LAO Contacts

- Mark Newton

- Overall Health Issues

- Ben Johnson

- Medi-Cal Issues

- Corey Hashida

- Medi-Cal Issues

- Behavioral Health Issues

- State Hospitals Issues

- Ned Resnikoff

- Medi-Cal Issues

- Covered California Issues

- Sonja Petek

- Public Health Issues

October 15, 2020

The 2020-21 Spending Plan

Health Spending Plan

Overview

Evolution of the Health Budget

January Budget Proposal

State Entered the Budget Process on Sound Overall Fiscal Footing. The Governor’s January budget proposal assumed a significant year-over-year growth in General Fund revenues—growing from $139.4 billion in 2018‑19 to $151.6 billion in 2020‑21. This projected revenue growth allowed for significant proposed augmentations across the budget and healthy year-end reserves ($20.5 billion).

Governor’s January Budget Proposed Major Policy Changes Requiring Significant Funding. The Governor’s January budget proposed a total of $29.2 billion from the General Fund for health programs and included the following significant proposed augmentations:

- Department of Health Care Services (DHCS). The Governor’s January budget included $348 million General Fund for the California Advancing and Innovating Medi-Cal (CalAIM) proposal, designed to provide more comprehensive services to high-risk and high-cost populations as well as streamline and standardize Medi-Cal benefits and administration. The budget also included $58 million General Fund to expand comprehensive Medi-Cal coverage to income-eligible seniors regardless of immigration status and $45 million General Fund for a behavioral health quality improvement incentives program to help prepare counties to implement the behavioral health reforms in CalAIM.

- Department of State Hospitals (DSH). The Governor’s January budget included $24.6 million General Fund in 2020‑21 for a six-year pilot program known as the Community Care Collaborative Pilot to provide incentive payments to three counties to develop community-based treatment options for individuals declared (or at risk of being declared) incompetent to stand trial (IST). (The annual cost of the pilot was scheduled to ramp up over time, such that the total cost over six years would be $364.2 million General Fund.) These treatment options would focus on reducing the rate of arrests or rearrests for the IST population. The budget also included $86.4 million General Fund for various DSH infrastructure improvements (for example, $49.3 million General Fund to repair several deteriorating roofs) and $39.9 million General Fund to implement new staffing standards at DSH facilities.

May Revision

Coronavirus Disease 2019 (COVID-19) Significantly Changed the State’s Overall Fiscal Outlook After January Budget Proposal. Largely as a result of a severe decline in economic activity due to COVID-19, the administration’s estimates for revenues in both 2019‑20 and, most notably, 2020‑21, declined substantially between January and May. At May Revision, the administration estimated a $54.3 billion budget problem, which was a net result of several factors, including lower revenues and higher caseload-related spending. The Governor’s May Revision proposal for health programs, discussed below, reflects proposed actions to both address the overall budget problem and account for additional COVID-19-related costs.

May Revision Withdrew or Scaled Back Major January Health Proposals. The Governor’s May Revision withdrew January augmentation proposals totaling about $500 million General Fund, including the proposals to implement CalAIM, the Behavioral Health Quality Improvement Program, the Community Care Collaborative Pilot Program, and the expansion of comprehensive Medi-Cal coverage to undocumented seniors. The Governor’s May Revision also reduced various other January proposals by a total of about $120 million General Fund. This mainly includes reductions to the proposed DSH infrastructure and staffing-related augmentations and the removal of the proposal for $26 million General Fund in 340B clinic supplemental payments that accompanied the savings proposal to carve the delivery of Medi-Cal pharmacy services out of managed care.

May Revision Included a Large Number of General Fund Savings Proposals in the Health Area. The Governor’s May Revision also included health-related General Fund savings proposals with assumed savings totaling about $2.4 billion. The largest of these was the proposal to eliminate or reduce Proposition 56-funded supplemental payments to health care providers, resulting in General Fund savings of close to $1.2 billion. The major savings proposals are listed in Figure 1. As noted in the figure, some savings proposals were characterized as a “trigger cut,” meaning that funding for a spending reduction would be restored if federal funding was provided to the state at specified levels.

Figure 1

Major May Revision General Fund Savings Proposals

2020‑21 General Fund Impact (In Millions)

|

Department/Program Name |

Assumed General Fund Savings |

Trigger Cut? |

|

DHCS Medi‑Cal Local Assistance |

||

|

Elimination/reduction of Proposition 56 provider supplemental payments |

‑$1,177.0 |

x |

|

New fund transfers and revenues (excluding MCO tax funding) |

‑474.0 |

|

|

Managed care capitated rate adjustments |

‑274.0 |

|

|

Elimination of optional benefitsa |

‑160.0 |

x |

|

Withdraw scheduled coverage expansion for Aged, Blind, and Disabled enrollees |

‑68.0 |

x |

|

Eliminate health center carve outs |

‑50.0 |

x |

|

Withdraw scheduled coverage expansion for postpartum women |

‑46.0 |

x |

|

Freeze county administration funding at 2019‑20 revised level |

‑21.0 |

x |

|

Reinstate expanded estate recovery |

‑17.0 |

x |

|

End Martin Luther King Hospital supplemental payments |

‑8.0 |

x |

|

Subtotal |

(‑$2,302.9) |

|

|

Department of Public Health |

||

|

Reduction in Black Infant Health Program |

‑$4.5 |

x |

|

Reduction in Safe Cosmetics Program |

‑0.5 |

|

|

Subtotal |

(‑$5.0) |

|

|

Department of State Hospitals |

||

|

Delayed implementation of nursing staff adjustments |

‑$21.0 |

|

|

Delayed activation of additional secure bed capacity |

‑6.8 |

|

|

Delayed recruitment and hiring of court evaluation staff |

‑3.3 |

|

|

Delayed activation of new county jail‑based competency treatment programs |

‑2.7 |

|

|

Delayed construction of Enhanced Treatment Program units |

‑1.4 |

|

|

Reduce positions for disaster preparedness, response, and recovery |

‑0.5 |

|

|

Subtotal |

(‑$35.6) |

|

|

Office of Statewide Health Planning and Development |

||

|

Eliminate General Fund support for Song‑Brown health care workforce program |

‑$33.3 |

x |

|

Subtotal |

(‑$33.3) |

|

|

Total |

‑$2,376.3 |

|

|

aProposed elimination also results in reduced General Fund expenditures of $1.6 million in the Department of Aging. DHCS = Department of Health Care Services and MCO = managed care organization. |

||

May Revision Reflected Substantial Savings Due to Enhanced Federal Funding and Revenues From the Reauthorized Managed Care Organization (MCO) Tax. In the spring of 2020, the federal government took two actions that together generate General Fund savings in Medi-Cal of around $5.3 billion across 2019‑20 and 2020‑21. First, Congress approved a 6.2 percentage-point increase in the federal government’s share of cost for Medicaid (Medi-Cal is the state’s Medicaid program) for the duration of the national public health emergency caused by COVID-19. The May Revision assumed this enhanced federal funding remains in place through the end of 2020‑21. Second, the federal government approved the state’s recently reauthorized MCO tax. We discuss these adjustments in detail in the “Medi-Cal” section of this post.

May Revision Anticipated Substantial Increase in Underlying Medi-Cal Program Costs Due to COVID-19-Driven Caseload Increases. The May Revision projected that the deteriorating economic environment caused by the COVID-19 crisis would cause a surge in the Medi-Cal caseload of nearly 1.7 million people, reflecting a 13 percent increase beyond what Medi-Cal caseload would have been absent the crisis. This significant projected increase would bring total Medi-Cal enrollment to over 14 million people, more than one-third of the state’s population, by July 2020. The caseload was then assumed to gradually decline over the course of 2020‑21. Across 2019‑20 and 2020‑21, the administration projected around $3.4 billion in higher General Fund costs ($7.7 billion total funds) in Medi-Cal due to COVID-19-related caseload increases.

May Revision Included a Few COVID-19-Related Policy Augmentations. The May Revision included some targeted General Fund augmentations that were primarily aimed at responding to the COVID-19 crisis. These included about $140 million of augmentations in Medi-Cal, including funding to provide COVID-19 testing and treatment coverage for the uninsured and to increase long-term care facility rates, and about $6 million in augmentations in the California Department of Public Health to enhance the laboratory, disease surveillance, and emergency response capacity of the department.

Budget Act

Budget Act Largely Approved the Withdrawal/Reduction of the Governor’s January Budget Augmentations... The budget act passed by the Legislature and signed by the Governor reflects withdrawing or reducing most January augmentation proposals. A notable exception to this is the budget act’s inclusion of $26 million General Fund for 340B clinic supplemental payments. While the spending plan approved the withdrawal of the Governor’s proposed expansion of comprehensive Medi-Cal coverage for undocumented seniors, the Legislature approved budget-related legislation to prioritize this augmentation in 2021‑22 if the Department of Finance (DOF) determines the budget can accommodate the expansion.

…And Mostly Incorporated the Administration’s Underlying Program Cost Projections. For the most part, the budget act reflects the Administration’s projections of underlying health program cost growth. One major exception relates to a $358 million downward adjustment made by the Legislature to the projected General Fund cost of the COVID-19-related caseload increase in Medi-Cal. A second major adjustment was to reduce by $773 million the amount of General Fund needed in 2020‑21 to redress erroneous federal fund claiming in Medi-Cal on a retroactive and prospective basis. (We discuss this issue in greater detail in the “Medi-Cal” section of the post.) This reduction is largely due to the administration, at the time of the May Revision, having annualized what should have been a half-year of related costs in 2020‑21.

Budget Act Rejected Most of the Health-Related May Revision General Fund Savings Proposals…Most of the health-related May Revision General Fund savings proposals were rejected by the Legislature. Notable exceptions include (1) the Legislature’s partial approval of the May Revision proposals to reduce funding in Medi-Cal managed care (the Legislature rejected the component of these proposals that would cap payments to hospitals) which is projected to result in General Fund savings of $241 million ($768 million total funds) and (2) the Legislature’s approval of reduced funding for DSH due to delays in program activation and implementation, which results in General Fund savings of $38.6 million.

Over $800 Million in Health-Related Programmatic Spending Is Subject to Potential Suspension in 2021‑22. Finally, similar to action taken in 2019‑20, the spending plan makes some spending (mostly in the area of health and human services) subject to suspension in 2021‑22. In these cases, statute directs DOF to calculate whether General Fund revenues will exceed General Fund expenditures—without suspensions—in 2021‑22 and 2022‑23. If DOF determines revenues will exceed expenditures, then the programs’ ongoing spending amounts will continue and not be suspended. Otherwise, the expenditures are automatically suspended. In the health area, four items of Medi-Cal programmatic spending are subject to potential suspension—(1) most Proposition 56-funded provider payment increases, (2) the extension of coverage for postpartum mental health, (3) the restoration of previously eliminated optional benefits, and (4) the expansion of screening and intervention to drugs other than alcohol. While the first suspension would take effect on July 1, 2021, the other three would take effect on December 31, 2021. If the four potential suspensions were operative, there would be estimated General Fund savings of $805 million in 2021‑22 (increasing to $871 million in 2022‑23).

Overview of Health Spending

The spending plan provides $26.7 billion General Fund for health programs. This is a net increase of just over $700 million, or 3 percent, compared to the revised 2019‑20 spending level, as shown in Figure 2. This year-over-year net increase is primarily due to growth in projected General Fund spending in Medi-Cal, which largely reflects increased projected caseload. The General Fund cost associated with the increased projected caseload would be substantially higher were it not for the state’s receipt of enhanced federal Medicaid funding and the MCO tax revenues.

Figure 2

Major Health Programs and Departments—Spending Trends

General Fund (Dollars in Millions)

|

2019‑20 |

2020‑21 |

Change From |

||

|

Amount |

Percent |

|||

|

Medi‑Cal—local assistance |

$22,731.5 |

$23,623.9 |

$892.5 |

4% |

|

Department of State Hospitals |

1,814.3 |

1,927.6 |

113.4 |

6 |

|

California Health Benefit Exchange (Covered California) |

428.6 |

348.9 |

‑79.7 |

‑19 |

|

DHCS—state administration |

279.3 |

260.4 |

‑18.9 |

‑7 |

|

Other DHCS programs |

231.4 |

323.4 |

92.0 |

40 |

|

Department of Public Health |

348.5 |

214.1 |

‑134.4 |

‑39 |

|

Office of Statewide Health Planning and Development |

163.2 |

33.3 |

‑129.9 |

‑80 |

|

Emergency Medical Services Authority |

21.5 |

10.7 |

‑10.8 |

‑50 |

|

Health and Human Services Agency |

18.4 |

6.7 |

‑11.7 |

‑64 |

|

Totals |

$26,037.0 |

$26,749.0 |

$712.4 |

3% |

|

DHCS = Department of Health Care Services. |

||||

In addition, and as shown in Figure 3, year-over-year net growth in health program General Fund spending reflects a number of actions (both policy actions and various budget adjustments) adopted by the Legislature as part of its 2020‑21 spending plan.

Figure 3

Major Actions—State Health Programs

2020‑21 General Fund Effect (In Millions)

|

Program |

Amount |

|

California Health Benefit Exchange (Covered California) |

|

|

Assumes increase in state individual mandate penalty revenues |

‑$15.0 |

|

Assumes lower projected demand for state subsidies |

‑90.3 |

|

Medi‑Cal—Department of Health Care Services |

|

|

Assumes significant COVID‑19‑related caseload growth |

$2,691.6 |

|

Repays the federal government for erroneous claiming |

668.1 |

|

Ensures access and provider financial protection during COVID‑19 |

139.6 |

|

Reforms nursing facility reimbursement |

92.8 |

|

Establishes 340B clinic supplemental payment program |

26.3 |

|

Assumes savings from Medi‑Cal Rx |

‑68.1 |

|

Assumes lower fee‑for‑service expenditures due to COVID‑19 |

‑146.8 |

|

Reduces Medi‑Cal managed care plan funding |

‑241.2 |

|

Makes use of additional state special fund resources |

‑315.8 |

|

Offsets General Fund with revenues from reauthorized MCO tax |

‑1,686.6 |

|

Reflects enhanced federal Medicaid funding |

‑2,838.5 |

|

Office of Statewide Health Planning and Development |

|

|

Reverts funding for mental health workforce, education, and training five‑year plan to the General Fund |

‑$20.0 |

|

Department of Public Health |

|

|

Provides ongoing funding to support state laboratory capacity |

$5.9a |

|

Provides ongoing funding for the immunization medical exemption program (SB 276) |

3.4b |

|

Department of State Hospitals |

|

|

Improves safety of infrastructure |

$32.0 |

|

Expands IST patient treatment capacity |

12.4 |

|

Partial implementation of new staffing standards |

5.0 |

|

Provides funding for planning and implementation of information technology projects |

3.4 |

|

Provides funding to support relocating department headquarters |

3.3 |

|

Increases placement evaluations for court‑ordered outpatient treatment |

2.2 |

|

Delays program activation or implementation |

‑38.6 |

|

aDeclines to $4.8 million in 2021‑22 and ongoing. bDeclines to $3.1 million in 2021‑22 and ongoing COVID 19 = coronavirus disease 2019; MCO = managed care organization; and IST=incompetent‑to‑stand‑trial. |

|

Medi-Cal

Balancing the Medi-Cal Budget Under COVID-19

As summarized in Figure 4, the spending plan provides $22.7 billion General Fund ($99.5 billion total funds) in 2019‑20 and $23.6 billion General Fund ($115.4 billion total funds) in 2020‑21. In this section, we describe the major drivers of growth in the Medi-Cal budget.

Figure 4

Medi‑Cal Spending Plan

(Dollars in Billions)

|

2019‑20 |

2020‑21 |

Change From |

||

|

Amount |

Percent |

|||

|

Federal funds |

$65.1 |

$76.0 |

$10.9 |

17% |

|

General Fund |

22.7 |

23.6 |

0.9 |

4 |

|

Other nonfederal funds |

11.7 |

15.8 |

4.1 |

35 |

|

Total Funds |

$99.5 |

$115.4 |

$15.9 |

16% |

Substantially Higher Costs, Largely Due to COVID-19

Higher Projected Caseload Assumed to Increase General Fund Costs by $3 Billion Across 2019‑20 and 2020‑21. The spending plan follows the May Revision in projecting a surge in Medi-Cal caseload of nearly 1.7 million beneficiaries, or a 13 percent increase of what Medi-Cal caseload would have been if the COVID-19 crisis had not occurred. This increase is assumed to be driven in large part by (1) rising unemployment and a loss of income for many households as a result of the economic slowdown associated with the COVID-19 crisis, and (2) federal rules that require the state to temporarily pause the automatic disenrollment of current Medi-Cal beneficiaries who, based on program eligibility rules, would otherwise have become ineligible to stay enrolled in the program. The spending plan assumes the increased caseload will result in General Fund costs of $3 billion across 2019‑20 and 2020‑21—an amount that is somewhat lower than the cost assumed in the May Revision. (This General Fund cost, as well as many General Fund expenditures throughout the Medi-Cal budget, will be partially offset by the enhanced federal share of cost provided for the duration of the public health emergency.)

Temporary Augmentations to Address the Impacts of the COVID-19 Pandemic. The spending plan provides funding to implement a number of programmatic changes aimed at ensuring access to services and providing financial protection to certain Medi-Cal provider types during the federal COVID-19 public health emergency. Below, we describe several of the temporary augmentations aimed at addressing the impacts of COVID-19. Collectively, the augmentations are assumed to require $258 million in General Fund ($761 million total funds) across 2019‑20 and 2020‑21. These augmentations are intended to be sustained for the duration of the national COVID-19 public health emergency, the end date of which is unknown, but is assumed to persist through 2020‑21.

- Cover COVID-19 Testing and Treatment Costs for the Uninsured. To address COVID-19 testing for those without coverage, federal COVID-19-related legislation gives states the option to enroll uninsured individuals in Medicaid for purposes of COVID-19 testing only. While Medicaid costs typically are shared by states and the federal government, the federal government will cover 100 percent of the costs of providing COVID-19 testing to this population through Medicaid. In addition, the spending plan provides funding to cover the COVID-19 treatment costs of the uninsured. Because the federal COVID-19-related legislation only extended to COVID-19 testing, the costs of providing COVID-19 treatment for the uninsured are entirely covered with General Fund. However, the state has requested to provide COVID-19 treatment services with federal funding. This request is still pending. For both COVID-19 testing and treatment, the spending plan provides $15 million General Fund ($28 million total funds).

- Expand Hospital Presumptive Eligibility. Hospitals currently are authorized to presume that patients are eligible for Medi-Cal, and thereby receive Medi-Cal reimbursement, based on preliminary patient information indicating potential Medi-Cal eligibility. However, this hospital presumptive eligibility is typically only available for certain types of potential Medi-Cal enrollees. The spending plan, utilizing a federal waiver, expands hospital presumptive eligibility to additional types of Medi-Cal enrollees, including seniors and persons with disabilities and uninsured individuals not normally eligible for Medi-Cal but who are allowed under federal COVID-19-related legislation to receive Medicaid coverage at states’ option. The spending plan allocates $62.6 million from the General Fund across 2019‑20 and 2020‑21 for expanded hospital presumptive eligibility.

- Long-Term Care (LTC) Facility Payment Rate Increase. In order to help LTC facilities in their COVID-19 prevention and mitigation efforts, the spending plan includes a 10 percent per diem rate increase to LTC facilities, pursuant to a federal waiver. The spending plan includes $114 million from the General Fund across 2019‑20 and 2020‑21 for the payment rate increase.

- Behavioral Health Payment Rate Increases. The spending plan includes $13.3 million General Fund ($135.3 million total funds) in 2019‑20 and $7.7 million General Fund ($77.7 million total funds) in 2020‑21 to implement temporary payment rate increases for behavioral health services in Medi-Cal. Due to the COVID-19 crisis, utilization of certain behavioral health services—specifically, outpatient mental health and substance use disorder services—in Medi-Cal has declined. As a result, Medi-Cal reimbursements to behavioral health providers also have declined. These temporary rate increases are meant to account for these impacts and provide financial relief to behavioral health providers.

Upward $966 Million Adjustment Related to Erroneous Federal Claiming. The state and federal government generally share in the cost of services provided to Medi-Cal enrollees who meet all state and federal eligibility rules. Over the course of many years, California has expanded Medi-Cal eligibility to include several populations who do not meet all federal eligibility rules related to immigration status. Because these populations do not meet federal eligibility rules, the state must pay 100 percent of the cost for most Medi-Cal services provided to these “state-only” populations. However, in early 2020, the administration discovered that the state has been erroneously claiming federal funding for services for these state-only populations since 2010. The state must repay the federal government the amount of funding that was claimed erroneously as well as increase state funding for Medi-Cal on an ongoing basis to ensure against ongoing erroneous claiming. The administration estimates the costs to address this issue to be $966 million General Fund in 2020‑21. (Of this amount, $298 million reflects General Fund for the Department of Developmental Services, which also has been erroneously claiming federal Medicaid funds for services provided to federally ineligible populations. A portion of the funding is for erroneous claiming for county behavioral health, which counties will have to repay.) Potentially around $1 billion General Fund will be needed on an ongoing basis to ensure against future erroneous claiming.

Reduced Projected Expenditures Due to COVID-19

The Governor’s stay-at-home order, as well as the potential risks associated with being in public and visiting a health professional during COVID-19, are expected to significantly reduce service utilization in Medi-Cal for the last several months of 2019‑20 and at least the first few months of 2020‑21. While data showing the decline in service utilization was not readily available at the time the budget was enacted, the spending plan reflects $376 million in anticipated General Fund savings (around $1 billion total funds) related to anticipated projected declines in Medi-Cal service utilization across 2019‑20 and 2020‑21. This amount exclusively reflects savings in Medi-Cal’s fee-for-service delivery system. As we discuss below, the Legislature approved budget-related legislation to reduce funding for Medi-Cal managed care plans to account for reduced service utilization under COVID-19 within the managed care delivery system.

Enhanced Federal Funding and Revenues From Reauthorized MCO Tax Offset General Fund Costs

As discussed above in the “Evolution of the Budget” section, the Medi-Cal budget reflects substantial General Fund savings from two major federal actions.

Enhanced Federal Medicaid Funding Offsets Around $3.6 Billion General Fund Across 2019‑20 and 2020‑21. To relieve state budgetary pressure caused by the impacts of COVID-19 on state tax revenues and Medicaid expenditures, Congress enacted legislation that provides for a temporary 6.2 percentage point increase in the federal government’s share of cost for state Medicaid programs. Under this legislation, beginning January 1, 2020 and ending the first quarter in which the national COVID-19 public health emergency is not in effect, the federal share of cost for Medi-Cal services generally increases from 50 percent to 56.2 percent. Because Medicaid is an entitlement program, the amount of additional federal funding due to the enhancement is not a fixed amount but instead will vary based on overall Medi-Cal program costs. The spending plan assumes this enhanced federal funding will remain in place until the end of 2020‑21 and will offset General Fund spending in Medi-Cal by around $800 million in 2019‑20 and $2.8 billion in 2020‑21.

Reauthorized MCO Tax Offsets Around $1.7 Billion in General Fund Spending in 2020‑21. For a number of years, the state has imposed a tax on MCOs’ Medi-Cal and commercial lines of business. The state’s previous MCO tax expired at the end of 2018‑19 and, in 2019‑20, the Legislature reauthorized the MCO tax in similar but not identical form to the prior tax. In January 2020, the federal government rejected the state’s proposal for being found in violation of federal rules on health care-related taxes. The state subsequently submitted a modified MCO tax proposal for federal approval, which the federal government approved in April 2020. As detailed further below, the reauthorized MCO tax offsets around $1.7 billion in General Fund spending in 2020‑21. This $1.7 billion in savings is generated from MCO tax revenues from both 2019‑20 and 2020‑21.

How Does the Federally Approved MCO Tax Differ From the Legislature’s Original 2019 Version? Over its full three-year term, the approved version of the MCO tax will generate a net General Fund benefit that is about a $2.1 billion lower than the version of the reauthorized tax that the state originally submitted for federal approval. For more information on the reauthorized MCO tax that the Legislature passed in 2019, see The 2019‑20 Budget: California Spending Plan: Health and Human Services (HHS) Spending Plan. The approved MCO tax differs from the original version passed by the Legislature in 2019‑20 in two primary ways:

- Top Tax Rate Applies to Fewer Enrollees. The MCO tax is a tax on managed care plan enrollment where different tax rates apply to different tiers of enrollment, with enrollment counted as the number of members an MCO has per month. In order to attain federal approval, the administration modified which tax rates apply to which enrollment tiers, with the most significant change from a state revenue perspective being a reduction in the number of member months to which the top tax rate ($40 in 2019‑20) applies. Figure 5 compares the tax rate structures of the original reauthorized and federally approved versions of the MCO tax. Collectively, the changes made to the tax rate structure result in reduced General Fund savings of about $1.4 billion over the full, multiyear period in which the tax is in effect.

- Shortened Duration. The approved MCO tax begins on January 1, 2020 and expires on December 31, 2022, whereas the original reauthorized tax instead would have implemented beginning on July 1, 2019 and expired on the same date as the approved tax. The shorter duration of the tax is due to its delayed federal approval. (Under federal rules, a health care-related tax that applies to Medicaid services only may be implemented with federal financial participation dating back to the beginning of the quarter in which a request for approval is submitted to the federal government.) The six-month shorter duration of the approved tax results in reduced General Fund savings in Medi-Cal of around $700 million.

Figure 5

Comparing the Original and Federally Approved

MCO Tax Structures

2020‑21 Tax Rates

|

Member Monthsa |

Tax Rate Per Member Month |

|

|

Original Proposalb |

Federally Approvedc |

|

|

Medi‑Cal Enrollees |

||

|

1 to 675,000 |

$45 |

— |

|

675,001 to 4,000,000 |

45 |

$45 |

|

4,000,001 and above |

— |

— |

|

Commercial Enrollees |

||

|

1 to 675,000 |

— |

— |

|

675,001 to 4,000,000 |

— |

$1 |

|

4,000,001 to 8,000,000 |

$1 |

— |

|

8,000,000 and above |

— |

— |

|

aA member month is defined as one member being enrolled for one month in an MCO. bOriginal proposal refers to the MCO tax as reauthorized and proposed to the federal government for consideration in 2019. cFederally approved refers to the MCO tax as modified by the administration and approved by the federal government in April 2020. |

||

|

MCO = managed care organization. |

||

Figure 6 compares the fiscal impact of the original reauthorized and federally approved versions of the MCO tax over the tax’s full duration, showing the combined impact of the tax rate structure changes made in, and the shortened duration of, the federally approved version.

Figure 6

Comparing the Fiscal Impacts of the Original Proposal and the Federally Approved MCO Tax

LAO Accrual Estimate (In Millions)

|

2019‑20 |

2020‑21 |

2021‑22 |

2022‑23b |

Full Duration |

|

|

Original Proposala |

|||||

|

Total MCO Tax Revenue |

$2,631 |

$2,958 |

$3,293 |

$1,810 |

$10,692 |

|

General Fund Cost of Medi‑Cal Reimbursement to MCOs |

‑915 |

‑1,029 |

‑1,144 |

‑629 |

‑3,717 |

|

Net General Fund Benefit |

$1,716 |

$1,928 |

$2,149 |

$1,181 |

$6,975 |

|

Federally Approved Taxc |

|||||

|

Total MCO Tax Revenue |

$1,031 |

$2,318 |

$2,584 |

$1,420 |

$7,353 |

|

General Fund Cost of Medi‑Cal Reimbursement to MCOs |

‑316 |

‑792 |

‑893 |

‑491 |

‑2,492 |

|

Net General Fund Benefit |

$715 |

$1,526 |

$1,691 |

$929 |

$4,861 |

|

Difference: Approved‑Original |

|||||

|

Total MCO Tax Revenue |

‑$1,599 |

‑$640 |

‑$709 |

‑$390 |

‑$3,339 |

|

General Fund Cost of Medi‑Cal Reimbursement to MCOs |

599 |

237 |

251 |

138 |

1,225 |

|

Net General Fund Benefit |

‑$1,001 |

‑$403 |

‑$458 |

‑$252 |

‑$2,114 |

|

aOriginal proposal refers to the MCO tax as reauthorized and proposed to the federal government for consideration in 2019. bThe MCO tax is only authorized for a half year in 2022‑23. cApproved tax refers to the MCO tax as modified by the administration and approved by the federal government in April 2020. The federal government approved the MCO tax for a half year, rather than a full year, in 2019‑20. |

|||||

|

MCO = managed care organization. |

|||||

Various Adopted Budget Solution Proposals Create General Fund Savings

Spending Plan Reduces Managed Care Payment Rates to Account for Lower Service Utilization Under COVID-19. We previously discussed the savings assumed in the Medi-Cal budget related to anticipated reductions in service utilization within the fee-for-service delivery system. Declines in service utilization also are expected to occur within Medi-Cal’s other major delivery system, managed care. However, unlike in fee for service, under prior state law, any immediate savings stemming from reduced service utilization in Medi-Cal managed care would have accrued to managed care plans rather than to the state. To redirect at least a portion of the immediate savings in Medi-Cal managed care to the state and federal governments, the spending plan adopted budget-related legislation to temporarily change state policy. This legislation features two key components:

- Reduces Capitated Rates. Medi-Cal managed care plans are paid using “capitated rates,” which are per-member per-month payments intended to cover their members’ average cost of care. The spending plan reduces Medi-Cal managed care plans’ capitated rates by up to nearly 1.5 percent for the 18-month period of July 1, 2019 through December 31, 2020. The downward adjustment applies to the vast majority of Medi-Cal managed care enrollees and is assumed to generate $182 million in General Fund savings ($586 million total funds) all in 2020‑21.

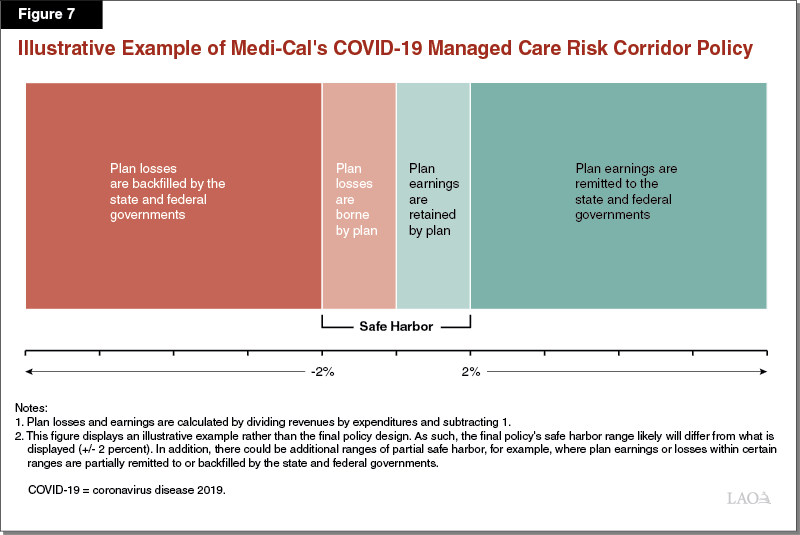

- Establishes a Risk Corridor. When the spending plan was adopted, there was (and continues to be) significant uncertainty around whether 1.5 percent is a reasonable downward adjustment in light of lower anticipated service utilization in Medi-Cal managed care. To account for this uncertainty, budget-related legislation establishes a “risk corridor” for the same period as the roughly 1.5 percent downward adjustment is in effect. (The legislation authorizes the administration to implement the risk corridor in subsequent years as well if necessary to continue to account for the impacts of the COVID-19 pandemic.) While we understand that the details of the risk corridor remain in development via the policymaking process, the intent of the legislation is for Medi-Cal managed care plans to be able to retain earnings up to a percentage target, while also bearing losses up to a percentage target. Plan earnings beyond the percentage target would have to be remitted in whole or in part to the state and federal governments, while plan losses beyond the percentage target would have to be backfilled in whole or in part by the state and federal governments. Figure 7 illustrates how the risk corridor generally is intended to work. No savings or costs are budgeted in the spending plan for the risk corridor since this policy’s fiscal impact likely will not materialize until 2022‑23.

Adjusts Managed Care Payments Down to Realize New Efficiencies. The spending plan includes budget-related legislation authorizing four prospective and potentially ongoing adjustments to capitated rates that are intended to help the state realize efficiencies within the managed care delivery system. Together, these four adjustments are expected to generate General Fund savings of $59 million ($182 million total funds) in 2020‑21. Because these adjustments first would be made to capitated rates starting in January 2021, these totals only reflect a partial year of savings. The following bullets describe the four adjustments. (As previously noted, a fifth adjustment that would have set a maximum Medi-Cal fee schedule for private and certain public hospitals was proposed in May, but not approved as a part of the final spending plan.)

- Assumes Savings Due to Lower Acuity of New Enrollees. As previously discussed, the spending plan assumes that the Medi-Cal caseload will increase significantly due to the effects of COVID-19. Most of these new enrollees are expected to be enrolled in managed care. The spending plan assumes that these new enrollees will have fewer health care needs than existing Medi-Cal managed care members, resulting in savings in the program. This adjustment is expected to generate roughly $18 million in General Fund savings ($55 million total funds) in 2020‑21.

- Reduced Funding for Managed Care Plan Earnings. Medi-Cal managed care capitated rates can be divided into three main components: (1) medical, which funds services; (2) administration, which funds managed care plans’ operating expenses; and (3) underwriting gain, which reflects funding intended to allow managed care plans to make reasonable earnings or profit. Currently, Medi-Cal funds the underwriting gain component in amounts intended to allow plans to make roughly 2 percent annually in earnings or profit. The spending plan adjusts the amount of funding provided for Medi-Cal managed care plan underwriting gains downward to amounts intended to allow plans to make roughly 1.5 percent annually in earnings or profit. This adjustment is expected to generate roughly $17 million in General Fund savings ($54 million total funds) in 2020‑21.

- Adjustment for Avoidable Emergency Room Visits. Many emergency room visits are considered to be avoidable through better outreach; care coordination; and access to other, more appropriate forms of care. To incentivize Medi-Cal managed care plans to take steps to help their members avoid unnecessary emergency room visits, the spending plan approves an adjustment that will reduce funding provided to plans when it is determined that the funding is for emergency room visits that could have been avoided. This adjustment is expected to generate roughly $14 million in General Fund savings ($38 million total funds) in 2020‑21.

- Adjustment to Lower Cost of Clinician-Administered Drugs. Medi-Cal managed care plans arrange and pay for the clinician-administered drugs used by their members. Under the spending plan, the state will adjust managed care plan payments with the intent of improving contracting for these drugs and realizing state savings. This adjustment is expected to generate roughly $11 million in General Fund savings ($35 million total funds) in 2020‑21.

Makes Use of Additional State Special Fund Resources. The spending plan includes General Fund savings of $316 million in Medi-Cal in 2020‑21 related to the additional use of state special fund resources. First, the spending plan includes $9.6 million in General Fund savings in 2020‑21 to reflect the impact of a proposed additional tax on electronic cigarettes (the state currently already levies an existing tax on these products). A portion of the new revenues collected from this proposed additional tax were assumed to be available to offset General Fund costs in the Medi-Cal program. However, as of the end of the 2019‑20 legislative session, this proposed tax had not been approved by the Legislature. Without such approval, $9.6 million in additional General Fund will be needed to fund Medi-Cal in 2020‑21 to make up for this alternative revenue that did not materialize. Second, the spending plan includes $306 million in General Fund savings in 2020‑21 due to one-time expenditures from three special funds that offset General Fund costs in the Medi-Cal program. These include use of the following state special fund resources to offset General Fund costs in Medi-Cal: (1) $170 million from the Medi-Cal Drug Rebate Fund, (2) $100 million from the Children’s Health and Human Services Special Fund (the state fund supported by the previous MCO tax), and (3) $36.5 million from the Health Care Services Plan Fines and Penalties Fund.

Some Ongoing Programmatic Funding Subject to Potential Suspension in 2021‑22

The spending plan makes several Medi-Cal spending items subject to potential suspension in 2021‑22. (We discuss the criteria under which these potential suspensions would take effect in the “Overview” section of this post.) These Medi-Cal items are (1) most Proposition 56-funded provider payment increases, (2) the extension of coverage for postpartum mental health, (3) the restoration of previously eliminated optional benefits, and (4) the expansion of screening and intervention to drugs other than alcohol. The potential suspension of Proposition 56-funded provider payments would take effect on July 1, 2021, after which most Proposition 56 funding in Medi-Cal would be used to offset General Fund spending on cost growth in Medi-Cal. The potential suspension of the other three items would take effect on December 31, 2021. If these four items of Medi-Cal spending were suspended, there would be estimated General Fund savings of $805 million in 2021‑22 and $871 million in 2022‑23. The use of Proposition 56 funding constitutes the bulk (96 percent in 2021‑22 and 92 percent in 2022‑23) of these savings.

Implements Medi-Cal Rx and Other Prescription Drug Changes

Medi-Cal Covers Pharmacy Services, in Large Part Through Managed Care. Through the pharmacy services benefit, Medi-Cal covers prescription drugs and other medical products that beneficiaries obtain from pharmacies. For managed care enrollees, managed care plans currently are responsible for paying for most of the prescription drugs obtained through pharmacies. However, certain prescription drugs are paid for through fee for service for managed care enrollees. The prescription drugs obtained from pharmacies for beneficiaries not enrolled in managed care are entirely paid for through fee for service.

Governor’s Executive Order Directed the State to Transition Medi-Cal Coverage of Pharmacy Services From Managed Care to Fee for Service. In January 2019, the Governor issued an executive order that directed DHCS to carve out the Medi-Cal pharmacy services benefit from managed care and transition it entirely to fee for service. Under the “carve out,” DHCS would more directly pay for and manage the pharmacy services utilized by Medi-Cal beneficiaries, in contrast to paying Medi-Cal managed care plans to do so. The intent of the carve out—now known as “Medi-Cal Rx”—is to achieve savings and standardize Medi-Cal’s pharmacy services benefit.

Spending Plan Includes Budget-Related Legislation to Facilitate Medi-Cal Rx…While the administration has authority to implement Medi-Cal Rx without statutory changes, the spending plan includes budget-related legislation that makes three changes to help facilitate the carve out. These changes are to:

- Establish a supplemental payment program for non-hospital-affiliated community clinics to mitigate financial losses associated with changes to reimbursement under Medi-Cal Rx for drugs paid for through the federal 340B program.

- Remove the current limit in fee for service of six prescriptions per Medi-Cal beneficiary per month.

- Eliminate the state’s authority to collect $1 copays for prescription drugs obtained at pharmacies.

…And Reflects the First Half-Year of Projected General Fund Savings. The spending plan assumes that Medi-Cal Rx, which begins on January 1, 2021, will generate $41 million in net General Fund savings ($122 million total funds) in 2020‑21. These net savings reflect the administration’s assumptions that Medi-Cal Rx will lower prescription drug and administrative costs. The net savings amount accounts for the $26 million in General Fund ($53 million total funds) dedicated to the 340B supplemental payment program. Prior estimates from the administration project net General Fund savings generated by Medi-Cal Rx to ultimately grow to several hundred millions of dollars annually after several years.

Spending Plan Approves Two Additional Changes Aimed at Lowering Drug Costs. The spending plan also includes budget-related legislation that specifically authorizes DHCS to do the following:

- Consider Best International Prices in Rebate Negotiations. Previously, state statute authorized DHCS to consider the best drug prices available to domestic purchasers and payers when negotiating rebates from drug manufacturers. The spending plan authorizes DHCS to consider the best prices manufacturers make available to international purchasers and payers also. The spending plan does not assume any savings related to this statutory change.

- Collect Rebates for Drugs Not Paid for by Medi-Cal. Currently, DHCS is authorized to collect rebates on drugs provided to recipients of comprehensive Medi-Cal coverage. The spending plan includes budget-related legislation authorizing DHCS to seek federal approval to collect rebates for drugs provided to non-Medi-Cal populations. The intent of the statutory change is to utilize the state’s purchasing power—as well as DHCS’ established infrastructure for collecting rebates—to obtain deeper discounts on drugs. The legislation gives the administration the authority to determine which non-Medi-Cal populations would be included in the rebate program. No additional savings related to this policy change are assumed in the spending plan.

Nursing Facility Rate Reauthorization

Overview of Medi-Cal’s Prior Nursing Facility Financing Structure. Nursing facility stays are a covered Medi-Cal benefit that are paid for with a mix of General Fund, federal funds, and revenues from a quality assurance fee (QAF) placed on nursing facilities. Medi-Cal reimbursement of nursing facilities is based on their reported costs, to which a variety of adjustments are made to promote quality and contain costs. Included among these adjustments is a cap on annual growth of reimbursement levels. In addition to this cost-based reimbursement, nursing facilities can receive incentive payments based on their performance on specified performance measures through the Quality Assurance Supplemental Payment (QASP) program. Prior to adoption of the spending plan, this Medi-Cal nursing facility reimbursement framework was scheduled to sunset in August 2020.

Spending Plan Reauthorizes Nursing Facility Financing Structure Through December 2022, While Making Several Reforms. The spending plan includes budget-related legislation to extend the nursing facility reimbursement framework (including the imposition of the QAF) through December 2022, with a variety of reforms. For 2020‑21, the cost of reauthorization is projected to be $92.8 million General Fund ($193 million total funds). Legislative action will be needed to reauthorize and potentially implement further reforms to Medi-Cal’s nursing facility financing structure after 2022. We describe the major reforms in the following bullets.

- Stipulates Annual Weighted Average Reimbursement Rate Increases Through 2022. The budget-related legislation stipulates annual weighted average rate increases of 3.62 percent through December 31, 2020, 3.5 percent plus the cost of complying with new state or federal mandates for 2021, and 2.4 percent plus the cost of complying with new state or federal mandates for 2022. While prior reauthorizations of the Medi-Cal nursing facility financing structure have included reimbursement rate increases, this reauthorization provides for an overall higher effective increase than typically is provided.

- Extends QASP Through 2022; Replacement Quality-Based Payment Methodology to Be Developed. The budget-related legislation extends QASP through 2022, at the same annual level of total funding ($88 million). After 2022, the QASP will be eliminated. The department is directed to convene a stakeholder process by September 1, 2021 to develop a successor supplemental payment or similar quality-based payment methodology to replace QASP following its expiration.

- Increases Emphasis on Direct Labor Costs in Rates. The budget-related legislation allows for higher reimbursement for direct labor costs by increasing the cost ceiling for nursing facilities’ direct labor costs compared to the ceiling under the prior nursing facility financing structure.

- Excludes Freestanding Pediatric Subacute Facilities (FS-PSAs) From QAF Requirement. FS-PSAs provide specialized care for children who are dependent on medical technology (typically ventilators) for survival. There currently are only four FS-PSAs in the state. Under prior QAF rules, FS-PSAs were subject to the same QAF as nursing facilities. The estimated QAF revenue from these facilities is just over $1 million. The budget-related legislation stipulates that the state will no longer assess the QAF on FS-PSAs.

Behavioral Health

Provides Counties Temporary Mental Health Services Act (MHSA) Flexibilities in Response to COVID-19. Approved by voters in 2004, the MHSA (Proposition 63) placed a 1 percent tax on incomes of over $1 million and dedicated the associated revenues of roughly $2 billion annually to mental health services, mainly those administered by counties. Under the MHSA, counties are required to submit three-year plans to the state reporting their MHSA programs and expenditures. Counties are also required to maintain a prudent reserve of MHSA funding to support program expenditures in the event of an economic downturn. (This prudent reserve balance cannot exceed 33 percent of the average amount of funding for community services that a county received in the last five years.) Other than prudent reserve funds, any MHSA funds left unspent after a specified time frame are subject to reversion back to the state for reallocation to other counties. The spending plan includes budget-related legislation providing counties with temporary MHSA flexibilities in response to the COVID-19 crisis. Specifically, it (1) provides counties with expiring three-year MHSA plans with a one-year extension to submit new plans, (2) authorizes counties to access their prudent reserve funding due to the current economic downturn, (3) provides counties with MHSA funds subject to reversion with an additional year to spend these funds, making them subject to reversion on July 1, 2021 instead, and (4) authorizes DHCS to allow counties to determine what percentage of funds to allocate across programs.

Provides Funding to Backfill Declines in County Realignment Revenues, Some of Which Could Fund County Behavioral Health Services. The spending plan includes $750 million from the General Fund in 2020‑21 to offset counties’ declines in realignment sales tax revenues. (We describe this funding in further detail in the “Funding to Local Governments” section of The 2020‑21 Budget: Overview of the California Spending Plan.) Counties use their realignment revenues to fund a variety of local program responsibilities, including behavioral health services. It is possible that part of this General Fund amount will be used to support counties’ behavioral health service obligations; however, the exact amount is uncertain.

Medi-Cal Behavioral Health. In response to the COVID-19 crisis, the spending plan includes $7.7 million from the General Fund in 2020‑21 to provide temporary Medi-Cal behavioral health payment rate increases. The spending plan also makes two items of behavioral health spending in Medi-Cal—(1) the extension of coverage for postpartum mental health and (2) the expansion of screening and intervention to drugs other than alcohol—subject to potential suspension in 2021‑22. (We further discuss the behavioral health payment rate increases and all Medi-Cal items subject to suspension in the “Balancing the Medi-Cal Budget Under COVID-19” section of this post.) The spending plan also includes budget-related legislation to provide Medi-Cal reimbursement for additional medications to treat opioid use disorder, in alignment with federal legislation.

Funding for Suicide Prevention and Other Mental Health Needs in Response to COVID-19. The spending plan makes available about $4 million from the Mental Health Services Fund—the fund into which MHSA revenues are deposited—to the Mental Health Services Oversight and Accountability Commission. Of this amount, $2 million is available for suicide prevention efforts, and about $2 million is available to support the development of innovative approaches to address mental health needs that arise due to the COVID-19 crisis. This funding is available for expenditure through 2021‑22.

Behavioral Health Parity Investigations. The spending plan includes $2.8 million (growing to $4.7 million in 2021‑22 and ongoing) from the Managed Care Fund for the Department of Managed Health Care to investigate health plans for compliance with federal behavioral health parity requirements.

Department of State Hospitals

Under the spending plan, General Fund spending for DSH will be $1.9 billion in 2020‑21, an increase of $113 million, or 6 percent, from the revised 2019‑20 level (which reflects a downward adjustment due to delays in program activations and implementations). This net increase reflects (1) scheduled funding increases for programs approved in prior years, and (2) new augmentations, such as funding for infrastructure improvements and expanded IST capacity. These increases are partially offset by savings in 2020‑21 due to additional delays in program activations and implementations, which we discuss below.

Savings Due to Delayed Activation or Implementation of Programs Funded in Prior Years. The spending plan reflects one-time General Fund savings of $38.6 million in 2020‑21 due to various program activation or implementation delays at DSH, several of which are the result of adjusted time lines due to the impact of the COVID-19 crisis. These savings include (1) $24.2 million due to delayed implementation of new staffing standards for nursing and court evaluation staff, (2) $13.4 million due to delayed activation of expanded IST treatment capacity, and (3) $994,000 due to delayed activation of expanded treatment capacity for patients at high risk of dangerous behavior.

Funding to Improve Safety of Infrastructure. The spending plan includes $32 million from the General Fund for projects to improve infrastructure safety. This includes (1) $26.7 million to repair three deteriorating roofs at Napa, Metropolitan, and Patton State Hospitals and (2) $5.3 million (growing to $15.4 million by 2024‑25) to mitigate ligature risk at state hospital facilities.

Funding for Additional IST Capacity. The spending plan includes $12.4 million from the General Fund for additional IST capacity. This includes (1) $6.1 million for the department to contract with counties for additional Jail-Based Competency Treatment beds; (2) $5.3 million ongoing to expand the Admission, Evaluation, and Stabilization Center in the Kern County jail; and (3) $1 million (growing to $2 million in 2021‑22 and ongoing) for additional county IST “Off Ramp” program capacity. (County IST Off Ramp programs assess potential IST patients for restoration of competency prior to admission to DSH.)

Partial Implementation of New Clinical Treatment Staffing Standards. The spending plan includes $5 million from the General Fund (increasing to $10 million in 2021‑22 and ongoing) to partially implement changes to clinical treatment staffing levels to support additional workload for providing psychiatric and medical care to patients.

Other Adjustments. The spending plan also includes various other General Fund augmentations. This includes (1) $3.4 million for planning and implementation of information technology (IT) projects, (2) $3.3 million (available through 2022‑23) to support relocating the department headquarters, and (3) $2.2 million (growing to $2.4 million in 2021‑22 and ongoing) to establish a program to provide medical and emotional support resources to hospital staff involved in violent incidents. In addition, the spending plan reappropriates $9.4 million that was appropriated in prior years to upgrade the fire alarm system at Patton State Hospital, and also includes budget-related legislation to (1) authorize the Governor—rather than the DSH Director—to appoint state hospital medical directors and (2) allow Patton State Hospital to operate 1,530 beds until September 2030.

Secretary of the California Health and Human Services Agency: Office of Systems Integration

Electronic Visit Verification (EVV)

Federal law requires states to implement EVV for Medicaid-funded personal care services by January 1, 2020 and for home health care services by January 1, 2023. EVV systems must collect and verify information about services performed, including the date and time of their delivery, the location, the types of services provided, and the individuals who provided and received care. The spending plan provides funding to plan and implement EVV and assumes some reduced federal Medicaid funds for failure to comply with set deadlines.

Personal Care Services (Phase I). The spending plan provides $20.7 million ($6.1 million General Fund) for the Department of Social Services and the Office of Systems Integration (OSI) to implement EVV for personal care services, specifically In-Home Supportive Services (IHSS). The federal government granted the state a “good faith effort” time extension until January 1, 2021 for this implementation. Recent federal guidance, however, requires changes to the state’s EVV system to be compliant with federal requirements. Therefore, the state will need to make changes to its current approach and re-engage stakeholders. How costly or extensive these system changes will be is unknown, but the state will likely incur federal penalties of at least $14.8 million in 2020‑21 (not provided in the spending plan) for its failure to implement the first phase of EVV by January 1, 2021 in IHSS. The spending plan does, however, assume reduced federal funding of $10.8 million (and corresponding increased General Fund expenditures of $5.6 million) for other smaller programs and services that the administration anticipated would not meet the federal EVV deadline for personal care services.

Home Health Care Services (Phase II). The spending plan provides $6.6 million ($1 million General Fund) for the Department of Developmental Services, the California Department of Public Health, DHCS, and OSI to implement EVV for home health care services. The administration expects to begin development and implementation of the EVV system for home health care services by the end of March 2021, and anticipates implementing the system before the federal deadline of January 1, 2023.

California Department of Public Health

The spending plan includes $3.2 billion from all fund sources for the California Department of Public Health (CDPH) for 2020‑21, an 8.8 percent decline from revised 2019‑20 expenditures of $3.5 billion. The General Fund accounts for $214 million of CDPH’s 2020‑21 budget, down 39 percent from $349 million in 2019‑20. (The decline in General Fund spending is the result of previously appropriated one-time funds expiring, rather than new spending reductions.) Federal funds and reimbursements make up $1.9 billion of CDPH’s budget and special funds make up $1.1 billion.

CDPH at the Forefront of the State’s COVID-19 Response

Along with the Governor’s Office of Emergency Services and the California Health and Human Services Agency, CDPH has been a leading player in the state’s COVID-19 response. For example, CDPH assists the Governor in devising the overall state response and strategy, issues statewide public health orders, runs the state’s public health laboratory, helps lead the testing task force, collects and reports data, issues guidance and educational materials, and oversees residents’ safety issues in skilled nursing and other health facilities. It also administers funding from the federal Centers for Disease Control and Prevention (CDC) for state and local functions.

Spending Plan Includes Increased Funding for State Lab Capacity and Activities. The spending plan includes an increase of $5.9 million General Fund in 2020‑21, declining to $4.8 million General Fund in 2021‑22 and ongoing, to strengthen the state lab’s response to infectious diseases, including COVID-19 and foodborne disease outbreaks, among others. Funding will support three additional technical positions, emergency coordination and response, and the purchase of equipment and supplies.

Recent Activities Since Budget Enactment. CDPH recently received $499 million from the CDC, bringing total CDC funding to the state for the COVID-19 response to $604 million. Of the funding from this recent grant, $286 million is being provided to California’s 61 local health jurisdictions, while $213 million is being retained for state functions, including additional positions for the COVID-19 response, enhanced lab capacity, improved data and IT systems, and increased surveillance of COVID-19 in the population. CDPH also is party to a new state contract—for up to $1.7 billion—with diagnostics company PerkinElmer. The agreement involves opening a new lab in California to increase the number of diagnostic tests processed each day by 150,000 (which more than doubles the number currently processed each day). The administration anticipates recouping many of the contract costs from third-party payers, such as health insurance plans, as well as from Federal Emergency Management Agency (FEMA) reimbursements (FEMA shares eligible costs with the state, typically covering 75 percent while the state covers 25 percent).

Center for Health Care Quality (CHCQ)

The CHCQ includes the Licensing and Certification (L&C) Program, which is responsible for regulation and oversight of health facilities, such as general acute care hospitals and skilled nursing facilities (SNFs). CDPH licenses facilities, allowing them to operate in California under state statute, and certifies facilities on behalf of the federal government, allowing them to receive Medicare and Medicaid payments. While the spending plan scales down some of the proposals made in January in light of current budget constraints, it still incorporates the following augmentations and expansions. The spending plan:

- Increases L&C Staffing to Complete Mandated Workload. The spending plan includes $2.7 million (L&C Program Fund) and 20 positions in 2020‑21, $8.1 million and 60 positions in 2021‑22, and $16.2 million and 115.6 positions in 2022‑23 (and ongoing) to increase L&C program staffing. These positions are intended to help the L&C program improve responsiveness to complaints and reported incidents, as well as to clear out the backlog of investigations yet to be completed. Funding also will support more timely completion of regular licensing surveys.

- Facilitates Projects to Benefit Nursing Home Residents. In an enforcement action conducted on behalf of the federal government, CDPH cites a LTC facility, such as a SNF, when the facility is substantially out of compliance with federal rules. The associated monetary penalty paid by the facility is deposited into the Federal Health Facilities Citation Penalties Account. These funds can be used to establish temporary managers and receiverships at an out-of-compliance LTC facility or for relocation expenses to transition patients to a new facility. The funds also support projects proposed by external organizations to improve the quality of care at LTC facilities. The federal government must approve a given year’s proposed projects before CDPH can award funds. (CDPH provides contract management and oversight on behalf of the federal government.) The 2020‑21 spending plan provides authority for CDPH to award up to $6 million in each of 2020‑21, 2021‑22, and 2022‑23 for projects that have received federal approval.

Licensing Fees Increased to Cover L&C Costs, but at a Lower Rate Than Originally Proposed. L&C activities are paid for with federal funds and state licensing fees. After the COVID-19 public health emergency was declared, CDPH lowered the proposed fee increases for 2020‑21, capping fee increases—relative to 2019‑20—at 20 percent in Los Angeles County and at 15 percent for facilities elsewhere in the state.

Other Infectious Disease Control and Prevention

CDPH handles prevention and control of many communicable diseases, such as COVID-19, sexually transmitted diseases (STDs), HIV and AIDS, hepatitis C, and other disease outbreaks as necessary, such as hepatitis A, Zika virus, and salmonella.

Previous Allocations for Other Infectious Disease Prevention and Control Activities Made Permanent. The 2019‑20 spending plan included $15 million General Fund to prevent and control infectious diseases, specifically $5 million for each of the following: STDs, HIV, and hepatitis C. The funding was subject to potential suspension in December 2021 if General Fund revenues failed to meet a certain threshold. The 2020‑21 spending plan removes the potential suspension language and makes the $15 million in annual funding permanent.

Office of AIDS—AIDS Drug Assistance Program (ADAP) Enrollment System. The spending plan includes $4.8 million from the ADAP Rebate Fund for maintenance and operations of a recently developed in-house IT system that helps enroll clients in the ADAP program and manage their benefits, which includes HIV medications.

Lead Poisoning Prevention

CDPH runs the Childhood Lead Poisoning Prevention Program, which sets testing standards for blood-lead levels in children, provides case management services to families with a child who tested positive for lead poisoning to mitigate the conditions that led to this result, and monitors testing data. CDPH also runs the Lead-Related Construction (LRC) Program, which certifies individuals who inspect buildings for the presence of lead (and conduct lead abatement) and accredits lead hazard identification and abatement training providers.

Childhood Lead Poisoning Prevention Program Funding Made Permanent and Increased in Response to State Auditor’s Recommendations. The spending plan makes permanent $8.2 million in annual spending from the Childhood Lead Poisoning Prevention Fund for the Childhood Lead Poisoning Prevention Program. Of this amount, $6.8 million is for local health jurisdictions and $1.4 million is for state functions. The spending plan also provides an additional $2.1 million for local health jurisdictions in response to findings from the California State Auditor who found that an increasing number of children need intervention and that better enforcement of environmental regulations was needed at the local level.

LRC Program Funding Increased to Support Online Certification System and Other Activities. The spending plan includes $415,000 ongoing from the LRC Fund to support CDPH’s new online certification and payment system and other program activities. The augmentation is supported by an increase in the LRC certification fee (from $87 to $135) and new fees for the LRC exam ($70) and LRC course completion ($36).

Covered California

State Established New Individual Market Insurance Subsidies in 2019‑20. In 2019‑20, the Legislature enacted a new state subsidy program to supplement the federal subsidies already offered to most households that purchase health insurance coverage through Covered California. While households do not qualify for federal subsidies if their income is greater than 400 percent of the federal poverty level (FPL), they can receive state subsidies if their income is equal to or less than 600 percent of the FPL. For households with incomes less than 400 percent of the FPL, the new state subsidies build on the federal subsidies by further lowering the percentage of income households are required to spend on premiums.

State Also Established Individual Mandate and Associated Penalty. As originally enacted, the federal Affordable Care and Patient Protection Act imposed a requirement, referred to as the individual mandate, that most individuals obtain specified minimum health insurance coverage or pay a penalty. As part of the federal Tax Cuts and Jobs Act of 2017, Congress set the penalty for violating the individual mandate’s coverage requirement to zero beginning in 2019. The Legislature enacted a state individual mandate as part of its 2019‑20 spending plan, modeling it after the original federal mandate before the penalty was set to zero. Revenues from the state’s individual mandate penalty are deposited in the General Fund and are intended to cover the cost of the state subsidies.

Spending Plan Projects Lower Spending on Subsidies and Greater Revenue From Individual Mandate Penalty. The spending plan adjusts General Fund spending of Covered California downward by $164.2 million in 2019‑20 and by $90.3 million in 2020‑21 to reflect lower-than-projected enrollment in the state subsidy program. The spending plan also assumes that the uninsured rate will rise due to the economic slowdown associated with the COVID-19 pandemic. As a result, the state projects an increase of $15 million in General Fund revenues from uninsured individuals paying the state individual mandate penalty.