October 27, 2021

The 2021-22 Budget

Overview of the Spending Plan (Final Version)

Each year, our office publishes the California Spending Plan to summarize the annual state budget. This publication provides an overview of the 2021‑22 Budget Act, then highlights major features of the budget approved by the Legislature and signed by the Governor. All figures in this publication reflect actions taken through July 15, 2021, but we have updated the narrative to reflect actions taken later in the legislative session. In addition to this report, we have released a series of issue‑specific, online posts that give more detail on the major actions in the budget package.

Budget Overview

General Fund Condition

Figure 1 summarizes the condition of the General Fund under the revenue and spending assumptions in the July 2021 budget package, as estimated by the administration.

Figure 1

General Fund Condition Summary

(In Millions)

|

Revised |

Enacted |

||

|

2019‑20 |

2020‑21 |

||

|

Prior‑year fund balance |

$11,442 |

$5,556 |

$28,248 |

|

Revenues and transfers |

140,400 |

188,775 |

175,345 |

|

Expenditures |

146,285 |

166,083 |

196,440 |

|

Ending fund balance |

$5,556 |

$28,248 |

$7,153 |

|

Encumbrances |

$3,175 |

$3,175 |

$3,175 |

|

SFEU balance |

2,381 |

25,073 |

3,978 |

|

Reserves |

|||

|

BSA |

$17,350 |

$12,339 |

$15,781 |

|

SFEU |

2,381 |

25,073 |

3,978 |

|

Safety net |

900 |

450 |

900 |

|

Total Reserves |

$20,631 |

$37,862 |

$20,659 |

|

Note: Reflects administration estimates of budget actions taken through July 15, 2021. |

|||

|

SFEU = Special Fund for Economic Uncertainties and BSA = Budget Stabilization Account. |

|||

Total General Fund Reserves Reach $20.7 Billion Under Spending Plan. As shown in Figure 1, the budget package assumes that 2021‑22 will end with nearly $21 billion in total reserves. This consists of: (1) $15.8 billion in the Budget Stabilization Account (BSA), (2) $4 billion in Special Fund for Economic Uncertainties, and (3) $900 million in the Safety Net Reserve, which is available for spending on the state’s safety net programs, like Medi‑Cal. In addition, the Proposition 98 Reserve (dedicated to school and community college spending) would reach $4.5 billion under the spending plan. (We do not include this reserve in the total because withdrawals supplement the constitutional minimum spending level for K‑14 education and therefore do not help the state address future budget problems. However, this reserve does benefit schools because it mitigates the funding reductions that occur when the constitutional minimum drops.)

State Revenues Not Expected to Exceed Appropriations Limit. The State Appropriations Limit (SAL) limits how the state can use revenues that exceed a specific threshold. While the Governor’s May Revision reflected revenue estimates that exceeded the SAL by roughly $16 billion, the July budget package reflects different choices, which result in revenues remaining below the limit. The nearby box describes budgetary actions related to the SAL.

The State Appropriations Limit (SAL)

Proposition 4 (1979) established an appropriations limit on the state and most types of local governments. Under these constitutional requirements, each year the state must compare the appropriations limit to appropriations subject to the limit. If appropriations subject to the limit are less than the limit, there is “room” under the limit. If appropriations subject to the limit exceed the limit (on net) over any two‑year period, there are excess revenues. The Legislature can use excess revenues in three ways: (1) appropriate more money for purposes excluded from the SAL, (2) split the excess between additional school and community college district spending and taxpayer rebates, or (3) lower tax revenues. For more information on the SAL, please see our recent report: The State Appropriations Limit.

Budget Allocates Significant Resources Toward Excludable Purposes. The state includes two major discretionary spending amounts that are excluded from the SAL. First, the July budget package includes $18 billion ($16.4 billion General Fund) in “qualified” capital outlay expenditures, which is spending that meets the statutory definition of capital outlay for exclusion under the SAL. Second, trailer bill language clarifies that the $8.1 billion in Golden State Stimulus payments are related to the state of emergency as a result of coronavirus disease 2019 and are therefore exempt from the SAL.

Budget Includes Other Technical Adjustments to the SAL. In addition, the budget package reflects two other more significant adjustments to the SAL, which both increase room under the limit. First, trailer bill legislation reflects the intent of the Legislature to count realignment revenues to local governments as subventions in accordance with the changes in the state‑local fiscal relationship that have occurred since 1980. This results in an additional $12.2 billion in room in 2021‑22. Second, the budget includes trailer bill language that recognizes room under the limits of school and community colleges at the state level. This results in an additional $4.3 billion in room in 2021‑22.

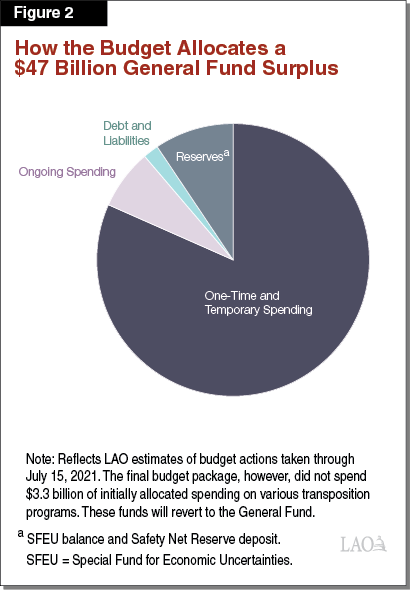

Budget Commits a $47 Billion General Fund Surplus. A surplus occurs when, over the three‑year budget window, the state collects more in General Fund revenues than it requires to meet its existing obligations. We estimate the Legislature had a $47 billion surplus to allocate in the 2021‑22 Budget Act. This surplus reflects significantly higher revenues than were estimated at the time of the 2020‑21 Budget Act. It is also larger than the surplus included in the Governor’s May Revision. The key reason for this is that the budget package uses $8.9 billion in American Rescue Plan (ARP) fiscal relief funds to offset General Fund revenue losses that have occurred, relative to the pre‑pandemic trajectory, due to the coronavirus disease 2019 (COVID‑19) public health emergency. (The initial estimate was $9.2 billion, but the figure was updated to reflect budgetary estimates made by the Department of Finance [DOF].) This lowers General Fund costs by that amount. Figure 2 describes the allocation of the $47 billion General Fund surplus as of July 2021. In particular, the spending plan dedicates the vast majority—nearly $39 billion—to one‑time or temporary program augmentations. The budget also uses $3.4 billion of the total for new, ongoing program spending. The full implementation cost of these ongoing commitments is $12.4 billion by 2025‑26.

Revenues

Figure 3 displays the administration’s revenue projections as incorporated into the July 2021 budget package. Revenues for 2020‑21 reached historic highs. Between 2019‑20 and 2020‑21, revenues are estimated to have increased 25 percent, the largest single year increase in over four decades. The budget package assumes General Fund revenues and transfers will be $175 billion in 2021‑22, which represents a decline of 7 percent over the historic 2020‑21 level. This decline is due to a variety of factors, including: the nearly $8 billion withdrawal from the BSA in 2020‑21 and the administration’s expectation that collections from the personal income tax and corporation tax will decline somewhat. In addition, federal reimbursements for state disaster spending, including on COVID‑19, are scored as revenues (accounted for in “other revenues”).

Figure 3

General Fund Revenue Estimates

(Dollars in Millions)

|

Revised |

Enacted |

Change From 2020‑21 |

|||

|

2019‑20 |

2020‑21 |

Amount |

Percent |

||

|

Personal income tax |

$99,599 |

$125,151 |

$123,298 |

‑$1,853 |

‑1% |

|

Sales and use tax |

25,509 |

27,936 |

28,986 |

1,050 |

4 |

|

Corporation tax |

13,954 |

20,720 |

18,106 |

‑2,615 |

‑13 |

|

Totals, Major Revenue Sources |

$139,061 |

$173,807 |

$170,390 |

‑$3,417 |

‑2% |

|

Insurance tax |

$3,135 |

$3,348 |

$3,428 |

$80 |

2% |

|

Other revenues |

2,886 |

3,786 |

7,798 |

4,012 |

106 |

|

Transfer to/from BSA |

‑3,345 |

5,011 |

‑3,442 |

‑8,453 |

‑169 |

|

Other transfers and loans |

‑1,337 |

2,822 |

‑2,829 |

‑5,651 |

‑200 |

|

Totals, Revenues and Transfers |

$140,400 |

$188,775 |

$175,345 |

‑$13,430 |

‑7% |

|

Note: Reflects administration estimates of budget actions taken through July 15, 2021. |

|||||

|

BSA = Budget Stabilization Account. |

|||||

Revenue‑Related Policy Changes. The revenue estimates in Figure 3 reflect some policy changes. Most notably, legislation included in the budget package created a new option for owners of certain businesses to restructure their taxes in a way that reduces their federal income taxes. While this change allows business owners to achieve a net reduction in their combined federal and state income taxes, some owners would pay somewhat higher state taxes. As a result, the administration estimates this change will increase General Fund revenues by $1.3 billion in 2021‑22, with lower gains in the out years. These revenue increases were offset slightly by some smaller revenue reductions, such as the main street tax credit.

Spending

Figure 4 displays the administration’s July 2021 estimates of total state and federal spending in the 2021‑22 budget package. As the figure shows, the spending plan assumes total state spending of $258 billion in 2021‑22, an increase of nearly $30 billion from the revised 2020‑21 level. This increase reflects the General Fund spending associated with the significant surplus in 2021‑22.

Figure 4

Total State and Federal Fund Expenditures

(Dollars in Millions)

|

Revised |

Enacted |

Change From 2020‑21 |

|||

|

2019‑20 |

2020‑21 |

Amount |

Percent |

||

|

General Fund |

$146,285 |

$166,083 |

$196,440 |

$30,358 |

18% |

|

Special funds |

55,086 |

61,692 |

61,216 |

‑476 |

‑1 |

|

Budget Totals |

$201,372 |

$227,774 |

$257,657 |

$29,882 |

13% |

|

Bond funds |

$6,718 |

$7,855 |

$4,932 |

‑$2,923 |

‑37% |

|

Federal funds |

148,996 |

277,220 |

192,984 |

‑84,236 |

‑30 |

|

Note: Reflects administration estimates of budget actions taken through July 15, 2021. |

|||||

Federal funds are expected to decline substantially between 2020‑21 and 2021‑22, from $277 billion to $193 billion. This is due to the significant federal funds the state has received from federally enhanced unemployment insurance (UI) benefits, which are accounted for in the state budget in the Employment Development Department (EDD). Under the administration’s assumptions, federal spending in EDD will reach $140 billion in 2020‑21 and will decline to $34 billion in 2021‑22.

In addition to funds for UI, the state has received significant federal funds through several pieces of federal legislation, most notably the ARP. For example, in addition to programmatic and public health funding, the ARP included $27 billion in fiscal relief funds for the state, which the state has mostly budgeted in 2021‑22. We describe the state’s allocation of the ARP fiscal relief funds in more detail below.

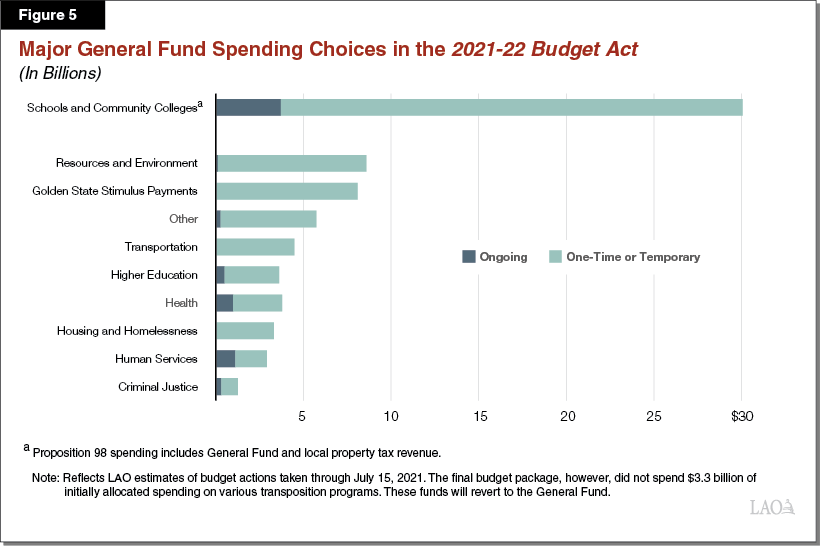

Budget Package Includes $72 Billion in Discretionary General Fund Spending Choices. The major spending choices in the budget package fall across ten key programmatic areas. First, the spending plan allocates about $30 billion in discretionary spending choices within the Proposition 98 minimum funding level for schools and community colleges. Second, the July spending plan allocated $42 billion of the total General Fund surplus to a range of different program areas, as shown in Figure 5. We also provide more program‑level information in the Appendix. (The Appendix only is available for the online version of this report.)

Budget Commits $30 Billion in Discretionary Proposition 98 Funds. The State Constitution sets a minimum annual funding requirement for schools and community colleges. Of the total Proposition 98 guarantee, the budget package includes about $30 billion in spending proposals to provide the constitutionally required funding increases to schools and community colleges. Of this total, about $26 billion is one time, with the largest allocation being $12.5 billion to pay down the deferrals the state adopted as part of the June 2020 budget plan. The remaining $4 billion is ongoing, with almost two‑thirds of the funds allocated to provide academic support and expanded learning time for disadvantaged students.

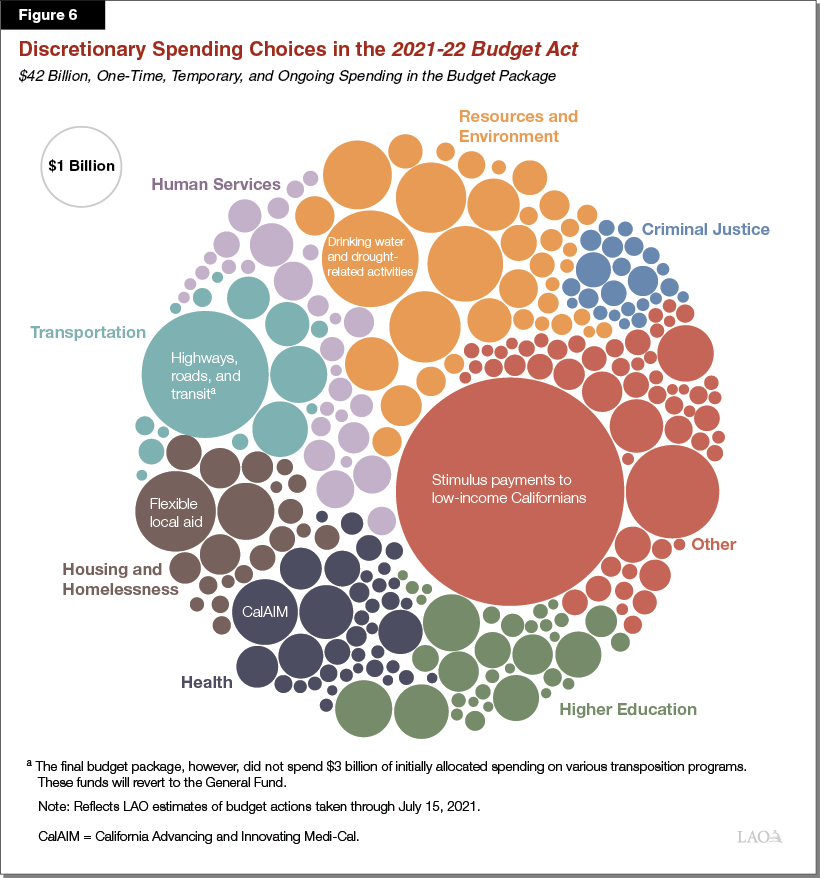

Initial Budget Committed $42 Billion in Other Discretionary General Fund Choices. The budget includes hundreds of spending choices across a range of policy areas, as shown in Figure 6. Some of the major spending decisions include $8.1 billion in stimulus payments to low‑income Californians (the second round of Golden State Stimulus); $1.5 billion for drinking water and drought‑related activities; $1 billion for flexible aid to local governments for homelessness; and nearly $890 million for clean vehicle incentive programs. While the initial budget package allocated $3.3 billion for a variety of transportation programs, including for transit and active transportation, this funding was contingent on subsequent legislation, which was not passed. As a result, these funds will revert to the General Fund.

Budget Also Commits $27 Billion in ARP Fiscal Relief Funds. The ARP included $350 billion in flexible funding to state and local governments for fiscal recovery in the Coronavirus State Fiscal Recovery Fund. Of this total, California’s state government received about $27 billion. The state has until December 31, 2024 to use the funds for any of the following purposes: (1) to respond to the public health emergency or negative economic impacts associated with the emergency; (2) to support essential work; (3) to backfill a reduction in total revenues that have occurred relative to the pre‑pandemic trajectory; or (4) for water, sewer, or broadband infrastructure. Figure 7 shows how the budget package allocates these funds. In addition to the $27 billion described in Figure 7, California received $550 million in Coronavirus Capital Projects Fund from the ARP, which also is available to the state on a more flexible basis. The budget package allocated these funds to broadband infrastructure.

Figure 7

How the Budget Package Allocates $27 Billion in

ARP Fiscal Relief Funds

(In Millions)

|

Amount |

|

|

Replace Lost State Revenue |

$9,196 |

|

Address Increased Homelessness and Housing Shortages |

4,876 |

|

Broadband Infrastructure, Access, and Affordability |

3,772 |

|

Relief for Unpaid Energy Utility Bills and Arrearages |

2,000 |

|

Child Savings Accounts |

1,778 |

|

Small Business Grants |

1,500 |

|

COVID‑19 Response Costs |

725 |

|

Community Economic Resilience |

600 |

|

Behavioral Health Continuum Infrastructure Program |

530 |

|

Training and Education Support for Displaced Workers |

473 |

|

Community Care Expansion |

450 |

|

Economic Support for Ports |

250 |

|

Emergency Financial Aid for Community College Students |

250 |

|

Youth Workforce Development |

185 |

|

CaliforniansForAll College Service Program |

128 |

|

Mental Health Student Services Partnership Grant Program |

100 |

|

Revitalization of California Tourism |

95 |

|

Legal Aid for Renters |

80 |

|

Reserve for Accountability and Oversight |

19 |

|

Federal Tracking, Accountability, and Cost Recoverya |

11 |

|

Total |

$27,017 |

|

aExpenditures planned over four‑year period. |

|

|

ARP = American Rescue Plan and COVID‑19 = coronavirus disease 2019. |

|

Additional Medicaid‑Related Federal Funds. The ARP also included a temporary enhanced federal match rate for home‑ and community‑based services (HCBS) funded through the Medicaid program. Specifically, the ARP allows the state to draw down an additional $3 billion in Medicaid HCBS funds, which the state must spend on new HCBS service expansions or enhancements, but ultimately will offset new General Fund costs. In addition, by spending these funds, the state would draw down an additional $1.6 billion in federal Medicaid funds. Figure 8 summarizes the budget’s approach for these funds, which includes over 25 HCBS service expansions and enhancements that must still be approved by the federal government.

Figure 8

LAO Summary of HCBS Spending Plan Proposalsa

(In Millions)

|

Description |

HCBS ARP |

Federal |

Total |

|

New HCBS services |

$966.4 |

$974.0 |

$1,940.4 |

|

Existing HCBS service expansions and enhancements |

850.9 |

484.8 |

1335.7 |

|

Workforce trainings and one‑time provider payment increases |

663.7 |

143.6 |

807.3 |

|

HCBS infrastructure improvements |

448.3 |

1.5 |

449.8 |

|

HCBS assessment and navigation improvements |

97.5 |

18.3 |

115.8 |

|

Totals |

$3,026.8 |

$1,622.2 |

$4,649.0 |

|

aReflects different categorization of HCBS spending plan proposals relative to administration’s categorization. bReflects costs that are expected to be covered by federal funding for home‑ and community‑based service (HCBS) expansions and enhancements made available by the American Rescue Plan (ARP) Act of 2021. |

|||

Evolution of the Budget

Governor’s January Budget Proposal

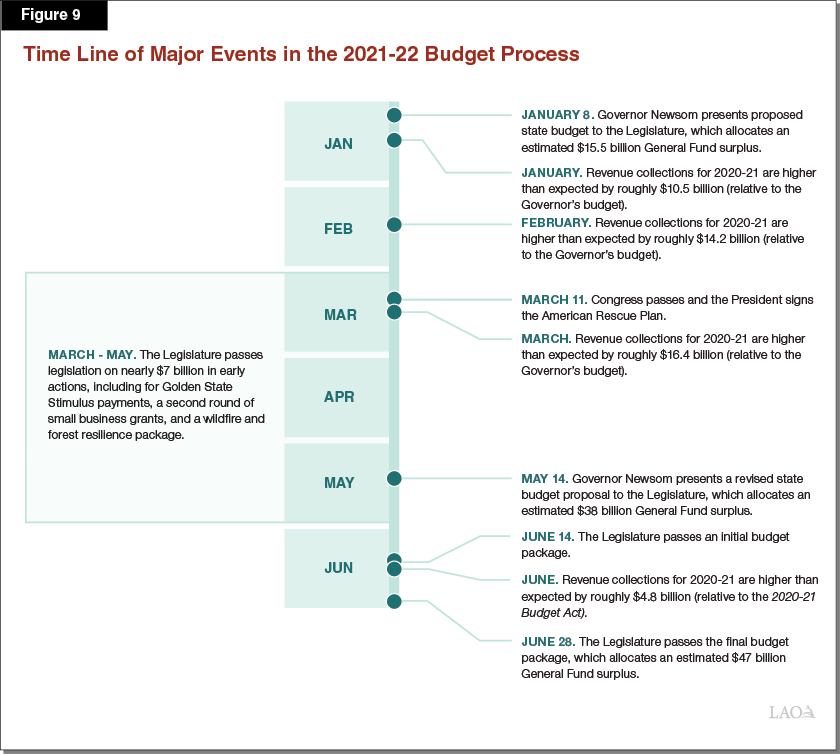

On January 8, 2021, Governor Newsom presented his state budget proposal to the Legislature, marking the formal beginning of the 2021‑22 budget process (see Figure 9).

January Budget Proposal Reflected a $15.5 Billion Surplus. At the time of the January Governor’s budget, and under the administration’s revenue estimates, we estimated the Governor had a $15.5 billion surplus to allocate in the 2021‑22 budget process. This surplus was nearly entirely the result of higher revenue collections and estimates relative to 2020 budget projections.

Governor Allocated Half of the Surplus Toward One‑Time and Temporary Programmatic Spending. In the January budget, Governor proposed allocating about half of the surplus ($8.1 billion) to one‑time or temporary programmatic spending, focused particularly on housing and homelessness and resources and the environment. The Governor’s budget also included about $2.5 billion on discretionary COVID‑19‑related spending, for example, for assistance for businesses. (At the time, the federal government was considering, but had not yet passed, the ARP.) In addition, the Governor proposed the Legislature take immediate or early action on $12.8 billion in spending increases or revenue reductions.

Early Actions

The Legislature took early action on nearly $6.8 billion in programmatic spending and revenue reductions during the 2021‑22 budget process. Figure 10 summarizes those actions. Most notably, they include:

- $3.8 billion in Golden State Stimulus payments, the first round of state direct payments to lower‑income taxpayers. Of this total, $2.3 billion was directed to taxpayers with adjusted gross income (AGI) of less than $30,000 and $500 million benefited undocumented taxpayers with AGIs less than $75,000 and who file using an Individual Taxpayer Identification Number. The package also included nearly $1 billion in additional one‑time payments for California Work Opportunity and Responsibility to Kids (CalWORKs) and Supplemental Security Income/State Supplementary Payment (SSI/SSP) recipients.

- Just over $2 billion for a second round of small business grants and $50 million in grants to nonprofit cultural institutions. (A first round of grants was provided through executive action.)

- $536 million ($411 million General Fund) for a wildfire and forest resilience package.

Figure 10

Early General Fund Actions in the 2021‑22 Budget Process

(In Millions)

|

Income Assistance |

Golden State Stimulus paymentsa |

$3,786 |

|

Business Assistance |

Small business and cultural institution grants |

2,075 |

|

Resources and Environment |

Wildfire and forest resilience package |

411 |

|

Human Services |

Exempt pandemic UI from CalWORKs income eligibility |

242 |

|

Other |

License renewal fee waivers (ABC and BBC) |

119 |

|

Other |

Other, various |

93 |

|

Human Services |

Child welfare, various |

42 |

|

Total |

$6,767 |

|

|

aIncludes direct payments to families, as well additional payments to CalWORKs and SSI/SSP recipients. |

||

|

UI = unemployment insurance; CalWORKs = California Work Opportunity and Responsibility to Kids; ABC = Alcoholic Beverage Control; and BBC = Board of Barbering and Cosmetology. |

||

Governor’s May Revision

On May 14, 2021, Governor Newsom presented a revised state budget proposal to the Legislature. (This annual proposed revised budget is called the “May Revision.”)

Governor’s May Revision Reflected a $38 Billion Surplus. At the time of the May Revision, and under the administration’s revenue estimates, we estimated the Governor had a $38 billion surplus to allocate. This surplus figure was the result of three major factors. First, excluding policy choices and reflecting very strong cash collections in the early months of 2021, revenues were higher by $51 billion. Second, constitutionally required spending, most notably for schools and community colleges, was higher by $16 billion. Third, other major adjustments, such as lower safety net spending and the costs of the early action package, reduced costs by $3 billion.

May Revision Included Total of $85 Billion in Major Budgetary Choices. In addition to the surplus described above, the Governor had to make choices about how to allocate an additional $23 billion in spending on schools and community colleges and $27 billion in ARP fiscal relief funds, which the ARP allocated to the state a couple of months before the May Revision was released. The Governor proposed spending these funds across a wide array of programmatic areas, including for program expansions and new programs.

The SAL Became an Important Issue in the May Revision. Although the Governor’s budget estimated the state would collect a small amount ($529 million) of revenues in excess of the SAL, due to significantly higher revenue estimates, the May Revision estimated the state would collect $16.2 billion in excess of the SAL. For the tax rebate portion, the Governor proposed allocating half of the total ($8.1 billion) to taxpayers in the form of a second round of Golden State Stimulus payments. For the school payment portion, the Governor proposed allocating the payments in a future year, as allowed under the constitution.

Legislature’s Budget Package

Initial Budget Package Passed on June 14, 2021. The Legislature passed an initial budget package on June 14, 2021. This package made two major modifications to the structure of the May Revision, which gave the Legislature additional resources to allocate. First, it used LAO revenue estimates from April 2021, modified for recent cash collections, rather than the administration’s estimates. Second, it used some funding from the ARP (both fiscal relief funds and funding for HCBS) to offset General Fund costs. The Legislature’s budget package also made different choices that meant that state revenues did not exceed the SAL. These choices included: (1) scoring the Golden State Stimulus II payments as revenue reductions, rather than spending; (2) reallocating some capital outlay from federal funds to General Fund spending; and (3) proposing changes to the how realignment revenues are treated under the SAL.

Major Budget Choices in the Legislature’s Package. With the additional resources described above, the legislative package made a number of programmatic augmentations above those included in the May Revision. For example, the package provided additional funding for: (1) drought, wildfire, and other climate‑related purposes; (2) homelessness services at the local level over multiple fiscal years; (3) phasing‑in the implementation of the developmental services rate study, (4) public health infrastructure, (5) lowering the age eligibility for the Medi‑Cal expansion; and (6) substantially larger augmentations for student financial aid programs. The Legislature’s budget package also took some additional actions related to reserves and borrowing, including making an additional deposit into the state’s Safety Net Reserve, paying off all the remaining outstanding school and community‑college deferrals, and setting aside funds to prepay bond debt service.

Final Budget Package

Legislature Passed a Final Budget Package on June 28, 2021. The final budget package largely reflected the Legislature’s approach on SAL‑related choices (see box above for more information on the SAL in the final 2021‑22 budget package) and choices to use funding from the ARP to offset General Fund costs. The subsequent section describes the major features of the final budget package and Figure 11 lists the budget and budget‑related legislation passed as of July 15, 2021 and Figure 12 includes budget‑related legislation passed later in the legislative session.

Figure 11

Budget‑Related Legislation

Passed on or Before July 15, 2021

|

Bill Number |

Chapter |

Subject |

|||

|

Budget Bills and Amendments |

|||||

|

AB 128 |

21 |

2021‑22 Budget Act |

|||

|

AB 85 |

4 |

Amendments to 2020‑21 Budget Act |

|||

|

SB 85 |

14 |

Amendments to 2020‑21 Budget Act |

|||

|

SB 89 |

1 |

Amendments to 2020‑21 Budget Act |

|||

|

SB 147 |

40 |

Amendments to 2020‑21 Budget Act |

|||

|

SB 129 |

69 |

Amendments to 2021‑22 Budget Act |

|||

|

AB 161 |

43 |

Amendments to 2021‑22 Budget Act |

|||

|

AB 164 |

84 |

Amendments to 2021‑22 Budget Act |

|||

|

Early Action Bills |

|||||

|

AB 81 |

5 |

Coronavirus disease 2019 (COVID‑19) relief |

|||

|

AB 82 |

6 |

COVID‑19 pandemic childcare |

|||

|

AB 86 |

10 |

School reopening and reporting |

|||

|

SB 86 |

15 |

Public social services |

|||

|

SB 92 |

18 |

Juvenile Justice Realignment |

|||

|

SB 93 |

16 |

Rehiring and retention in employment |

|||

|

AB 83 |

11 |

License renewal fees |

|||

|

AB 88 |

12 |

Golden State Stimulus |

|||

|

SB 87 |

7 |

COVID‑19 small business grants |

|||

|

SB 88 |

8 |

Golden State Stimulus |

|||

|

SB 91 |

2 |

Rental assistance |

|||

|

SB 94 |

9 |

License renewal fees |

|||

|

SB 95 |

13 |

COVID‑19 supplemental paid sick leave |

|||

|

Trailer Bills Passed on or Before July 15, 2021 |

|||||

|

AB 130 |

44 |

Education finance |

|||

|

AB 131 |

116 |

Child development |

|||

|

AB 132 |

144 |

Higher eduction |

|||

|

AB 133 |

143 |

Health |

|||

|

AB 134 |

75 |

Mental Health Services Act |

|||

|

AB 135 |

85 |

Human services |

|||

|

AB 136 |

76 |

Developmental Services |

|||

|

AB 137 |

77 |

State government |

|||

|

AB 138 |

78 |

Unemployment insurance |

|||

|

AB 140 |

111 |

Housing |

|||

|

AB 141 |

70 |

Cannabis licensure |

|||

|

AB 143 |

79 |

Courts |

|||

|

AB 145 |

80 |

Public Safety |

|||

|

AB 148 |

115 |

Public resources |

|||

|

AB 149 |

81 |

Transportation |

|||

|

AB 150 |

82 |

Taxes |

|||

|

AB 153 |

86 |

Social services |

|||

|

SB 139 |

71 |

Golden State Stimulus II |

|||

|

SB 142 |

39 |

State employee bargaining agreements |

|||

|

SB 146 |

72 |

Correctional facilities |

|||

|

SB 151 |

74 |

Economic development |

|||

|

SB 152 |

34 |

Elections |

|||

|

SB 156 |

112 |

Broadband |

|||

|

SB 157 |

83 |

Crime enforcement and training programs |

|||

|

SB 158 |

73 |

Hazardous waste |

|||

|

SB 159 |

42 |

State employee compensation: Bargaining Unit 6 |

|||

|

SB 160 |

87 |

Cannabis licensure |

|||

|

Note: This figure includes budget bills and trailer bills identified in Section 39.00 of the 2020‑21 Budget Act that were enacted into law. Ordered by bill number. |

|||||

Figure 12

Budget‑Related Legislation

Passed After July 15, 2021

|

Bill Number |

Chapter |

Subject |

|

Budget Bills and Amendments |

||

|

SB 170 |

240 |

Amendments to 2021‑22 Budget Act |

|

Trailer Bills Passed After July 15, 2021 |

||

|

AB 163 |

251 |

State government |

|

AB 167 |

252 |

Education finance |

|

AB 172 |

696 |

Human services |

|

AB 173 |

253 |

Public safety |

|

AB 174 |

254 |

Vehicles |

|

AB 175 |

255 |

Housing |

|

AB 176 |

256 |

Small business grants |

|

AB 177 |

257 |

Public safety |

|

SB 155 |

258 |

Public resources |

|

SB 162 |

259 |

Community Economic Resilience Fund Program |

|

SB 165 |

279 |

State employee bargaining agreements |

|

SB 166 |

260 |

License fee waivers and deferrals |

|

SB 168 |

261 |

Childcare |

|

SB 169 |

262 |

Higher education |

|

SB 171 |

263 |

Health |

|

Note: This figure includes budget bills and trailer bills identified in Section 39.00 of the 2020‑21 Budget Act that were enacted into law. Ordered by bill number. |

||

Major Features of the 2021‑22 Spending Plan

The major General Fund and federal fund spending actions in the 2021‑22 budget package are briefly described in this section, organized around the issue areas shown in Figure 5 in the first section of this report. We plan to discuss these and other actions in more detail in a series of forthcoming publications this fall.

K‑14 Education

Significant Increase in School and Community College Funding. Proposition 98 (1988) established the minimum annual funding level for schools and community colleges. This funding requirement depends upon various formulas that adjust for several factors, including changes in state General Fund revenue. For 2020‑21, the minimum requirement is up $22.5 billion (31.8 percent) compared with the estimates made in June 2020 (Figure 13). This increase represents the largest upward revision since the passage of Proposition 98 and is due to higher General Fund revenue estimates. For 2021‑22, the minimum requirement increases by an additional $309 million (0.3 percent) relative to the revised 2020‑21 level.

Figure 13

Comparing June 2020 and June 2021 Proposition 98 Estimates

(In Millions)

|

2020‑21 |

2021‑22 |

||||||

|

June 2020 (Enacted) |

June 2021 (Revised) |

Change |

June 2021 (Enacted) |

Change From 2020‑21 Revised |

Change From 2020‑21 Enacted |

||

|

Minimum Guarantee |

|||||||

|

General Fund |

$45,066 |

$67,685 |

$22,619 |

$66,374 |

‑$1,310 |

$21,309 |

|

|

Local property tax |

25,824 |

25,745 |

‑79 |

27,365 |

1,620 |

1,540 |

|

|

Totals |

$70,890 |

$93,430 |

$22,539 |

$93,739 |

$309 |

$22,849 |

|

|

Funding by Segment |

|||||||

|

K‑12 schools |

$62,525 |

$80,918 |

$18,393 |

$80,523 |

‑$395 |

$17,998 |

|

|

Community colleges |

8,365 |

10,622 |

2,258 |

10,598 |

‑24 |

2,234 |

|

|

Reserve deposit |

— |

1,889 |

1,889 |

2,617 |

728 |

2,617 |

|

Makes Required Reserve Deposit, Pays Down Deferrals, and Funds New Programs. When the minimum funding requirement is growing quickly, the Constitution requires the state to deposit some of the available funding into a statewide reserve account for schools and community colleges. Under the June 2021 budget plan, the total required deposit is $4.5 billion—$1.9 billion in 2020‑21 and $2.6 billion in 2021‑22. The largest discretionary allocation of Proposition 98 funding is $12.5 billion to pay down the deferrals the state adopted as part of the June 2020 budget plan. Beginning in 2021‑22, schools and community colleges will receive all of their funding according to the regular monthly payment schedule. The budget allocates the remaining funds for significant one‑time and ongoing program increases. For schools, these augmentations focus on providing academic support for disadvantaged students, reopening schools and addressing learning loss, enhancing the education workforce, and implementing new curriculum or instructional practices in certain subjects. The community college augmentations focus on increasing the number of full‑time faculty, addressing deferred maintenance at campus facilities, and funding basic student needs (including mental health services). The budget also provides a 5.07 percent baseline increase for the primary school and community college funding formulas.

Eliminates Supplemental Payments but Establishes Multiyear Plan to Fund Universal Transitional Kindergarten. Trailer legislation adopted in June 2020 would have required the state to make payments to schools and community colleges on top of the minimum funding requirement beginning in 2021‑22. These supplemental payments were intended to accelerate the recovery of school funding from the decline the state anticipated last June. In recognition of the significant revenue increases (and ensuing increases in the guarantee) that have occurred since that time, the June 2021 budget plan repeals these payments. The budget, however, makes another commitment that will increase funding for schools—above the existing minimum requirement—on an ongoing basis. Specifically, it establishes a plan to make all four‑year olds eligible for Transitional Kindergarten by 2025‑26. (Currently, only children born between September 2 and December 2 are eligible.) The Legislature and the Governor have reached an agreement to cover the associated costs—approximately $2.7 billion at full implementation—by adjusting the Proposition 98 formulas to increase the share of General Fund revenue allocated to schools.

Resources and Environment

The spending plan provides a total of $8.4 billion in new, discretionary General Fund monies in 2021‑22, of which nearly all is one time or temporary, for a variety of resources and environment programs. In particular, the budget package provides $6.9 billion General Fund (a total of $12.7 billion over four years) for seven major “packages” that each include funding for multiple programs and projects. Specifically, the budget act includes (1) $3.1 billion to address the drought emergency and increase water resiliency, (2) $2 billion to incentivize increased adoption of zero‑emission vehicles and installation of charging infrastructure, (3) $758 million for wildfire prevention and mitigation activities, (4) $369 million for efforts to better adapt to the impacts of climate change, (5) $253 million for a program to increase access to parks and outdoor recreation, (6) $170 million for incentives and planning efforts to increase renewable energy, and (7) $65 million to incentivize improved waste management and recycling activities.

Transportation

The spending plan provides a total of $1.2 billion in new, discretionary General Fund monies in 2021‑22, which is entirely one time or temporary, for transportation infrastructure. This includes $475 million in 2021‑22 ($1.1 billion over three years) for litter abatement and beautification projects on state highways and local roads. The budget also includes one‑time funding of $280 million for improvements at the Port of Oakland, nearly $300 million for various California Highway Patrol and Department of Motor Vehicles facility improvements, and $100 million for rail and transit demonstration projects as part of the larger “zero‑emission vehicle package.” Notably, the budget act included an additional $3.3 billion from the General Fund for the California Department of Transportation and the California State Transportation Agency, which will revert to the General Fund because subsequent legislation to allocate funds was not enacted by October 10, as required in the budget act.

Higher Education

The spending plan provides a total of $3.7 billion in new, discretionary General Fund monies in 2021‑22, of which approximately $500 million is ongoing, for higher education. Below, we highlight some of the major changes.

Universities’ Core Operations. The spending plan includes a total augmentation of $1 billion ongoing General Fund for core operations at the California State University (CSU) and the University of California (UC). The augmentation brings the universities’ base funding back to pre‑pandemic levels and then provides an additional 5 percent base increase. (We do not include these base funding increases in our discretionary funding totals.)

Targeted Augmentations for Universities. Beyond base funding, the budget includes $2.6 billion General Fund in 2021‑22 for targeted initiatives focused solely or primarily on the universities. The largest spending components within this category are $650 million for deferred maintenance and energy efficiency projects at CSU and UC, $500 million for student housing (with an additional $1.5 billion provided over the subsequent two fiscal years), and $458 million for CSU Humboldt to transition to a polytechnic institution. By 2025‑26, the one‑time initiatives in this category will have expired, but approximately $400 million in higher ongoing spending will remain. The largest of these ongoing commitments involve supporting future resident enrollment growth.

Student Financial Aid Programs. The spending plan significantly expands the Cal Grant and Middle Class Scholarship (MCS) programs. Specifically, it provides $235 million ongoing General Fund to expand eligibility for Cal Grant entitlement awards to community college students regardless of their age and time out of high school. In addition, the budget agreement includes $515 million ongoing General Fund beginning in 2022‑23 to revamp the MCS program. The revamped program results in a significant increase in the number of MCS recipients and MCS award amounts.

Health

The spending plan provides a total of $3.8 billion in new, discretionary General Fund monies in 2021‑22, of which $1 billion is ongoing, for health‑related programs. Below, we highlight some of the major changes.

California Advancing and Innovating Medi‑Cal (CalAIM). CalAIM is a far‑reaching set of reforms with a variety of goals. To support the first half‑year of CalAIM implementation, the spending plan dedicates $664 million General Fund ($1.1 billion total funds) in 2021‑22. The bulk of CalAIM funding—ramping up and then settling in at $500 million General Fund ($900 million total funds) ongoing—supports an expanded array of services aimed at addressing the health and social needs of Medi‑Cal’s high‑cost, high‑need populations.

Medi‑Cal Coverage Expansion. The spending plan provides $94 million General Fund ($158 million total funds) for three major expansions to Medi‑Cal eligibility. First, the spending plan expands comprehensive Medi‑Cal coverage to income‑eligible undocumented immigrants ages 50 and older. Second, the spending plan raises the Medi‑Cal “asset limit”—a cap on specified assets for eligible seniors and persons with disabilities. (Once necessary federal approvals are obtained, the asset limit would be eliminated altogether.) Third, the spending plan extends pregnancy and postpartum Medi‑Cal coverage (available to higher‑income individuals) from 2 months to 12 months post‑childbirth. By 2024‑25, the annual cost of these expansions is expected to reach about $1.9 billion General Fund ($2.7 billion total funds).

Behavioral Health. The spending plan funds two major investments in behavioral health. First, the spending plan includes roughly $1 billion General Fund ($1.5 billion total funds) in 2021‑22 to fund the Children and Youth Behavioral Health Initiative—a package of augmentations through multiple state departments intended to transform behavioral health service delivery for children and youth under age 25. Second, the spending plan includes $445.7 million General Fund ($755.7 million total funds) in 2021‑22 to fund the Behavioral Health Continuum Infrastructure Program—which will provide grant funding to local entities for behavioral health facilities or mobile crisis infrastructure. Funding for these two initiatives will be provided across five and three years, respectively.

Public Health Infrastructure (Beginning in 2022‑23). In negotiations on the 2021‑22 budget, the Governor and Legislature agreed to provide on an ongoing basis, beginning in 2022‑23, a $300 million General Fund augmentation to the California Department of Public Health (CDPH) to improve state and local public health systems. (Prior to the pandemic, the average annual General Fund budget for CDPH has been about $175 million since CDPH became a standalone department in 2007‑08.)

Human Services

The spending plan provides a total of $7.9 billion in new, discretionary General Fund monies in 2021‑22, of which $1.1 billion is ongoing, for a variety of new and existing initiatives throughout human services. (The full implementation costs of these ongoing proposals grow to $6.6 billion by 2025‑26.) Additionally, the budget includes hundreds of millions of dollars for continued temporary assistance related to the COVID‑19 pandemic response and support in child welfare, In‑Home Supportive Services (IHSS), and CalWORKs. Below, we highlight some of the major changes.

Developmental Services. The 2021‑22 budget package lays out a five‑year plan to reform the service provider rate‑setting process in the Department of Developmental Services system. The plan involves phasing in the full implementation of the study’s recommended rate models over a five‑year period—with a General Fund funding level of $89.9 million in 2021‑22 that ramps up to $1.2 billion in 2025‑26 and ongoing. The plan includes the implementation of a quality incentive provider payment program, whereby a portion of a service provider’s full payment ultimately will be contingent on meeting certain performance and consumer outcomes benchmarks.

CalWORKs. The 2021‑22 spending plan provides over $100 million (nearly $500 million ongoing) for a various policy changes in CalWORKs. These policy changes are primarily aimed at increasing eligibility and participation in the CalWORKs programs. In terms of direct assistance to families, the budget uses (1) realignment funding to provide a 5.3 percent increase to the CalWORKs grant and (2) federal COVID‑19 relief funds to provide a one‑time payment of about $640 to families.

Food Assistance. The 2021‑22 budget provides $5 million (and $280 million ongoing) to expand the state’s California Food Assistance Program to individuals who were previously ineligible for assistance as a result of their immigration status. Additionally, the budget provides $150 million in one‑time funds for food bank infrastructure assistance and increases ongoing funding levels for senior nutrition programs to $35 million General Fund.

Child Care. The budget package includes $735 million in 2021‑22 ($1.6 billion ongoing) across state and federal fund sources to provide additional slots for child care across several child care programs. The Legislature and Governor further agreed to add 80,000 child care slots through 2025‑26, which is anticipated to cost an additional $1 billion General Fund by 2026‑27. In addition, the budget package provides $604 million in 2021‑22 ($1.1 billion ongoing) across several fund sources to increase rates for child care providers.

Child Welfare. The budget provides one‑time and ongoing funding, along with significant budget‑related legislation, for the implementation of the federal Family First Prevention Act in Child Welfare. Specifically, the budget includes $32 million General Fund under the Department of Social Services to implement the federally required components of the act and an additional $222 million General Fund in one‑time funds to implement the optional prevention components of the law. Additionally, the budget includes legislation aimed at reducing the number of foster youth placed out of state. In support of this effort, the budget includes $140 million to support foster youth with complex or highly acute behavioral health needs who may have otherwise been placed in congregate care out of state. The 2021‑22 budget also includes $233 million General Fund for pandemic assistance within child welfare, including continued support for non‑minor dependents who would otherwise become ineligible for Extended Foster Care payments as well as new funding for direct payments to foster caregivers, payments to short‑term residential therapeutic program providers impacted by the pandemic, and funds to increase emergency response child welfare social workers.

Aging Programs. The 2021‑22 budget provides over $1 billion in funding for several program expansions and enhancements that are in line with the state’s Master Plan for Aging. Some examples of these include (1) expand full‑scope Medi‑Cal, including IHSS, to undocumented older adults; (2) providing a grant increase for SSI/SSP recipients; (3) expanding eligibility and services for the Adult Protective Services program; and (4) establishing a permanent IHSS back‑up provide system.

Energy Utility Assistance. The 2021‑22 budget includes significant new one‑time funding under the Department of Community Services and Development to implement the California Arrearage Payment Program, which will address energy utility debts accrued throughout the pandemic. The program is funded using $1 billion Advanced Research Projects Agency funds from the state’s fiscal relief funds, and will provide direct payments to energy utility providers to offset customer arrearages.

Housing and Homelessness

The 2021‑22 budget provides over $7.4 billion (all funds) to about 30 housing and homelessness programs within the Business, Consumer Services, and Housing Agency and departments under the Agency’s purview. The vast majority of funding is one time or temporary. Specifically, funding in the budget declines to $2.5 billion (all funds) in 2022‑23 for these housing and homelessness programs and the budget only provides $24 million (General Fund) in ongoing funding beginning in 2023‑24. The ongoing funding largely provides housing assistance for foster youth and former foster youth, and resources to enhance local governments’ compliance with state housing laws. Most of the funding in 2021‑22, $4.5 billion (all funds), is primarily for homelessness‑related proposals, while $2.9 billion (all funds) is allocated primarily towards housing‑related programs in 2021‑22. In addition, 65 percent of funding in 2021‑22 is federal, while 35 percent is state funding.

Some of the major uses of housing and homelessness funding in the budget would support the Homekey Program’s acquisition of properties for use as permanent housing, provide flexible aid to local governments to address homelessness in their communities, provide funding to address the backlog in affordable housing development, and help local governments plan to meet their housing production goals. The budget also provides funding that could be used to address homelessness and/or housing affordability in other program areas, including the health, human services, veteran services, courts, transportation, higher education, and labor programs.

Other

Golden State Stimulus II. The budget includes $8.1 billion General Fund in Golden State Stimulus II payments, the second round of state direct payments to lower‑income taxpayers. Under the second round, the state will send payments to an estimated 14.2 million taxpayers. Most of the funding will go out as $600 one‑time payments to taxpayers with incomes below $75,000 (taxpayers with dependents will receive an additional $500 payment). The remainder will go out as $500 one‑time payments to taxpayers with incomes less than $75,000 who file using an Individual Taxpayer Identification Number.

Broadband Infrastructure. As part of the spending plan, the administration and Legislature agreed to spend $6 billion ($1.7 billion General Fund) over three fiscal years, starting in 2021‑22, on broadband infrastructure. Of the $6 billion, $4.35 billion is appropriated in 2021‑22 as follows:

- $3.25 billion in federal ARP fiscal relief funds to the California Department of Technology to implement, with the help of a third‑party administrator, a statewide open‑access “middle‑mile” broadband network for internet service providers to connect “last‑mile” broadband infrastructure projects. (A middle‑mile network often consists of high‑capacity fiber‑optic cables laid over tens or hundreds of miles, for example, near the state’s highways. Last‑mile projects, by contrast, connect middle‑mile networks to individual communities and their households.)

- $1.05 billion in ARP fiscal relief funds to the California Public Utilities Commission (CPUC) to fund last‑mile projects with grants administered through its California Advanced Services Fund program. (The multiyear spending agreement anticipates additional appropriations totaling $950 million General Fund over 2022‑23 and 2023‑24 for CPUC to provide last‑mile project grants.)

- $50 million General Fund to CPUC to operate a “loan loss reserve fund” to help local entities and nonprofit organizations obtain financing for their broadband internet service projects. (The multiyear spending agreement anticipates additional appropriations totaling $700 million General Fund over 2022‑23 and 2023‑24 for CPUC to operate the fund.)

Legislature Ratified New Labor Agreements. The Legislature ratified labor agreements with 20 of the state’s 21 bargaining units. There are common provisions among all of the agreements that include:

- Ending Personal Leave Program (PLP) 2020. The agreements ended PLP 2020. As such, employees no longer (1) have their pay reduced or (2) receive PLP 2020 leave each month.

- Restoring Employee Contributions to Prefund Retiree Health Benefits. With PLP 2020 ending, state employees resumed contributing a specified percentage of pay to prefund their retiree health benefits.

- Restoring Suspended or Deferred Compensation Increases. During PLP 2020, many previously scheduled compensation increases were suspended or deferred. The ratified labor agreements restore these compensation increases.

In addition to the above provisions, a number of agreements included compensation increases for specific bargaining units. In total, the agreements increased state costs by about $1.3 billion ($717 million General Fund) in 2021‑22. These increased costs are ongoing. Our report on labor agreements ending the personal leave program provides more detail on these agreements.

New Administrative Spending Authority. The budget includes three new control sections that grant flexible spending authority to the administration in the 2021‑22 for a few different purposes. They are:

- Control Section 11.91. This control section provides the administration with flexibility to expend the $1.7 billion from the General Fund allocated in the 2021‑22 Budget Act to support the COVID‑19‑related activities of nine state departments. Specifically, the language allows DOF to shift these funds to any other item in the budget to support COVID‑19‑related response and recovery costs. The language requires notification to the Joint Legislative Budget Committee (JLBC) ten days prior to any shift of funds. (The Governor initially proposed, but the budget did not ultimately adopt, authority to extend Disaster Response and Emergency Operations Account authorization for COVID‑19.)

- Control Section 11.95. As previously mentioned, the state expects to receive $3 billion in one‑time additional federal Medicaid funds authorized under ARP for existing HCBS activities. As a condition of receiving these funds, the state will be required to spend an equal amount of funding on new HCBS enhancements and expansions. Control Section 11.95 creates a new fund—the HCBS ARP Fund—dedicated to supporting the implementation of new HCBS enhancements and expansions. The administration is allowed to oversee and expend the HCBS ARP funds through the annual budget process or through written midyear notifications to the Legislature. Some of the HCBS ARP funds will be used to replace General Fund allocated through the budget process to implement new HCBS activities. The remainder of the HCBS ARP funds will be used to implement additional HCBS activities that currently are not budgeted in the 2021‑22 Budget Act, but are proposed in the state’s HCBS Spending Plan (pending federal approval). Due to delays in the federal Medicaid claiming process, Control Section 11.95 also allows the administration to issue a General Fund loan of up to $750 million to the HCBS ARP Fund, which can be used to pay for the approved HCBS activities prior to receipt of federal funds.

- Control Section 11.96. This control section provides the administration with some flexibility to fully expend the $27 billion in ARP fiscal relief funds allocated in the 2021‑22 budget package. For example, the language allows DOF to transfer amounts within a program, project, or function, or between department’s state operations and local assistance items, in order to support the implementation of the appropriations of these funds. The language also allows DOF to reallocate funding if they are not encumbered by August 1, 2024 and use up to $10 million in interest earnings on the funds to address unanticipated workload. Any changes DOF makes pursuant to this section require a 30‑day notification to JLBC.

Small Business Grants. The budget provides the Governor’s Office of Business and Economic Development (GO‑Biz) $1.5 billion ARP fiscal relief funds for around 130,000 additional grants to small businesses and nonprofits financially impacted by the COVID‑19 pandemic. These funds increase total state and federal funding for the California Relief Grant program to $4 billion. The program provides financial assistance grants in amounts between $5,000 and $25,000, depending on the applicant’s 2019 revenue.

Other Business Assistance Programs. The budget provides GO‑Biz $600 million ($95 million ARP fiscal relief funds and $505 million General Fund) for a variety of new and existing programs that offer financial and technical assistance to businesses, including a new California Competes grant program, financial assistance to performance venues, tourism promotion, and support for small and underserved businesses.

Community Economic Resilience Fund. The budget includes $600 million one‑time ARP fiscal relief funds to start a new grant program for regions to develop and implement regional plans to create jobs in sustainable industries, including zero‑emission vehicle infrastructure, climate resilience, transit systems, biomass projects, offshore wind, and oil well capping and remediation.

Eligibility Workload Backlog at EDD. The budget includes $276 million General Fund for EDD to hire an outside contractor to determine whether several million workers who received UI benefits during the pandemic were eligible to receive those benefits.

School Facilities Grants. The budget allocates $740 million (non‑Proposition 98 General Fund) for school facility grants. Of this total, $490 million is for schools to construct or renovate State Preschool, transitional kindergarten, and full‑day kindergarten classrooms. The remaining $250 million is to cover the state share for new construction and modernization projects under the School Facilities Program. These funds supplement existing funds from Proposition 51, the state school bond approved by voters in 2016.

Control Sections 19.56 and 19.57. Two budget control sections provide a total of $1.2 billion for a variety of augmentations, across a number of program areas, for various legislative priorities. Control Section 19.56 includes: $19 million for workforce and economic development programs; $114 million for transportation and infrastructure; $32 million for health and human services programs; $260 million for parks, recreation, and resources; $238 million for arts and cultural programs; $110 million for housing and homelessness; and $98 million for fire prevention and public safety. Control Section 19.57 includes $329 million in program augmentations for a variety of purposes, including research and educational programs.

Agriculture Package. The budget includes $445 million from the General Fund on a one‑time basis in 2021‑22 (and an additional $425 million in 2022‑23) for various activities related to the agricultural sector in California. The budget‑year amount includes $180 million for incentives to farmers to find alternatives to the burning of agricultural waste and $50 million for the Healthy Soils Program.

Creation of the Department of Cannabis Control (DCC). The budget reflects the transfer of responsibility for most cannabis regulatory functions from the Bureau of Cannabis Control (BCC), CDPH, and the California Department of Food and Agriculture to a new department within the Business, Consumer Services and Housing Agency—DCC. Because BCC’s only responsibilities were related to cannabis licensing, the budget also reflects the dissolution of the bureau. The budget package includes $294 million in funding for the new department.