LAO Contacts

October 29, 2020

The 2020-21 Spending Plan:

Proposition 98 and K-12 Education

This post begins by covering the Proposition 98 minimum guarantee and overall Proposition 98 spending, then covers spending for K-12 education. The EdBudget part of our website contains dozens of tables providing more detail about the 2020‑21 education budget package.

Proposition 98

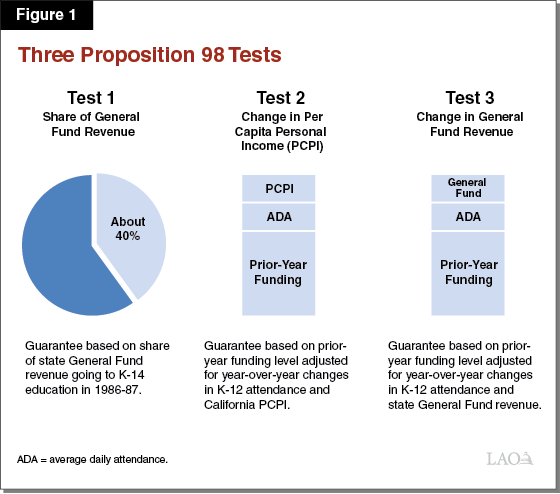

Proposition 98 Establishes Minimum Funding Level for Schools and Community Colleges. This minimum funding requirement is commonly called the minimum guarantee. The state calculates the minimum guarantee by comparing three main formulas or “tests” (Figure 1). Each test takes into account certain inputs, such as state General Fund revenue, per capita personal income, and K-12 student attendance. The state can choose to fund at the minimum guarantee or any level above it. It also can suspend the guarantee with a two-thirds vote of each house of the Legislature, allowing the state to provide less funding than the formulas require that year. The state meets the guarantee through a combination of state General Fund and local property tax revenue.

Minimum Funding Requirement Down Significantly in 2019‑20 and 2020‑21. As Figure 2 shows, estimates of the minimum guarantee under the June 2020 budget plan have dropped significantly compared with June 2019 estimates. For 2019‑20, the minimum requirement is down $3.4 billion (4.2 percent). For 2020‑21, the minimum requirement is down $6.8 billion (8.7 percent) from the revised 2019‑20 level and $10.2 billion (12.5 percent) from the 2019‑20 level estimated in June 2019. These drops mainly reflect reductions in state General Fund revenue. Test 1 remains operative in both years, with the drop in the General Fund portion of the guarantee equal to nearly 40 percent of the drop in revenues. The local property tax portion of the guarantee, by contrast, grows slowly from 2019‑20 to 2020‑21.

Figure 2

Comparing June 2019 and June 2020 Proposition 98 Estimates

(In Millions)

|

2019‑20 |

2020‑21 |

||||||

|

June 2019 (Enacted) |

June 2020 (Revised) |

Change |

June 2020 (Enacted) |

Change From 2019‑20 Revised |

Change From 2019‑20 Enacted |

||

|

Minimum Guarantee |

|||||||

|

General Fund |

$55,891 |

$52,656 |

‑$3,235 |

$45,066 |

‑$7,590 |

‑$10,825 |

|

|

Local property tax |

25,166 |

25,022 |

‑144 |

25,824 |

802 |

659 |

|

|

Totals |

$81,056 |

$77,678 |

‑$3,379 |

$70,890 |

‑$6,788 |

‑$10,166 |

|

|

Funding by Segment |

|||||||

|

K‑12 schools |

$71,243 |

$68,568 |

‑$2,675 |

$62,525 |

‑$6,043 |

‑$8,718 |

|

|

Community colleges |

9,437 |

9,109 |

‑327 |

8,365 |

‑745 |

‑1,072 |

|

|

Reserve deposit |

377 |

— |

‑377 |

— |

— |

‑377 |

|

Budget Plan Implements Significant Payment Deferrals. In both 2019‑20 and 2020‑21, the budget plan reduces school and community college funding to the lower minimum requirement. It implements these reductions primarily by deferring $12.5 billion in payments. (When the state defers payments from one fiscal year to the next, the state can reduce spending while allowing school districts to maintain programs by borrowing or using cash reserves.) Of the $12.5 billion, $11 billion applies to K-12 schools and $1.5 billion applies to community colleges. Although the budget plan authorized the Department of Finance to rescind up to $6.6 billion of the deferrals if the state received additional federal funding by October 15, 2020, Congress did not approve any additional funds prior to this deadline.

Makes a Few Other Spending Adjustments. In addition to the deferrals, the budget plan makes a few other adjustments to school and community college funding. Most notably, it does not provide the 2.31 percent statutory cost-of-living adjustment for school and community college programs in 2020‑21. The budget plan also uses $833 million in one-time funds to cover costs for the K-12 Local Control Funding Formula (LCFF) and community college apportionments in 2019‑20 and 2020‑21. These one-time funds consist of $426 million in unspent prior-year funds and a $407 million settle-up payment. In addition, the budget plan withdraws the entire $377 million the state deposited into the Proposition 98 Reserve in the fall of 2019. (Formulas in the State Constitution govern Proposition 98 Reserve deposits and withdrawals.) Finally, the budget plan obtains $240 million in savings ($110 million in 2019‑20 and $130 million in 2020‑21) from eliminating unallocated State Preschool slots.

Creates Supplemental Obligation to Increase Funding Beginning in 2021‑22. This obligation has two parts. First, it requires the state to make temporary payments on top of the Proposition 98 guarantee beginning in 2021‑22. Each payment will equal 1.5 percent of annual General Fund revenue. The state can allocate these payments for any school or community college purpose. Payments will continue until the state has paid $12.4 billion—the amount of funding schools and community colleges could have received under Proposition 98 if state revenues had continued to grow. (Technically, the obligation equals the total difference between the Test 1 and Test 2 funding levels in 2019‑20 and 2020‑21.) Second, the obligation requires the state to increase the minimum share of General Fund revenue allocated to schools and community colleges from 38 percent to 40 percent on an ongoing basis. This increase is set to phase in over the 2022‑23 and 2023‑24 fiscal years.

K-12 Education

Proposition 98 Funding Decreases 12 Percent. The budget package includes $62.5 billion in Proposition 98 funding for K-12 education in 2020‑21—$8.7 billion (12.2 percent) less than the 2019‑20 Budget Act level. Figure 3 describes the major changes.

Figure 3

Major Changes in K‑12 Education Proposition 98 Spending

Proposition 98 and Reappropriated Funds (In Millions)

|

Amount |

||

|

One‑Time Actions |

||

|

Payment deferrals |

Defers payments from the latter half of 2020‑21 to the first half of 2021‑22. |

‑$11,042 |

|

Learning loss mitigation |

Funds activities mitigating learning loss due to COVID‑19 school closures. (Budget also includes $4.8 billion one‑time federal funding for this purpose.) |

540 |

|

State Preschool |

Removes unspent 2019‑20 contract funds. |

‑110 |

|

Child Nutrition |

Provides up to $0.75 for each breakfast or lunch served between March and August 2020. (Budget also includes $112 million one‑time federal funding for this purpose.) |

80 |

|

Classified Summer Assistance program |

Allows classified employees to deposit a portion of their income earned into a fund that would be supplemented by state dollars and paid out in one or two installments during the summer months. |

60 |

|

Early literacy |

Provides $50 million in early literacy grants for the 75 schools with the lowest performance on third grade standardized tests and $3 million to establish an expert lead in literacy within the statewide system of support. |

53 |

|

Operating grants for two fiscally distressed districts |

Provides special grants to Inglewood Unified School District ($16 million) and Oakland Unified School District ($5.8 million) as set forth in Chapter 426 of 2018 (AB 1840, Committee on Budget). |

22 |

|

Refugee student services |

Provides grants to districts serving notable numbers of refugee students. |

15 |

|

Curriculum frameworks |

Funds one or more COEs to develop training and resources for implementation of the curriculum frameworks in health and history/social science. |

8 |

|

Other |

Includes funding for the SACS replacement project, dyslexia resources, the fourth and final operations grant for the Southern California Regional Occupational Center, and development of distance learning and curriculum guidance. |

12 |

|

Subtotal |

(‑$10,362) |

|

|

Ongoing Spending |

||

|

Special education |

Increases base special education funding for the lowest funded SELPAs to $625 per student. |

$545 |

|

State Preschool |

Makes ongoing reduction to account for unallocated contract funds. |

‑130 |

|

Low incidence funding |

Provides additional special education funding based on counts of students who have hearing, visual, and/or orthopedic impairments. |

100 |

|

Exploratorium |

Eliminates ongoing Proposition 98 funding for program. |

‑4 |

|

Other |

Consists of several minor technical adjustments. |

— |

|

Subtotal |

($512) |

|

|

Total Changes |

‑$9,850 |

|

|

COVID‑19 = coronavirus disease 2019; COEs = county offices of education; SACS = Standard Account Code Structure; and SELPAs = Special Education Local Plan Areas. |

||

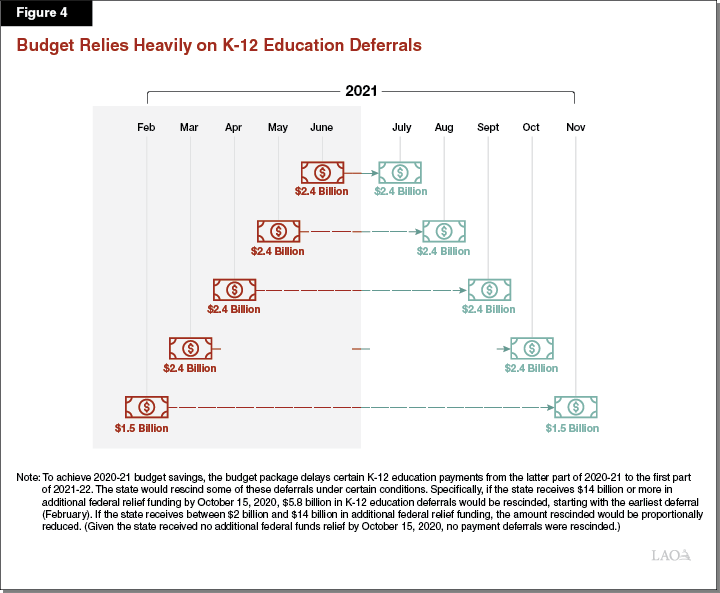

Defers $11 Billion in K-12 Payments, Allows Exemptions in Limited Circumstances. The state distributes funding for LCFF and special education following a monthly payment schedule established in law. The budget plan modifies this schedule in 2019‑20 to defer $1.9 billion in payments to the following fiscal year. In 2020‑21, the budget plan maintains these deferrals and adopts $9.1 billion in additional deferrals. Under the modified schedule (see Figure 4), portions of the payments otherwise scheduled for the months of February through June will be paid over the July through November period. The total amount deferred equates to about 16 percent of all state and local funding schools receive for LCFF and special education, or 24 percent of the General Fund allocated for these programs. If a district or charter school can demonstrate it would be unable to meet its financial obligations because of the deferrals, and has exhausted all other sources of internal and external borrowing, it can apply for an exemption. The law allows the Department of Finance, State Controller, and State Treasurer to authorize up to $300 million in deferral exemptions per month. If these exemption requests exceed the funding available, the earliest applications will be approved first.

Addresses Historically Low-Funded Special Education Regions. Most state special education funding is provided to Special Education Local Plan Areas (SELPAs) based on total student attendance within the area. (Most SELPAs are regional collaborations of neighboring districts, county offices of education [COEs], and charter schools, though some consist of only a single large district.) Each SELPA receives a unique per-student rate linked to certain historical factors. In 2019‑20, these per-student rates varied from $557 to more than $900. The budget provides $545 million to bring low-funded SELPAs to a new rate of $625 per student. This rate is roughly equivalent to the 93rd percentile of current rates.

Allocates $6.4 Billion in One-Time Federal Funding. As Figure 5 shows, the budget package allocates $6.4 billion in one-time federal Coronavirus Aid, Relief, and Economic Security (CARES) Act funding for K-12 education. The majority of funding ($4.8 billion) is provided for learning loss mitigation. The budget also includes $1.5 billion that can be used for a variety of activities and is distributed based on counts of low-income and disadvantaged children. The remaining funds are used to provide higher reimbursement rates for some school meals, create a competitive grant program for implementing the community schools model, and cover state costs of allocating and overseeing how CARES Act funds are spent.

Figure 5

One‑Time Federal CARES Act Funding for K‑12 Education

2020‑21 (In Millions)

|

Program |

Description |

Spending Deadline |

Amount |

|

Learning loss mitigation |

Funds activities to address student learning loss due to COVID‑19 school closures. |

December 30, 2020a |

$4,795b |

|

Grants to schools |

Provides funding for broad array of activities, including those related to COVID‑19. Funding distributed based on counts of low‑income and disadvantaged children. |

September 30, 2022 |

1,483 |

|

Child Nutrition |

Provides up to $0.75 for each breakfast or lunch served between March and August 2020. |

September 30, 2022 |

112c |

|

California Community Schools Partnership Program |

Provides competitive grants to coordinate or expand community schools. |

September 30, 2022 |

45 |

|

State operations |

Funds California Department of Education to allocate and monitor CARES Act funding. |

September 30, 2022 |

2 |

|

Total |

$6,436 |

||

|

aOf total amount, $4.4 billion must be spent by December 30, 2020. Remaining $355 million must be spent by September 30, 2022. bBudget also includes $540 million Proposition 98 to be spent by June 30, 2021 for this purpose. cBudget also includes $80 million Proposition 98 funding for this purpose. |

|||

|

CARES = Coronavirus Aid, Relief, and Economic Security and COVID‑19 = coronavirus disease 2019. |

|||

Funds Learning Loss Mitigation Activities. The budget package provides $5.3 billion in one-time funding for activities mitigating learning loss due to coronavirus disease 2019 (COVID-19) school closures. This amount consists of $4.4 billion from the federal Coronavirus Relief Fund, $540 million Proposition 98 General Fund, and $355 million from the federal Governor’s Emergency Education Relief Fund. Allocations from the Coronavirus Relief Fund can be used to cover eligible costs incurred between March 1, 2020 and December 30, 2020, while the remainder of the funding covers costs incurred between March 13, 2020 and September 30, 2022. Allowable activities include expanding learning supports, increasing instructional time, offering additional academic services (such as diagnostic assessments and devices and connectivity for distance learning), and addressing other barriers to learning (such as mental health services, professional development for teachers and parents, and student meals). Of this funding, $2.9 billion is to be allocated based on LCFF supplemental and concentration grants, $1.5 billion based on the number of students with disabilities, and $980 million based on total LCFF allocation.

Funds Schools Based on 2019‑20 Attendance Levels, Allows Growth Under Certain Conditions. For funding purposes, the state ordinarily credits school districts with their average daily attendance in the current or prior year, whichever is higher. Charter schools and COEs are funded according to their attendance in the current year only. In 2020‑21, however, the state will not collect average daily attendance data. Instead, districts, charter schools, and COEs will be funded according to their 2019‑20 attendance levels unless they had previously budgeted for attendance growth. Any attendance growth for a district or charter school is limited to the lower of its (1) previously projected increase in enrollment or attendance, as documented in its budget, or (2) actual increase in enrollment from October 2019 to October 2020. (For this calculation, enrollment numbers are converted to an equivalent amount of average daily attendance by adjusting them for the statewide average absence rate.) Charter schools providing most of their instruction outside of a traditional classroom setting (such as online charter schools) are ineligible for growth funding. The trailer legislation also allows a few other attendance-related adjustments. Most notably, if a charter school closes during the 2020‑21 school year, the attendance it previously generated will be credited to its sponsoring school district.

Modifies Instructional Requirements to Allow for Distance Learning. The budget package suspends requirements for annual instructional minutes for 2020‑21 to provide additional flexibility to schools and allows minimum instructional day requirements be met through a combination of in-person instruction and distance learning. The budget package also sets expectations for distance learning. Among other specified activities, distance learning must be substantially equivalent to in-person instruction; include daily live interaction between teachers and students; and provide appropriate supports to students with disabilities, English learners, and other student subgroups.

Requires Learning Continuity and Attendance Plans in 2020‑21. Existing law requires school districts, COEs, and charter schools to annually adopt a Local Control and Accountability Plan (LCAP) that sets goals in key state priority areas and specifies actions they will take to achieve these goals. On April 28, 2020, the Governor issued an executive order that shifted the 2020‑21 LCAP deadline from July 1, 2020 to December 15, 2020. However, budget trailer legislation eliminates the LCAP requirement for 2020‑21 and instead requires school districts, COEs, and charter schools to adopt a Learning Continuity and Attendance Plan by September 30, 2020. These plans must include descriptions of (1) actions that will be taken to provide continuity of learning and address the impact of COVID-19 on students, staff, and the community; (2) how state and federal funding is being used to support the actions specified; and (3) how services for students who are low income, English learners, and/or foster youth will be increased or improved. Trailer legislation also requires the Superintendent of Public Instruction, by August 1, 2020, to develop a template for local education agencies to use in adopting their Learning Continuity and Attendance Plan.

Prohibits Layoffs for Teachers and Certain Other Employees. State law generally prohibits districts from laying off certificated employees (including teachers, administrators, and counselors) unless the affected employees received preliminary notice on or before March 15 of the preceding school year. An exception to this law allows districts to initiate layoffs between the adoption of the state budget and August 15 if their per-pupil funding does not increase at least 2 percent over the previous year. For 2020‑21, the budget plan eliminates the August layoff window for all certificated employees except those in administrative positions (such as school principals and vice principals). Regarding classified employees (including instructional aides, clerical staff, custodians, and other non-certificated employees), the law ordinarily allows districts to initiate layoffs at any time, provided the affected employees receive at least 60 days’ notice. For 2020‑21, the budget plan prohibits districts from laying off classified employees who work in nutrition, transportation, or custodial services. It also encourages districts to avoid laying off employees who work in other areas.

Includes Additional Fiscal Flexibility in a Few Areas. Budget trailer legislation includes several changes to provide more spending flexibility for school districts:

For the purposes of calculating minimum routine maintenance deposits, excludes one-time funding for state pension payments on behalf of school districts, learning loss mitigation funds, and federal Elementary and Secondary School Emergency Relief funds. Typically, school districts receiving funding from the state’s School Facility Program are required to establish a restricted account for routine maintenance of school facilities and deposit 3 percent of the district’s annual expenditures.

Allows for proceeds from the sale or lease of surplus property purchased entirely with local funds to be used for one-time general fund purposes through 2023‑24.

For the purpose of spending restricted lottery revenues, permanently expands the definition of instructional materials to also include laptop computers and devices that provide internet access. Schools and community colleges receive about $450 million in lottery revenues annually that must be spent on instructional materials.

Allows the California Department of Education (CDE) to waive several programmatic requirements for the After School Education and Safety program.

Repurposes Prior Pension Payment to Reduce District Costs Over the Next Two Years. School district pension costs have been rising relatively quickly over the past several years. To help mitigate future cost increases, the 2019‑20 budget plan included $2.3 billion non-Proposition 98 General Fund to make a supplemental pension payment on behalf of schools and community colleges. Of this amount, $1.6 billion was for the California State Teachers’ Retirement System and $660 million was for the California Public Employees’ Retirement System. (Nearly all school employees are covered by one of these two pension systems.) At the time, the state estimated that the supplemental payment could reduce district pension costs by roughly 0.3 percent of annual pay over the next few decades. The 2020‑21 budget plan repurposes this payment to reduce pension costs by a larger amount over the next two years. Specifically, districts will receive cost savings of approximately 2.2 percent of pay in 2020‑21 and 2021‑22, but will not experience savings over the following decades. We provide further information on budget actions affecting the state’s pension systems in our Pensions post.

Supports New and Ongoing CDE Workload. The budget provides CDE with 9.5 additional positions and an associated $3.6 million augmentation for accommodating new workload. Of that amount, $2.2 million is one time and $1.4 million is ongoing. The most notable one-time workload is related to allocating and monitoring federal CARES Act funding. The new ongoing workload includes tracking implementation of changes for charter school petitions and renewals, as well as supporting new workload related to deferrals and attendance changes. A list of all new K-12 workload for the department is on our EdBudget website.