LAO Contact

Update 1/24/20: Adjusted Judicial Branch items in Appendix Figure 1 to reflect ongoing spending.

January 13, 2020

The 2020-21 Budget:

Overview of the Governor's Budget

January 20, 2020: Upon further review, one item included in the original version of Appendix Figure 3 on discretionary health spending should not have been included (specifically, use of the Medi-Cal drug rebate fund to offset General Fund costs). Removing this item—which reduces General Fund spending—from the list of discretionary choices made in the Governor’s budget increases our calculation of the surplus to $6 billion. The document is updated to reflect these changes.

Executive Summary

On January 10, 2020, Governor Newsom presented his proposed state budget to the Legislature. Under the administration’s budget estimates and proposals, General Fund revenues would total $151.6 billion in 2020‑21 and spending would total $153 billion. Overall school and community college spending would total $84 billion in 2020‑21 (of which nearly 70 percent is funded by the General Fund).

Total Reserves Would Reach $20.5 Billion. Under the Governor’s proposed budget, the state would end 2020‑21 with $20.5 billion in total reserves. (This represents an increase of $1.7 billion from the 2019‑20 enacted reserve level as required by the State Constitution.) Reserves are the most important tool the state has to insulate programs from the adverse effects of budget shortfalls. Over recent years, the Legislature prudently dedicated a sizeable portion of available surpluses to building more discretionary reserves. The Governor’s budget does not continue this practice. As the Legislature begins to craft the 2020‑21 budget, we urge first considering the overall budget structure, including a target level of reserves. In particular, we encourage the Legislature to determine whether it is satisfied with the level of reserves proposed by the Governor or whether it would like to aim for a higher level.

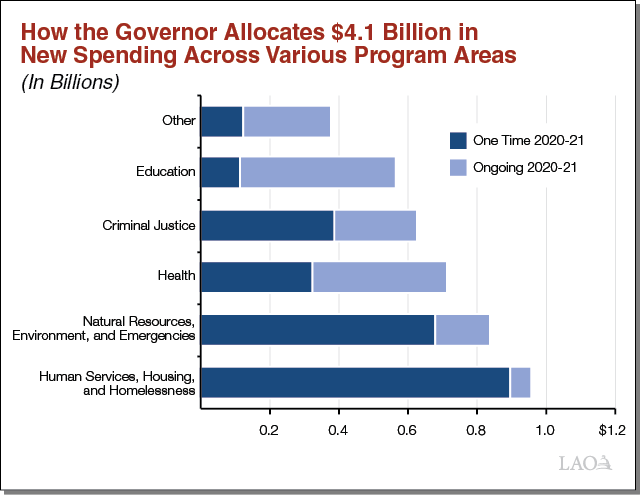

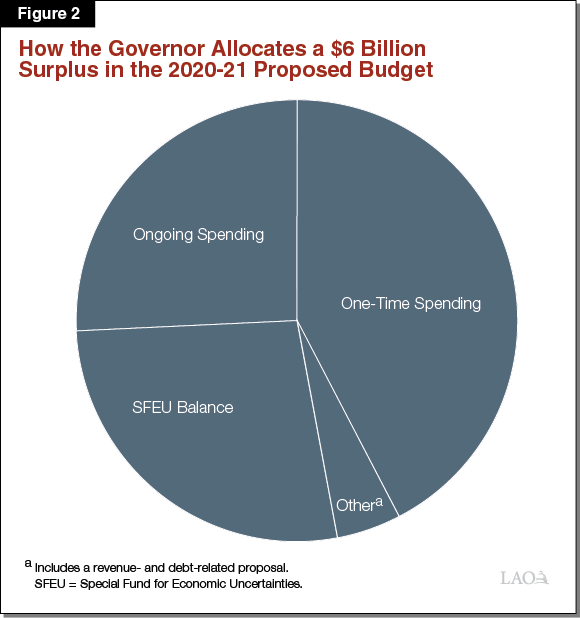

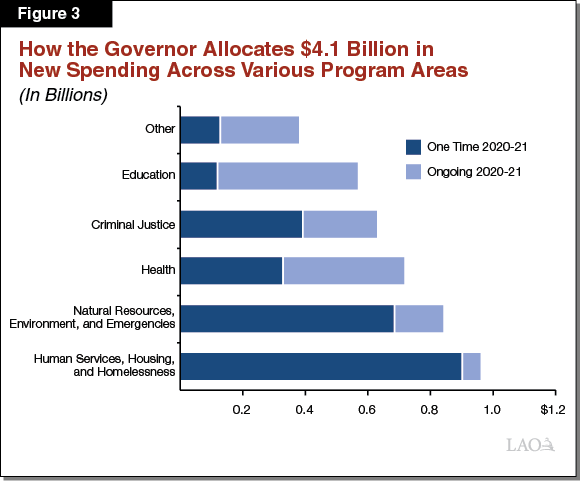

Governor Proposes Allocating a Surplus of $6 Billion. We estimate the Governor had a $6 billion surplus to allocate in the 2020‑21 budget process. Of this total, the Governor allocates $2.6 billion to one‑time spending, $1.6 billion to maintain the state’s discretionary reserve, and $1.6 billion to ongoing spending (other nonspending changes account for the remaining $300 million). The figure shows how the one‑time and ongoing spending proposals—totaling $4.1 billion and roughly 140 proposals—are distributed by program area. While these proposals include some larger amounts, 95 percent of them—accounting for half of the proposed spending—cost less than $100 million in 2020‑21. Put simply, the Governor’s budget includes a large array of proposals, across many priorities, with relatively small dollar amounts. We recommend the Legislature consider whether to take this approach or to dedicate larger amounts to a smaller number of priorities.

Budget Condition Is Positive, but Subject to Heightened Risk. California continues to enjoy a healthy fiscal situation. Despite its positive near‑term picture, the budget’s multiyear outlook is subject to considerable uncertainty. In particular, the state’s fiscal situation in the coming years is sensitive to federal decisions around healthcare financing. Moreover, while a broader economic slowdown is not necessarily imminent, there are several signals that the economy could be cooling. Either of these factors could weaken the budget’s condition by billions of dollars.

Consider Larger Operating Surplus. In addition to reserves, another key tool to insulate the budget from shortfalls is the state’s operating surplus—when revenues exceed expenditures on an ongoing basis. Under the administration’s projections, however, the state would have small operating surpluses in the out years. Given the Governor does not allocate the surplus to increasing discretionary reserves, the maturity of this economic expansion, and federal policy uncertainty, eliminating the operating surplus is risky. As the Legislature begins shaping the budget for the upcoming year, we encourage aiming to preserve this tool by maintaining a positive operating balance in its own multiyear budget plans.

On January 10, 2020 Governor Newsom presented his proposed state budget to the Legislature. In this report, we provide a brief summary of the proposed budget based on our initial review. In the coming weeks, we will analyze the plan in more detail and release several additional budget reports.

The objective of this report is to summarize the Governor’s budget structure and major proposals for the Legislature, including any themes that emerged as we conducted our preliminary review. We also provide our initial assessment of the structure of the budget and raise issues for legislative consideration on the major budget proposals.

Budget Condition

Budget Condition for 2020‑21

This section summarizes the overall condition of the state budget in the near term under the Governor’s proposals. Figure 1 shows the General Fund condition assuming the Legislature adopted those proposals using the administration’s estimates and assumptions. Over the three year period, revenues (including transfers) grow from a revised level of $139.4 billion in 2018‑19 to $151.6 billion in 2020‑21. Spending also grows from $141.9 billion in 2018‑19 to $153 billion in 2020‑21. (Because recent budgets have benefited from upward revisions to prior year revenues, spending has exceeded revenues within fiscal years as the state has allocated those surpluses.)

Figure 1

General Fund Condition Under Administration’s Estimates

(In Millions)

|

2018‑19 Revised |

2019‑20 Revised |

2020‑21 Proposed |

|

|

Prior‑year fund balance |

$10,979 |

$8,497 |

$5,234 |

|

Revenues and transfers |

139,379 |

146,486 |

151,635 |

|

Expenditures |

141,861 |

149,749 |

153,083 |

|

Ending fund balance |

$8,497 |

$5,234 |

$3,785 |

|

Encumbrances |

2,145 |

2,145 |

2,145 |

|

SFEU balance |

6,352 |

3,089 |

1,640 |

|

Reserves |

|||

|

BSA |

$13,968 |

$16,018 |

$17,977 |

|

SFEU |

6,352 |

3,089 |

1,640 |

|

Safety net |

900 |

900 |

900 |

|

Total Reserves |

$21,220 |

$20,007 |

$20,517 |

|

SFEU = Special Fund for Economic Uncertainties (discretionary reserve) and BSA = Budget Stabilization Account (rainy day fund). |

|||

Constitutional General Fund Requirements. California has two key constitutional formulas which require the state to allocate minimum amounts each year to (1) schools and community colleges and (2) certain eligible debts and reserves. These formulas generally require more spending as General Fund tax revenues increase. Under the Governor’s estimates, the state is required to spend:

- $1.7 Billion General Fund Increase for Schools and Community Colleges. General Fund spending on schools and community colleges is determined mainly by a set of constitutional formulas outlined in Proposition 98 (1988). Reflecting the administration’s revised revenue estimates, the Governor’s budget proposal provides an additional $575 million General Fund to schools and community colleges (relative to June 2019) for 2018‑19 and 2019‑20. Between 2019‑20 and 2020‑21, General Fund spending on schools and community colleges increases by $1.2 billion, consistent with growing revenues. The nearby box provides more information on Proposition 98 and the overall changes in school and community college spending.

- $2 Billion in Additional Payments on Debts and Liabilities. In addition, under the rules of Proposition 2 (2014), the Governor’s budget includes $2 billion General Fund in constitutionally required debt payments. The Governor allocates this amount among three uses: (1) continuing to implement the state’s plan to prefund retiree health benefits, (2) repaying a 2017‑18 loan from the state’s cash resources that supported a supplemental pension payment in that year, and (3) a supplemental pension payment to the state’s teacher retirement system. Although the overall amount of these payments are required under the state’s constitutional rules, the Legislature has the discretion to change the allocation of these funds to different eligible purposes.

- $2 Billion in Reserve Deposit. As discussed in more detail below, the rules of Proposition 2 also require a $2 billion deposit into the Budget Stabilization Account (BSA)—the state’s primary rainy day fund—in 2020‑21.

Estimates of the Proposition 98 Minimum Guarantee Under the Governor’s Budget

The minimum guarantee is the constitutionally required funding level for schools and community colleges. The state meets the guarantee through a combination of state General Fund and local property tax revenue. As part of each budget cycle, the state revises its estimate of the minimum guarantee for the prior, current, and upcoming fiscal years. Under the Governor’s budget, the minimum guarantee is up $302 million in 2018‑19 and $517 million in 2019‑20 compared to the estimates from the 2019‑20 budget package. For 2020‑21, the administration estimates the minimum guarantee is $84 billion, an increase of $2.5 billion (3 percent) over the revised 2019‑20 level. Higher property tax revenue and higher General Fund revenue each account for about half of the increase in the 2020‑21 guarantee. The constitution also requires the state to make deposits into a Proposition 98 reserve when a series of conditions are met. Under the administration’s estimates, the balance of the Proposition 98 reserve would reach $487 million at the end of 2020‑21.

Total Reserves Reach $20.5 Billion. Figure 1 displays revised 2018‑19 and 2019‑20 budget estimates as well as proposed estimates for 2020‑21. At the bottom of the figure, we display the total reserves planned for the end of 2020‑21 under the administration’s estimates and assumptions. Under the Governor’s proposed budget, the state would end 2020‑21 with $20.5 billion in total reserves. This represents an increase of $1.7 billion from the 2019‑20 enacted reserve level of $18.8 billion. Total reserves has three components:

- $18 Billion in the BSA. Under the Governor’s estimates and the constitutional rules of Proposition 2, the state is required to make a nearly $2 billion deposit into its constitutional reserve, the BSA. The reserve would reach a balance of $18 billion at the end of 2020‑21. (Under the complicated constitutional rules under Proposition 2, the state must also draw down the balance of the BSA for 2018‑19 and 2019‑20 due to lower estimated capital gains revenues. The net effect is a $1.5 billion increase in BSA relative to the enacted 2019‑20 amount.)

- $1.6 Billion in the Special Fund for Economic Uncertainties (SFEU). The state’s other general purpose reserve account is the SFEU. Unlike the BSA, which has restrictions on its use of funds, the Legislature has discretion to use the funds in the SFEU at any time and can set the balance of this fund to any amount above zero. The Governor proposes a 2020‑21 year‑end balance in the SFEU of $1.6 billion, which is $230 million more than the enacted level of the fund for the end of 2019‑20.

- $900 Million in Safety Net Reserve. The 2018‑19 budget package created the Safety Net Reserve to save money specifically for California Work Opportunity and Responsibility to Kids (CalWORKs) and Medi‑Cal. (During a recession, these programs typically have increased expenditures as caseload increases.) The Governor proposes no additional deposits into the reserve so it remains at its 2019 enacted level of $900 million under this budget proposal.

Governor Has a $6 Billion Surplus to Allocate. We estimate the Governor had a $6 billion surplus to allocate in the 2020‑21 budget process. (The box below gives more information on how we use the term “surplus” in the Overview of the Governor’s Budget.) This estimate does not assume the state’s reauthorized managed care organization (MCO) tax is approved by the federal government in 2020‑21 (although the administration’s multiyear estimates do assume it is ultimately approved to take effect in 2021‑22, as we discuss later). After adjusting for a variety of accounting changes, this surplus is very close to the one our office estimated would be available in our November Fiscal Outlook.

What Do We Mean by “Surplus” in This Report?

The Governor’s January budget is the starting point for legislative deliberation. Ultimately, the Legislature will make its own determination about how to allocate funds available in the upcoming budget process. One of the goals of this report is to estimate for the Legislature how much capacity the budget has to make those allocations under the Governor’s estimates of revenues. Assuming the proposed budget is balanced, we answer this question by assessing which of the Governor’s proposals are “discretionary.” We define discretionary spending to mean spending not authorized under current law. We also include the full amount of the proposed balance in the Special Fund for Economic Uncertainties (SFEU) as discretionary. The sum of these amounts is the surplus allocated in the Governor’s budget.

Importantly, these calculations are subject to some caveats. First, there are a number of proposals that could be viewed as more or less discretionary. For example, we categorize the full amount the administration sets aside for state employee compensation increases as discretionary. We take this approach to reflect the Legislature’s authority to approve memorandums of understanding with state bargaining units and allocate the necessary funds. While the Legislature typically provides funds for these purposes, we do not assume the Legislature will make the same choices as the administration. Second, although the Legislature does have the authority to set the level of the SFEU at any amount above zero, setting this amount too low is inadvisable. Consequently, the total surplus—$6 billion—is larger than what ultimately will be available for new programs or expanded programs.

How the Governor Allocates the Available Surplus. Figure 2 shows how the Governor proposes to allocate the $6 billion in discretionary resources. The Governor allocates:

- $2.6 Billion to One‑Time or Temporary Programmatic Spending. The Governor proposes spending nearly half of discretionary resources, or $2.6 billion, on a one‑time or temporary basis for a variety of programmatic expansions. Across a variety of program areas, one‑time spending includes nearly $500 million for infrastructure‑related construction and maintenance.

- $1.6 Billion to Maintain the State’s Discretionary Reserve Balance. As mentioned earlier, the Governor proposes a year‑end balance in the SFEU of $1.6 billion. This represents a $230 million increase relative to the enacted level of the fund for the end of 2019‑20. While the Legislature could set this fund balance to any amount greater than zero, since 2015‑16 the state has enacted balances in the SFEU of around $1.5 billion.

- $1.6 Billion in Ongoing Spending. The Governor’s spending proposals also include $1.6 billion in ongoing spending, representing roughly a quarter of resources available. Because some of these ongoing proposals are phased in over a multiyear period, we estimate the cost at full implementation of these proposals is $1.9 billion annually.

- $300 Million in Other. In addition, the Governor allocates $50 million to new tax reductions for small businesses and $235 million to accelerate a CalPERS supplemental pension payment.

Governor Allocates Most One‑Time Spending to Homelessness, While Most Ongoing Spending Is for Health and Education. Figure 3 shows how the $4.1 billion in one‑time or temporary and ongoing spending proposals are distributed across program areas. The largest one‑time spending proposals include $750 million to reduce homelessness (in the California Access to Housing and Services Fund) and $250 million to establish a new loan program for private environmental projects (the Climate Catalyst Revolving Loan Fund). Ongoing amounts are focused on the universities, which receive $417 million in discretionary increases, and health programs. In health, the largest single ongoing spending proposals include nearly $200 million in 2020‑21 for the Medi‑Cal Healthier California for All proposal (there also are one‑time or temporary components of this proposal). Other ongoing spending includes employee compensation increases.

Budget Condition Over the Multiyear

In this section we describe the administration’s estimates of the condition of the General Fund budget over the longer term under the Governor’s 2020‑21 budget proposal.

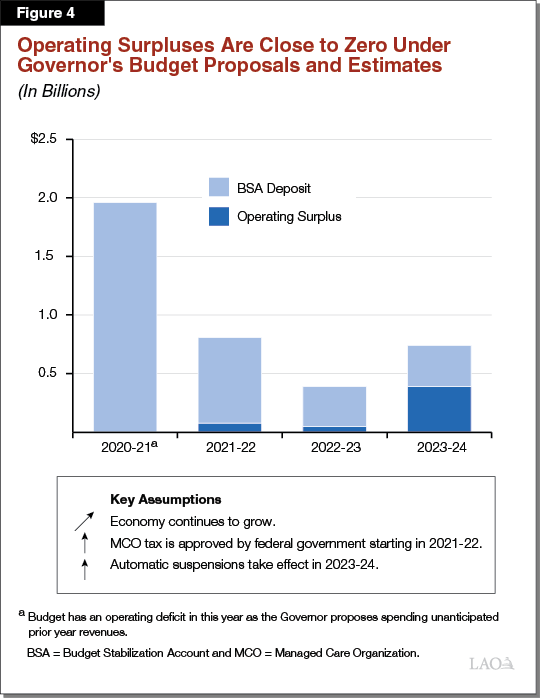

BSA Reaches Maximum Threshold in 2021‑22. Under Proposition 2, the state must make deposits into the BSA until its balance reaches a threshold of 10 percent of General Fund taxes. Under the administration’s estimates, the state reaches this threshold in 2021‑22. Each year that General Fund tax revenues grow, this 10 percent threshold also grows. As such, in each of these years, the state is required to make deposits into the BSA to bring the fund to the revised estimate of 10 percent of General Fund taxes. These amounts are shown in light blue in Figure 4.

Small Operating Surpluses Under Governor’s Plan and Estimates. In the previous section we used the term surplus to describe the amount available to allocate in the budget year. When examining a budget’s multiyear condition, the “operating surplus” is an important marker of budget health. An operating surplus is the amount of additional resources available annually—or the yearly amount by which revenue estimates exceed expenditures. Figure 4 shows the operating surpluses under the administration estimates in the Governor’s proposed budget. (Importantly this figure shows the administration’s own assessment of its proposals, not our independent estimates.) As the figure shows, the administration’s estimates suggest the proposed budget is in structural balance with operating surpluses near zero in most years of the period.

Governor Proposes Delaying Suspensions to 2023‑24. The 2019‑20 budget package made a number of ongoing program augmentations subject to suspension on December 31, 2021 if the budget did not collect sufficient revenues to fund them. Our office estimated the full‑year savings—in 2022‑23—of suspending these expenditures was $1.7 billion. The augmentations subject to suspensions were in a variety of state programs, including In‑Home Supportive Services, developmental services, and Medi‑Cal. The administration proposes delaying the planned suspensions by eighteen months—to July 1, 2023. (The Governor’s budget makes a couple of newly proposed augmentations subject to the same suspension language—together representing $71 million in costs in 2020‑21—but makes no other changes to the programs subject to the suspensions.)

Operating Deficit Emerges Assuming Suspensions Do Not Take Effect. As shown in Figure 4, the operating surplus under the Governor’s budget is roughly $400 million in 2023‑24. This assumes, however, that the suspensions take effect, reducing General Fund spending by $2.2 billion in that year. Absent the suspensions, the budget would face an operating deficit in 2023‑24 of nearly $2 billion

Large Operating Deficits Could Emerge Depending on Recently Proposed Federal Regulations. In late 2019, the federal government released draft regulations with significant implications for state General Fund costs related to the Medi‑Cal program. If adopted in their current form, these regulations would limit the state’s ability to continue certain Medi‑Cal financing mechanisms, such as the MCO tax. The Governor’s budget assumes that the federal government ultimately approves the state’s MCO tax, resulting in a General Fund benefit beginning in 2021‑22. If this does not occur, however, the state would lose between $1.2 billion and $2 billion annually over the multiyear period. The draft regulations also likely would affect a number of other Medi‑Cal financing mechanisms, potentially resulting in additional state General Fund costs—and large operating deficits—in the billions of dollars annually. The Governor’s budget, however, does not assume any fiscal impact from these draft regulations overall.

LAO Comments

Economy and Revenues

Administration’s Revenues Estimates Are Reasonable. The administration’s revenue assumptions are very close to our November 2019 Fiscal Outlook revenue estimates in the near term. Across 2018‑19 to 2020‑21, the administration’s estimates of revenue from the state’s three largest taxes are $34 million (less than 0.01 percent of total collections) above our Fiscal Outlook estimates.

Revenue Estimates Nonetheless Have Considerable Downside Risk. While the administration’s revenue estimates generally are reasonable, multiple factors create a risk that revenues will come in lower than anticipated. Two key factors are:

- Slowing Economic Growth. There are several signals that the economy may be cooling. For example, housing markets have been stagnant, job growth is down, and trade activity is slowing. This does not necessarily mean a broader economic slowdown is imminent. Nonetheless, there likely is greater risk in the economic outlook for 2020‑21 than in previous budget cycles.

- Uncertain Behavioral Assumptions. Recently, corporation tax collections have grown faster than anticipated while personal income tax collections have grown somewhat slower. The administration assumes that this pattern will continue. This is because they attribute the pattern to partnerships, which are taxed under the personal income tax, changing to corporations in response to 2017 federal tax changes. This assumption is plausible, but there currently is limited evidence to support it. There are other reasonable explanations for this pattern which would suggest that the recent uptick in corporation tax receipts will not necessarily persist. Should such an alternative explanation prove to be true, corporation tax collections could be weaker than expected in the budget year.

Budget Condition

Small Operating Surpluses. The administration projects the budget would be roughly balanced—with operating surpluses near zero—under its proposed budget. While our office’s most recent revenue estimates are somewhat higher in the out years than the administration’s current estimates, under both sets of revenue estimates the state would face operating deficits under two conditions. First, if new draft federal policy changes take effect and result in significant General Fund cost increases for the state’s Medi‑Cal program. Second, if the Legislature chose not to suspend the program expenditures described earlier. Given the budgetary risks posed by economic uncertainty and federal policy changes, maintaining positive operating surpluses would put the budget on better footing.

Without an Operating Surplus, Responding to a Recession More Challenging. In our November Fiscal Outlook, we found the state has sufficient reserves to cover operating deficits in the event of a typical post‑World War II recession. This finding was based on two important assumptions. First, we assumed the state built reserves of $23 billion in 2020‑21. Second, we assumed the state maintained operating surpluses of a few billion dollars each year under its baseline plan. While reserves are the most important tool the state has to respond to a budget shortfall, maintaining a positive operating surplus also provides the budget with an important first line of defense as revenues decline or spending unexpectedly increases. Smaller operating surpluses mean that the budget has less “cushion” to absorb these changes, resulting in the need for more reserves. By proposing a budget with very small operating surpluses, the Governor eliminates a key tool of recession preparedness.

Recommend Legislature Consider Overall Targets for Reserves and Operating Surplus. As the Legislature begins to craft the 2020‑21 budget, we urge first considering the overall budget structure before evaluating individual budget proposals. This includes determining a target level of reserves and how much to commit to ongoing spending. Given the maturity of the economic expansion, revenues may not grow as quickly as past years. Consequently, in our November Fiscal Outlook, we recommended the Legislature commit no more than $1 billion to ongoing purposes in 2020‑21. Under our revenue estimates, this allows the state to maintain a positive operating surplus so that risks to the bottom line, such as revenue reductions and changes in federal policy, are less likely to result in budget deficits. While the Governor commits a good portion of the surplus to one‑time purposes, he proposes spending $1.6 billion on ongoing purposes—growing to $1.9 billion over time. This effectively would eliminate the budget’s operating surplus under his proposals and estimates. In a still‑growing but now mature economic expansion, continuing to build reserves or to otherwise supplement the state’s fiscal resilience by preserving a larger operating surplus would be prudent.

Budget Proposals

This section describes the major General Fund budget proposals included in the Governor’s January budget, including both discretionary and nondiscretionary spending amounts. While the Governor’s discretionary proposals include some larger items, the vast majority of the Governor’s proposals are smaller. To summarize the numerous smaller proposals, we provide figures in the Appendix that itemize the Governor’s proposals by policy area. The remainder of this section describes those higher cost proposals and those with important policy implications. Where feasible, we also provide our initial assessment of these proposals and issues for legislative consideration.

Schools and Community Colleges

After Providing Cost‑of‑Living Adjustment (COLA), Package Dedicates Most Available Funding to One‑Time Purposes. Most of the ongoing school and community college augmentations are to cover a 2.29 percent COLA and enrollment changes. For K‑12 education, the budget includes $1.2 billion for the Local Control Funding Formula, which reflects funding for the COLA offset by a 0.3 percent attendance decline. For community colleges, the Governor’s largest ongoing proposal is $199 million to cover the COLA and 0.5 percent enrollment growth. After covering these costs, the Governor’s budget has $1.3 billion in Proposition 98 funding available for new commitments in 2020‑21. The Governor proposes to use the bulk of these funds ($1.1 billion) for one‑time purposes. This approach provides the state with a cushion to more easily accommodate a drop in the minimum guarantee without making cuts to ongoing programs.

Though the Governor Is Focusing on Issues of Legislative Concern, One‑Time Funding Might Not Have Much Impact. The Governor’s budget includes $1.9 billion in total one‑time Proposition 98 spending—the $1.1 billion from 2020‑21, plus an additional $819 million attributed to the prior and current fiscal years. The one‑time funds are primarily used for two purposes. Most notably, the Governor provides a combined $900 million for six programs aimed at improving school employee training, recruitment, and retention. The budget also provides $600 million for two new grant programs: (1) $300 million for grants to help low‑performing schools and districts improve their performance and (2) $300 million for schools that implement the community schools model—which typically integrates health, mental health, and other services for students and families and provides these services directly on school campuses. Although these initiatives are broadly consistent with the priorities of the Legislature, many key details on how the programs would operate are not yet available. Moreover, many of these proposals provide one‑time funding for staffing and achievement issues that have been ongoing for many years and may require ongoing funding to address.

One‑Time Funding Could Be Used to Provide Districts Long‑Term Fiscal Relief. Most of the one‑time proposals in the Governor’s budget would require districts to implement new programs or expand existing services as a condition of receiving funding. The Legislature might want to consider repurposing some of the one‑time funding to instead help school and community college districts address their unfunded liabilities. Districts currently have a number of such obligations, including growing pension costs and unfunded retiree health liabilities. Such an approach would provide districts with long‑term relief that would make balancing their budgets easier to do on a sustained basis.

Universities

Governor Proposes Discretionary Base Increases for the Universities. The Governor’s budget includes various General Fund increases for the California State University (CSU) and the University of California (UC). The largest ongoing proposal for each segment is a 5 percent General Fund base increase ($199 million for CSU and $169 million for UC). Unlike the Governor’s and the Legislature’s approach last year, which connected every CSU and UC funding augmentation with a specific purpose, the Governor’s approach in 2020‑21 gives the segments flexibility in allocating their base increases. The administration, however, expects each segment to focus on college affordability, access, timely degree completion, and the narrowing of student achievement gaps. The administration, however, is silent on the specific issue of whether the segments are to increase student tuition levels. Regarding access, the administration sets no specific enrollment targets for either segment but makes general intent statements. The administration expects UC to further increase resident undergraduate enrollment in 2020‑21 and 2021‑22. It expects CSU to support additional enrollment at its most impacted campuses and programs.

Recommend Linking Base Increases With Clear, Explicit Expectations. By failing to link base funding increases to clear, specific state spending priorities, the administration effectively relinquishes important budget responsibilities. Rather than make key budget trade‑offs directly—for example, between enrolling more students and raising employee salaries—the Governor allows the segments to make these choices. This budget approach leaves the Legislature without a clear understanding as to how the segments will use their funding increases, and it raises the potential for some allocation decisions made by the segments to be poorly aligned with broader legislative priorities. We recommend the Legislature take a different approach and retain its budget authority to make key, high‑level decisions. Specifically, we recommend the Legislature set enrollment expectations for each segment, decide how much to provide for graduation and other core student support initiatives, and determine how much to provide for compensation increases and other operating costs. Our recent report, Analyzing UC and CSU Cost Pressures, is intended to help the Legislature as it begins thinking through these issues.

Homelessness

Governor Proposes $750 Million to Reduce Homelessness. The Governor proposes $750 million General Fund in one‑time funding to establish the California Access to Housing and Services (CAAHS) Fund within the Department of Social Services (DSS). The funds would be provided through contracts with regional administrators to help finance the development of affordable housing, provide rental subsidies to people facing homelessness, and provide subsidies to operators of board and care facilities. The administration envisions that the state funding would be coupled with other government and private funds to expand the potential effect of this initiative. The Governor requests the Legislature take early action on this component of the budget so that the administration can expedite its implementation. The Governor’s efforts to address homelessness also include reforms to Medi‑Cal, the state’s behavioral health system, and state hospitals. (We provide additional information about some of these proposals in the next section.) In addition, a recently issued Executive Order directs the administration to inventory state properties that could be used for shelters.

Questions to Ask the Administration About New Approach to Homelessness. Below, we highlight some initial questions the Legislature might want to ask the administration as it considers the merits of the requests.

- Why is the administration taking a new approach to address homelessness? The past two budgets primarily allocated funds directly to local governments. What data or other information about these allocations made the administration suggest changing course?

- What incentives are there for the federal government, local governments, and private entities to contribute funding to the CAAHS Fund? Would funds be used interchangeably regardless of source?

- How will the administration select regional administrators?

- What oversight will the state exercise over regional administrators? How will the state evaluate progress and assess outcomes?

- Why is the Governor requesting early action by the Legislature on the CAAHS Fund? Does the early action obligate the Legislature to funding in 2020‑21? Given the downside risk to revenues and the smaller operating surpluses under the Governor’s proposed budget, taking early action to obligate funding would be risky.

- In recent years, the state has built substantial infrastructure to address homelessness, particularly within the Business, Consumer Services, and Housing Agency. Why has the administration decided to establish the CAAHS Fund within DSS? How will the CAAHS Fund, other components of the 2020‑21 homelessness package, and existing programs work collaboratively to address homelessness?

Medi‑Cal Healthier California for All

Funds “Medi‑Cal Healthier California for All” Proposal. In October 2019, the administration announced a series of proposed Medi‑Cal reforms that are now collectively referred to as Medi‑Cal Healthier California for All. Under the proposal, for example, the state aims to (1) encourage contracted managed care plans to provide additional non‑health care services, such as intensive care management and temporary housing services, intended to more comprehensively address the needs of Medi‑Cal enrollees with the most complex and costly conditions (such as the homeless); (2) simplify state administration and service delivery in the Medi‑Cal program; and (3) shift further toward models of paying for health care services that reward quality over volume. The Governor’s budget includes $695 million total funds ($347.5 million General Fund) to implement key components of the proposal for a half year in 2020‑21, increasing to $1.4 billion total funds ($695 million General Fund) in 2021‑22.

Legislative Considerations for Making Potentially Complex and Far‑Reaching Changes to Medi‑Cal. The Medi‑Cal Healthier California for All proposal is complex and far‑reaching. We raise three issues for consideration as the Legislature reviews the details of the proposal in the coming months. First, Medi‑Cal Healthier California for All would implement on a statewide basis strategies that are either entirely new or have been only recently piloted in parts of the state. We recommend that the Legislature ensure that processes are in place to robustly evaluate the impact of any adopted components of the proposal, both on achievement of the proposal’s objectives and on Medi‑Cal spending. Second, Medi‑Cal has significant interactions and interdependencies with other state policy and planning initiatives. We recommend that the Legislature ask the administration to lay out how Medi‑Cal Healthier California for All affects other programs and planning initiatives, such as the Governor’s Master Plan for Aging and efforts related to homelessness. Third, many of these changes would require federal approval. Given the new approach taken in this proposal, approval is uncertain.

Government Operations

Governor Proposes Various Changes Intended to Improve Government Operations. Across several issue areas, the Governor’s budget makes changes aimed at improving the organization or function of government operations. In many of these cases, the Governor proposes creating a new department or reorganizing an existing department. Among others, the administration proposes creating: the Department of Early Childhood Development, the Department of Better Jobs and Higher Wages, and the Office of Health Care Affordability. In some cases the administration’s proposed change reorganizes existing state functions into a new entity, but in other cases the administration appears to intend to begin providing new state services. For example, the proposed changes to the existing Department of Business Oversight—which the administration renames the Department of Financial Protection and Innovation—appears to include new functions to be added to the department’s existing mission.

Issues for Legislative Consideration. As it considers the merits of these departmental organizational changes, there are a number of key questions the Legislature might wish to ask the administration:

- Would the reorganization make programs more effective? Would the public receive better services as a result?

- Would the reorganization improve efficiency? Do existing programs exhibit duplication or a lack of coordination?

- Would the new structure improve accountability?

- How would the reorganization affect public understanding of government? Is the proposed rebranding aligned with the nature of the work done by the department or agency?

- How does the administration intend to effectuate the reorganization—through budget trailer legislation or the executive branch reorganization process established in statute? The executive reorganization process not only is relatively expedient (it can be completed in 90 days) but also includes a framework designed to increase the likelihood that a reorganization would be effective and smoothly implemented.

Other Policy Proposals

Expands the State Housing Tax Credit Program. The Governor proposes $500 million General Fund for an ongoing extension of the state’s housing tax credit program, authorized on a one‑time basis, in the 2019‑20 budget. Of this amount, $300 million would be allocated to the state’s low‑income housing tax credit program, which provides funding to builders of low‑income affordable housing. The remaining $200 million would target mixed‑income projects. Both the 2020‑21 budget and the administration’s multiyear plan assume no reduction in revenues due to the tax credit already authorized in 2019‑20 or from the newly proposed expansion. As a result, out‑year revenues would be lower if these tax credits are claimed in the next few years.

Revolving Loan Fund for Private Environmental Projects. The Governor’s budget includes $250 million General Fund in 2020‑21—with a plan to allocate an additional $750 million in future years—to establish a new loan program at the California Infrastructure and Economic Development Bank (I‑Bank). I‑Bank provides financial assistance to local governmental entities by lending funds at below‑market rates. The new Climate Catalyst Revolving Loan Fund would lend money to private sector organizations for projects determined to advance the state’s environmental goals, along with other priorities—such as creating high‑quality jobs. The climate‑related projects would be selected based on criteria developed in consultation with the Strategic Growth Council and Labor and Workforce Development Agency. Eventually, the administration intends for the Climate Catalyst lending program to be self‑sustaining from fees and interest earnings.

Two Ballot‑Related Proposals. The Governor’s budget includes two ballot‑related proposals. First, the Governor proposes putting a $4.8 billion bond before voters in November 2020 to fund a variety of activities intended to help the state mitigate and prepare for the effects of climate change. Once issued, the bonds would generate annual debt service costs, which are included in the Governor’s multiyear General Fund expenditure estimates. Second, the Governor has expressed interest in reforming Proposition 63 (2004), also known as the Mental Health Services Act (MHSA), to change the use of MHSA revenues to address different priorities. These include early intervention for youth, services for people experiencing homelessness, and services for people involved in the criminal justice system.

Medi‑Cal Expansion. The Governor’s budget proposes expanding comprehensive Medi‑Cal coverage to income‑eligible seniors aged 65 and older, regardless of immigration status, beginning no sooner than January 1, 2021. The budget assumes 27,000 seniors will gain comprehensive coverage at a half‑year cost of $64 million General Fund in 2020‑21 and an annual ongoing cost of $320 million General Fund at full implementation. These costs include those in both the Medi‑Cal and In‑Home Supportive Services programs.

Reforms Aimed at Improving Health Care Affordability. The Governor’s budget proposes a number of reforms—currently in conceptual form—aimed at improving the affordability of health care in California. These reforms include two major initiatives. The first is to establish an Office of Health Care Affordability responsible for increasing price transparency and developing cost containment strategies and targets for the health care industry. The second is to build on last year’s efforts to control drug spending. Most significantly, the Governor proposes to: (1) to establish a uniform statewide schedule of prices at which drugs would have to be sold and (2) have the state contract with drug manufacturers to create its own brand of generic drugs that would be available for purchase statewide.

Emergency Response and Preparedness. The budget provides General Fund augmentations for various programs to improve the state’s emergency preparedness and response. Major proposals include: (1) $120 million (growing to $150 million annually) for an increase of 677 positions and equipment replacements for the California Department of Forestry and Fire Protection; (2) $80 million on a one‑time basis for the California Natural Resources Agency to collect data and create maps of the state using light detection and ranging analysis (commonly known as LiDAR); and (3) $50 million on a one‑time basis to the Governor’s Office of Emergency Services for community power resiliency to mitigate the impact of power outages, such as those related to disasters or preventing wildfires.

LAO Comments

Trade‑Off Between Addressing More Small Proposals Versus Fewer Large Proposals. In this budget, the Governor proposed the state take on a wide variety of activities across a number of program areas. In our initial review, we itemized roughly 140 distinct proposals in the estimated $4.1 billion in new discretionary spending for 2020‑21. (These estimates aggregate some individual proposals into groups based on topic area and excludes some smaller proposals [less than $5 million].) While these proposals include some larger amounts, 95 percent of them—accounting for half of proposed spending—cost less than $100 million in 2020‑21. Put simply, the Governor’s budget aims to address a large array of proposals, across many issue areas, with relatively small dollar amounts. We recommend the Legislature consider whether this approach aligns with its own priorities. Alternatively, the Legislature could identify a smaller number of priorities and dedicate a larger amount of funds to each to ensure the proposals have a significant impact.

Some Budget Proposals Could Create Pressure to Continue Expansions. We estimate the Governor’s budget spends $1.6 billion on ongoing purposes in 2020‑21, growing to $1.9 billion over time. In some cases, whether by expanding state government into a new area—for example, new responsibilities around prescription drugs—or expanding the scope of the mission of a state department, the Governor’s budget proposal could put more pressure on the budget’s ongoing costs than is reflected in these estimates. Similarly, the Governor’s budget focuses some new resources on a particular region—like the Fresno Drive initiative—which could create expectations that these types of resources should be provided to other regions of the state facing similar challenges.

Conclusion

As has been the case for several years, California’s budget condition continues to be positive. With an estimated surplus of $6 billion and a proposed reserve level of nearly $21 billion, the state is still enjoying a stable and healthy fiscal situation. Despite this positive near‑term picture, the multiyear outlook is subject to considerable uncertainty. In particular, federal decisions around healthcare financing could have significant implications for the state’s fiscal situation.

The Governor’s proposed 2020‑21 budget has some laudable features. The Governor’s budget dedicates funding to a number of new and existing priorities that align with recent legislative action and initiatives. In addition, by focusing three‑quarters of the estimated surplus to one‑time commitments (including maintaining the balance of the state’s discretionary reserve), the state maintains a key tool for responding to a potential recession.

Nonetheless, changes to the Governor’s budget could improve its structural balance. In particular, our office recently recommended the Legislature commit no more than $1 billion to ongoing purposes in 2020‑21, a level that we think would allow the state to maintain a positive operating surplus. Maintaining an operating surplus makes responding to revenue declines or unexpected cost increases easier. Moreover, given the maturity of this economic expansion, eliminating the operating surplus is particularly risky. As the Legislature begins shaping the budget for the upcoming year, we encourage aiming to preserve this tool and maintain a positive operating balance in its own multiyear budget plans.

Appendix

Appendix Figure 1

Criminal Justice: Discretionary Spending Proposals in the 2020‑21 Governor’s Budget

(In Millions)

|

Proposal |

General Fund Cost in 2020‑21 |

Infrastructure‑ |

||

|

One‑Time or |

Ongoing |

Total |

||

|

Board of State and Community Corrections |

||||

|

Funding for post release community supervision population |

$13.8 |

— |

$13.8 |

|

|

Indigent Defense Pilot Program |

10.0 |

— |

10.0 |

|

|

California Victim Compensation Board |

||||

|

Backfill of Restitution Fund |

23.5 |

— |

23.5 |

|

|

California Deparment of Corrections and Rehabilitation |

||||

|

CIM: 50‑Bed Mental Health Crisis Facility |

91.0 |

— |

91.0 |

X |

|

Adult probation reform |

60.0 |

$11.0 |

71.0 |

|

|

Medication Distribution Improvements—Phase II |

31.7 |

— |

31.7 |

X |

|

Technology for inmates/academic programs |

8.9 |

18.0 |

26.9 |

|

|

Fire suppression system |

22.5 |

— |

22.5 |

X |

|

Video Surveillance and Drug Interdiction Project |

19.5 |

2.1 |

21.6 |

|

|

Officer training initiatives |

1.6 |

19.8 |

21.4 |

|

|

Medical guarding and transportation |

— |

14.8 |

14.8 |

|

|

CHCF—Legionella remediation |

9.7 |

4.4 |

14.1 |

X |

|

CIM Air Cooling Facility A |

11.3 |

— |

11.3 |

X |

|

Other CDCR proposals |

32.9 |

33.0 |

65.9 |

|

|

Department of Justice |

||||

|

Bureau of Forensic Services backfill and equipment refresh |

22.0 |

7.3 |

29.3 |

|

|

Other Department of Justice proposals |

14.5 |

— |

14.5 |

|

|

Judicial Branch |

||||

|

Unallocated trial court operations augmentation |

— |

61.7 |

61.7 |

|

|

Increase funding equity among trial courts |

— |

45.9 |

45.9 |

|

|

Information technology modernization projects |

7.4 |

2.8 |

10.3 |

|

|

Other Judicial Branch proposals |

8.8 |

17.7 |

26.5 |

|

|

State Public Defender |

||||

|

Indigent criminal defense attorney assistance |

0.5 |

3.5 |

4.0 |

|

|

Totals |

$398.6 |

$242.1 |

$631.7 |

|

|

Note: Generally excludes proposals less than $5 million. One time or temporary defined as three years or fewer. Ongoing defined as four years or more. Some ongoing proposals increase in cost after 2020‑21. CIM = California Institution for Men; CHCF = California Health Care Facility; and CDCR = California Department of Corrections and Rehabilitation. |

||||

Appendix Figure 2

Education: Discretionary Spending Proposals in the 2020‑21 Governor’s Budget

(In Millions)

|

Proposal |

General Fund Cost in 2020‑21 |

Infrastructure‑ |

||

|

One‑Time or |

Ongoing |

Total |

||

|

California State Library |

||||

|

Various proposals |

$2.0 |

$0.6 |

$2.6 |

|

|

California State University (CSU) |

||||

|

General Fund base increase (5 percent) |

— |

199.0 |

199.0 |

|

|

CSU extended education |

6.0 |

— |

6.0 |

|

|

California Student Aid Commission |

||||

|

Student loan outreach initiative |

5.0 |

— |

5.0 |

|

|

Child Care and Preschool |

||||

|

10,000 full‑day State Preschool slots starting April 1, 2021 |

— |

32.0 |

32.0 |

|

|

California Department of Food and Agriculture |

||||

|

Fresno‑Merced Food Innovation Corridor |

33.0 |

— |

33.0 |

|

|

Hastings College of the Law |

||||

|

General Fund base increase (5 percent) |

— |

1.4 |

1.4 |

|

|

Office of Planning and Research |

||||

|

Fresno Integrated K‑16 Education Collaborative |

17.0 |

— |

17.0 |

|

|

University of California (UC) |

||||

|

General Fund base increase (5 percent) |

— |

169.2 |

169.2 |

|

|

UC Davis animal shelter grant program |

50.0 |

— |

50.0 |

|

|

UC Riverside medical school operations |

— |

25.0 |

25.0 |

|

|

UC San Francisco Fresno branch campus operations |

— |

15.0 |

15.0 |

|

|

Other UC proposals |

6.0 |

8.6 |

14.6 |

|

|

Totals |

$119.0 |

$450.8 |

$569.8 |

|

|

Note: Generally excludes proposals less than $5 million. One time or temporary defined as three years or fewer. Ongoing defined as four years or more. Some ongoing proposals increase in cost after 2020‑21. |

||||

Appendix Figure 3

Health: Discretionary Spending Proposals in the 2020‑21 Governor’s Budget

(In Millions)

|

Proposal |

General Fund Cost in 2020‑21 |

Infrastructure‑ |

||

|

One‑Time or |

Ongoing |

Total |

||

|

Department of Health Care Services |

||||

|

Behavioral Health Quality Improvement Program |

$45.1 |

— |

$45.1 |

|

|

Department of State Hospitals (DSH) |

||||

|

Roof repairs |

49.3 |

— |

49.3 |

X |

|

Mission‑Based Review—treatment team and primary care |

32.0 |

— |

32.0 |

|

|

Community Care Collaborative Pilot Program |

— |

$24.6 |

24.6 |

|

|

Napa State Hospital repairs |

18.4 |

— |

18.4 |

X |

|

Other DSH proposals |

16.0 |

41.5 |

57.5 |

|

|

Medi‑Cal |

||||

|

Local assistance funding for Medi‑Cal Healthier California for All proposal |

150.0 |

197.5 |

347.5 |

|

|

Reauthorize skilled nursing facility reimbursement methodology |

— |

62.2 |

62.2 |

|

|

Full‑scope coverage expansion for undocumented seniors |

— |

58.3 |

58.3 |

|

|

340B entity supplemental payments |

— |

26.3 |

26.3 |

|

|

Cost‑of‑living adjustment for county Medi‑Cal administrative costs |

— |

23.7 |

23.7 |

|

|

Placeholder state operations funding for MHCA proposal |

— |

20.0 |

20.0 |

|

|

Hearing aids for children grant program |

— |

5.0 |

5.0 |

|

|

Net savings: Medi‑Cal pharmacy services carve out |

— |

‑69.5 |

‑69.5 |

|

|

Secretary for Health and Human Services Agency |

||||

|

Office of the Surgeon General: trauma‑informed training and public awareness |

10.0 |

— |

10.0 |

|

|

Establishing Department of Early Childhood Development |

8.5 |

— |

8.5 |

|

|

Totals |

$329.3 |

$389.6 |

$718.9 |

|

|

Note: Generally excludes proposals less than $5 million. One time or temporary defined as three years or fewer. Ongoing defined as four years or more. Some ongoing proposals increase in cost after 2020‑21. MHCA = Medi‑Cal Healthier California for All. |

||||

Appendix Figure 4

Human Services, Housing, and Homelessness: Discretionary Spending Proposals in the 2020‑21 Governor’s Budget

(In Millions)

|

Proposal |

General Fund Cost in 2020‑21 |

Infrastructure‑ |

|||

|

One‑Time or |

Ongoing |

Total |

|||

|

Department of Social Services (DSS) |

|||||

|

Access to Housing and Services Initiative |

$750.0 |

— |

$750.0 |

||

|

Hold CalFresh county administrative funding harmless for decreased caseload while new methodology is developed |

26.9 |

— |

26.9 |

||

|

Support CalFresh online application tool |

— |

$5.0 |

5.0 |

||

|

Child Welfare workforce development |

— |

5.6 |

5.6 |

||

|

IHSS impact of full‑scope coverage expansion for undocumented seniors |

— |

5.9 |

5.9 |

||

|

Increase assistance to food banks |

20.0 |

— |

20.0 |

||

|

Other DSS proposals |

— |

3.2 |

3.2 |

||

|

Department of Youth and Community Restoration |

|||||

|

Transition of the Division of Juvenile Justice |

— |

25.4 |

25.4 |

||

|

Department of Aging |

|||||

|

Department of Aging headquarter relocation |

— |

2.3 |

2.3 |

||

|

Department of Developmental Services (DDS) |

|||||

|

Performance Incentive Program |

60.0 |

— |

60.0 |

||

|

Enhanced caseload ratios for young children |

— |

11.2 |

11.2 |

||

|

Supplemental rate increases for additional service codes |

10.8 |

— |

10.8 |

||

|

Other DDS proposals |

16.4 |

— |

16.4 |

||

|

Department of Veterans Affairs |

|||||

|

Veterans Home, Yountville: Steam Distribution System Renovation |

7.8 |

— |

7.8 |

X |

|

|

Mental health services in veterans homes |

— |

2.3 |

2.3 |

||

|

Housing and Community Development |

|||||

|

Technical assistance for local governments on housing |

10.0 |

— |

10.0 |

||

|

Totals |

$901.9 |

$60.9 |

$962.8 |

||

|

Note: Generally excludes proposals less than $5 million. One time or temporary defined as three years or fewer. Ongoing defined as four years or more. Some ongoing proposals increase in cost after 2020‑21. IHSS = In‑Home Supportive Services and CalWORKs = California Work Opportunity and Responsibility to Kids. |

|||||

Appendix Figure 5

Natural Resources, Environment and Emergencies: Discretionary Spending Proposals in the 2020‑21 Governor’s Budget

(In Millions)

|

Proposal |

General Fund Cost in 2020‑21 |

Infrastructure‑ |

||

|

One‑Time or |

Ongoing |

Total |

||

|

California Department of Forestry and Fire Protection |

||||

|

Fire protection enhancements: multiple BCPs |

— |

$120.0 |

$120.0 |

|

|

Various capital outlay |

$27.0 |

— |

27.0 |

X |

|

Air attack bases capital outlay |

13.6 |

— |

13.6 |

X |

|

Wildland Firefighting Research Grant |

5.0 |

— |

5.0 |

|

|

California Department of Food and Agriculture |

||||

|

State Water Efficiency and Enhancement Program |

20.0 |

— |

20.0 |

|

|

Needles Border Protection Station |

10.4 |

— |

10.4 |

X |

|

Farm to School Program |

8.5 |

1.5 |

10.0 |

|

|

California Natural Resources Agency (CNRA) |

||||

|

Innovation and improving technology: LiDAR |

80.0 |

— |

80.0 |

|

|

CNRA new facility relocation |

9.6 |

— |

9.6 |

|

|

Department of Fish and Wildlife |

||||

|

Advance biodiversity protection |

20.0 |

— |

20.0 |

|

|

Department of General Services |

||||

|

Electric vehicle assessments and infrastructure |

15.0 |

— |

15.0 |

|

|

Department of Water Resources |

||||

|

American River Common Features project |

46.0 |

— |

46.0 |

X |

|

Sustainable groundwater management |

30.0 |

9.6 |

39.6 |

|

|

Tijuana River project |

35.0 |

— |

35.0 |

|

|

New River improvement project |

18.0 |

— |

18.0 |

|

|

Hydrometeorology and surface water observations |

— |

6.0 |

6.0 |

|

|

Office of Emergency Services |

||||

|

Community Power Resiliency |

50.0 |

— |

50.0 |

|

|

California Disaster Assistance Act adjustment |

16.7 |

— |

16.7 |

|

|

Disaster planning and preparedness |

— |

9.2 |

9.2 |

|

|

Governor’s Office of Business and Economic Development |

||||

|

Climate Catalyst Fund |

250.0 |

— |

250.0 |

|

|

Office of Environmental Health Hazard Assessment |

||||

|

Evaluating unassessed chemicals |

5.0 |

1.0 |

6.0 |

|

|

Department of Parks and Recreation |

||||

|

Equitable access: new state park |

20.0 |

— |

20.0 |

X |

|

State Lands Commission |

||||

|

Oil and gas well decommissioning studies |

5.0 |

— |

5.0 |

|

|

Various Departments |

||||

|

California Cybersecurity Integration Center |

— |

11.1 |

11.1 |

|

|

Totals |

$684.8 |

$158.3 |

$843.1 |

|

|

Note: Generally excludes proposals less than $5 million. One time or temporary defined as three years or fewer. Ongoing defined as four years or more. Some ongoing proposals increase in cost after 2020‑21. BCPs = budget change proposals and LiDAR = Light Detection and Ranging. |

||||

Appendix Figure 6

Other: Discretionary Spending Proposals in the 2020‑21 Governor’s Budget

(In Millions)

|

Proposal |

General Fund Cost in 2020‑21 |

Infrastructure‑ |

||

|

One‑Time or |

Ongoing |

Total |

||

|

Department of General Services |

||||

|

Elevator deferred maintenance |

$56.4 |

— |

$56.4 |

X |

|

Fire alarm system deferred maintenance |

23.6 |

— |

23.6 |

X |

|

Employment Development Department |

||||

|

Benefit Systems Modernization information technology project |

23.0 |

— |

23.0 |

|

|

California Department of Technology |

||||

|

Security Operations Center and Audit Program funding |

— |

$15.1 |

15.1 |

|

|

Various Other Proposals |

25.6 |

238.8 |

264.4 |

|

|

Totals |

$128.6 |

$253.9 |

$382.5 |

|

|

Note: Generally excludes proposals less than $5 million. One time or temporary defined as three years or fewer. Ongoing defined as four years or more. Some ongoing proposals increase in cost after 2020‑21. |

||||