TANF Expenditures |

$3,996 |

$3,984 |

-$12 |

|

Annual TANF block grant allocation |

$3,734 |

$3,734 |

— |

|

Unspent funds carried in from prior years |

512 |

250 |

-$262 |

|

Total TANF Funding Available |

$4,246 |

$3,984 |

-$262 |

|

Unspent Funds Available for Later Years |

$250 |

— |

-$250 |

|

aIncludes TANF funding transferred to Title XX Social Services Block Grant. TANF = Temporary Assistance for Needy Families; CDE = California Department of Education; DDS = Department of Developmental Services; and CCC = California Community Colleges. |

|||

Figure 4

The Four Purposes of TANF

|

|

|

|

|

TANF = Temporary Assistance for Needy Families. |

TANF Block Grant Funds Are Used to Offset What Otherwise Would Be General Fund Spending. Because the state has significant flexibility in how it may spend TANF block grant funds, TANF funding can be used to support programs and activities that otherwise would be supported by the General Fund, thereby freeing up General Fund dollars for other purposes. For example, prior to 2012‑13, student financial aid in the Cal Grants program was supported almost entirely by the General Fund. In 2012‑13, TANF funds were used to replace a significant amount of General Fund spending in Cal Grants, pursuant to the second and third federal TANF purposes. The amount of TANF funding provided to support Cal Grants has both increased and decreased in subsequent years. The 2017‑18 Governor’s budget proposes to provide $926 million for Cal Grants—roughly 47 percent of the program’s total funding. Similarly, TANF funding has historically been used to pay for a portion of costs in Stage 2 child care, which provides subsidized child care vouchers for current and former CalWORKs recipients. In recent years, Stage 2 has received $10 million of TANF funding. The Governor’s 2017‑18 budget proposal proposes to increase TANF funding for Stage 2 child care to $130 million, freeing up for other purposes $120 million in the General Fund that otherwise would be spent in Stage 2 child care.

Certain Factors Lead to TANF Spending Outside CalWORKs. In recent years, the amount of TANF funding spent outside the CalWORKs program has increased, from roughly $1 billion in 2014‑15 to nearly $1.7 billion proposed in 2017‑18. Certain factors contribute to the shift of TANF funding from CalWORKs to other budget items:

- Decreasing CalWORKs Program Costs. In 2017‑18, total funding for CalWORKs from all funding sources will have decreased by more than $400 million relative to 2014‑15, largely due to declining caseloads. This means that less funding is required from the program’s various funding sources to meet the program’s funding requirements under current law, allowing these funds to be spent elsewhere. However, for the reasons described below, when less total funding is needed to fund CalWORKs due to declining costs, it is the TANF funding that is more likely to be reduced than funding from the General Fund, realignment, or other county funds.

- Increasing Use of Realignment Funding in CalWORKs Budget. Since 2014‑15, the amount of realignment funding directed by current law to be spent in CalWORKs has increased. The increase in realignment funds available to support CalWORKs means that less General Fund and federal TANF funds are required. Furthermore, when total program funding requirements decrease due to declining caseloads as described above, General Fund and TANF funding are reduced but realignment funding is not, since current law specifies that the realignment funds must be spent on CalWORKs costs.

- MOE Requirement Limits Reductions to General Fund and Local Funding Support for CalWORKs. As described earlier, the state is required to spend a certain amount of state and local funds (including realignment and other county funds) each year in order to receive the TANF block grant. Under the Governor’s proposed 2017‑18 budget, state and local spending will be at the minimum allowed by the MOE. As a result, when total program funding requirements decrease due to declining caseloads, TANF funding is reduced and reallocated elsewhere in the state budget, rather than General Fund or local funds.

TANF Funding Could Be Used to Augment CalWORKs Program, at a Cost to the General Fund. The factors described above contribute to an increasing amount of TANF funding being spent outside the CalWORKs program as the CalWORKs caseload declines and the total funding requirements of the program under current law decrease. We note that federal TANF block grant funds could be redirected back to the CalWORKs program to pay for augmentations, such as higher grants or increased funding for county services and administration. Redirecting TANF funding from programs other than CalWORKs that are proposed to receive it would require backfilling lost TANF funding in those other programs with General Fund dollars.

Single Allocation Reduction

Background on County Allocations

Single Allocation Provides Bulk of County Funding to Administer CalWORKs. As shown in Figure 1 above, the Governor’s budget provides nearly $1.7 billion in funding for the county single allocation in 2017‑18. The single allocation encompasses different categories of funding for various purposes connected to administering the CalWORKs program:

- Employment Services. Employment services funding is used to provide case management, welfare-to-work activities like job search and job readiness assistance or education and training, and other services intended to help CalWORKs recipients obtain employment and increase earnings.

- Eligibility and Administration. Eligibility and administration funding is used to pay for the costs of determining initial and ongoing eligibility for CalWORKs, as well as other general overhead costs, such as those related to budget preparation, program oversight, and personnel functions.

- Stage 1 Child Care. Child care funding is used to provide child care vouchers that enable CalWORKs recipients to work or participate in activities intended to lead to employment. (CalWORKs families initially receive child care vouchers through the Stage 1 CalWORKs child care program, funded from the county single allocation, until their employment or participation in welfare-to-work activities is deemed stable by the county. Once a family is deemed stable, child care vouchers are provided through the Stage 2 CalWORKs child care program, which is funded separately through the California Department of Education’s budget and is not part of the CalWORKs single allocation.)

- Cal-Learn Case Management. Cal-Learn funding is used to provide intensive case management for individuals enrolled in Cal-Learn—a component of the CalWORKs program that encourages pregnant and parenting teens to complete high school or an equivalent.

Single Allocation Categories Budgeted Separately . . . As part of the annual budget process, the administration proposes statewide funding amounts for each category in the single allocation separately, based on established methodologies that adjust funding from prior years based on caseload projections, assumed costs per case, and adjustments for policy changes that are expected to affect program costs.

Generally, when caseloads increase, the single allocation increases and when caseloads decline, so does the single allocation. The single allocation also increases or decreases due to changes in assumed costs per case. Cost per case assumptions are typically updated to reflect policy changes that affect county workload, such as new activities required by state legislation or new efficiencies due to simplified administrative requirements. However, the budget historically has not made regular adjustments to reflect changes in baseline county costs to administer the program, such as changes in the cost of labor or facilities, sometimes referred to as the “cost of doing business.”

After the statewide amounts are determined through the budget process, funds for each category are allocated to individual counties according to a schedule developed jointly by DSS and the County Welfare Directors Association. Single allocation funds generally must be spent by counties within the fiscal year. Unspent funds revert to the state.

. . . But Single Allocation May Be Spent Flexibly Across Categories. Although single allocation categories are budgeted and allocated to counties separately, counties can, and do, spend their total single allocation funds flexibly across the categories. As a result, actual spending on the individual single allocation categories often differs from the amounts determined in the state budget. This flexibility is intended to allow counties to adapt to local circumstances or differences in county costs that may not be well reflected in the process used to determine the statewide single allocation amount or the process used to allocate that statewide amount to individual counties.

Counties Receive Additional Allocations. In addition to the single allocation, counties receive several other allocations to operate CalWORKs that total $348 million in the proposed 2017‑18 budget. These include $127 million for mental health and substance abuse services; $134 million for Expanded Subsidized Employment, which provides dedicated funding for counties to support subsidized positions for CalWORKs recipients; $47 million for the CalWORKs Housing Support Program, which assists homeless CalWORKs families to obtain permanent housing; and $40 million for the Family Stabilization Program, which provides intensive case management and other services beyond those provided from the single allocation for CalWORKs families experiencing a destabilizing situation that prevents them from participating in welfare-to-work activities. Like the single allocation, these allocations generally must be spent within the fiscal year and unspent funds revert to the state. Unlike the single allocation, these funds are not flexible and must be spent on the purposes specified in each individual allocation.

LAO Comments

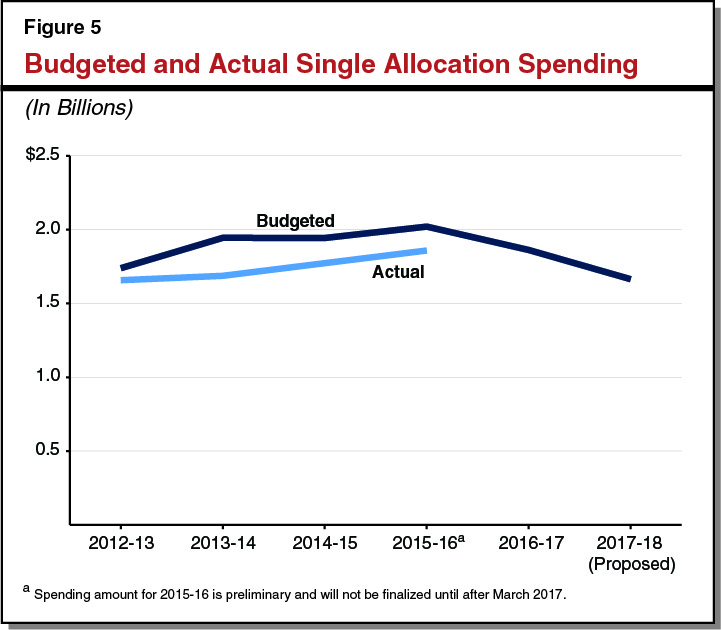

County Spending Lagged Growth in Budgeted Single Allocation. From 2013‑14 through 2015‑16, the amount of funding provided in the state budget for the CalWORKs single allocation generally grew, as shown in Figure 5. This is in large part because certain exemptions to the work requirement were being phased out and formerly exempt cases required employment services and child care subsidies in order to meet the work requirement. Actual county spending from the single allocation also grew over this period, but lagged growth in the budget. As a result, counties spent less than was budgeted in each of these years. Some potential causes for the lagged growth in county spending are that some counties may have been cautious in increasing spending following the recession or may have faced practical challenges in ramping up staffing and services at the pace the new funding was provided.

Proposed 2017‑18 Reduction to Single Allocation Follows Reduction in 2016‑17. After increasing from 2013‑14 through 2015‑16, the budget decreased funding for the single allocation in 2016‑17 by $160 million to reflect a projected decline in the number of cases requiring services and child care subsidies. (Once the exemptions described above were fully phased out, the number of cases requiring services and child care began to decline with the number of total families receiving cash assistance, due to the improving economy.) As described previously, the Governor’s budget reduces funding for the CalWORKs single allocation in 2017‑18 by an additional $200 million relative to 2016‑17. The proposed 2017‑18 reduction is also related to a projected decline in caseload. However, as we describe below, the effect of these two consecutive reductions to the single allocation on actual county spending is likely to be different in practice.

Limited County Action Required, if Any, to Align Spending With Lower Budget in 2016‑17 . . . As shown in Figure 5 above, counties did not fully expend the budgeted single allocation in 2015‑16. Preliminary administrative data indicate that, as of this January, counties collectively spent $1.9 billion from the 2015‑16 single allocation—roughly $160 million less than was budgeted for 2015‑16 and roughly equal to the amount budgeted for 2016‑17. This means that, despite a decline in the amount budgeted for the single allocation in 2016‑17, counties could spend the same amount or nearly the same amount in 2016‑17 as they did in 2015‑16 by spending the entire amount budgeted for the single allocation in 2016‑17. In other words, if counties collectively spend the entire 2016‑17 single allocation, only limited actions will be required, if any, to align spending with the lower budgeted amount. (We note that, due to differences in county caseload trends and the way funding from the statewide single allocation is allocated to individual counties, even if counties fully expend the 2016‑17 single allocation in aggregate, actual spending may increase in some counties and decrease in others.)

. . . More Actions May Be Needed to Align Spending With Budget in 2017‑18. The proposed 2017‑18 single allocation, about $1.7 billion, is less than both the amount spent in 2015‑16 and the amount likely to be spent in 2016‑17. Thus, counties would likely need to take additional actions in 2017‑18 to align spending with the additional caseload-driven reductions in the Governor’s budget.

Caseload-Driven Approach to Budgeting Is Reasonable . . . The number of families served in CalWORKs changes from year to year depending on various factors, most importantly the state of the economy. It is reasonable to expect that county costs will increase or decrease depending on the number of families served. The administration’s budgeting methodology, and the single allocation reduction proposed in the Governor’s budget, are consistent with that expectation.

. . . But in Some Years Counties May Have Difficulty Quickly Adjusting to Changes in Funding Levels. While a caseload-driven approach to budgeting single allocation funds makes sense in general, there are instances in which the outcome of this approach may present challenges for counties. In particular, counties may have difficulty quickly adjusting to more significant changes in funding levels, as appears to have been the case from 2013‑14 through 2015‑16, when counties underspent the budgeted single allocation as it grew. Similarly, some counties may have more difficulty quickly adjusting to the reduction in single allocation proposed in the 2017‑18 budget.

Key Questions for Legislative Consideration. The actual effect of the proposed reduction on county service levels is unclear for a variety of reasons. Below, we outline some key questions for the Legislature to consider as it evaluates the proposed CalWORKs budget.

- What Steps Will Counties Take to Adjust to Reduced Caseloads and Funding? Due to variation in how counties approach CalWORKs administration, counties are likely to respond to reduced caseloads and the reduction in the single allocation in different ways. For example, counties might take steps to reduce spending in light of lower caseloads that could include reducing contract costs, reducing staffing levels, reallocating staff to other health and human services programs, or a combination of all three. As part of the budget subcommittee review of the proposed budget, the Legislature may wish to ask DSS and counties to report on how counties would reduce spending to reflect lower caseloads and how services might change.

- Have Changes in Base County Costs Affected Services Levels? As noted above, the single allocation budgeting methodology generally does not make adjustments to reflect changes in county cost of doing business. Changes in cost of doing business will vary by county, but, over time, growth in county costs would lead to pressure on the amount of single allocation funding that is provided for a given number of cases. The Legislature may wish to ask DSS and counties to report on how changes in county costs may have affected the services provided through the single allocation.

- Does the Proposed Budget Reflect Changes in Services Needs of the Caseload? Since 2012‑13, the CalWORKs program has been more focused on addressing the needs of cases with significant barriers to employment. As the state’s economy improves and the CalWORKs caseload continues to decline, it may be that cases that remain in the program despite an improving economy have more significant barriers to employment, on average, than when the state of the economy is poor and CalWORKs caseloads are larger. The Legislature may wish to ask DSS to report on how its budgeting methodology accounts for changes in the services needs of the CalWORKs caseload.

- How Might Other CalWORKs Allocations Be Affected? As described above, counties receive several other allocations to provide services in CalWORKs in addition to the single allocation. Most of these allocations, including Expanded Subsidized Employment, the Housing Support Program, and the Family Stabilization Program, were created recently (since 2013‑14). These new allocations are intended to build on, not replace, the single allocation and cannot be mingled with single allocation funds. However, some of the services provided from these allocations can be similar to services provided from the single allocation and may have affected to some degree what services counties provide from the single allocation. Changes in funding levels for the single allocation may also affect how counties use other allocations. The Legislature may wish to ask DSS and counties to report on how the various CalWORKs allocations interrelate and how the proposed reduction in the single allocation might affect the services from all allocations.

LAO Assessment

CalWORKs Budget Consistent With Current Law and Practice. In our view, the Governor’s 2017‑18 CalWORKs budget proposal is consistent with current law and budgetary practice. The CalWORKs budget is largely driven by assumptions made by the administration about the number of families that will receive assistance and what services they will need. Based on information about current caseload levels available at this time, the administration’s caseload projections appear reasonable.

Questions About Practical Effect of Proposed Single Allocation Reduction. As described above, while the proposed reduction to the single allocation is consistent with current law and budgetary practice, we raise several questions relative to the potential practical effects of the reduction for the Legislature to consider as it reviews the administration’s proposal.

Will Revisit Caseload and Other Assumptions at May Revision. We note that, due to data conversion issues associated with the rollout of Los Angeles County’s new eligibility determination and case management system, actual caseload numbers for Los Angeles County for certain aspects of the CalWORKs program are not available for most of 2015‑16 or any of 2016‑17. Because roughly one-third of the state’s CalWORKs caseload resides in Los Angeles County, these missing data introduce additional uncertainty into projections for 2017‑18. The department has indicated that the missing data is currently being validated and will be released in the near future. Additionally, we anticipate that additional months of actual caseload data for the rest of the state, along with more information on actual county spending from the 2016‑17 single allocation, will be available in advance of the May Revision. We will revisit caseload assumptions at the time of the May Revision to determine whether we would recommend any changes to the administration’s projections and what affect these changes would have on the CalWORKs budget, including the proposed reduction to the county single allocation.