LAO Contact

May 15, 2019

The 2019-20 May Revision

Governor’s May Revision Update:

Health Insurance Affordability Proposals

With the May Revision (and prior to the May Revision with the release of proposed implementing legislation), the administration has provided additional details on its January proposal to impose a state individual mandate and use penalty revenues from the mandate to fund health insurance subsidies. Below, we summarize key updates to the Governor’s proposals and raise some issues for the Legislature’s consideration.

Key Updates to Governor’s Proposal Since January

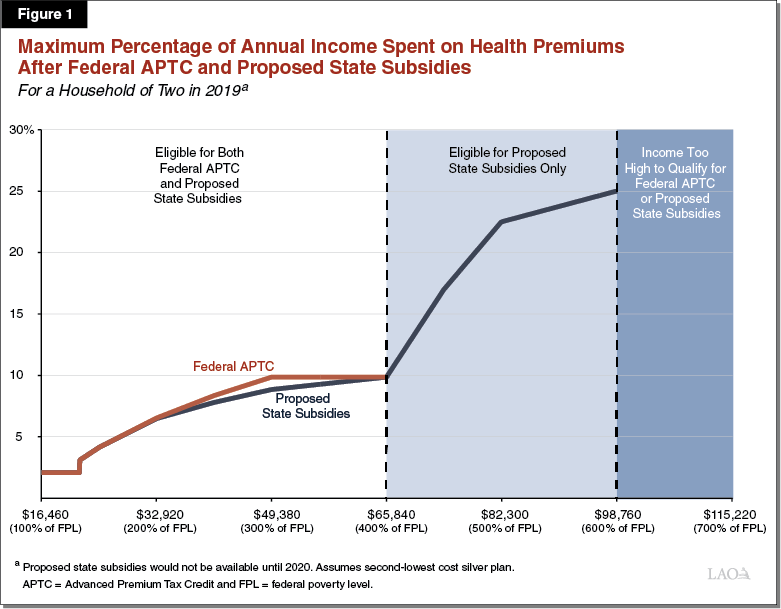

Subsidies to Be Modeled After Federal Advance Premium Tax Credit (APTC). The administration’s subsidies would limit a qualifying household’s net premium payments to a certain percentage of income that depends on a households annual income. Figure 1 displays how this percentage would change for different income levels under both the federal APTC and under the Governor’s proposed state subsidies. For example, for a household with income of 300 percent of the federal poverty level (FPL), the federal APTC limits the household’s net premium cost to about 10 percent of income. Under the Governor’s proposed state subsidy, the household’s net premium costs would be further limited to just less than 9 percent of income. Like the federal APTC, the state subsidy could be advanced to health insurers to immediately reduce the household’s monthly premiums. At the end of the year, the state subsidies would be reconciled through the state income tax system. The proposed state subsidies would be available beginning in 2020, but Figure 1 shows hypothetical income amounts for a household of two in 2019 because 2020 FPL amounts have not yet been determined.

Eligibility for Subsidies Would Extend Down to 200 Percent of the FPL. In January, the Governor proposed making state subsidies available to households with incomes between 250 percent and 600 percent of the FPL. The administration stated that it did not propose making state subsidies available to households under 250 percent of the FPL because such households qualify for federal cost-sharing reduction subsidies in addition to the federal APTC. In the May Revision, the administration now proposes making state subsidies available down to 200 percent of the FPL, in response to concerns that cost-sharing reduction subsidies are not significant for households with incomes between 200 percent and 250 percent of the FPL.

Relatively Larger Subsidies to Be Provided to Currently Unsubsidized Households . . . In the May Revision, the administration proposes allocating 75 percent of state subsidies in 2020 to households with incomes between 400 percent and 600 percent of the FPL. These households are currently not eligible for the federal APTC, and therefore pay the full premium cost of coverage. The proposed state subsidies would limit these households’ net premiums to a fixed percentage of income that would grow from about 10 percent for households with income just over 400 percent of the FPL to 25 percent for households with income at 600 percent of the FPL. We note that the proposed state subsidies would be particularly beneficial to those with incomes just above 400 percent of the FPL, the point where eligibility for the federal APTC ends (sometimes referred to as the “subsidy cliff”). The administration estimates that the average subsidy for households with incomes between 400 percent and 600 percent of the FPL would be about $100 per month.

. . . With Relatively Smaller Subsidies for Households Eligible for Federal Assistance. The remaining 25 percent of subsidies in 2020 would be allocated to households with incomes between 200 percent and 400 percent of the FPL that are currently eligible for the federal APTC. The administration estimates that the average subsidy for households in this income range would be about $10 per month.

Subsidies Would Sunset at the End of 2022. The administration proposes to make the subsidies available for three years, with a sunset at the end of 2022. Consistent with the January proposal, subsidies provided over this period would be fully covered by individual mandate penalty revenues. However, because households required to pay the penalty will not do so until early 2021 (when state income taxes are filed for 2020), the state General Fund would cover the cost of subsidies provided in 2019‑20, as shown in Figure 2. Penalty revenues generated after the subsidies sunset would be used to reimburse the General Fund for the costs not covered by penalty revenues in prior years, including in 2019‑20. Unlike the proposed state subsidies, the individual mandate penalty would be ongoing.

Figure 2

Individual Mandate Penalty Revenues and Insurance Subsidy Costs

Administration Projection (In Millions)

|

2019‑20 |

2020‑21 |

2021‑22 |

2022‑23 |

|

|

Penalty revenues |

— |

$317.2 |

$335.9 |

$352.8 |

|

Subsidy costs |

‑$295.3 |

‑330.4 |

‑379.9 |

— |

|

Net General Fund Impact |

‑$295.3 |

‑$13.2 |

‑$44.0 |

$352.8 |

LAO Comments

Individual Mandate Penalty Revenue Projections Appear Reasonable. The May Revision provides the administration’s estimate of how much penalty revenues would be generated by the state individual mandate, as shown in the above table. The May Revision projections are lower than initial estimates that were based on federal data because fewer people would be subject to the proposed state individual mandate than have been subject to the federal individual mandate. The administration’s penalty revenue projections appear reasonable. As of the release of this analysis, we have not received detailed information on the assumptions that informed the projections. We will advise the Legislature if we have concerns with penalty revenue projections once we have reviewed these assumptions.

No Concerns With Proposal for Administration of Penalty and Subsidy Reconciliation. The May Revision budget includes $8.2 million in 2019‑20 for the Franchise Tax Board to implement the proposed state individual mandate penalty and to reconcile state insurance subsidy payments. Following one-time start-up costs, administration of the individual mandate penalty would be funded on an ongoing basis because it would not have a sunset date.

Proposal to Sunset Subsidies Raises Questions. As we note in our office's Initial Comments on the Governor’s May Revision, the Governor sunsets a variety of budget-year proposals in order to maintain a balanced budget through the forecast period ending in 2022‑23. We raise a number of concerns with the Governor’s approach, finding that the May Revision understates the true ongoing cost of its policy commitments.

Cost of Subsidies for Currently Unsubsidized Households Could Grow Rapidly. The federal APTC covers the difference between premium costs and a certain percentage of a household’s income. While this insulates the household from year-over-year growth in health insurance premiums, nearly all of the cost of increased premiums must be covered by the subsidy. Consequently, the cost of the federal APTC grows more rapidly (on a percentage basis) than health premiums. The proposed state subsidy for households with incomes between 200 percent and 400 percent of the FPL would be insulated from increases in health premiums. However, similar to the federal APTC, the proposed state subsidy for households with incomes between 400 percent and 600 percent of the FPL could be subject to rapid cost escalation over time. The administration has indicated that subsidies would be adjusted for 2021 and 2022 so that subsidy expenditures would fit within projected penalty revenues. If the subsidies are continued after 2022, the state would need to weigh controlling the cost of the subsidies against controlling households’ net health insurance costs on an ongoing basis.