LAO Contacts

February 22, 2019

The 2019-20 Budget

Analysis of the Department of

Social Services Budget

Executive Summary

The Department of Social Services Administers Several Major Human Services Programs. California’s Department of Social Services (DSS) administers a number of human services programs that provide a variety of benefits to the state’s residents. These include income maintenance for the aged, blind, or disabled; cash assistance and employment services for low‑income families with children; protecting children from abuse and neglect; and providing home care workers who assist the aged and disabled in remaining in their own homes. This report provides information, analysis, and recommendations on the Governor’s 2019‑20 proposals for the major programs in DSS.

Governor’s Proposed Grant Increase for CalWORKs Is a Step Towards the Legislature’s Goal, but With Some Key Differences. The 2018‑19 budget package included statutory intent language stating the Legislature’s goal to increase the California Work Opportunity and Responsibility to Kids (CalWORKs) grants to ensure participating families’ incomes are above 50 percent of the federal poverty level (FPL) by 2020‑21. The 2018‑19 budget approved the first step of this plan by providing an across‑the‑board 10 percent grant increase effective April 1, 2019. The Governor’s budget proposes to further increase CalWORKs grants by 13.1 percent, which would raise grant levels for CalWORKs cases with three eligible family members to 50 percent of FPL for a family of three. The proposal assumes the grant increase would go into effect October 1, 2019 and cost $348 million in 2019‑20. Full‑year costs are expected to be $455 million in 2020‑21. The administration’s proposal differs from the Legislature’s plan in terms of how grant increases are distributed across CalWORKs cases of different sizes, how much overall grant amounts increase, and when the increases would occur. We provide background on the Legislature’s plan for CalWORKs grant increases, describe how it differs from the Governor’s proposal, and provide the Legislature with options to consider as it shapes its 2019‑20 plan for CalWORKs.

Setting a Target for the CalWORKs Portion of the Safety Net Reserve. In 2018‑19, the Legislature created the Safety Net Reserve account and made an initial deposit of $200 million General Fund into the reserve. Funds in the Safety Net Reserve were to be available for two programs—CalWORKs and Medi‑Cal. (The $200 million initial deposit was made in the CalWORKs subaccount.) These programs are counter‑cyclical—meaning program spending ramps up during economic downturns, as more people become eligible to receive benefits, and slows during periods of economic growth when the labor market is stronger. We provide background on the Safety Net Reserve, review how the Great Recession affected CalWORKs, and simulate three recession scenarios to help the Legislature consider a target level for the CalWORKs portion of the Safety Net Reserve. We estimate that cumulative additional costs in CalWORKs could range from $2 billion (as a result of a minor recession) to more than $6 billion (over the course of a major recession). With these amounts in mind, we recommend that the Legislature set a target based on the share of these additional costs it intends for the Safety Net Reserve to cover during a recession, and assess the Governor’s proposed Safety Net Reserve deposit based on whether it is in‑line with the Legislature’s target.

Governor’s Proposals for IHSS and SSI/SSP Program Appear Reasonable. We have reviewed the administration’s 2019‑20 budget proposals for the In‑Home Supportive Services (IHSS) and the Supplemental Security Income/State Supplementary Payment (SSI/SSP) programs. While we raise a few issues for legislative consideration—for example, questions related to the implementation of the elimination of the SSI cashout policy—overall we find the administration’s proposals to be reasonable at this time. We will continue to monitor IHSS and SSI/SSP programs and update the Legislature if we think any changes to the caseload and budgeted funding levels should be made.

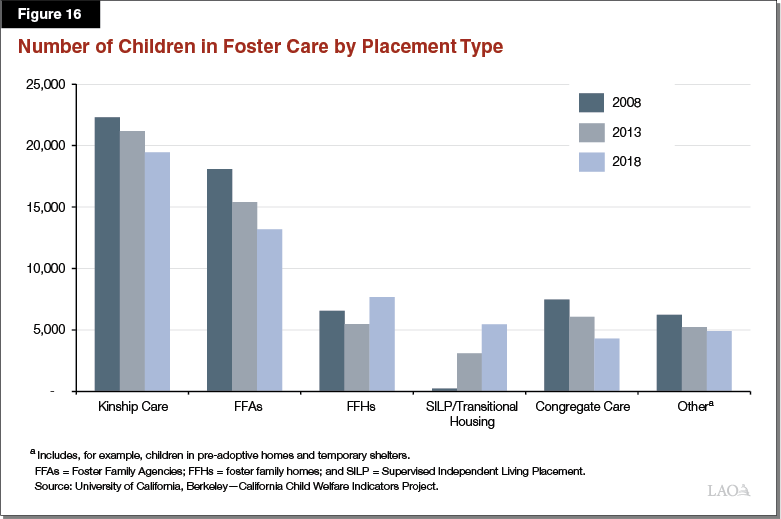

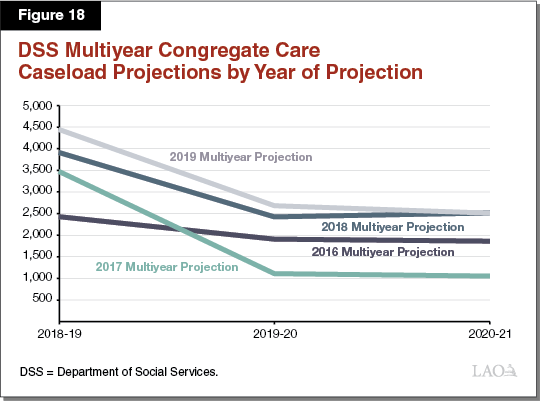

Governor Continues to Implement Continuum of Care Reform (CCR), Some Challenges Remain. The Governor’s budget proposes funding in 2019‑20 to continue to implement CCR in the state’s foster care system. At a high level, CCR aims to reduce reliance on long‑term group home placements and increase the utilization and capacity of home‑based family placements for children in the foster care system. While the Governor’s proposal for CCR does not include any major policy changes, it does reflect more up‑to‑date estimates of the costs of CCR implementation—including the expiration of certain temporary funding augmentations for the counties. We provide background on CCR, highlight a few implementation challenges, describe the Governor’s funding proposal, and raise issues and questions for legislative consideration.

CalWORKs

Background

The California Work Opportunity and Responsibility to Kids (CalWORKs) program was created in 1997 in response to the 1996 federal welfare reform legislation that created the federal Temporary Assistance for Needy Families (TANF) program. CalWORKs provides cash grants and job services to low‑income families. The program is administered locally by counties and overseen by the state Department of Social Services (DSS).

Cash Assistance. Grant amounts are adjusted for family size, income level, and other factors. As an example, a family of three in a high‑cost county that has no other earned income currently receives $714 per month. In 2018‑19, the average CalWORKs grant amount is estimated to be $568 monthly. (As will be discussed later, grant amounts are scheduled under current law to increase in April 2019. The 2018‑19 average grant amount accounts for this increase.) Adults may receive cash assistance for up to 48 months. Adults who exceed the time limit are no longer included as part of the CalWORKs case for purposes of determining the family’s grant amount. (Children and other eligible adults in these families continue to receive assistance.) This has the effect of reducing the family’s monthly grant amount, typically by $100 to $200 per month for each ineligible member. Families enrolled in CalWORKs are typically also eligible for CalFresh food assistance and Medi‑Cal health coverage.

Work Requirement and Employment Services. As a condition of receiving aid, adults are generally required to be employed or to participate in job search and readiness training. People who are enrolled in these activities may also receive services to help them meet these requirements, including subsidized child care, reimbursement for transportation, and housing assistance. Housing assistance may include short‑term vouchers, rental deposits, and long‑term subsidized housing. Adults who do not meet the work participation requirements of the program may be sanctioned. Sanctioned adults are temporarily ineligible to receive cash assistance, meaning grants for these families are reduced by between $100 and $200 per month until the sanction is addressed.

In More Than One‑Half of Cases, Family Size Differs From CalWORKs Assistance Unit Size. Monthly CalWORKs grant amounts are set according to the size of the assistance unit (AU). The size of the AU is the number of CalWORKs‑eligible people in the household. Grant amounts are adjusted based on AU size—larger AUs are eligible to receive a larger grant amount—to account for the increased financial needs of larger families. In almost one‑half of CalWORKs cases, everyone in the family is eligible for CalWORKs and therefore the AU size and the family size are the same. In about 55 percent of cases, though, one or more people in the family are not eligible for CalWORKs and therefore the AU size is smaller than the family size.

Some Family Members May Not Be Counted. People may be ineligible for CalWORKs for a number of reasons. Most commonly, people are ineligible because they (1) have exceeded the 48‑month time limit, (2) are currently sanctioned for not meeting the work participation requirements, or (3) are receiving Supplemental Security Income/State Supplementary Payment (SSI/SSP) benefits and therefore ineligible to receive both SSI/SSP and CalWORKs. Additionally, many individuals are ineligible due to their immigration status. Undocumented immigrants, as well as most immigrants with legal status who have lived in the United States for fewer than five years, are ineligible.

Funding. CalWORKs is funded through a combination of California’s federal TANF block grant allocation ($3.7 billion annually), the state General Fund, realignment funds, and county general funds. To receive its annual TANF block grant, the state must spend a maintenance‑of‑effort (MOE) amount from state and local funds to provide services for families eligible for CalWORKs. This MOE amount is $2.9 billion. In addition to funding for cash grants, counties receive several other funding allocations from the state to administer and operate CalWORKs. The main funding allocation—known as the “single allocation”—funds employment services, eligibility determination and administrative costs, and child care subsidies.

Recent Changes

2018‑19 Budget Enacted Significant CalWORKs Changes. The 2018‑19 Budget Act implemented several changes to the CalWORKs program. The 2019‑20 Governor’s Budget proposes adjustments to these changes. Below, we outline the major CalWORKs components of the 2018‑19 budget agreement.

- Legislature Outlines Multiyear Plan for CalWORKs Grant Increases. As part of the 2018‑19 Budget Act, the Legislature set a goal to increase CalWORKs grants so that monthly grant levels are high enough such that CalWORKs families’ incomes are above 50 percent of the federal poverty level (FPL). (The U.S. Census Bureau designates families with cash resources below 50 percent of the FPL as living in “deep poverty.”) The goal of the Legislature’s plan is to ensure that no children live in families who have monthly cash income that is below the threshold for deep poverty. To meet this objective, budget‑related legislation included a three‑year plan, subject to annual appropriation, to ultimately increase grants to 50 percent of the FPL for a family that is one person larger than the CalWORKs AU size. The Legislature chose this expanded family size as its target because, as discussed earlier, more than one‑half of CalWORKs families include an ineligible family member—typically due to their immigration status, having reached the 48‑month time limit, or not meeting the program’s work requirements. Setting grants to 50 percent of the FPL for a larger family size has the effect of ensuring that families with an ineligible member also have monthly cash incomes above the deep poverty threshold.

- 10 Percent Grant Increase Provided as First Step in Legislature’s Plan. The 2018‑19 budget included a 10 percent across‑the‑board grant increase as the first step in meeting the Legislature’s ultimate goal. Throughout this report, we refer to this upcoming increase as the “current‑law” increase because it is scheduled, under current law, to go into effect April 1, 2019. The maximum grant for a family of three will increase from $714 per month to $785 per month. The administration estimates that the full‑year cost of this increase will be $320 million in 2019‑20. If funded, the second step in the Legislature’s plan would occur in 2019‑20. This interim grant increase would raise grants for all families up to an amount that is halfway between the current‑law grant level and the ultimate goal of 50 percent of poverty for family that is one person larger than the CalWORKs AU size. The final step, to go into effect in 2020‑21 if funded, would raise grants from the interim amount to the ultimate goal.

- Newly Created Safety Net Reserve Receives $200 Million Up‑Front Deposit. The 2018‑19 budget plan created the Safety Net Reserve, which aims to set aside funds for future expenditures of two programs: CalWORKs and Medi‑Cal. (These are programs that, during a recession, typically have increased expenditures as caseload increases.) The 2018‑19 budget plan deposited an initial $200 million in the CalWORKs subaccount and directed the administration to develop a methodology to (1) calculate savings that occur in the programs when the caseload declines and (2) deposit a portion of these savings into the reserve in future years.

- New CalWORKs Home Visiting Initiative. The budget included $158 million in federal TANF funds to begin a three‑year home visitation program within CalWORKs. Under the new program, CalWORKs families with a child under two years old could be eligible to receive regular visits from a nurse, parent educator, or early childhood specialist who works with the family to improve maternal health, parenting skills, and child cognitive development.

Budget Overview

Overall Spending Trends. As shown in Figure 1, the Governor’s budget proposes $5.3 billion in total funding for the CalWORKs program in 2019‑20, an increase of $391 million (8 percent) relative to the most recent spending estimate for 2018‑19. This increase is the net effect of higher spending on cash grants, due to recent and proposed increases in grant levels, offset somewhat by lower underlying costs that result from declining year‑over‑year caseload. We provide an in‑depth analysis of the Governor’s proposed grant increase in the section of this analysis that follows.

Figure 1

CalWORKs Budget Summary

All Funds (Dollars in Millions)

|

2018‑19 |

2019‑20 |

Change From 2018‑19 |

||

|

Amount |

Percent |

|||

|

Number of CalWORKs cases |

391,161 |

371,316 |

‑19,845 |

‑5% |

|

Cash Grants |

$2,685 |

$3,068 |

$384 |

14% |

|

Single Allocation |

||||

|

Employment services |

$841 |

$809 |

‑$32 |

‑4% |

|

Cal‑Learn case management |

20 |

20 |

— |

— |

|

Eligibility determination and administration |

602 |

579 |

‑23 |

‑4 |

|

Stage 1 child care |

290 |

272 |

‑17 |

‑6 |

|

Subtotals, Single Allocation |

($1,753) |

($1,680) |

(‑$72) |

(‑4%) |

|

Home Visiting Initiative |

$29 |

$79 |

$50 |

170% |

|

Other County Allocations |

383 |

405 |

22 |

6 |

|

Othera |

12 |

21 |

— |

— |

|

Totals |

$4,862 |

$5,253 |

$391 |

8% |

|

aPrimarily includes various state‑level contracts. |

||||

Funding CalWORKs. Figure 2 displays the various funding sources for the CalWORKs program. In general, CalWORKs is funded through a combination of California’s federal TANF block grant allocation (which totals $3.7 billion annually), the state General Fund, realignment funds, and county general funds. Federal law allows for a degree of state flexibility in the use of federal TANF funds. Specifically, the state may use its annual TANF block grant to support other state programs, including student financial aid, Child Welfare Services, and services for people with developmental disabilities. As a result of this flexibility, the state does not use its entire TANF grant within the CalWORKs program. Instead, the proposed budget dedicates $2.2 billion of the annual $3.7 billion block grant to CalWORKs and the rest to other areas of the state budget.

Figure 2

CalWORKs Funding Source

(Dollars in Millions)

|

2018‑19 |

2019‑20 |

Change From 2018‑19 |

||

|

Amount |

Percent |

|||

|

Federal TANF block grant funds |

$1,958 |

$2,200 |

$242 |

12% |

|

State General Fund |

295 |

520 |

225 |

76 |

|

Realignment and other county fundsa |

2,609 |

2,532 |

‑77 |

‑3 |

|

Totals |

$4,862 |

$5,253 |

$391 |

8% |

|

aPrimarily various realignment funds, but also includes county share of grant payments, about $60 million. TANF = Temporary Assistance for Needy Families. |

||||

Caseload Continues to Decline Faster Than Anticipated. The Governor’s budget updates prior caseload projections and assumes that a monthly average of 391,161 families will receive CalWORKs benefits in 2018‑19. This represents a 7.6 percent year‑over‑year decline from 2017‑18. This decline is greater than was anticipated—the 2018‑19 Budget Act assumed a 4.4 percent year‑over‑year decline. Looking ahead, the Governor’s budget assumes that a monthly average of 371,316 families will receive CalWORKs during 2019‑20, a decline of 5.1 percent relative to the revised estimate for 2018‑19.

Administration’s Caseload Forecast Appears Reasonable. Both our office and the administration have over‑estimated the CalWORKs caseload in recent forecasts. In other words, since it reached its highest recession‑period mark in 2011, the caseload has declined more rapidly each year than we forecasted. With this tendency in mind, both our office and the administration have recalibrated our caseload forecast models to more accurately account for the ongoing caseload decline. Despite prior over‑estimation, the administration’s updated forecast is generally in‑line with our office’s expectation for the CalWORKs caseload and thus appears reasonable in our view. Updated caseload data will be available for us to fully assess the estimate for the May Revision.

Budget Proposes to Make CalWORKs Home Visiting Initiative Larger and Ongoing. As mentioned previously, the 2018‑19 budget included $158 million in federal funds to begin a three‑year home visiting program in CalWORKs. The Governor’s budget proposes to make the home visiting program ongoing. Funds provided in the 2018‑19 Budget Act, including $79 million proposed to be used in 2019‑20, would support this program for the next two years.

Budget Proposes Placeholder Single Allocation for County CalWORKs Services. As part of the 2017‑18 budget, the Legislature requested that the administration reevaluate the methodology used to determine how much funding counties receive to operate CalWORKs. Last year, the Legislature adopted a new methodology for eligibility and administration operations. The administration is now revising the methodology for county employment services. In the meantime, the proposed budget includes a placeholder funding amount for county employment services. This proposal has the effect of holding funding for employment services at the level provided in the 2018‑19 budget.

Analysis of Governor’s Proposed Grant Increase

LAO Bottom Line. The Governor proposes to increase CalWORKs grants by 13.1 percent across‑the‑board in 2019‑20. The proposal represents a step toward the Legislature’s stated goal of raising grant amounts. However, the Governor’s proposal differs from the Legislature’s plan in several ways. First, instead of raising grants by the same percentage across‑the‑board, as the Governor proposes and as has been done in the past, the Legislature’s plan, as outlined in current law as a statement of intent (that is subject to appropriation), takes a new approach. Specifically, the Legislature’s plan would raise the grant level for each AU size by the amount necessary to reach its target of 50 percent of the FPL. This would have the effect of raising grant levels by varying amounts depending on the size of the AU. Second, in order to reach its stated target, the Legislature’s plan would raise grants to a higher level overall than the Governor’s proposal. The Legislature’s target—50 percent of FPL for a family size one person larger than the AU size—is intended to ensure that no families with children have cash income below 50 percent of the FPL, even if a family member is ineligible to receive cash assistance. Finally, the Governor has proposed a single grant increase, whereas the Legislature’s plan calls for multiple grant increases—the next in 2019‑20 and the final in 2020‑21. (While the administration has proposed a single grant increase for 2019‑20, that does not prevent it from proposing additional grant increases in future years.) As a result of the higher grant amounts overall, the Legislature’s plan would be somewhat more costly than the Governor’s proposal in 2019‑20 and significantly more costly in future years.

In assessing the Governor’s proposal, we recommend that the Legislature consider what it wants to accomplish first—distributing grant increases equally across all AU sizes (similar to the Governor’s approach) or concentrating grant increases among some AU sizes in pursuit of its aim to eventually get all AUs to the same percentage of the FPL (the Legislature’s stated approach)—and how quickly it hopes to reach its final target. The Legislature could then adopt the Governor’s proposal as is, or take a different action, based on what it wants to accomplish first and how quickly it hopes to reach its final target.

13.1 Percent Across‑the‑Board Grant Increase. The Governor proposes a 13.1 percent increase to CalWORKs cash grants, to go into effect October 1, 2019. (This would be in addition to the 10 percent across‑the‑board increase that is scheduled under current law to take effect in April 2019). This increase would raise monthly grants for an AU of three to 50 percent of the FPL for a family of three. As shown in Figure 3, specifically, the Governor’s proposal would increase the maximum grant for an AU of three in a high cost county from $785 per month (the amount scheduled to go into effect April 1, 2019 under current law) to $888 per month. The Governor’s proposal assumes that the grant increase would cost an additional $348 million General Fund in 2019‑20 (reflecting three‑quarters of the fiscal year). Full‑year costs are expected to be $455 million General Fund in 2020‑21.

Figure 3

Governor’s Proposed 13.1 Percent CalWORKs Grant Increase

As Shown, for CalWORKs Families in High‑Cost Counties With No Other Income

|

AU |

Current |

Enacted |

Governor’s Proposal |

|||||

|

Amount |

As a Share |

Amount |

As a Share |

Amount |

As a Share |

|||

|

1 |

$355 |

34% |

$391 |

38% |

$442 |

43% |

||

|

2 |

577 |

41 |

635 |

45 |

718 |

51 |

||

|

3 |

714 |

40 |

785 |

44 |

888 |

50 |

||

|

4 |

852 |

40 |

937 |

44 |

1060 |

49 |

||

|

5 |

968 |

38 |

1065 |

42 |

1205 |

48 |

||

|

aAssistance unit size is the number of family members who are eligible for CalWORKs. bShare of 2019 federal poverty guideline for a family size equal to the AU size. cThe 2018‑19 Budget Act provided a 10 percent grant increase effective April 1, 2019. AU = assistance unit. |

||||||||

Governor’s Proposed Increase Reflects Step Toward Legislature’s Stated Goal . . . The Governor’s grant increase proposal represents a substantial step toward meeting the Legislature’s ultimate goal for CalWORKs grant levels to be reached in 2021.

. . . But Differs From Legislature’s Approach. The Governor’s proposed grant increase for 2019‑20 differs from what would occur under the Legislature’s plan in 2019‑20. Overall, the Governor’s proposed increase would be somewhat smaller but occur six months earlier (in October 2019 instead of April 2020). The Legislature’s approach differs conceptually from the Governor’s proposal in two additional ways, which we describe below:

- Administration’s Proposal Links AU Size to the FPL, Whereas Legislature Aims to Link Family Size to the FPL. Under the Governor’s approach, which would increase grants by 13.1 percent across‑the‑board, a CalWORKs case with an AU of three would be eligible to receive a maximum grant equal to 50 percent of the FPL for a family of three. In this way, the Governor’s proposal links the AU size to the FPL for that size. The Legislature’s plan takes a new approach. Under this approach, the Legislature would raise grants to 50 percent of the FPL for a family size that is one person larger than the AU size. In this way, the Legislature’s plan attempts to account for the fact that the family size is larger than the AU size in cases where there is an ineligible member. For example, a CalWORKs family with an AU size of three would receive a maximum grant of 50 percent of the FPL for a family of four. As a result of this new approach, the grant increase that would occur in 2019‑20 under the Legislature’s approach is higher than the Governor’s proposed increase for 2019‑20.

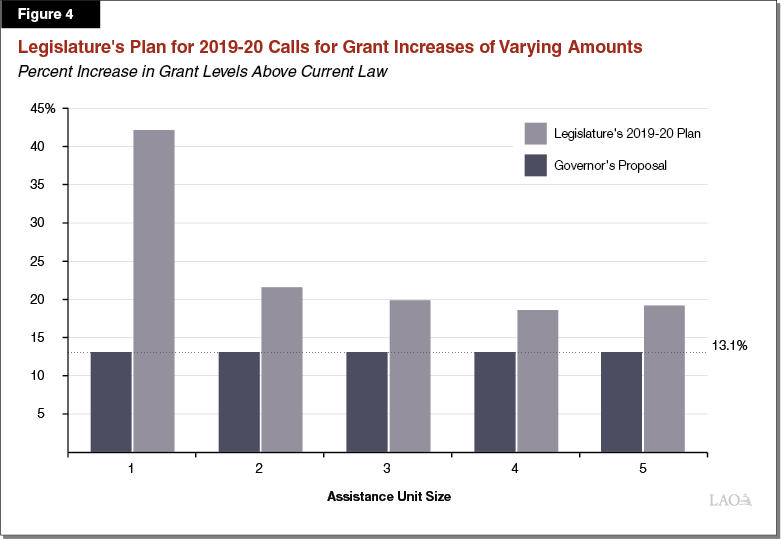

- Governor Proposes Across‑the‑Board Grant Increase, Whereas Legislature’s Approach Raises Grants by Varying Amounts. Figure 4 shows the percentage increase to grant levels—for different AU sizes—that would occur in 2019‑20 under the Governor’s proposal and the Legislature’s plan. As illustrated in the figure, the Governor’s across‑the‑board approach would increase all grant levels by the same percentage. On the other hand, the Legislature’s approach would raise grants by varying percentages. This is because the current grant amounts for some AU sizes are further from the Legislature’s final target. Therefore, grant amounts for these AU sizes must increase by a larger percentage in order to reach the Legislature’s target grant level for each AU size.

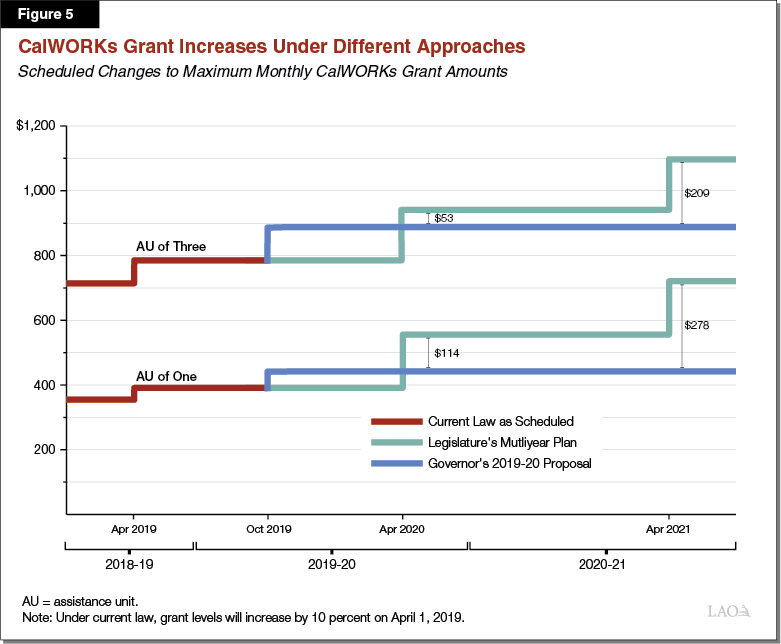

Difference Between Approaches Most Notable for Smallest CalWORKs Families. As previously shown in Figure 3, the current‑law maximum grant for cases with one eligible family member is $391 per month, equal to 38 percent of the FPL for a family of one. However, current‑law grants for other family sizes are higher relative to the FPL—about 44 percent of the FPL on average. The key difference between the Governor’s approach and the Legislature’s plan to raise CalWORKs grants in 2019‑20 relates to proposed grant increases for the smallest cases. This is because the grant amount for the smallest AU size is currently lower, relative to the FPL, than grants for other AU sizes. The Governor’s proposal would increase all grants by 13.1 percent. The Legislature’s approach, which adjusts grants for each AU size, calls for varying increases in grants. The smallest percentage grant increase (for an AU of four) would be 19 percent. The largest percentage grant increase (for an AU of one) would be 42 percent. Figure 5 illustrates this difference by comparing how the two proposals would impact grants for an AU of three and for an AU of one. In 2019‑20, the Governor’s proposal and the Legislature’s approach would increase grants for a family of three by roughly similar amounts. Yet, for a family of one, the Legislature’s approach would increase grants in 2019‑20 by $114 more per month. The figure also shows that the grant increases occur at different times during the 2019‑20 fiscal year.

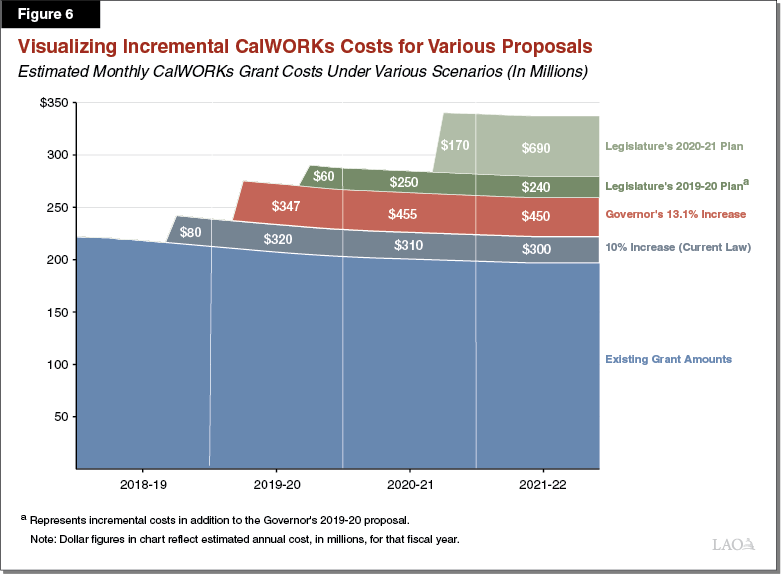

Legislature’s 2019‑20 Plan Would Be More Costly Than Governor’s Proposal. We estimate that the full‑year cost of the grant increase to occur in 2019‑20 under the Legislature’s plan would be about $250 million higher annually than the Governor’s proposal. (Added costs for 2019‑20 would be a smaller amount, about $60 million above the Governor’s proposal, due to differences in timing between the two approaches.) Overall, relative to the Governor’s proposal, the Legislature’s plan would require a much larger increase in 2019‑20 for cases that have only one eligible family member. (By definition, these cases have at least one ineligible family member.) Higher expenditures under the Legislature’s approach result primarily from the larger grant increases for these cases.

Out‑Year Costs Likely Also Higher Under Legislature’s Approach. It is difficult to compare the cost of the Legislature’s plan to the administration’s proposal in the out years because the Governor has not discussed specific CalWORKs proposals for future years. (While the administration has proposed a one‑time increase in this case, that does not prevent it from proposing further grant increases in future years.) As a point of reference, however, Figure 6 illustrates the estimated multiyear costs of each proposal. The figure displays the monthly total cost of providing CalWORKs grants under (1) current grant levels, (2) the 10 percent increase scheduled to go into effect under current law, (3) the Governor’s 13.1 percent increase, and (4) the two additional steps proposed under the Legislature’s multiyear plan. The dollar figures displayed in the chart show the estimated additional cost of each increase for that fiscal year. As shown in the figure, the Legislature’s final target in 2020‑21 would require more than $900 million in annual ongoing spending above the Governor’s current proposal.

Assess the Governor’s Proposal Based on What the Legislature Hopes to Accomplish First. The Governor’s proposal differs from the Legislature’s plan but nevertheless represents a step in the direction of the Legislature’s ultimate goal. In assessing whether to adopt the Governor’s proposal as is, or take a different action, we recommend that the Legislature consider what it hopes to accomplish first: (1) increasing grant levels by an across‑the‑board amount, or (2) beginning to increase grant levels for each AU size by varying amounts in an attempt to get all AUs to the same percentage of the FPL. The former would distribute grant increases equally across AU sizes. The latter, which would also increase grant levels, would distribute these grant increases differently across AU sizes. After considering what it hopes to accomplish first, we recommend that the Legislature then determine how quickly it hopes to reach its final target. Doing so sooner would require a higher amount of spending in the near‑term, whereas taking longer to reach the final target would allow for a more gradual increase in spending on CalWORKs grants. Below, we discuss how the Legislature might assess the Governor’s proposal depending on what it hopes to accomplish first and how quickly it hopes to reach its final target.

- Legislature Could Prioritize an Across‑the‑Board Grant Increase First. Because the Legislature’s ultimate goal for CalWORKs grant levels requires more than a 13.1 percent increase for all AU sizes, one option to consider is adopting the Governor’s proposal for 2019‑20 and, in subsequent years, providing other increases to reach the Legislature’s ultimate goal. This would be consistent with recent actions—for example, the Legislature took this approach when it enacted the first step of its multiyear plan, a 10 percent across‑the‑board grant increase included in the 2018‑19 budget package. If the Legislature takes this approach, the grant increases that are provided in later years will have to be of varying percentages rather than across‑the‑board. This is because grants for the smallest and the largest AUs have further to go than other AU sizes to reach the Legislature’s final goal of all grant levels being at 50 percent of the FPL for a family that is one person larger than the AU.

- Legislature Could Instead Prioritize Linking Grant Levels to the FPL First. Alternatively, the Legislature could first prioritize increasing grant levels for each AU by varying amounts—effectively bringing grants for all AUs to the same level of the FPL, as it proposed to do in its multiyear plan. Under this approach, grant levels for the smallest and largest AU sizes would increase by more, in percentage terms, than grant levels for AUs of two, three, and four. If the Legislature hopes to accomplish this first, it would have two options in approaching the Governor’s proposal. First, it could modify the Governor’s proposal of a 13.1 percent across‑the‑board increase and instead distribute the same funding amount (estimated to be $347 million over three‑quarters of 2019‑20) differently across the various AU sizes. Under this approach, larger percentage increases could be given to the smallest and largest AUs (those that are currently the furthest away from the Legislature’s goal), with more modest increases given to the AU sizes that are relatively closer to the Legislature’s ultimate goal. For example, under this approach, we estimate that the $347 million proposed by the Governor for 2019‑20 could be used to increase grant levels for all AU sizes to about 48 percent of the FPL. Alternatively, the Legislature could reject the Governor’s proposal and instead move ahead with the second step of its multiyear plan. This approach, which would distribute increases differently across AU sizes, would do so by increasing grants halfway to the Legislature’s final target of 50 percent of the FPL for a family size that is one person larger than the AU size. We estimate that this approach would require an additional $60 million above the Governor’s proposed amount in 2019‑20 and $230 million (full year) above the Governor’s proposal in 2020‑21.

Setting a Target for the CalWORKs Portion of the Safety Net Reserve

In 2018‑19, the Legislature created the Safety Net Reserve account and made an initial deposit of $200 million General Fund into the reserve. Funds in the Safety Net Reserve were to be available for two programs—CalWORKs and Medi‑Cal. These programs are counter‑cyclical—meaning program spending ramps up during economic downturns, as more people become eligible to receive benefits, and shrinks during periods of economic growth when the labor market is stronger. In the following section, we (1) provide a background on the Safety Net Reserve, (2) review how the Great Recession affected CalWORKs, in particular, and (3) simulate three recession scenarios to help the Legislature consider a target level for the CalWORKs portion of the Safety Net Reserve. Overall, we recommend that the Legislature consider its goals for the CalWORKs component of the Safety Net Reserve, set a target amount based on those goals, and assess the Governor’s proposed Safety Net Reserve deposit based on whether it is in‑line with the Legislature’s target. We describe and evaluate the Governor’s proposed structural changes to the Safety Net Reserve in the final section of this analysis.

Background on the Safety Net Reserve

2018‑19 Budget Created New Reserve for Two Social Safety Net Programs. In 2018‑19, the Legislature created the Safety Net Reserve. The reserve has two subaccounts—one for CalWORKs and one for Medi‑Cal. An initial deposit of $200 million General Fund was made into the CalWORKs subaccount. (No initial deposit was made into the Medi‑Cal subaccount.) Reserves were to be available to address cost increases in these programs that occur during a recession. The 2018‑19 budget also directed the administration to determine how to build additional reserves. Specifically, statute directs the Department of Finance to calculate CalWORKs and Medi‑Cal savings that occur when the caseloads in these programs decline, and to propose a plan to deposit part of those savings into the reserve.

Governor Proposes to Deposit $700 Million Into Safety Net Reserve. The 2019‑20 Governor’s Budget proposes to deposit $700 million General Fund into the Safety Net Reserve. In addition to the deposit, the Governor also proposes two structural changes to the Safety Net Reserve. We evaluate these proposals in the final section of this analysis.

State Has Two Major Budget Reserves. The state has two primary general purpose budget reserves: the Special Fund for Economic Uncertainties (SFEU) and the Budget Stabilization Account (BSA). The SFEU is the state’s discretionary budget reserve—that is, the Legislature at any time can appropriate SFEU funds for any purpose. The BSA is the state’s constitutional reserve, and the use of its funds is more restricted. The State Constitution sets specific rules regarding how and when the state must make deposits into, or may make withdrawals from, the BSA.

CalWORKs During the Great Recession

How Does a Recession Lead to Increased CalWORKs Costs? Before describing our estimates of the budgetary effects of the Great Recession on CalWORKs specifically, below we outline how an economic recession leads to increased CalWORKs expenditures.

- Economic Recessions Drive CalWORKs Caseloads Upward. During a recession, there is a slowdown of economic activity that leads to job losses and an increase in unemployment. The loss of earnings for some families may result in them becoming eligible for CalWORKs. (A family of three is currently eligible for CalWORKs if their household income is below $1,430 per month.) A portion of families who become eligible for the program will enroll in CalWORKs and begin receiving monthly cash assistance and job services.

- Higher CalWORKs Caseloads Lead to Increased Program Costs. Expenditure levels for most human services programs depend on the number of participants (caseload) and the average cost per participant (cost per case). As discussed above, caseload depends primarily on economic conditions. On the other hand, CalWORKs cost per case depends on the level of benefits and services the program offers. These benefit amounts are set in state law and do not adjust if caseload increases. As a result, if the state makes no policy changes, program and administration costs generally increase roughly in line with caseload.

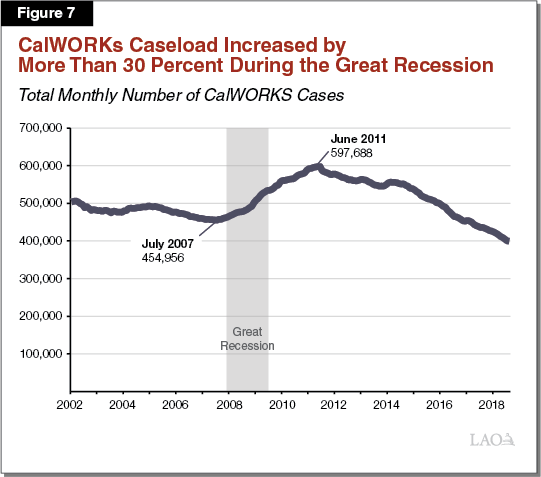

How Much Did CalWORKs Costs Increase as a Result of the Last Recession? Reviewing what happened in the last recession may help the Legislature consider its target reserve amount going forward. Given the severity of the Great Recession, estimates of the caseload increases during that period probably reflect the upper end of potential outcomes going forward. Figure 7 shows the monthly CalWORKs caseload over the last two decades, which began to increase in 2007, a few months before the beginning of the Great Recession. At that time, there were 455,000 families enrolled in the program and total costs were $4.7 billion. Over the next four years—between July 2007 and May 2011—the caseload increased by more than 30 percent. By then, nearly 600,000 families were receiving cash assistance and program costs had increased by $1 billion (to a total of $5.7 billion). These costs would have increased by a greater amount if the state had not enacted policy changes that had the effect of reducing costs within CalWORKs, as we discuss below.

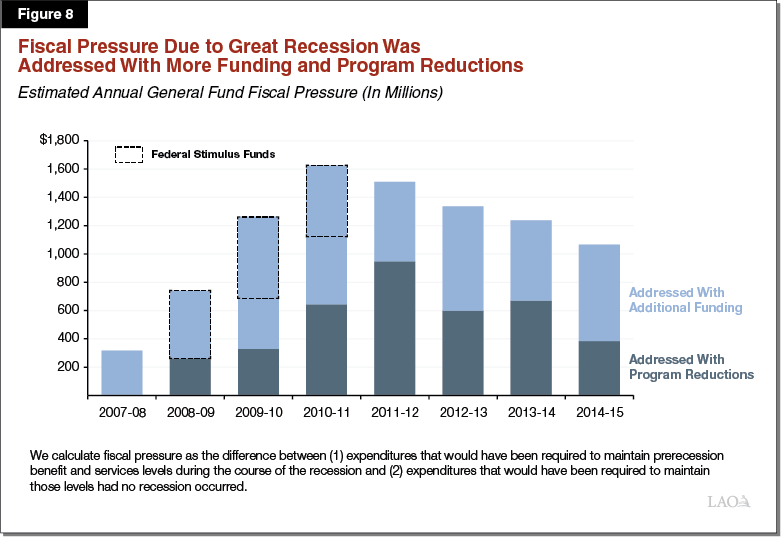

Fiscal pressure in CalWORKs increased as a result of the recession. In this analysis, fiscal pressure is defined as the additional funding needed to operate CalWORKs at its current level of benefits and eligibility when the caseload is increasing. (CalWORKs fiscal pressure ultimately impacts the state’s General Fund. This is because federal TANF funds and county funds that are used to support CalWORKs and other programs’ costs are fixed or relatively flat from year‑to‑year. As such, large annual increases in CalWORKs program costs, such as those that occur during a recession, are borne by the General Fund.) We calculate that annual fiscal pressure in CalWORKs peaked at about $1.6 billion during the Great Recession. Specifically, actual total CalWORKs expenditures were $4.7 billion in 2006‑07 and we estimate that expenditures would have been $6.3 billion annually by 2010‑11 had the state taken no actions to reduce costs. Figure 8 shows the estimated annual fiscal pressure each year that occurred as a result of the recession. Fiscal pressure extends beyond the time period of the recession because the CalWORKs caseload remained elevated for several years following the end of the recession. From 2007‑08 to 2014‑15, the cumulative fiscal pressure in CalWORKs was over $9 billion. The figure also shows how the pressure was addressed—either by the increasing total spending in CalWORKs or by enacting program reductions. (We discuss these approaches below.)

What Actions Did the State Take to Address Fiscal Pressure During the Recession? During the recession, the state enacted several program reductions, including lowering monthly grant levels, that had the effect of reducing CalWORKs expenditures. Despite these reductions (because of elevated caseloads), total CalWORKs expenditures increased during the recession. Overall, program reductions addressed almost one‑half of CalWORKs fiscal pressure in the recession. The state addressed the remaining fiscal pressure by increasing funding for the program. At the time, the state did not have a safety net reserve and had very little set aside in the state’s other general purpose reserve accounts.

The state was able to increase total funding for CalWORKs during the recession due, in part, to additional funding sources that became available during that time. First, the federal American Recovery and Reinvestment Act (ARRA) of 2009 provided roughly $500 million in additional TANF funds annually in 2008‑09, 2009‑10, and 2010‑11. Figure 8 highlights the portion of additional funding attributable to ARRA in those years. Second, voters approved Proposition 30 in 2012, which increased state revenue from the personal income tax and sales tax. These additional sources had the effect of limiting, at least to a degree, the magnitude of CalWORKs program reductions that were enacted during the Great Recession.

Ways to Build a Reserve

Looking ahead to the next recession, the Legislature has several options for building funds in the Safety Net Reserve. One way is to make one‑time discretionary deposits depending on the availability of funds. The Legislature followed this method when it deposited $200 million into the reserve as part of the 2018‑19 budget. The Governor as well follows this method in his proposal to deposit $700 million into the reserve in 2019‑20. Alternatively, the state could take a formula‑driven approach. Under this method, in years when the caseload declines, a portion of caseload savings that materialize due to this decline could be automatically set aside to be used in future years. Budget‑related legislation enacted along with the creation of the Safety Net Reserve directed the administration to put forward an option for this approach. The legislation tasked the administration with calculating annual caseload savings in CalWORKs and proposing a method to deposit some of those savings into the reserve. The administration has proposed to eliminate this requirement. Below, we evaluate how such a mechanism would have fared since the end of the Great Recession. In particular, we describe caseload savings and take a look at how much savings have materialized since the Great Recession ended.

What Are Caseload Savings? Caseload savings occur when the CalWORKs caseload declines from one year to the next. There are savings because fewer families receive benefits and thus program costs are lower relative to the year before. In some years with caseload savings, the state enacts policy changes—such as increasing the monthly grant amount—that increase the average cost per case. Caseload savings, in these instances, in effect help pay for higher benefits. In other years, caseload savings serve to benefit other areas of the state budget. For example, caseload savings have facilitated larger shifts of federal TANF funds to the Student Aid Commission to fund higher education financial aid grants. Such shifts have the effect of reducing the amount of General Fund used for these purposes, thus freeing up funds for other areas of the state budget.

What Amount of Caseload Savings Would Have Been Available to Be Deposited Into the Reserve? Figure 9 displays our estimate of the annual gross caseload savings that have occurred in CalWORKs since the caseload peaked in 2010‑11. The amount of caseload savings generally corresponds with the magnitude of the caseload decline—a greater decline leads to more caseload savings. Caseload savings that materialized during this period were used for various purposes, including restoring some program reductions that were enacted during the recession and offsetting General Fund costs for higher education financial aid.

Figure 9

Estimate of Recent Caseload Savings in CalWORKs

Total Funds (In Millions)

|

Fiscal Year |

CalWORKs Caseload |

Estimated |

|

|

Number |

Change From |

||

|

2011‑12 |

575,910 |

‑2% |

$105 |

|

2012‑13 |

559,871 |

‑3 |

147 |

|

2013‑14 |

550,859 |

‑2 |

88 |

|

2014‑15 |

535,029 |

‑3 |

152 |

|

2015‑16 |

495,554 |

‑7 |

400 |

|

2016‑17 |

454,046 |

‑8 |

461 |

|

2017‑18 |

423,121 |

‑7 |

354 |

|

2018‑19b |

391,161 |

‑8 |

378 |

|

2019‑20b |

371,316 |

‑5 |

244 |

|

aCalculated by estimating how much overall CalWORKs program costs would be reduced if no program or grant changes occurred from one year to the next. It represents an estimate of the effect that a declining caseload has on program costs. bAs estimated based on 2019‑20 Governor’s Budget caseload and expenditures. |

|||

Preparing for the Next Recession

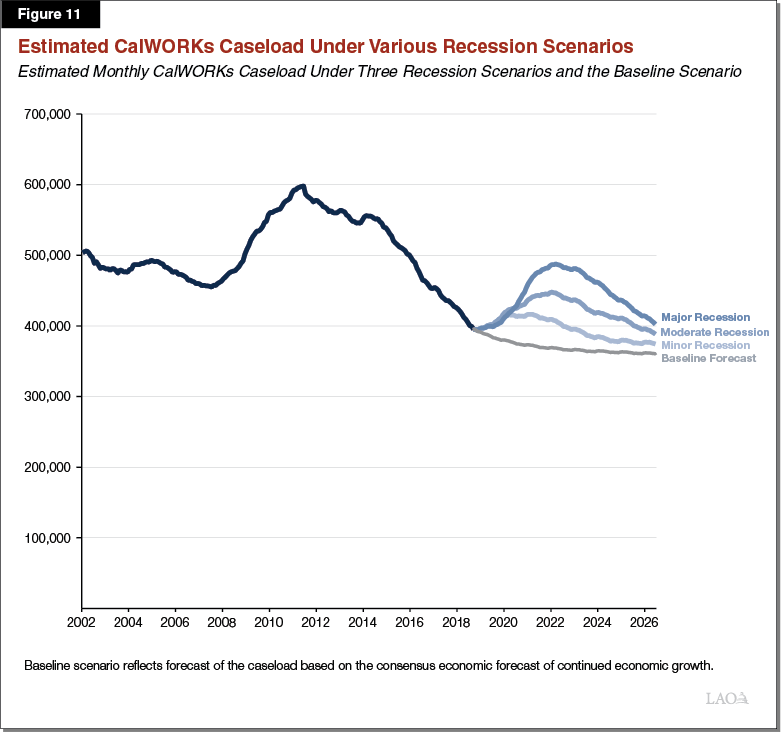

How Much Will CalWORKs Expenditures Increase During the Next Recession? We simulated three recession scenarios of varying degrees of severity to calculate how much CalWORKs expenditures might increase during the next recession. (For these scenarios, we assume current‑law grant levels—that is, grant levels as they will be following the 10 percent increase that is scheduled under current law to go into effect April 1, 2019.) We then compare each scenario to our baseline forecast, which assumes continued growth of the U.S. and California economies. Prior recessions inform our three scenarios. The minor recession scenario is similar to the 2001 dot‑com bust. The moderate recession scenario is similar to the early 1990s recession. And the major recession scenario is similar to the Great Recession. (Although the state often considers the dot‑com bust a more sizeable recession from a budgetary perspective, it was much smaller, and shorter, than these others in terms of its effects on unemployment and the broader economy.) Figure 10 shows the results of this simulation over a seven‑year period. (We selected a seven‑year period, beginning in early 2019, in order to include the peak and subsequent decline under each recession scenario.) The caseload under our baseline forecast declines from about 390,000 cases in 2019 to about 360,000 cases by 2026. Caseloads increase above the baseline forecast under each recession scenario. As shown in Figure 11 , we estimate that the caseload would peak at about 490,000 in a major recession, 450,000 in a moderate recession, and about 420,000 in a minor recession. We note that these peaks in caseload are lower than what occurred in the prior recession because the caseload today has hit an historic low.

Figure 10

Key Details of Each Recession Scenario

Recessions Modeled 2019 Through 2026

|

Scenario |

Modeled After |

Duration of Elevated CalWORKs Caseload |

Peak Unemployment Rate |

Peak CalWORKs Caseload |

Unemployment Rate at End of Forecast |

|

Minor |

Dot‑com bust |

41 months |

6.2% |

417,000 |

4.2% |

|

Moderate |

1990s Recession |

72 months |

8.7 |

448,000 |

5.0 |

|

Major |

Great Recession |

86 months |

11.4 |

488,000 |

5.9 |

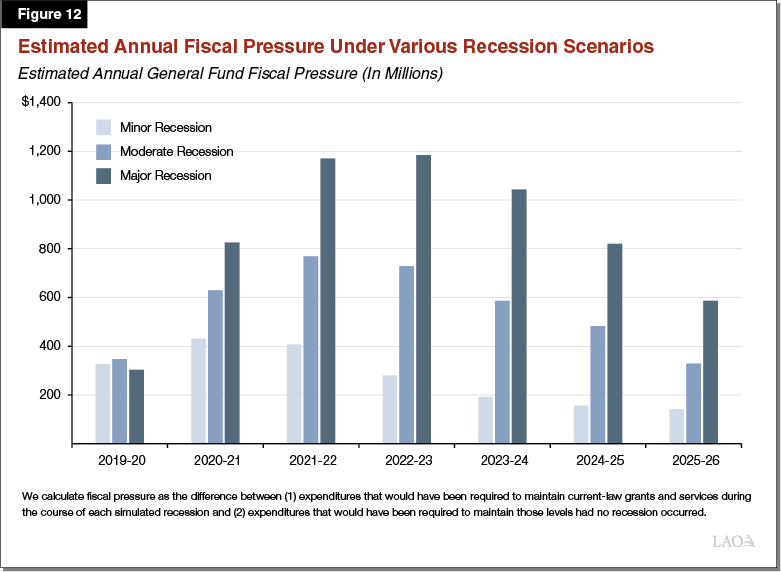

CalWORKs Fiscal Pressure Under Each Recession Scenario. Figure 12 displays estimated fiscal pressure that could occur under each of our scenarios. This represents the extra expenditures necessary to sustain current‑law grants and operations costs during a recession. Under the minor recession scenario, fiscal pressure peaks at about $400 million annually. Fiscal pressure is greater under the other scenarios—about $800 million annually in a moderate recession and $1.2 billion annually in a major recession.

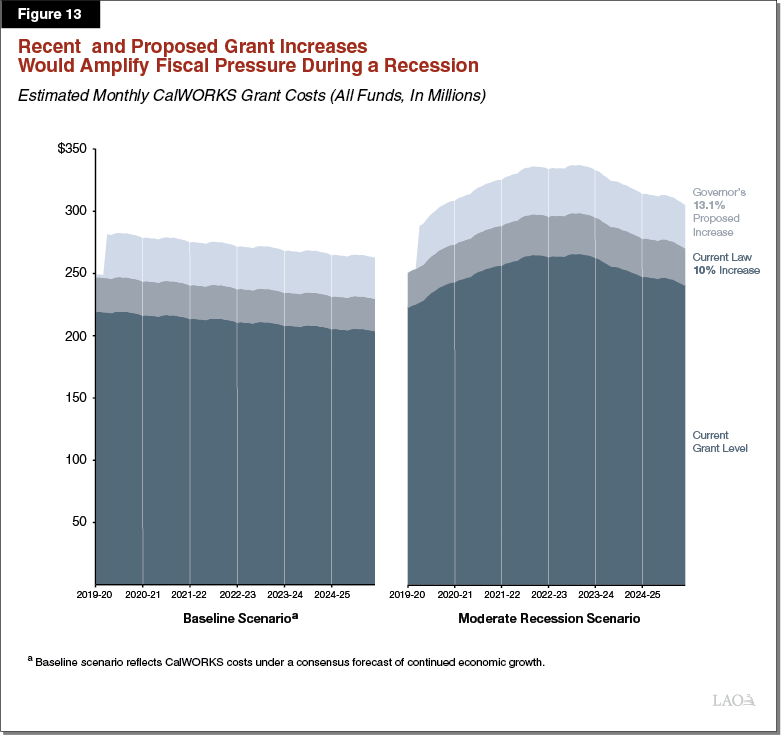

Recent and Proposed Grant Increases Would Amplify Fiscal Pressure in a Recession. The 2018‑19 Budget Act included a 10 percent across‑the‑board CalWORKs grant increase. The administration proposes to enact an additional 13.1 percent across‑the‑board increase in 2019‑20. Higher grant amounts will have the effect of amplifying the fiscal pressure in a recession. As a point of reference, the maximum grant for a family of three in 2017‑18 was $714 per month. Under the Governor’s proposal, this amount will increase to $888 per month (including the 10 percent grant increase enacted in 2018‑19). As such, each new case during the next recession would be associated with more fiscal pressure. Figure 13 illustrates this effect. It compares estimated additional expenditures due to recently approved and proposed grant increases under our baseline economic forecast (left side) and estimated expenditures under our moderate recession scenario (right side).

Setting a Target for the CalWORKs Component of the Safety Net Reserve

First, Identify an Approach for the Safety Net Reserve . . . In determining its goals for the CalWORKs component of the Safety Net Reserve, the first factor the Legislature should consider is the timing, size, and duration of the next recession for which it would like to prepare. No one can predict these factors with certainty ahead of time, but the Legislature could begin by identifying the magnitude of a recession it plans to prepare for and considering how cautious it would like to be. In general, being prepared for a larger recession will mean more reserves are needed. The second factor to consider is whether the Legislature plans to rely on the Safety Net Reserve for the entire duration of a recession. The Legislature could, for instance, identify as its reserve target a level that it anticipates will cover the first year or two of a recession. This would have the effect of delaying the need to take other actions to address fiscal pressure in CalWORKs. The third factor to consider is how willing the Legislature is to enact reductions in CalWORKs or take other actions to increase funding to CalWORKs, as it did during the Great Recession in response to the fiscal pressure at that time. If the Legislature is more willing to take these actions, less reserves are needed. If the Legislature would prefer to use reserves to address most or all of the fiscal pressure, then more reserves would be needed. The fourth factor to consider is whether other reserve funds, including from the SFEU or the BSA, would be available to be used to address fiscal pressure in CalWORKs during a recession. Finally, the Legislature may wish to consider whether additional federal funds will be made available during the next recession, as they were with ARRA in 2009, or whether the state will need to weather a recession on its own. Going forward, we think that the Legislature should not rely heavily on receiving the extraordinary federal aid as it did with ARRA, in future recessions.

. . . And Then Set a Target That Fits That Approach. After forming its approach to the reserve, we next encourage the Legislature to select a target that fits that approach. Our simulation suggests that if a minor recession were to begin in 2018‑19, cumulative CalWORKs costs over the next seven years could increase by $2 billion. Similarly, we estimate that costs would increase by nearly $4 billion in a moderate recession and by about $6 billion in a major recession. (These estimates do not include the additional costs that would be associated with the Governor’s proposed 13.1 percent grant increase.) If, for example, the Legislature chooses as its approach to use the Safety Net Reserve to address all fiscal pressure in a minor recession, we recommend a reserve target of at least $2 billion (for CalWORKs alone). If the Legislature wishes to prepare for a major recession using this approach, a much larger reserve would be necessary. As discussed above, if the Legislature intends for the reserve to be available for a shorter duration, such as the first two years of a recession, fewer reserves would be necessary under each of the recession scenarios. Alternatively, if the Legislature is willing to enact some reductions and/or rely on other funds or reserves, it could set a lower target. This is because the state would rely on the Safety Net Reserve for only part of the overall shortfall.

Assess the Governor’s Proposed Reserve Deposit Based on Legislature’s Target. Once the Legislature sets its desired target, we encourage evaluating the Governor’s proposal as it compares to that target. If the Legislature would like to prepare for a minor recession, the Governor’s proposed reserve deposit (which would build the reserve to $900 million) may be adequate to address CalWORKs costs during a minor recession if the Legislature is willing to enact some reductions and shift funds from other areas or from other reserves. On the other hand, the proposed reserve amount would likely not cover more than one‑quarter of the fiscal pressure in a moderate recession or one‑sixth of the fiscal pressure in a major recession. We note, however, that the Legislature may not need to reach its target reserve amount this year. An additional deposit could be made next year. We nevertheless urge the Legislature to achieve its target amount for the reserve sooner, rather than later. The surplus available under the Governor’s budget is extraordinary. Consequently, this year provides a unique opportunity to build reserves to prepare for a future recession.

Evaluating Proposed Structural Changes to the Safety Net Reserve

The 2019‑20 Governor’s Budget proposes two structural changes to the Safety Net Reserve. First, the Governor proposes to change the statutory parameters for the reserve to allow the state to use the total amount of reserve funds for either CalWORKs or Medi‑Cal. The 2018‑19 budget package established separate subaccounts for CalWORKs and Medi‑Cal within the Safety Net Reserve. Secondly, the proposal would eliminate the current‑law requirement that the administration establish a methodology for calculating savings that occur in CalWORKs and Medi‑Cal when the caseload declines and depositing some portion of those savings each year into the reserve.

Should CalWORKs and Medi‑Cal Have Separate Reserve Subaccounts? As discussed above, the Governor proposes to eliminate the CalWORKs and Medi‑Cal subaccounts within the Safety Net Reserve, in effect creating one reserve account to be used for both programs. The Legislature may wish to consider the trade‑offs between separate and combined accounts. On the one hand, separate accounts for these two programs may allow the Legislature to signal its priority for the use of reserve funds in one program or the other. Additionally, separate reserve subaccounts may make it easier to set target reserve amounts for each program, independently, and assess the Legislature’s progress in meeting those targets. On the other hand, combined subaccounts for Medi‑Cal and CalWORKs might provide some added flexibility in responding to a downturn. We would note, however, that combining the subaccounts may not practically increase the Legislature’s budgetary flexibility. This is because the state could enact statutory changes at any time to allow funds from one subaccount to be transferred to the other subaccount (or, for that matter, elsewhere in the budget).

Should Caseload Savings Be Deposited Automatically Into the Safety Net Reserve? In addition to combining the subaccounts within the Safety Net Reserve, the Governor proposes to eliminate the requirement that the Department of Finance calculate annual caseload savings and propose a way to automatically deposit some of the Medi‑Cal and CalWORKs caseload savings each year. We acknowledge that the proposed deposit of $700 million strengthens the reserve in the near term. As a result, automatic deposits may be less important in the near term than if the reserve were smaller. Even so, the Legislature should look beyond the next recession to consider what system it wants in place when the caseload begins to decline next time. As discussed earlier, a larger CalWORKs component of the reserve would exist today if a portion of recent caseload savings had been deposited each year since the end of the Great Recession. (Of course, these funds would not have been available for other uses.) The Legislature may wish to consider whether the proposal to eliminate the method to count and deposit caseload savings makes it less likely that the state builds sufficient reserves in the future.

In the case of CalWORKs, as an alternative to an automatic deposit, we recommend that the Legislature direct the administration to calculate and publish the amount of caseload savings that it expects to materialize each year. The administration would publish this forecast when it releases the Governor’s Budget and the May Revision. Under this alternative, the Legislature and the administration would know how much funding had been freed‑up for other uses. Then, they could decide whether some of that amount should be deposited into the reserve. Making this forecast more prominent could help ensure that the Legislature and the Governor consider a deposit each year during the budget process. In our view, highlighting the expected caseload savings will further the Legislature’s goal to focus on reserve deposits when the caseload is declining. It would also allow the state to deposit more or less than what would occur under an automatic, formula‑driven, deposit.

In‑Home Supportive Services

Background

Overview of the In‑Home Supportive Services (IHSS) Program. The IHSS program provides personal care and domestic services to low‑income individuals to help them remain safely in their own homes and communities. In order to qualify for IHSS, a recipient must be aged, blind, or disabled and in most cases have income below the level necessary to qualify for the SSI/SSP cash assistance program (for example, about $930 a month for an aged and/or disabled individual living independently in 2018‑19). IHSS recipients are eligible to receive up to 283 hours per month of assistance with tasks such as bathing, dressing, housework, and meal preparation. Social workers employed by county welfare departments conduct an in‑home IHSS assessment of an individual’s needs in order to determine the amount and type of service hours to be provided. In most cases, the recipient is responsible for hiring and supervising a paid IHSS provider—oftentimes a family member or relative. The average number of service hours that will be provided to IHSS recipients is projected to be 110 hours per month in 2019‑20.

IHSS Receives Federal Funds as a Medi‑Cal Benefit. The IHSS program is predominately delivered as a benefit of the state federal Medicaid health services program for low‑income populations (known as Medi‑Cal in California). As a result, IHSS is subject to federal Medicaid rules, including the federal reimbursement rate of 50 percent of costs for most Medi‑Cal recipients. Additionally, about 40 percent of IHSS recipients, based on their assessed level of need, qualify for an enhanced federal reimbursement rate of 56 percent, referred to as the Community First Choice Option. As a result, the effective federal reimbursement rate for IHSS is about 54 percent. The remaining IHSS costs are paid for by counties and the state.

Counties’ Share of IHSS Costs Is Set in Statute. Historically, counties paid 35 percent of the nonfederal—state and county—share of IHSS service costs and 30 percent of the nonfederal share of IHSS administrative costs. However, beginning in 2012‑13, the historical county share of cost model was replaced with an IHSS county MOE, meaning county costs would reflect a set amount of nonfederal IHSS costs as opposed to a certain percent of nonfederal IHSS costs. The 2019‑20 Governor’s Budget proposes to further modify the IHSS county MOE. (We discuss in more detail the evolution of the IHSS county MOE and proposed 2019‑20 changes later in this section.)

Budget Overview and LAO Assessment

The Governor’s budget proposes a total of $12.7 billion (all funds) for IHSS in 2019‑20, which is about $1.3 billion (11.1 percent) above estimated expenditures in 2018‑19. The budget includes about $4.3 billion from the General Fund for support of the IHSS program in 2019‑20. This is a net increase of about $565 million (15.2 percent) above estimated General Fund costs in 2018‑19. The year‑over‑year net increase in IHSS General Fund expenditures is primarily due to caseload growth, increased state minimum wage costs, and the shifting of some county costs to the state. Below, we discuss some of the main components of the Governor’s budget for IHSS and note any issues with them.

Primary Drivers of Increased Costs in IHSS

Caseload growth, a rising number of paid hours per case, and wage increases for IHSS providers are key drivers of increasing IHSS costs. Below, we describe these trends and how these cost drivers affect the Governor’s 2019‑20 budget proposal for IHSS.

Increasing Caseload. The average monthly caseload for IHSS has increased by 25 percent over the past ten years, from about 430,000 in 2008‑09 to an estimated 540,000 in 2018‑19. The IHSS caseload has historically fluctuated, increasing at most by 7.4 percent in 2008‑09 and decreasing by 4 percent in 2013‑14. More recently, average year‑to‑year IHSS caseload growth has remained at 5 percent and is expected to continue growing at a similar rate in 2019‑20. Specifically, the 2019‑20 budget projects that IHSS caseload will increase to 564,000 in 2019‑20—4.5 percent above 2018‑19 caseload estimates. The reasons for the steady caseload growth in recent years are not completely understood, but could be related to the growth in California’s senior population (adults aged 65 and older). We have reviewed the caseload projections in light of actual caseload data available to date and do not recommend any adjustments at this time.

Increasing Paid Hours Per Case. Over the past ten years, the average amount of paid monthly hours per case for IHSS has increased by 26 percent, from about 86 hours in 2008‑09 to an estimated 109 hours in 2018‑19. Between 2008‑09 and 2012‑13, average paid hours per case remained relatively flat—at around 86 hours. However, between 2013‑14 and 2017‑18, average paid hours per case has increased annually by an average of 4.8 percent.

The growth in average paid hours per case reflects, in part, a series of policy changes. For example, one reason for the recent increase in paid hours per case includes the implementation of the federal requirement that IHSS providers be compensated for previously unpaid work tasks, such as time spent waiting during their recipient’s medical appointments. Additionally, similar to the increase in the caseload, as the IHSS population ages there may be an increasing number of more complex IHSS cases that typically require more service hours. For example, as recipients live longer, they may develop more severe needs and require an increasing amount of IHSS service hours.

The Governor’s budget estimates that the average hours per case will be roughly the same in 2018‑19 as they were in 2017‑18 (109 hours) and will then increase slightly to 110 hours in 2019‑20. We have reviewed the estimates of average hours per case in light of actual hours per case data available to date. While we do not raise any major concerns at this time, based on recent growth trends in hours per case, it is likely that average hours per case in 2018‑19 would be higher than (as opposed to remain the same as) actual 2017‑18 average hours per case. To the extent that, similar to the prior years, the average hours per case grow in 2018‑19 and 2019‑20 (about 2 percent annually), the combined General Fund costs for IHSS in 2018‑19 and 2019‑20 could be roughly $200 million higher than estimated in the Governor’s budget.

State and Local Wage Increases. In addition to increasing caseload and paid hours per case, provider wage increases at the county and state levels have contributed to increasing IHSS costs. Since 2008‑09, the average hourly wage for IHSS providers increased by 25 percent, from $9.58 to an estimated $11.96 in 2018‑19. (We note that this average IHSS wage reflects the base hourly wages for IHSS providers averaged across all counties.) IHSS provider wages generally increase in two ways—(1) increases that are collectively bargained or established at the local level and (2) increases that are in response to state minimum wage increases. The Governor’s budget includes $408 million General Fund ($894 million total funds) for the combined impact of the recent state minimum wage increases on IHSS provider wages from $11 per hour to $12 per hour on January 1, 2019 and the scheduled increase from $12 per hour to $13 per hour on January 1, 2020. The General Fund costs associated with state minimum wage increases in 2019‑20 are more than double the estimated 2018‑19 costs. This is primarily due to the fact that a greater number of counties are expected to be impacted by the state minimum wage increase to $13 per hour in 2020 (50 counties) than the increase to $12 per hour in 2019 (44 counties) or the increase to $11 per hour in 2018 (37 counties). (A county is impacted by the state minimum wage increase when the current local wage is below the new state minimum wage level.) We note that in future years, as the state minimum wage continues to increase, more counties will be impacted, resulting in higher IHSS costs.

We note that the Governor’s budget does not take into account locally established wage increases that were negotiated after October 2018. These include scheduled locally established wage increases for Los Angeles County IHSS providers in 2018‑19 and 2019‑20—$12 to $12.60 effective January 1, 2019 and $12.60 to $12.80 effective July 1, 2019 (pending state approval). We estimate that the combined annualized costs of the Los Angeles County wage increases are approximately $70 million General Fund in 2019‑20. We expect that the Governor’s revised estimates released in May will account for these and other locally established wage increases that occurred after the development of the Governor’s budget, but are set to be in effect in 2018‑19 and 2019‑20.

Continues Restoration of IHSS Service Hours by 7 Percent

Since 2016‑17, the state has imposed a tax on managed care organizations (MCOs) that—when combined with a package of associated tax changes—generates a net General Fund benefit of about $1.5 billion by drawing additional federal funds for the state. Under current law, the General Fund has supported the restoration of IHSS service hours, which were previously reduced by 7 percent, so long as the MCO tax is in place. (Additional information on the MCO tax can be found in our report, The 2019‑20 Budget: Analysis of the Medi‑Cal Budget.) While the Governor’s budget does not assume the renewal of the MCO tax once it expires at the end of 2018‑19, it does propose the continued use of General Fund for the 7 percent restoration in 2019‑20. The cost of the 7 percent restoration is estimated to be $342.3 million General Fund in 2019‑20. While the administration is not proposing to eliminate the current statutory language that ties the 7 percent restoration to the existence of the MCO tax, we understand that it intends for the restoration of IHSS service hours to be ongoing. If the Legislature and the administration want to ensure funding for the 7 percent restoration in future years, they may wish to consider legislation that eliminates the link between the restoration and the MCO tax.

Implementation of Paid Sick Leave

Pursuant to Chapter 4 of 2016 (SB 3, Leno), IHSS providers became eligible to receive eight hours of paid sick leave beginning in 2018‑19. The number of paid sick hours is scheduled to increase to 16 hours annually on January 1, 2020 (or when state minimum wage reaches $13 per hour) and ultimately to 24 hours annually on July 1, 2022 (or when state minimum wage reaches $15 per hour). In general, providers must first work a certain number of hours to be eligible to receive and use their paid sick leave hours. The 2019‑20 budget includes about $30 million General Fund for paid sick leave costs—roughly equal to the estimated costs in 2018‑19. The budget assumes that in 2018‑19 and 2019‑20, all IHSS providers—509,289 in 2018‑19 and 534,623 in 2019‑20—will each claim eight hours of paid sick leave.

While we do not raise any major concerns at this time, paid sick leave costs could come in lower or higher depending on the actual number of IHSS providers who use paid sick leave and the amount of paid sick leave hours that they use. This is for a number of reasons. First, 2018‑19 utilization data (September 2018 to December 2018) shows that, so far, about 7,000 IHSS providers (less than 2 percent) each claimed and were paid for about seven of the eight hours of paid sick leave they were eligible to receive. To the extent that this trend continues and fewer than estimated IHSS providers utilize paid sick leave in 2019‑20, General Fund costs would be significantly less than estimated. Second, while the number of paid sick leave hours a provider can claim is expected to double to 16 hours in 2019‑20, the budget assumes that all IHSS providers will claim eight hours of paid sick leave in 2018‑19 and 2019‑20. We note that General Fund costs would be higher if at least some providers claim and get paid for more than eight hours of paid sick leave in 2019‑20. Given the very limited availability of utilization data, we find these budget assumptions reasonable at this time. These estimates, however, should be revised in May when a greater amount of data is available to better reflect actual utilization and paid hours of paid sick leave. We will continue to monitor paid sick leave utilization data relative to current budget assumptions and provide further comments at the time of the May Revision if necessary.

Proposed Changes to the IHSS County MOE

Historically, counties paid 35 percent of the nonfederal—state and county—share of IHSS service costs and 30 percent of the nonfederal share of IHSS administrative costs. Under this historical share‑of‑cost model, counties had a share of costs for all IHSS costs, meaning when total IHSS costs increased (or decreased) county costs would also increase (or decrease) proportionately. However, beginning in 2012‑13, the historical county share of cost model was replaced with an IHSS county MOE. Under an MOE model, counties are responsible for a set amount of IHSS costs, which does not change as a result of changes to total IHSS costs. In 2017‑18, the initial IHSS MOE was eliminated and replaced with a new IHSS MOE. The Governor’s budget proposes additional changes to the IHSS MOE financing structure in 2019‑20. Below, we discuss the recent and proposed changes to the IHSS MOE financing structure.

New IHSS County MOE Established in 2017‑18. In 2017‑18, the initial IHSS MOE was eliminated and replaced with a new county MOE financing structure—referred to as the 2017 IHSS MOE. Under the 2017 IHSS MOE, the counties’ share of IHSS costs was reset to roughly reflect the counties’ share of estimated 2017‑18 IHSS costs based on historical county cost‑sharing levels (35 percent of the nonfederal share of IHSS service costs and 30 percent of the nonfederal share of IHSS administrative costs). Similar to the initial IHSS MOE, the 2017 IHSS MOE increased annually by (1) counties’ share of costs from locally established wage increases, and (2) an adjustment factor (which, depending on certain circumstances, could be 5 percent or 7 percent).

Department of Finance (DOF) Report Finds That 1991 Realignment Revenues No Longer Cover IHSS County MOE Costs Over Time. When the 2017 IHSS MOE was implemented, there was concern that county revenues made available through 1991 realignment—the revenue source used to pay for IHSS county costs—would no longer be able to fully cover the IHSS county costs associated with the new MOE. As a result, current law provides some General Fund assistance to counties to mitigate the cost of the 2017 IHSS MOE. Additionally, the 2017‑18 budget agreement required DOF to review and report on the funding structure of 1991 realignment, how revenues and costs are growing, and the ability of available revenues to meet program costs of the realigned programs. In its January 2019 report, Senate Bill 90: 1991 Realignment Report, DOF found that 1991 realignment could no longer support county costs of IHSS primarily because of programmatic changes that have made IHSS more costly over time. In our report, Reevaluating the 1991 Realignment (October 2018), we reached a similar conclusion. In response to the findings of its report, as part of the 2019‑20 budget, the administration included a proposal to make significant changes to 1991 realignment. We focus here on some of the major proposed changes impacting IHSS, but will be publishing a report that analyzes the administration’s proposal more comprehensively in the coming weeks.

Governor’s Budget Reduces IHSS County MOE Costs to Match 1991 Realignment Revenue Levels, Shifting Costs to the General Fund. As a result of DOF’s 1991 realignment report, the budget proposes to eliminate the General Fund assistance counties were receiving to assist them in covering IHSS costs associated with the 2017 IHSS MOE and instead reduces the IHSS county MOE itself—thereby reducing county IHSS costs. Specifically, proposed changes to the IHSS MOE include (1) reducing the 2019‑20 IHSS MOE from $2 billion to $1.56 billion and (2) reducing the annual adjustment to the IHSS MOE from as high as 7 percent down to 4 percent. Overall, as a result of these changes, the administration estimates that, on net, $242 million of county costs will be shifted to the state in 2019‑20, increasing to $547 million in 2022‑23. (We note that the budget proposes additional changes to the county share of cost for locally established IHSS wage and benefit increases beginning when state minimum wage reaches $15 per hour and how certain funds for social services and health programs are allocated within 1991 realignment. These changes will be discussed in detail in our larger evaluation of realignment‑related proposals that will be released in the coming weeks.)

It is our understanding that the administration lowered the IHSS county MOE costs to an amount that it estimated 1991 realignment revenues could cover in 2019‑20. The administration will revise the new IHSS county MOE base for 2019‑20 in May based on updated estimates of realignment revenues. To the extent that 1991 realignment revenues used to cover IHSS county costs come in lower (or higher) than initial budget estimates, a greater (or lower) amount of IHSS county MOE costs would be shifted to the General Fund. We are still analyzing the details of the administration’s proposed changes to 1991 realignment and will release more detailed comments in the coming weeks.

New IHSS Administrative Funding Methodology. In addition to lowering the IHSS county MOE for counties, the 2019‑20 budget includes a new methodology for funding IHSS administrative costs. Specifically, the Governor is proposing to use the General Fund to fully cover the budgeted nonfederal (state and county) share of IHSS administrative costs—effectively eliminating the county share of costs for administration that had existed historically. The budget includes about $383 million General Fund ($781 million total funds) for IHSS administrative costs in 2019‑20. The amount of General Fund counties receive to pay for IHSS administrative costs will increase year‑to‑year by the rate of growth in the IHSS caseload. The administration will adjust this funding mid‑year if actual caseload growth is higher than estimated, but not if growth in caseload is lower. To the extent that counties increase administrative funding for IHSS beyond what the allocation provides, counties will need to pay for those costs in addition to their overall MOE obligation. Overall, this methodology increases the predictability of funding for IHSS administration for both the state and counties.

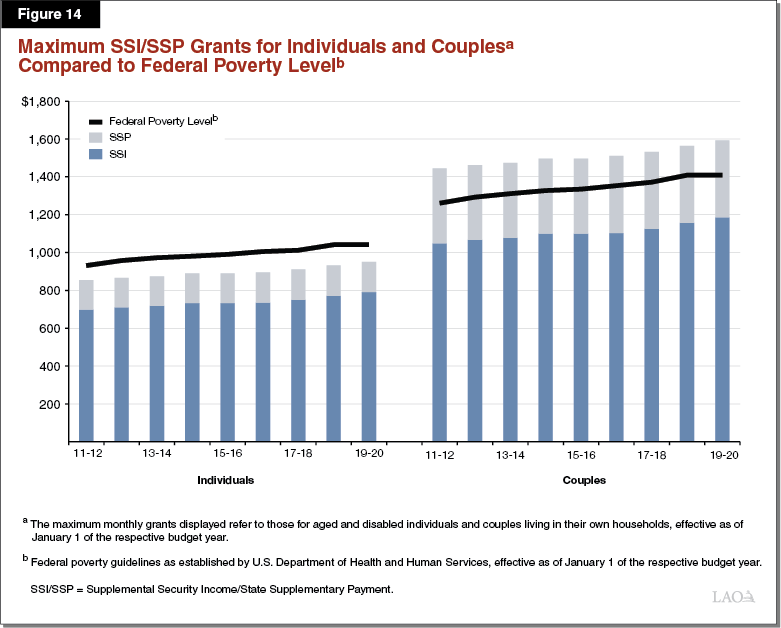

SSI/SSP

The SSI/SSP program provides cash grants to low‑income aged, blind, and disabled individuals. The state’s General Fund provides the SSP portion of the grant while federal funds pay for the SSI portion of the grant. Total spending for SSI/SSP grants is estimated to increase by about $125 million—or 1.3 percent—from an estimated $9.8 billion in 2018‑19 to $9.9 billion in 2019‑20. This is primarily due to increased federal expenditures as a result of the estimated increase to the federal SSI grant levels in 2019‑20. Of this total, the Governor’s budget proposes about $2.8 billion from the General Fund, an amount relatively equal to revised estimates of 2018‑19 expenditures.

Caseload Slightly Decreasing. The SSI/SSP caseload grew at a rate of less than 1 percent each year between 2011‑12 and 2014‑15. More recently, however, SSI/SSP caseload has slightly decreased—by 1.2 percent in 2016‑17, 1.5 percent in 2017‑18, and an estimated 1.5 percent in 2018‑19. The budget projects that caseload will be about 1.2 million individual and couple SSI/SSP recipients in 2019‑20, a decrease of 1.2 percent below estimated 2018‑19 caseload levels.

Background on SSI/SSP Grants