Table of Contents

LAO Contacts

- Ginni Bella Navarre

- Deputy Legislative Analyst: Human Services and Governance

- Angela Short

- Child Welfare

- CSD

- Community Care Licensing

- Sonia Schrager Russo

- CalWORKs

- Food Assistance

- Juwan Trotter

- Aging-Related Issues

- Karina Hendren

- Department of Developmental Services

- Brian Metzker

- California Statewide Automated Welfare System

Other Related Spending Plan Posts

November 6, 2023

The 2023-24 California Spending Plan

Human Services

CalWORKs

The California Work Opportunity and Responsibility to Kids (CalWORKs) program provides cash assistance, child care, and employment services to low-income families with children. As shown in Figures 1 and 2, the spending plan provides a total of $7.1 billion (all funds) to support the CalWORKs program in 2023-24, an increase of about $68 million (1 percent) relative to estimated spending in 2022-23. The year-over-year increase reflects a projected increase in CalWORKs caseload and various programmatic augmentations, as described below.

Figure 1

CalWORKs Funding Sources

(Dollars in Millions)

|

2022‑23 |

2023‑24 |

Change From 2022‑23 to 2023‑24 |

||

|

Amount |

Percent |

|||

|

Federal TANF block grant funds |

$3,394 |

$2,609 |

‑$785 |

‑23% |

|

General Fund |

612 |

1,397 |

785 |

128 |

|

Realignment funds from local indigent health savings |

586 |

407 |

‑179 |

‑30 |

|

Realignment funds dedicated to grant increases |

909 |

1,130 |

221 |

24 |

|

Other county/realignment funds |

1,537 |

1,562 |

25 |

2 |

|

Totals |

$7,037 |

$7,105 |

$68 |

1% |

|

TANF = Temporary Assistance for Needy Families. |

||||

Figure 2

CalWORKs Budget Summary

All Funds (Dollars in Millions)

|

2022‑23 |

2023‑24 |

Change From 2022‑23 to 2023‑24 |

||

|

Amount |

Percent |

|||

|

Number of CalWORKs cases |

331,707 |

340,743 |

9,036 |

3% |

|

Cash grants |

$3,868 |

$4,255 |

$387 |

10% |

|

Single Allocation |

||||

|

Employment services |

$1,274 |

$1,158 |

‑$115 |

‑9% |

|

Cal‑Learn case management |

11 |

11 |

— |

2 |

|

Eligibility determination and administration |

632 |

551 |

‑81 |

‑13 |

|

Subtotals |

($1,916) |

($1,721) |

(‑$196) |

(‑10%) |

|

Stage 1 child carea |

$532 |

$604 |

$71 |

13% |

|

Other allocations |

||||

|

Home Visiting Program |

$101 |

$102 |

$1 |

1% |

|

Housing Support Program |

285 |

95 |

‑190 |

‑67 |

|

Other |

316 |

320 |

3 |

1 |

|

Subtotals |

($702) |

($517) |

(‑$186) |

(‑26%) |

|

Otherb |

$18 |

$9 |

‑$9 |

‑50% |

|

Totals |

$7,037 |

$7,105 |

$68 |

1% |

|

aIn 2020‑21 and prior years, this was included in the single allocation. Starting in 2021‑22, it became a separate allocation. bPrimarily includes various state‑level contracts. |

||||

Within the total funding amount, the spending plan provides about $1.4 billion General Fund for CalWORKs in 2023-24, an increase of about $790 million (128 percent) relative to 2022-23. This increase in General Fund is due largely to the usage of unspent 2021-22 federal Temporary Assistance for Needy Families (TANF) funds in 2022-23, which offset 2022-23 General Fund CalWORKs spending. The unspent 2021-22 TANF funds stemmed mostly from the overestimation of the 2021-22 CalWORKs caseload. The 2023-24 spending plan assumes no TANF funds will be left unspent in 2022-23. The spending plan increases General Fund relative to the prior year to backfill the overall decrease in TANF funding, holding total spending on CalWORKs relatively steady. The increase in General Fund is partially offset by some savings in program administration and the expiration of one-time CalWORKs Housing Support Program funding. Major changes in CalWORKs funding and policy included in the 2023-24 spending package are described below.

Projects Caseload to Grow Following Historic Decline. CalWORKs caseload and costs generally increase during and following economic recessions, and decrease during economic expansions. The public health emergency and subsequent recession caused by COVID-19 represented a deviation from this historic norm, with caseload decreasing from about 360,000 in March 2020 to about 285,000 in September 2021. However, caseload has increased since fall 2021 to almost 301,000 in June 2023. The 2023-24 spending plan anticipates this upward trend to continue, with caseload forecasted to average about 341,000 a month in 2023-24.

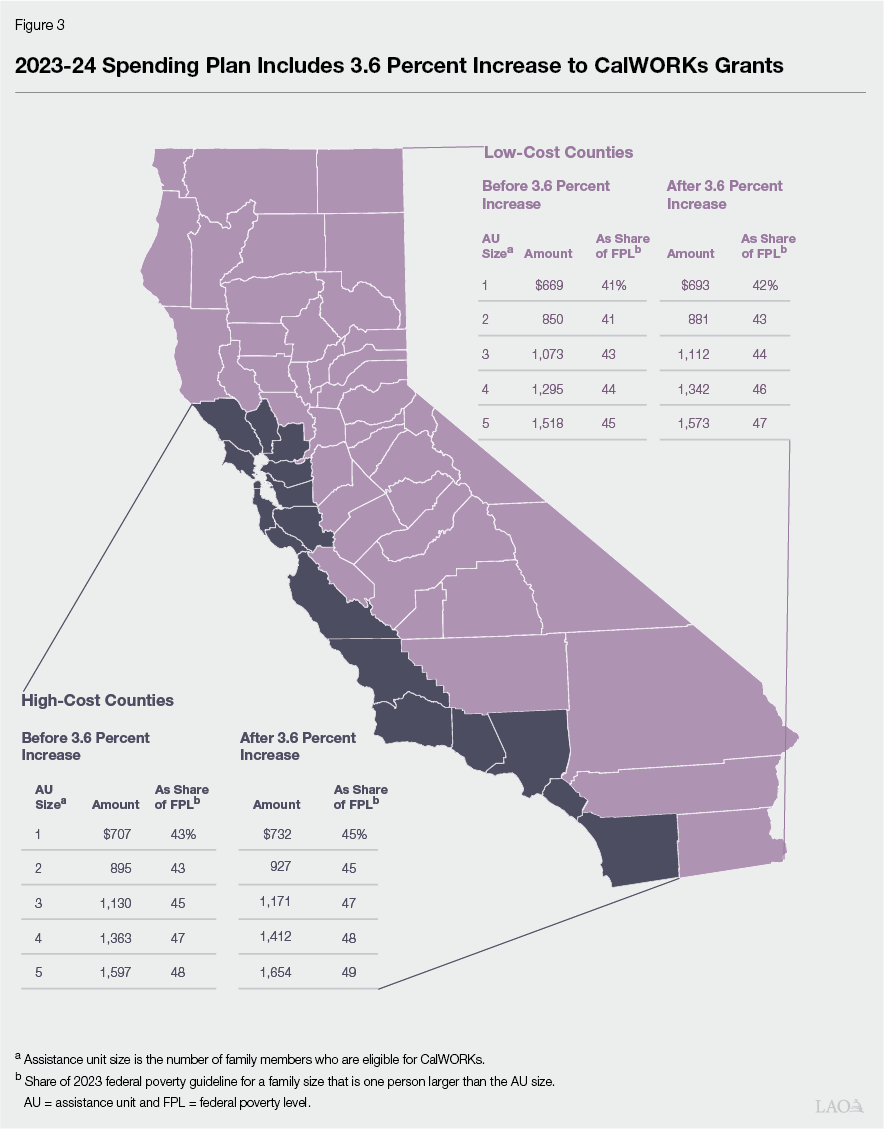

Increases Maximum Monthly Cash Grants and Makes a Temporary Increase Permanent. Last year’s spending plan introduced a temporary 10 percentage point maximum grant increase. The increase was scheduled to remain in effect until September 30, 2024 unless funds were appropriated to extend the grant increase. This year’s spending plan included budget-related legislation that removes this end date, making the 10 percent grant increase permanent. The spending plan assumes that this will cost roughly $500 million in ongoing funds beginning in 2024-25. The 2023-24 Budget Act also includes $111 million for an ongoing maximum grant increase of 3.6 percent, effective October 2023. The 3.6 percent increase will be funded with revenues in the Child Poverty and Family Supplemental Support Subaccount. Figure 3 shows the 3.6 percent increase will raise grants for all AU sizes in high-cost counties to between 45 percent and 49 percent of the FPL for a family one person larger than the AU size, and to slightly lower levels for families in lower-cost counties.

Provides $1.8 Billion for CalWORKs Administration and Support Services. The state provides counties with a “single allocation” to cover most costs associated with CalWORKs aside from cash assistance. Counties can shift the single allocation funding between supported functions, including CalWORKs administration and employment services. Single allocation funding generally is adjusted with caseload changes. The 2023-24 spending plan, however, includes an additional one-time supplemental augmentation of $55 million for CalWORKs Eligibility Administration, totaling $1.8 billion in funding for CalWORKs administration and support services.

Reverts $288 Million in Unspent CalWORKs Funds. These unspent single allocation funds from the 2021-22 Budget Act would naturally revert to the General Fund in 2024-25. The 2023-24 spending plan’s reversion of these funds represents a one-year acceleration. The early reversion serves as a solution to address the state’s budget deficit. The California Department of Social Services (CDSS) has indicated the early reversion will not impact families receiving CalWORKs services.

Allocates Funds to Enhance EBT Security. In recent years, CalWORKs and other benefits loaded onto Electronic Benefit Transfer (EBT) cards have been subject to increasing levels of theft. The administration projects this theft will cost the state $167 million for reimbursements in 2023-24. Most of this theft is believed to be accomplished through creating “clones” of EBT cards. EBT card cloning is possible, in part, because EBT cards lack many security features common to debit and credit cards, such as security chips. The spending plan includes $50 million ($15.5 million General Fund) in 2023-24, $23 million ($7.9 million General Fund) in 2024-25, and $3.5 million ($1.2 million General Fund) in 2025-26 to improve EBT card technology and security. CDSS will pursue security upgrades and technology enhancements to better protect benefits against theft. The administration currently anticipates that, beginning in May 2024, EBT cards will be issued with chip and tap-to-pay technologies, which provide improved fraud protection over magnetic stripe technology.

Requests a Cost Estimate for Changing the Program Name. The spending plan includes supplemental reporting language that requires CDSS and the Department of Finance provide a comprehensive estimate of the one-time and ongoing costs to change the name of the CalWORKs program. The estimate shall be submitted to the Legislature’s relevant policy and fiscal committees by March 1, 2024, with preliminary information provided to the Legislature as early as possible in the fall of 2023.

Requires Reporting on CalWORKs Families’ Needs and Barriers. The spending plan includes supplemental reporting language requiring CDSS to provide information to the Legislature on CalWORKs families’ needs and barriers on at least an annual basis. The first report must be provided on February 1, 2024. CDSS shall work to centralize the information, such as on a public-facing online dashboard. A meeting with Legislative staff, including the Legislative Analyst’s Office, will be convened annually on the topic. During this meeting, CDSS will (1) present on the information outlined below, (2) discuss the individual data elements with context and available trend analysis information, and (3) be available to answer questions. The annual reports must include information on the program’s take-up rate; trends on reasons for program exits; and, where available, the number and proportion of participating individuals and/or households who:

Do not receive an adult portion of the grant.

Lack a high school diploma or General Education Degree.

Have been approved to receive Housing Support Program benefits.

Have been approved to receive Homeless Assistance Program benefits.

Are engaged in supportive services as captured in Cal-OAR.

Are in welfare-to-work sanction status.

Are enrolled in the Home Visiting program.

Are transitioning from subsidized to unsubsidized employment.

Are participating in Family Stabilization services.

Are referred to Stage 1 Child Care services.

Are receiving good cause exemptions.

Are entering the safety net (retaining the child-only grant) after exhausting their 60 months on aid for adults.

Refer to the Supplemental Report of the 2023-24 Budget Act report for additional information.