LAO Contacts

February 14, 2020

The 2020‑21 Budget

The Governor’s Cannabis‑Related Proposals

Executive Summary

Proposition 64 Legalized Adult‑Use Cannabis. In November 2016, California voters approved Proposition 64. Under Proposition 64, adults 21 years of age or older can legally grow, possess, and use cannabis for nonmedical purposes, with certain restrictions. Under the measure, various state agencies are responsible for regulating cannabis. For example, the Bureau of Cannabis Control (BCC), California Department of Food and Agriculture (CDFA), and Department of Public Health (DPH) have responsibility for licensing different types of cannabis businesses.

Proposition 64 Imposes Two State Excise Taxes on Cannabis. Proposition 64 established two state excise taxes on cannabis, which are administered by the California Department of Tax and Fee Administration (CDTFA). The first is a 15 percent excise tax on retail gross receipts (known as the retail excise tax). The second is a cultivation tax on the weight of harvested plants. Currently, final distributors must remit these taxes to CDTFA, despite cultivators and retailers being legally responsible for initial payment of the taxes. These taxes are deposited into the Cannabis Tax Fund, which is continuously appropriated for various types of activities.

Governor’s Budget Proposal

Proposes Change to Point of Collection of Cannabis Taxes, and Interest in Additional Changes. The Governor proposes moving the responsibility for remitting (1) the cultivation tax to the first distributor and (2) the retail excise tax to the retailer. The Governor also expressed interest in other changes to cannabis taxes, but has not provided any additional details on these potential changes.

Proposes Consolidation of Licensing Functions Into New Department. The Governor proposes consolidating the cannabis‑related licensing functions in BCC, CDFA, and DPH into a new Department of Cannabis Control. The administration has not provided any details on the proposal but indicates that further information will be available in the spring.

Proposes Various Cannabis‑Related Expenditures. The Governor’s budget proposes $70.2 million to support 291 positions across eight departments. Funding for these proposals would come from a variety of sources, such as the Cannabis Tax Fund and various fees. The administration has also provided its plan for expending the Cannabis Tax Fund revenues in 2020‑21 directed by Proposition 64 to certain types of activities.

Issues for Legislative Consideration

Proposed Changes to Point of Collection Would Improve Tax Administration, but Other Tax Changes Also Merited. We find that changing the point of collection for the retail excise and cultivation tax should improve tax administration and compliance by creating a closer nexus between the taxed activity and the responsibility for remitting taxes. We also find that additional changes to the structure and rates for cannabis taxes are warranted, consistent with our December 2019 report, How High? Adjusting California’s Cannabis Taxes. Accordingly, we recommend that, if the Legislature retains the retail excise and cultivation taxes, it approve the Governor’s proposal to change their point of collection. However, we also recommend that the Legislature consider other changes to the state’s cannabis tax structure and rates.

Concept of Consolidating Licensing Functions Makes Sense, but Details Are Important. We find that the concept of consolidating the cannabis licensing functions into a single entity focused on cannabis makes sense, and could improve the accountability and effectiveness of the state’s cannabis activities. However, we also find that the Legislature will want to closely evaluate the details of the proposal to ensure it is well planned and aligns with legislative priorities. Accordingly, we recommend that the Legislature request the administration to provide additional details on the plan—and the associated budget proposal and trailer bill legislation—as soon as possible.

Take Holistic, Incremental Approach to Funding Proposals, Focusing on Oversight. We find that the Legislature’s decisions regarding changes to the cannabis regulatory structure and taxes could affect departments’ resource needs. As a result, we recommend that the Legislature withhold action on cannabis‑related proposals until all the budget proposals and budget trailer language are available this spring. We also find that there is significant uncertainty regarding some departments’ resource needs due to the immaturity of the cannabis industry and, therefore, recommend that the Legislature be cautious about ongoing funding commitments for such departments. Finally, we recommend that the Legislature use its oversight role to ensure that departments are implementing programs effectively and programs are achieving desired outcomes.

Introduction

The Governor’s 2020‑21 budget includes various cannabis‑related proposals, including both budget trailer legislation and budget change proposals from multiple departments. To help the Legislature in its consideration of the Governor’s various proposals, this report: (1) provides some background on cannabis regulation and taxation in California, (2) describes the Governor’s proposals, and (3) provides recommendations on these proposals for legislative consideration.

Background

Legislature Created the Regulatory Framework for Medical Cannabis. While voters legalized the use of medical cannabis in California in 1996, the state did not create a regulatory framework for medical cannabis until the Legislature approved three state laws (Chapter 688 [AB 243, Wood], Chapter 689 [AB 266, Bonta], and Chapter 719 [SB 643, McGuire])—known collectively as the Medical Cannabis Regulation and Safety Act (MCRSA)—in 2015. Prior to MCRSA, most regulation of medical cannabis was left to local governments.

Proposition 64 Legalized Adult‑Use Cannabis. In November 2016, California voters approved Proposition 64. Under Proposition 64, adults 21 years of age or older can legally grow, possess, and use cannabis for nonmedical purposes (often referred to as recreational or adult‑use), with certain restrictions. Proposition 64 authorizes the Legislature to amend the measure’s provisions, if the amendments are consistent with the measure’s intent and further its purposes. (We note that amendments to the measure’s regulatory structure require a majority vote; however, amendments to the measure’s taxation structure require a two‑thirds vote.) Since the passage of Proposition 64, the Legislature has passed laws amending the measure, including Chapter 27 of 2017 (SB 94, Committee on Budget and Fiscal Review), which brought the state’s medical and adult‑use regulatory structures into conformity and made changes to the point of collection for cannabis taxes, as described later.

Proposition 64 Tasked Various Departments with Responsibilities. Under Proposition 64, as amended by Chapter 32 of 2016 (SB 837, Committee on Budget and Fiscal Review), various state agencies have roles related to regulating the cannabis industry. For example, as shown in Figure 1, it gives three state departments responsibility for licensing different types of cannabis businesses and various other departments roles, including hearing appeals of cannabis‑related disciplinary actions, tax collection, and cannabis‑related environmental functions.

Figure 1

Key Departments Involved in Cannabis Regulation in California

|

Regulatory Agency |

Current Primary Responsibilities |

|

Licensing and Enforcement Activities |

|

|

Bureau of Cannabis Control |

|

|

Food and Agriculture |

|

|

Public Health |

|

|

Appeals |

|

|

Office of Administrative Hearings (OAH) |

|

|

Cannabis Control Appeals Panel |

|

|

Tax Collection and Other Administrative Activities |

|

|

Tax and Fee Administration |

|

|

Employment Development Department |

|

|

Secretary of State |

|

|

Environmental Activities |

|

|

State Water Resources Control Board |

|

|

Fish and Wildlife |

|

|

Pesticide Regulation |

|

Proposition 64 Imposes Two State Excise Taxes on Cannabis. Like other businesses, cannabis businesses generally must pay broad‑based taxes such as income taxes, payroll taxes, and sales taxes. Additionally, Proposition 64 established two state excise taxes on cannabis. The first is a 15 percent excise tax on retail gross receipts (known as the retail excise tax). The second is a cultivation tax on harvested plants. As of January 1, 2020, the cultivation tax rates are $9.65 per ounce of dried flowers, $2.87 per ounce of dried leaves, and $1.35 per ounce of fresh plants. The California Department of Tax and Fee Administration (CDTFA), which administers these cannabis taxes, adjusts the cultivation tax rates annually for inflation. Proposition 64 identifies three broad goals that should be considered when adjusting cannabis tax rates: undercutting illicit market prices, generating sufficient revenues, and discouraging youth use.

Distributors Responsible for Remitting State Taxes. Cultivators and retailers bear the legal responsibility for the initial payment of the cultivation and retail excise taxes, respectively. However, pursuant to Chapter 27, final distributors—rather than cultivators or retailers—must remit these taxes to CDTFA, resulting in a multistep payment process. We explain this process below and illustrate how it works for a hypothetical manufactured product in Figure 2.

- Cultivation Tax. A cultivator determines the amount of cultivation tax it owes by weighing the plants it harvests. It then pays this amount to a distributor when it sells or transfers the harvested plants. In a case in which cannabis travels from the cultivator to just one distributor prior to retail sale, that distributor remits the tax to CDTFA. In many cases, however (such as the case illustrated in Figure 2), the supply chain is more complex, with multiple manufacturers and distributors handling harvested cannabis and the products derived from it. In these cases, each of those businesses must transfer the cultivation tax until the final distributor remits it to CDTFA.

- Retail Excise Tax. Retailers generally must pay the retail excise tax to final distributors when they make wholesale purchases. These distributors then remit the retail excise taxes to CDTFA. Retailers must make these payments before they sell the products to consumers, so the tax is based directly on the wholesale price (the price that retailers pay to distributors) rather than the retail price (the price that consumers pay to retailers). Pursuant to Chapter 27, CDTFA sets the tax based on its estimate of the average ratio of retail prices to wholesale prices—commonly known as a “markup.” CDTFA’s current markup estimate (as of January 1, 2020) is 80 percent. Due to the 15 percent statutory tax rate and the 80 percent markup estimate, the current effective tax rate on wholesale gross receipts is 27 percent (15 percent x [100 percent + 80 percent]).

Revenues From Cannabis Taxes Go to Three Types of Activities. The state deposits the revenues from the two cannabis taxes into the Cannabis Tax Fund. Proposition 64 continuously appropriates Cannabis Tax Fund proceeds to fund three types of activities:

- Allocation 1—Regulatory and Administrative Costs. First, revenues pay back certain state agencies for any cannabis regulatory and administrative costs not covered by license fees.

- Allocation 2—Specified Allocations. Second, after regulatory and administrative costs are covered, revenues go to certain research and other programs, such as researching the effects of cannabis and the effects of the measure.

- Allocation 3—Percentage Allocations. Third, these revenues go to three broad types of activities: 60 percent for youth programs related to substance use education, prevention, and treatment; 20 percent for environmental programs; and 20 percent for law enforcement. (Unlike the other allocations, funding for Allocation 3 comes from tax receipts from the prior year.) The measure generally authorizes the administration to choose how to allocate funding among various eligible activities within each of the three Allocation 3 categories.

Legislature Provided Funding to Implement Cannabis Regulations. Starting in 2015‑16, the Legislature provided funding to a variety of departments to implement the state’s cannabis‑related regulatory efforts. Generally, this funding was provided on a limited term basis—through 2019‑20—because it was recognized that there was substantial uncertainty regarding the level of ongoing workload that the departments would experience related to this newly‑regulated industry.

Governor’s January Cannabis Proposals

Modifications to Cannabis Tax Structure

Proposes Change to Point of Collection of Cannabis Taxes. The Governor proposes budget trailer legislation changing the type of businesses responsible for remitting the state’s two cannabis excise taxes (known as the point of collection). First, he proposes moving the responsibility for remitting the cultivation tax from the final distributor to the first distributor. Second, he proposes moving the responsibility for remitting the retail excise tax from the final distributor to the retailer.

Signals Interest in Considering Additional Changes to Taxes. The Governor also indicates that he will consider other changes to the existing cannabis tax structure, including the number of taxes and tax rates, with the aim of simplifying the system and supporting the legal cannabis market. However, to date, the administration has not provided any additional details on what specific changes may be under consideration.

Consolidation of Licensing Functions Into New Department of Cannabis Control

The Governor proposes consolidating the cannabis‑related functions that are currently housed in three licensing agencies—the Bureau of Cannabis Control (BCC) within the Department of Consumer Affairs (DCA), the California Department of Food and Agriculture (CDFA), and the Department of Public Health (DPH)—into a new department with dedicated enforcement resources by July 2021. This new department, the Department of Cannabis Control (DCC), would be housed within the Business, Consumer Services, and Housing Agency (BCSH). (BCSH currently oversees DCA and the Department of Alcoholic Beverage Control, among other departments.) The administration has not provided any details on this planned consolidation to date. However, the administration has indicated that it anticipates providing further information this spring.

Adjustments to Cannabis‑Related Funding

Proposes $70.2 Million in 2020‑21 for Eight Departments. As shown in Figure 3, the Governor’s budget proposes $70.2 million to support 291 positions (including 15 temporary help positions) across eight departments. The administration proposes funding these proposals from a variety of sources, such as the Cannabis Tax Fund and various fees. In some cases—such as the Cannabis Control Appeals Panel and the Office of Administrative Hearings (OAH)—these proposals represent a continuation of funding levels similar to those provided in the current year. However, in other cases, they represent changes. For example, CDTFA is proposed to receive additional funding in 2020‑21 compared to 2019‑20. This increase in 2020‑21 is primarily due to (1) one‑time resources proposed for cannabis‑related changes to the department’s information technology system and (2) greater resources for enforcement activities.

Figure 3

Governor’s January 2020‑21 Budget Proposals for Cannabis Implementation—Summary of Fundinga

(In Thousands)

|

Department |

Funding Proposed |

|||

|

2020‑21 |

2021‑22 |

2022‑23 |

2023‑24 and ongoing |

|

|

State Water Resources Control Board |

$22,556 |

$22,556 |

$22,556 |

$4,510 |

|

Fish and Wildlife |

12,717 |

12,717 |

12,717 |

4,743 |

|

Tax and Fee Administration |

12,864 |

8,184 |

7,983 |

7,983 |

|

Office of Administrative Hearings |

11,452 |

11,452 |

11,452 |

— |

|

Employment Development Department |

3,633 |

3,630 |

3,630 |

1,637 |

|

Pesticide Regulation |

3,487 |

2,667 |

2,667 |

2,667 |

|

Cannabis Control Appeals Panel |

3,033 |

3,032 |

3,036 |

— |

|

Secretary of State |

448 |

448 |

448 |

448 |

|

Totals |

$70,190 |

$64,686 |

$64,489 |

$21,988 |

|

aDoes not include funding for a new Department of Cannabis Control, which is anticipted to be requested in spring 2020. |

||||

We discuss the proposals for each of these eight departments in more detail below.

- State Water Resources Control Board ($22.6 Million). The State Water Resources Control Board (SWRCB) requests $22.6 million in 2020‑21 through 2022‑23 from the Waste Discharge Permit Fund, Cannabis Tax Fund, and Water Rights Fund to support 116 positions and the acquisition of aerial imagery. Beginning in 2023‑24, annual funding would decline to $4.5 million (Cannabis Tax Fund) to support 24 of the 116 positions. The proposed resources would support SWRCB’s efforts to address water quality and instream flow related impacts of cannabis cultivation and associated water diversions through activities such as permitting and enforcement.

- Department of Fish and Wildlife ($12.7 Million). The Department of Fish and Wildlife (DFW) requests $12.7 million from the Cannabis Tax Fund and the Lake and Streambed Alteration Dedicated Account in 2020‑21 through 2022‑23 to support 63 positions. Beginning in 2023‑24, annual funding would decline to $4.7 million (Cannabis Tax Fund) to support 14 of the 63 positions. The proposed resources would support DFW’s environmental permitting and enforcement.

- CDTFA ($12.9 Million). CDTFA requests $12.9 million from the Cannabis Tax Fund to continue its implementation and enforcement of the retail excise and cultivation taxes. This includes two proposals: (1) $8.4 million in 2020‑21—declining to $8 million annually in 2022‑23—to support 39.8 positions (including 1.3 temporary positions) and (2) $4.5 million on a one‑time basis related to adding cannabis taxes to the department’s new information technology system. (Our office will provide additional comments on CDTFA’s proposal in a forthcoming analysis.)

- OAH ($11.5 Million). OAH requests $11.5 million in Service Revolving Fund authority on a three‑year limited‑term basis to provide administrative hearings related to denied licenses, discipline actions against licensees, and citations for unlicensed activities.

- Employment Development Department ($3.6 Million). The Employment Development Department (EDD) requests $3.6 million in 2020‑21—declining to $1.6 million annually beginning in 2023‑24—from the Cannabis Tax Fund to support cash collection of payroll taxes from cannabis businesses, payroll tax enforcement, and outreach activities.

- DPR ($3.5 Million). DPR requests $3.5 million in 2020‑21 and $2.7 million annually thereafter from the Cannabis Tax Fund to support nine positions focused on enforcement of cannabis‑related pesticide use activities. This includes $1 million annually to County Agricultural Commissioners for compliance assistance and enforcement activities at the local level. This request also includes a contract with CDFA for laboratory testing of pesticide residue on legal cannabis grows.

- Cannabis Control Appeals Panel ($3 Million). The Cannabis Control Appeals Panel requests $3 million from the Cannabis Control Fund on a three‑year limited‑term basis to hear appeals of OAH’s cannabis‑related decisions.

- Secretary of State ($448,000). The Secretary of State requests $448,000 annually beginning in 2020‑21 from the Business Fees Fund to support three positions that process cannabis‑related business filings and trademark registration workload.

Notably, the Governor has not yet provided a proposal to fund the new DCC. That proposal is anticipated to be available in spring 2020, along with the details of the proposed consolidation.

Proposes Expenditure of Cannabis Tax Fund Revenues. As previously discussed, the language in Proposition 64 is broad enough to allow cannabis tax revenues—particularly those provided pursuant to Allocation 3—to be used to support a variety of different possible eligible activities. Figure 4 presents the administration’s decisions on which specific programs and activities to fund in 2020‑21 based on its estimates of Cannabis Tax Fund revenues. If actual tax receipts differ from expectations, these funding amounts would change.

Figure 4

Cannabis Tax Fund—Expected Revenues and Planned Allocations

(Dollars in Millions)

|

2019‑20 |

2020‑21 |

|

|

Revenues |

||

|

Beginning Balance |

$210.8 |

$332.8 |

|

Cannabis tax revenues |

479.1 |

550.4 |

|

General Fund loan repayment |

‑59.3 |

— |

|

Total Revenues |

$630.5 |

$883.1 |

|

Allocations—Department/Program |

||

|

Allocation 1: Regulatory and Administrative |

||

|

Bureau of Cannabis Control for Equity Program administered by Go‑Biz |

$15.6 |

$15.5 |

|

State Water Resources Control Board |

14.4 |

10.9 |

|

Fish and Wildlife |

9.6 |

8.5 |

|

Tax and Fee Administration |

7.4 |

12.9 |

|

Employment Development Department |

2.5 |

3.6 |

|

Pesticide Regulation |

2.3 |

3.5 |

|

Statewide General Administration |

0.2 |

2.9 |

|

Total Allocation 1 |

$52.0 |

$57.8 |

|

Allocation 2: Specified Allocations for Research and Other Programs |

||

|

Go‑Biz—community reinvestment |

$20.0 |

$30.0 |

|

Public universities—evaluation of effects of measure |

10.0 |

10.0 |

|

Highway Patrol—methods for determining impaired driving |

3.0 |

3.0 |

|

University of San Diego—cannabis research |

2.0 |

2.0 |

|

Total Allocation 2 |

$35.0 |

$45.0 |

|

Allocation 3: Percentage Allocations |

||

|

Youth Education Prevention, Early Intervention & Treatment Account |

||

|

Education—child care slots |

$85.8 |

$140.8 |

|

Health Care Services—local prevention programs |

22.9 |

37.5 |

|

Public Health—cannabis surveillance and education |

12.0 |

12.0 |

|

Resources Agency—youth community access grant |

5.7 |

9.4 |

|

Subtotal, Youth Account |

($126.4) |

($199.7) |

|

Environmental Restoration and Protection Account |

||

|

Fish and Wildlife—environmental cleanup and enforcement |

25.3 |

39.9 |

|

Parks—program development, ingress and egress, and restoration |

16.9 |

26.6 |

|

Subtotal, Environmental Restoration and Protection Account |

($42.2) |

($66.5) |

|

State and Local Government Law Enforcement Account |

||

|

State and Community Corrections—local grants for public health and safety |

27.7 |

44.8 |

|

Highway Patrol—impaired driving and traffic safety |

14.5 |

21.8 |

|

Subtotal, State and Local Government Law Enforcement Account |

($42.2) |

($66.6) |

|

Total Allocation 3 |

$210.8 |

$332.8 |

|

Total Expenditures |

$297.8 |

$435.6 |

|

Balance of Tax Receiptsa |

$332.8 |

$447.5 |

|

aBalance available for Allocation 3 in the following fiscal year. Go‑Biz = Governor’s Office of Business and Economic Development. |

||

Assessment

Modifications to Cannabis Tax Structure Are Needed

Proposed Changes to Point of Collection Would Improve Tax Administration. We find that the proposed changes to the point of collection for the retail excise and cultivation tax should improve tax administration and compliance. As we described earlier, the state’s current approach to cannabis taxes splits the responsibilities for collecting the original tax payment and remitting the tax to the state between multiple businesses. This separation of taxpaying responsibilities—which is not typical for other state taxes—weakens each business’s incentive to ensure that the correct amount of tax is paid. An additional concern arises because many cannabis businesses have limited access to financial services due to federal criminalization. As a result, cannabis businesses often have to conduct transactions in cash. Accordingly, the current split of taxpaying responsibilities often involves cash changing hands multiple times, leading to problems with security, compliance, and enforcement. Furthermore, distributor remittance of the retail excise tax requires a markup calculation that makes the tax more difficult to administer. The Governor’s proposal to change the point of collection for the retail excise and cultivation taxes addresses these problems by creating a much closer nexus between the activity that is taxed and the responsibility for remitting taxes. For example, moving the point of collection for the retail excise tax from the final distributor to the retailer would eliminate the need for the administrative complexity of having CDTFA perform the markup calculation, thus further simplifying the tax collection process.

Additional Changes to Cannabis Tax Structure and Rates Are Warranted. As we discussed in more detail in our December 2019 report, How High? Adjusting California’s Cannabis Taxes, we also find that additional changes—beyond the point of collection—are merited. Specifically, in that report, we analyzed four types of taxes:

- Basic ad valorem, set as a percentage of price, such as the current retail excise tax.

- Weight‑based, such as the current cultivation tax.

- Potency‑based, for example, based on the amount of the main psychotropic component of cannabis known as tetrahydrocannabinol (THC) that is in the product.

- Tiered ad valorem, set as a percentage of price with different rates based on potency and/or product type.

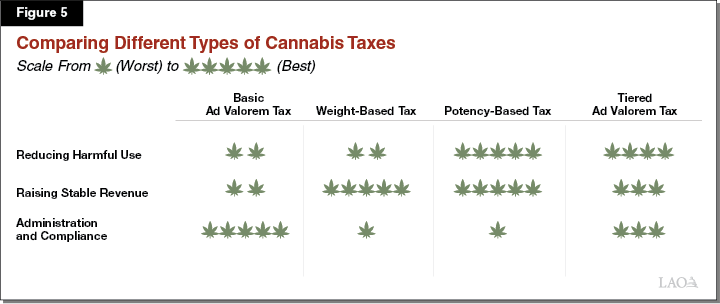

Our analysis focused primarily on three main criteria: (1) effectiveness at reducing harmful use, (2) revenue stability, and (3) ease of administration and compliance. As shown in Figure 5, we found that no individual type of tax performed best on all criteria. For example, tiered ad valorem and potency‑based likely are best for reducing harmful use, but basic ad valorem is easiest to administer. Given these trade‑offs, we found that the Legislature’s choice depends heavily on the relative importance it places on each criterion. That said, we found that the weight‑based tax is generally weakest, performing similarly to, or worse than, the potency‑based tax on the three main criteria.

In our December 2019 report, we also discussed how various tax rates are likely to affect the three goals for cannabis taxes outlined in statute: undercutting illicit market prices, generating sufficient revenues, and discouraging youth use. We found that there are trade‑offs among the three outcomes. For example, we expect a lower tax rate would facilitate undercutting the illicit market, but make it less likely the state would generate sufficient revenues under the measure.

Consolidation of Licensing Agencies Reasonable, but Details Lacking

Concept of Consolidating Licensing Functions in One Entity Makes Sense… We find that the concept of consolidating the cannabis licensing and associated enforcement functions that are currently spread across three departments into a single entity focused on cannabis makes sense. This is because the current structure of having three separate licensing entities—and no clear lead agency for cannabis—creates challenges for the Legislature, as well as the cannabis industry. Specifically, the lack of a clear lead agency makes it more difficult for the Legislature to know who to hold accountable when issues related to cannabis arise or to easily access consistent information on cannabis licensing and enforcement activities. Similarly, the lack of a clear lead agency means that there is no central point of contact for cannabis businesses. Instead, businesses that hold multiple types of cannabis licenses may have to go to multiple departments to seek guidance. We note that the challenges with the current structure are exacerbated due to the structure of DCA. Specifically, the sworn officers that work on BCC‑related issues are housed under DCA’s Division of Investigation rather than BCC itself, which further bifurcates responsibility and accountability for cannabis enforcement. Given the challenges identified above, we think that the Governor’s concept of consolidating the cannabis‑related licensing and enforcement functions that are currently housed in three departments into a new stand‑alone department has significant potential to improve the accountability and effectiveness of the state’s cannabis activities.

…But Legislature Will Want to Closely Evaluate Specifics. While we think the Governor’s concept of consolidating the functions of the three licensing agencies within a single entity is very promising, the Legislature will want to closely evaluate the specifics of the choices made by the administration. Specifically, as we describe in our recent report, The 2020‑21 Budget: Assessing the Governor’s Reorganization Proposals, and summarize in the nearby text box, it will be important for the Legislature to keep in mind several key considerations when evaluating the specifics of the proposal, such as whether the reorganization would improve efficiency and whether it is well planned. In addition to these general considerations, the Legislature will also want to consider whether the changes to Proposition 64 that are necessary to implement the reorganization might require voter approval.

Key Considerations When Reviewing Reorganization Proposals

In our recent publication, The 2020‑21 Budget: Assessing the Governor’s Reorganization Proposals, we recommend that the Legislature consider the following key questions when evaluating proposals to reorganize state departments through consolidation or transferring government functions:

- Would the Reorganization Make Programs More Effective? A reorganization should result in programs becoming more effective and the public receiving improved government services.

- Would the Reorganization Improve Efficiency? A reorganization should result in programs using fewer resources or improving the quality of services provided within existing resources.

- Would the New Structure Improve Accountability? A reorganization should result in a government structure where the Legislature and the public can easily identify the person or entity responsible for managing a program.

- Is the Reorganization Based Upon a Policy Rationale? A reorganization should be consistent with an underlying policy rationale to address a problem that has been clearly identified.

- Does the Reorganization Reflect Legislative Priorities? A reorganization should be consistent with the priorities that the Legislature has set for a program or government function.

- Do the Benefits Outweigh the Costs? The benefits of a reorganization should outweigh the costs to implement the reorganization, which can sometimes be significant.

- Is the Reorganization Well Planned? A reorganization should be well planned given that it can result in significant complexities—such as the need to reclassify positions and responsibilities.

- How Should the Reorganization Be Implemented? Government reorganizations can be implemented in a few different ways, though typically they have been pursued either through the formal executive branch reorganization process laid out in statute or budget trailer legislation.

Issues to Consider When Evaluating Cannabis‑Related Funding Proposals

Choices About Tax Structure and Consolidation Will Affect Some Resource Needs. We find that the Legislature’s ultimate decisions regarding possible changes to the cannabis regulatory structure—including the creation of DCC—as well as its decisions regarding cannabis taxes could affect the level of resources state agencies need to implement their programs. For example, the Legislature’s policy choices regarding the structure of cannabis taxes and the point of collection of those taxes would affect the number of taxpayers and the complexity of tax collecting activities undertaken by CDTFA. However, the Governor’s proposed budget for CDTFA does not reflect the proposed change in the point of collection for cannabis taxes. This is potentially problematic if the Legislature approves the proposal to change the point of collection given that it could result in higher or lower resource needs for CDTFA.

Significant Uncertainty Regarding Resource Needs Given Early Stages of Implementation. In some cases, due to the immaturity of the regulated cannabis industry, we find that there continues to be a high level of uncertainty regarding some departments’ future resource needs related to cannabis. For example, we find that there is uncertainty regarding the level of ongoing workload for OAH and the Cannabis Control Appeals Panel because neither entity has begun hearing cases. As such, there is no data on the number of cases that will likely be heard or the number of appeals that will result. Additionally, we find that there is uncertainty regarding the level of ongoing workload for the Secretary of State because the number of businesses seeking to register and receive trademarks is likely to vary over time as the industry matures. Departments have taken different approaches to this uncertainty. For example, some proposals—such as those related to OAH and the Cannabis Control Appeals Panel—have recognized this uncertainty by proposing limited‑term funding. However, the Secretary of State has proposed ongoing resources despite the uncertainty regarding its ongoing workload.

Opportunity for Resource Sharing Possible in Cash Collection. EDD’s proposal includes resources to enable it to collect payroll tax payments from cannabis businesses in cash. However, we find that it is unclear why EDD needs to perform its own cash collection activities rather than leveraging those that are already in place at CDTFA. Notably, the Franchise Tax Board (FTB) already leverages CDTFA’s capacity to collect cash from cannabis businesses.

Legislature Plays Key Oversight Role Over Expenditure Plan for Cannabis Tax Fund. Since Proposition 64 continuously appropriates Cannabis Tax Fund revenues to specific departments, no legislative action is needed to appropriate the funds. We also note that the ability for the Legislature to direct the use of the Cannabis Tax Fund revenues is uncertain, given the language of Proposition 64. Despite this, the Legislature retains an important oversight role over the expenditures from the Cannabis Tax Fund. The Legislature can use its oversight authority to ensure that departments are implementing programs effectively and programs are achieving desired outcomes.

Recommendations

Modify Cannabis Tax Structure

Approve Changes to Point of Collection. We recommend that, if the Legislature retains the retail excise and cultivation taxes (we discuss potential changes below), it approve the Governor’s proposal to change their point of collection. These changes to the point of collection would simplify tax remittance and collection responsibilities, thus significantly improving tax administration and compliance.

Consider Broader Changes to Cannabis Tax Structure and Rates. We recommend that the Legislature consider other additional changes to the state’s cannabis tax structure and rates, consistent with our December 2019 report, How High? Adjusting California’s Cannabis Taxes. Specifically, we recommend that the Legislature replace the state’s existing cannabis taxes with a tax designed to reduce harmful cannabis use more effectively—namely, a potency‑based tax or tiered ad valorem tax. That said, if the Legislature prioritizes administration and compliance more highly, a basic ad valorem tax is worth considering as an alternative. We do not recommend keeping the cultivation tax.

We further recommend that the Legislature consider changes to cannabis tax rates to achieve the three goals identified in Proposition 64: undercutting illicit market prices, generating sufficient revenues, and discouraging youth use. The trade‑offs among the three outcomes mean that the right tax rate ultimately is a question of policy priorities. That said, we recommend the that Legislature consider tax rate changes ranging from a significant tax cut to changes that would be revenue neutral. For example, if the Legislature were to eliminate the cultivation tax but retain the retail excise tax, we would recommend setting the retail excise tax between 15 percent and 20 percent. (We estimate that a 20 percent retail excise would be roughly revenue neutral in the short term if the cultivation tax were eliminated.) We find that such an approach would most effectively balance the goals identified in Proposition 64. To the extent the Legislature makes these additional changes, it will also want to make conforming changes to the Governor’s proposal for the point of collection.

Consider Consolidating Licensing Functions

Request Administration Provide Details on Consolidation Plan in a Timely Manner. We recommend that the Legislature request the administration to provide additional details on its consolidation plan—and the associated budget proposal and trailer bill legislation—as soon as possible. This is because, while the concept of this plan is promising, the specific details will be critical to ensuring the Legislature is comfortable moving forward. Having these details in a timely manner will provide the Legislature with time to adequately assess the Governor’s proposal. As it performs this review, we recommend that it consider the key questions for reorganizations that we identified previously, such as whether the proposal improves the efficiency and effectiveness of government and is well planned.

Take Holistic, Incremental Approach to Cannabis‑Related Funding Proposals, Focusing on Oversight

Make Resource Decisions After Making Proposed Changes. We recommend that the Legislature withhold action on cannabis‑related proposals until all the budget proposals and budget trailer language are available this spring. This approach will enable the Legislature to see the proposals in the context of the resources provided to DCC. Additionally, this will allow the Legislature to assess if any changes to resources levels provided to departments are merited based on specifics of the changes that are proposed. For example, the Legislature’s decisions about the point of collection for taxes—as well as the structure of taxes—could impact the level of workload for CDTFA to administer these taxes.

Limit Funding for Out‑Years When There is Uncertain Level of Ongoing Workload. Once the Legislature has all the administration’s proposals in the spring, it will be faced with individual decisions on budget proposals. As it evaluates these proposals, we recommend that the Legislature be cautious about ongoing commitments when there is uncertainty regarding the level of ongoing workload. For example, we recommend approving funding for the Secretary of State proposal on a limited‑term basis given the uncertainty in the amount of business filings and trademark registration workload the department will have for cannabis businesses on an ongoing basis. Additionally, the Legislature will want to consider whether to approve a portion of the forthcoming DCC‑related proposal on a limited‑term basis given that there is likely to be uncertainty regarding the level of ongoing licensing workload. Taking an incremental approach to budgeting will better enable the Legislature to use the annual budget process to oversee the implementation of cannabis regulation and ensure that departments are appropriately resourced for this implementation.

Direct CDTFA and EDD to Report at Budget Hearings on Proposals Using Cannabis Tax Fund. The CDTFA and EDD proposals are proposed to be funded from the Cannabis Tax Fund. While legislative action is not required to appropriate these funds, the Legislature still has an interest in ensuring that they are spent efficiently and effectively. This is because, when more funds than necessary are spent on administrative activities in Allocation 1, such as those performed by EDD and CDTFA, fewer funds are available to fund the legislative priorities supported in Allocation 3, such as childcare slots. Accordingly, we recommend the Legislature use its oversight functions to seek information from the following departments on their budget proposals using the Cannabis Tax Fund:

- CDTFA. We recommend asking CDTFA to explain how, if at all, it plans to adjust its proposal to reflect the administration’s proposed change to the point of collection for cannabis taxes, as well as any other changes to the tax structure and point of collection under consideration.

- EDD. We recommend asking EDD to explain why it proposes collecting cash payments from the cannabis industry rather than collaborating with CDTFA as FTB does. This is particularly important given that CDTFA has already invested significant resources to enable it to collect cash payments.

Conduct Oversight Over Other Expenditures of Cannabis Tax Funds. We recommend that the Legislature continue to use its oversight role to ensure that it is comfortable with the administration’s plans for Cannabis Tax Fund revenues more broadly. For example, the Legislature could ask the administration to identify the outcomes that it seeks to achieve with the use of these funds—such as restoring habitat or reducing rates of youth substance use—and whether it has measurable targets for each outcome, such as the number of acres of habitat restored or the change in rates of youth substance abuse. A clear articulation of the desired outcomes from the funds provided would assist the Legislature in evaluating the administration’s approach to the use of the funds and in holding the administration accountable on an ongoing basis.

In cases where the administration has not adequately identified expected outcomes, the Legislature could adopt reporting language requiring the administration to identify these outcomes. Alternatively, the Legislature could adopt legislative intent language articulating its desired outcomes and require the administration to report on measures assessing whether those outcomes are achieved.