December 17, 2019

Comparing Taxes on Cannabis to Taxes on Other Products in California

Discussions about cannabis taxes often refer to taxes on other products, such as alcohol, tobacco, sugary drinks, and medicines. In this post, we describe some of the similarities and differences between taxes on cannabis and taxes on these products in California. First, we compare excise taxes on cannabis to excise taxes on alcohol, tobacco, and sugary drinks. Second, we compare taxes on cannabis to taxes on prescription and over-the-counter medicines. These comparisons focus on sales and excise taxes. (Additionally, federal income taxes generally treat cannabis businesses less favorably than other businesses, but this post does not examine this issue in detail.) Our estimates suggest that taxes on certain cannabis products are roughly comparable to taxes on distilled spirits but much higher than taxes on beer and wine. California’s state and local governments generally tax cannabis—including medical cannabis—more heavily than other medicines. In some instances, however, exemptions can make tax rates on medical cannabis comparable to tax rates on other medicines. Comparisons between taxes on cannabis and other goods—such as tobacco and sugary drinks—are more complex.

Comparing Cannabis Excise Taxes to Other Excise Taxes

Excise Taxes on Alcohol, Tobacco, and Sugary Drinks. Figure 1 describes the excise taxes levied by various levels of government on alcoholic beverages, tobacco products, and sugary drinks. These taxes take a variety of forms, including:

Unit-Based Taxes. State and federal taxes on cigarettes, state taxes on beer and wine, and local taxes on sugary drinks are a fixed dollar amount on each unit of the taxed good. This type of tax is feasible only when the quantity of a good can be measured in a standardized way. For example, for beer, wine, and sugary drinks, the taxed unit is an ounce of drink volume; for cigarettes, the taxed unit is a cigarette.

Ad Valorem Taxes. California’s state tax on non-cigarette tobacco products—including e-cigarettes, cigars, and chewing tobacco—is a percentage of the wholesale price of these products. Such price-based taxes are called ad valorem taxes.

Potency-Based Taxes. The federal tax on distilled spirits is based directly on the volume of alcohol in the drink, not on the volume of the drink itself. As a result, the tax rate on a given amount of liquor depends on its “potency”—the amount of alcohol it contains.

Taxes Tiered by Potency and/or Size of Producer. Federal taxes on alcoholic beverages, along with the state tax on distilled spirits, have rates that are split into different levels, or tiers, based on certain product characteristics. In particular, the state tax on distilled spirits has one rate that applies to most drinks and a second rate (double the standard rate) for the most potent drinks. Federal taxes on beer and spirits tax the output of larger brewers and distilleries more heavily than the output of smaller producers. The federal tax on wine has rate tiers that depend both on winery size and alcohol content.

Figure 1

Comparing Excise Taxes

|

Type of Product |

Excise Tax |

||

|

Federal |

State |

Local |

|

|

Beer |

0.1 cent to 0.5 cent per ounce of drink volumea |

0.2 cent per ounce of drink volume |

— |

|

Wine |

0.1 cent to 2.7 cents per ounce of drink volumeb |

0.2 cent per ounce of drink volume |

— |

|

Distilled spirits |

4 cents to 21 cents per ounce of alcohola |

|

— |

|

Cigarettes |

$1.01 per pack of 20 cigarettes |

$2.87 per pack of 20 cigarettes |

— |

|

E‑cigarettes |

— |

59% of wholesale price |

— |

|

Chewing tobacco |

$0.50 per pound |

59% of wholesale price |

— |

|

Cigars |

53% of manufacturer’s sales price, to a maximum of $0.40 per cigar |

59% of wholesale price |

— |

|

Sugary drinks |

— |

— |

One cent per ounce of drink volume in four Bay Area cities |

|

Cannabis |

— |

|

Varies; estimated average rate roughly equivalent to 14 percent of retail sales |

|

aRate within range depends on size of producer: the larger the producer, the higher the rate. bRate within range depends on alcohol content and size of producer: the greater the alcohol content and the larger the producer, the higher the rate. |

|||

Cannabis Subject to Various State and Local Excise Taxes. As shown in Figure 1, California’s state and local governments levy a variety of excise taxes on cannabis, including:

State Cultivation Tax. This weight-based tax is somewhat similar to the unit-based taxes on cigarettes, beer, wine, and sugary drinks. Unlike those goods, however, there is no standardized way to measure the quantity of a cannabis product. Instead, the unit-based tax on cannabis applies to the one thing all cannabis products have in common—the plant used to make them.

State Retail Excise Tax. This ad valorem tax is based loosely on retail prices of cannabis products. As described in our recent report, the state collects this “retail” tax primarily at the wholesale level, effectively making it an ad valorem tax on wholesale prices.

Local Taxes. Many cities and counties levy cannabis taxes. Most of these taxes are ad valorem taxes on sales made by cannabis businesses. Another common type of local tax is a unit-based tax on the total square footage of the plant canopy grown by cultivators.

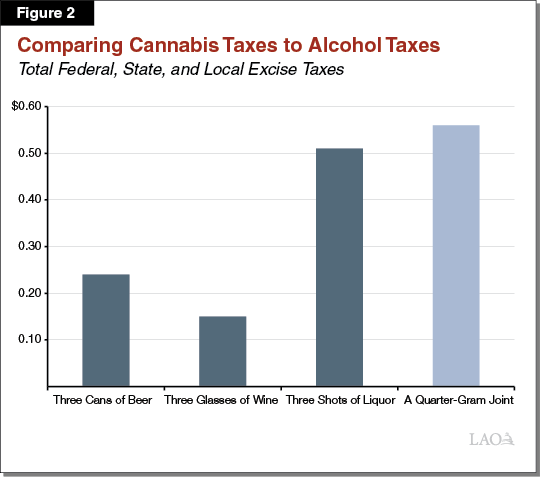

Taxes on Cannabis Flower Roughly Comparable to Spirits, Much Higher Than Beer and Wine. In Figure 1, some similarities and differences between cannabis taxes and other excise taxes are apparent. For example, most of these goods are taxed by two levels of government—alcohol and tobacco by federal and state governments and cannabis by state and local governments. In Figure 2, we present estimates of the total amount of federal, state, and local excise taxes levied on representative amounts of alcohol and cannabis. This comparison can be instructive, as a common purpose for using these substances is intoxication. As shown in the figure, the typical total excise tax on a quarter-gram joint appears to be roughly similar to the typical total excise tax levied on three shots of liquor. In contrast, typical excise taxes on beer and wine appear to be much lower. (We chose these quantities because, in many cases, they might be sufficient to intoxicate novices or other low-tolerance users.) Although we know of no similarly suitable way to compare cannabis taxes to tobacco taxes, taxes on tobacco clearly are very substantial.

Comparing Taxes on Cannabis to Taxes on Medicines

Taxes on Medical Cannabis. Many people use cannabis for medicinal purposes. Medical cannabis is exempt from certain taxes under three scenarios. First, cannabis is fully exempt from state and local sales taxes if purchased for medical use with a valid state medical identification (ID) card, which requires a physician’s recommendation, county health department approval, and an application fee. (Administrative data suggest that this sales tax exemption applies to less than two percent of all cannabis sales.) Second, under a new law that takes effect January 1, 2020 (Chapter 837, Statutes of 2019 [SB 34, Wiener]), medical cannabis products that businesses donate to consumers free of charge (and that meet other conditions) are fully exempt from the state’s cannabis excise taxes. Third, some cities and counties levy lower excise tax rates on purchases made with a doctor’s recommendation than on nonmedical (often called adult-use) sales.

Taxes on Medicines. Although tangible goods generally are subject to sales tax, state law exempts some specified goods. In particular, prescription medicines are exempt. Most over-the-counter medicines, however, are subject to sales tax. Excise taxes do not apply to either type of medicine.

Comparison Between Medical Cannabis and Other Medicines. Under state law, doctors may recommend cannabis for their patients. Due to federal cannabis criminalization, however, doctors may not write prescriptions for cannabis. As a result, cannabis is not eligible for the sales tax exemption for prescription medicines. We estimate that most cannabis purchased with a doctor’s recommendation is subject both to sales taxes and excise taxes because the purchaser does not have a state-issued medical ID card, resulting in a higher overall tax rate than other medicines. That said, in some instances, the exemptions described above could result in tax rates on medical cannabis that are comparable to tax rates on other medicines.