LAO Contact

February 27, 2024

The 2024‑25 Budget

Department of Health Care Access and Information

Summary

The Governor proposes providing the Department of Health Care Access and Information (HCAI) $373 million General Fund ($523 million total funds) in 2024‑25, of which most is one time. This amount is after accounting for a proposed $140 million delay to planned spending on workforce initiatives from 2024‑25 to 2025‑26. We analyze the Governor’s workforce proposals and find the proposed delays warranted to help address the state’s budget problem. That said, the Legislature likely will need to pull back even more one-time funding than proposed by the Governor to help address the state’s deteriorating budget situation. We also provide an implementation update to HCAI’s hospital relief programs, which were expanded as part of last year’s managed care organization (MCO) tax package.

Overview

In this section, we provide background on HCAI and summarize its budget under the Governor’s budget.

Background

Department Has Several Key Responsibilities. One of several health departments overseen by the California Health and Human Services Agency, HCAI has a number of responsibilities. These include: (1) promoting health care access and affordability, (2) overseeing state health workforce issues, (3) regulating the design and construction of health care facilities, (4) insuring loans for nonprofit healthcare facilities, and (5) collecting healthcare data. In 2023‑24, the department is authorized to have 706 positions to manage operations and administer programs.

Department Recently Was Reorganized. For many decades, the department was known as the Office of Statewide Health Planning and Development (OSHPD). Chapter 143 of 2021 (AB 133, Committee on Budget) changed the department’s name to HCAI and expanded its mission and operations in several ways. For example, the legislation expanded the department’s scope to include health care affordability issues, and also reorganized and expanded the department’s pre-existing activities around health care workforce planning and development.

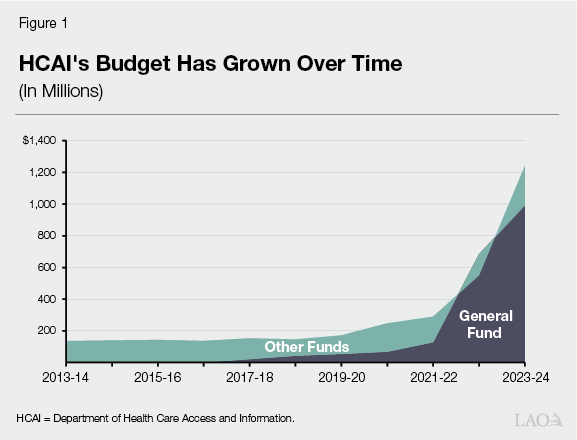

Department Is Supported by Many Fund Sources. Reflecting its varied mission and activities, HCAI’s budget is supported by several sources of funding. For example, HCAI assesses fees on health care facilities, which are collected in special funds. These funds support HCAI’s regulation of facilities, data collection activities, and other programs. Most General Fund support for HCAI has been limited term, and focused on health care workforce and affordability programs. In 2023‑24, the department has a budget of $1.2 billion, of which $992 million (80 percent) comes from General Fund support.

General Fund Support Has Expanded in Recent Years. Prior to 2017‑18, the department (then known as OSHPD) did not receive General Fund support. Instead, special funds supported its various activities. Since 2017‑18, the state has provided General Fund support for certain limited-term initiatives. Many of these funds are being spent over multiple years. Following its reorganization into HCAI, the department’s budget also has expanded somewhat to support new health care affordability activities. As Figure 1 shows, this General Fund support has notably increased HCAI’s budget.

Governor’s Budget

Overall Spending Declines, Though Ongoing General Fund Support Increases. Under the Governor’s budget, overall HCAI spending is nearly double in 2023‑24 relative to budget enactment. From this revised level, total spending in 2024‑25 declines, bringing the new level (across all funds) to $523 million. As Figure 2 shows, the substantial upward revision in 2023‑24 largely is due to the carryover of General Fund spending enacted from previous years, such as funds for the Children and Youth Behavioral Health Initiative and the CalRx initiative. Excluding this technical carryover adjustment, total spending is down in 2023‑24 relative to budget enactment, and then increases in 2024‑25.

Figure 2

Overall Spending Varies Year to Year

HCAI Funding (In Millions)

|

2023-24 |

2024-25 |

Change From 2023-24 Revised |

|||||

|

Enacted |

Revised |

Amount |

Percent |

||||

|

General Fund |

|||||||

|

Ongoing |

$68 |

$70 |

$88 |

$19 |

27% |

||

|

One time |

220 |

170 |

285 |

115 |

68 |

||

|

Carryover |

— |

753 |

— |

-753 |

-100 |

||

|

Totals |

$288 |

$992 |

$373 |

-$619 |

-62% |

||

|

Other Funds |

$379 |

$247 |

$150 |

-$97 |

-39% |

||

|

Grand Totals |

$667 |

$1,240 |

$523 |

-$716 |

-58% |

||

|

HCAI = Department of Health Care Access and Information. |

|||||||

In Current Year, Deferred One-Time Funds Drive Down General Fund Spending. Excluding the carryover of spending from previous years, one-time General Fund spending is down in 2023‑24 relative to budget enactment. This downward revision is the result of an assumed $50 million in deferred spending for the CalRx initiative to 2025‑26. The initiative supports a public-private partnership to develop and manufacture a biosimilar insulin product. The deferred funds originally were intended to support the construction of a manufacturing facility. According to HCAI, manufacturing instead initially will occur at an existing facility in Virginia, with construction of a California facility occurring at a later date. In contrast to one-time spending, ongoing General Fund spending is up slightly over the enacted level due to technical compensation-related adjustments.

In Budget Year, a Few Key Adjustments Impact General Fund Spending. Under the Governor’s budget, General Fund spending at HCAI is $373 million in 2024‑25, $619 million lower than the revised level in 2023‑24. As Figure 3 shows, the overall decline is the net result of ongoing and one-time augmentations being more than offset by the expiration of one-time spending from the previous year. Most of the augmentations implement previously enacted multiyear agreements. For example, the Governor’s budget includes one-time funding for health workforce initiatives enacted in the 2022‑23 budget. Some of this funding is offset by proposed delays. The Governor’s budget also provides an ongoing augmentation to ramp up the Office of Health Care Affordability to full operations, pursuant to a multiyear plan enacted in the 2022‑23 budget.

Figure 3

Several Factors Drive Net Reduction in Budget Year

General Fund Changes (In Millions)

|

Item |

Amount |

|

Revised 2023-24 Spending |

$992.3 |

|

Ongoing |

|

|

Office of Health Care Affordability |

$18.6 |

|

Other adjustments |

0.2 |

|

Total |

$18.8 |

|

One-Time |

|

|

Workforce for a Healthy California for All |

$399.0 |

|

Song Brown (physicians and nurses) |

25.0 |

|

Other initiatives |

0.9 |

|

Delay to workforce initiatives |

-140.1 |

|

Total |

$284.8 |

|

Technical |

|

|

Removed previous year one-time funding |

-$169.6 |

|

Removed previous year carryover |

-753.0 |

|

Total |

-$922.6 |

|

Total Changes |

-$619.1 |

|

Proposed 2024-25 Spending |

$373.2 |

Special Fund Spending Down Primarily Due to Delays and Expiration of One-Time Spending. Outside of General Fund spending, spending is down in 2023‑24 relative to last year’s enacted budget primarily because of proposed delays in Mental Health Services Fund spending. While last year’s budget provided $196 million one time from this account to support HCAI workforce initiatives, the Governor’s budget proposes to delay nearly all of this amount to 2025‑26. Special fund spending further declines in 2024‑25 primarily due to the expiration of one-time support in 2023‑24 from the Opioid Settlements Fund and the Home and Community-Based Services American Rescue Plan Fund.

Governor’s Budget Increases Department’s Staffing. The Governor’s budget includes 748 positions at HCAI in 2024‑25, an increase of 42 positions (5.9 percent) over the previous year. Of this amount, 16 positions are proposed to help administer the department’s portfolio of workforce initiatives and would be supported by existing one-time General Fund and various special funds. The remaining 23 positions are proposed to implement previous actions, such as the operational ramp up of the Office of Health Care Affordability and administration of a previously approved Naloxone-related initiative. (For this latter initiative, last year’s budget approved funds from the Opioid Settlements Fund for three positions but did not authorize the department to increase its staffing. The Governor proposes a technical correction to allow for the positions.)

Health Care Workforce Proposals

In this section, we analyze the Governor’s health care workforce proposals, which include a mix of delays, reductions, and augmentations. We first provide background on recent state augmentations for workforce initiatives at HCAI. Next, we describe the Governor’s proposals. We then assess the proposals and provide associated recommendations.

Background

In Recent Years, State Has Expanded Support for Health Care Workforce Initiatives and Programs. Since 2017‑18, the state has provided HCAI (previously OSHPD) General Fund support for a number of health care workforce initiatives, most of which were limited term. While the initiatives cut across different areas of health care, most have focused on increasing the statewide supply of providers, addressing regional shortages of providers, or enhancing the diversity of the workforce. For example, the Song-Brown program provides grants to postgraduate training programs for primary care physicians and other related providers. Other initiatives have focused on areas such as nursing and behavioral health care, and supported activities such as scholarships and loan repayment programs.

State Enacted Large Health Workforce Package in 2022‑23 Budget. Expanding upon recent health care workforce augmentations, the 2022‑23 budget included a multiyear package of limited-term health workforce initiatives at HCAI totaling over $900 million General Fund. The package spanned several areas of health care, including primary care and behavioral health. It also included funds for an initiative called “Workforce for a Healthy California for All,” which supports activities to expand the statewide supply of community health workers, nurses, and social workers.

Last Year’s Budget Included Delays and Fund Shifts to Workforce Package. To help address last year’s budget problem, the 2023‑24 budget enacted two key budget solutions to HCAI’s 2022‑23 workforce package. First, it delayed $115 million community health worker funds in the Workforce for a Health California for All initiative from 2023‑24 to 2024‑25. Second, it shifted $196 million in 2023‑24 for several behavioral health initiatives from the General Fund to the Mental Health Services Fund.

Last Year’s Budget Also Included Intent to Support Workforce Programs Using MCO Tax Funds. As we noted in our recent publication The 2024‑25 Budget: Medi-Cal Analysis, the 2023‑24 budget enacted a multiyear plan to spend funds from the renewed MCO tax. As part of this plan, the Legislature designated a portion of the associated funds to support certain health program augmentations, including health workforce programs. The augmentations generally are intended to improve access, quality, and equity in Medi-Cal and to increase the number of providers serving Medi-Cal beneficiaries. The Legislature did not determine the exact programs to support, but instead directed the administration to propose a plan for the augmentations as part of the 2024‑25 budget process.

Proposals

Delays and Reduces Funds for Certain HCAI Workforce Initiatives. As Figure 4 shows, the Governor proposes to delay or reduce spending across several limited-term workforce initiatives. The proposal impacts General Fund and Mental Health Services Fund spending. We describe the proposals further below.

Figure 4

Proposed Delays and Reductions Impact Several Initiatives

Package of Limited-Term Workforce Initiatives at HCAI

|

2022-23 |

2023-24 |

2024-25 |

2025-26 |

Total |

|

|

Spending at 2023-24 Enacted Budget |

$120 |

$311 |

$424 |

$58 |

$913 |

|

General Fund |

120 |

115 |

424 |

58 |

716 |

|

Mental Health Services Fund |

— |

196 |

— |

— |

196 |

|

Proposed Delays and Reductions in 2024-25 Governor’s Budget |

|||||

|

Workforce for a Healthy California for All |

|||||

|

Nursing |

— |

— |

-$70 |

$70 |

— |

|

Social workers |

— |

-52 |

-70 |

122 |

— |

|

Behavioral Health |

— |

||||

|

Master’s in social work programs |

— |

-$30 |

— |

30 |

— |

|

Behavioral health training programs |

— |

-52 |

— |

52 |

— |

|

Addiction psychiatry and medicine GME |

— |

-49 |

— |

49 |

— |

|

Psychiatry loan repayment (counties) |

— |

-7 |

— |

7 |

— |

|

Psychiatry loan repayment (State Hospitals) |

-$7 |

-7 |

— |

— |

-14 |

|

Totals |

-$7 |

-$196 |

-$140 |

$330 |

-$14 |

|

General Fund |

-7 |

— |

-140 |

140 |

-7 |

|

Mental Health Services Fund |

— |

-196 |

— |

189 |

-7 |

|

Total Spending at 2024-25 Governor’s Budget |

$113 |

$115 |

$284 |

$387 |

$899 |

|

General Fund |

113 |

115 |

284 |

198 |

709 |

|

Mental Health Services Fund |

— |

— |

— |

189 |

189 |

|

HCAI = Department of Health Care Access and Information and GME = graduate medical education. |

|||||

Delays General Fund Support for Healthy California Initiative. As a budget solution to help address the state’s budget problem, the Governor proposes to delay $140 million General Fund for the Workforce for a Healthy California for All initiative from 2024‑25 to 2025‑26. Under the delay, around half of the funding for nursing ($70 million) and all of the funding for social workers ($70 million) in 2024‑25 would be deferred to 2025‑26. The Governor does not propose changes to the initiative’s funding for community health workers.

Delays Mental Health Services Fund Support for Behavioral Health Initiatives. The Governor proposes to delay $189 million Mental Health Services Fund support from 2023‑24 to 2025‑26 for behavioral health workforce initiatives, including for social workers in the Workforce for a Healthy California for All initiative. The proposal would impact all but one of the initiatives that were shifted from the General Fund to the Mental Health Services Fund in last year’s budget. (The Governor proposes to eliminate the remaining initiative, described in the next paragraph.) According to the Department of Finance (DOF), the proposed delay is intended to address weaker-than-anticipated revenues and balances in the fund’s account.

Eliminates Funding for Loan Repayment Initiative. The Governor proposes to eliminate $14 million ($7 million General Fund in 2022‑23 and $7 million Mental Health Services Fund in 2023‑24) for a loan repayment initiative targeted toward psychiatrists who work at the Department of State Hospitals. A separate $14 million ($7 million General Fund in 2022‑23 and $7 million Mental Health Services Fund in 2023‑24) for loan repayments for psychiatrists at county behavioral health departments remains in the Governor’s budget, with the amount originally appropriated in 2023‑24 included in the Mental Health Services Fund delay described earlier.

Proposes to Expand Staffing to Administer Workforce Initiatives. The Governor proposes to increase the department’s permanent staffing for workforce development by 16 authorized positions (20.5 percent), bringing the total to 94.2 positions in 2024‑25. The added positions would cover a variety of activities, such as policy analysis, project and program management, and research and data analysis. According to HCAI, the cost of the staffing increase (around $2 million in 2024‑25) would be supported by its existing resources rather than new augmentations. For example, the department plans for some of the staff to replace existing spending on a limited-term contract with a private entity, which the department used for initial program start up. The department also plans to carryover unspent one-time funding over multiple years to support the positions.

Supports MCO Tax-Funded Program, With More Detail Forthcoming. The administration states that it intends to propose providing $75 million annually from the MCO tax package to support a workforce program at HCAI. To date, the administration has not released a description or proposed trailer bill legislation for the proposal.

Assessment

Given Fiscal Constraints, General Fund Budget Solutions Are Warranted. As we noted in our recent publication The 2024‑25 Budget: Overview of the Governor’s Budget, the Governor’s budget addresses a sizable budget problem. Given the magnitude of the problem, revisiting one-time initiatives is warranted. In recent years, the state has focused on supporting one-time initiatives, rather than new ongoing programs, because they could be pulled back during a budget problem without impacting core services. Moreover, pulling back one-time spending now would leave other one-time tools—such as reserve withdrawals—available to the Legislature in the future.

State’s Ability to Resume Support for Delayed General Fund Spending in Future Is Uncertain. By proposing to delay spending on HCAI workforce initiatives to the future, the Governor implicitly assumes the state will have adequate budget capacity to resume spending on these initiatives in 2025‑26. With regard to the General Fund, such an assumption may not be realistic. This is because we estimate the General Fund is likely to have significant operating deficits in the future. With lower revenues and higher ongoing spending obligations projected beyond the budget year, it may be difficult to resume support for delayed initiatives.

Further General Fund Actions Likely Will Be Needed in May. Since the release of the Governor’s budget in January, the state has received more data on tax payments. These data indicate that General Fund revenue estimates will be lower in May, relative to what the administration assumed in January. Given the state’s deteriorating budget situation, the Legislature will need to identify more solutions than those proposed by the Governor. Within HCAI, $284 million in one-time General Fund spending remains in 2024‑25 for workforce initiatives under the Governor’s budget. Also, some previously enacted one-time funds—such as the loan repayment initiative for county psychiatrists ($7 million General Fund and $7 million Mental Health Services Fund)—have not yet been spent. While pulling back funding for these initiatives could disrupt future plans, they also could avoid having to enact more significant reductions to core programs and services down the road.

Mental Health Services Fund Delays Also Warranted. Similar to the General Fund, the Mental Health Services Fund is experiencing a deteriorated condition. In particular, the fund’s revenues in 2022‑23, which primarily come from a tax on incomes over $1 million, are 21 percent lower than what was assumed in last year’s budget. This lower level of revenues results in less funding available to the state and counties over the budget window and fewer resources in the fund’s reserve. For this reason, the Mental Health Services Fund no longer appears to have the capacity to support HCAI’s behavioral health workforce initiatives in 2023‑24. That said, whether the fund would have capacity to resume funding for these initiatives in 2025‑26 is uncertain. The amount of revenue in the fund can vary notably year to year, making it difficult to project its condition.

Department’s Staffing Needs Depend on Legislative Actions Around Workforce Initiatives. In recent years, the state has expanded HCAI’s role in overseeing statewide health workforce issues and implementing workforce development programs. These expansions have come with additional staffing, with HCAI’s existing workforce development staffing levels about 60 percent higher in 2023‑24 compared to the authorized level when the 2017‑18 budget was enacted. In light of the state’s fiscal situation, the Legislature may face pressure to further delay or reduce spending on HCAI programs, likely also reducing the department’s administrative needs.

Recommendations

Consider Proposed General Fund Solutions as Starting Point. Given the size of the state’s budget problem, we recommend the Legislature adopt the proposed General Fund delays at a minimum. If the Legislature does not adopt the proposed solutions, it would need to identify a like amount of General Fund support elsewhere in the budget to reduce or delay. Also, considering additional solutions beyond those proposed by the Governor—such as reducing or delaying remaining one-time workforce funding in 2024‑25—would be prudent in light of the state’s deteriorating budget situation. In tandem, we recommend the Legislature adjust HCAI’s staffing levels to reflect its expected workload needs over the coming years, after accounting for enacted budget solutions.

Adopt Mental Health Services Fund Delays. We recommend the Legislature adopt the proposed delays in Mental Health Services Fund support for behavioral health initiatives, given the fund’s capacity constraints. That said, the Legislature likely will want to keep apprised of the fund’s condition in the future and, if capacity for behavioral health workforce initiatives remains limited, take further actions as needed.

Withhold Action on MCO Tax-Funded Initiative Until More Information Provided. Though the administration states that the Governor’s budget includes MCO tax funds for a new HCAI-administered workforce program, it has not released basic information about the proposal. In discussions with our office, the administration has stated that more information will be available at a later date. Until this time, the Legislature cannot assess the extent to which the proposed program would meet the stated goal of the MCO tax package of improving access, quality, and equity in the Medi-Cal program. Therefore, we recommend the Legislature withhold action on the proposed MCO tax-funded program until the administration provides more information on which to assess its merits. To the extent more information is not forthcoming, we recommend the Legislature use the funds to support workforce programs of its choosing, support other high-priority areas, or offset General Fund spending in Medi-Cal.

Hospital Relief Program Implementation Update

In this section, we provide an implementation update to two hospital relief programs enacted in last year’s budget. We first provide background on hospitals in California and the two relief programs. We then describe how the initiatives have been implemented to date.

Background

California Hospitals Are Operated by Many Different Entities. Hospitals in California are operated by many different entities, such as private entities, counties, health care districts, and the University of California. Most are known as “general acute care” hospitals and are licensed to provide 24-hour inpatient care for a comprehensive set of services, including medicine, nursing, and surgery. According to data from the California Department of Public Health, which licenses hospitals, there are over 400 general acute care hospitals in California. A smaller number of hospitals are licensed to provide a narrower set of specialized services, such as psychiatric care.

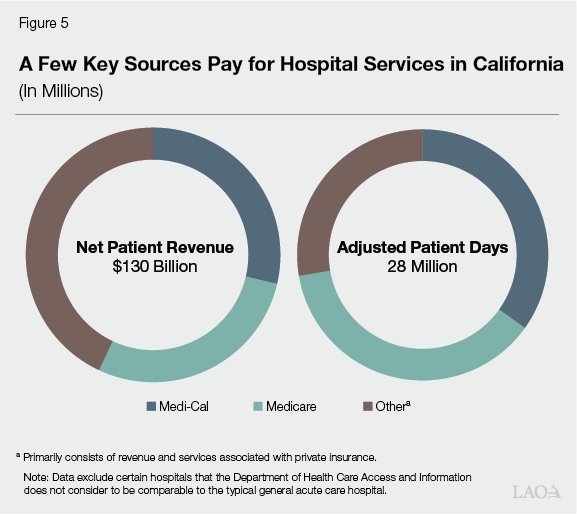

Hospitals Receive Clinical Revenues From Different Sources. To cover the cost of providing health care services, hospitals primarily rely on payments from health insurance plans and public health coverage programs. As Figure 5 shows, more than half of funding comes from Medi-Cal and Medicare, with the remainder primarily coming from private insurance. Relative to their share of hospital revenue, Medi-Cal and Medicare comprise a smaller share of adjusted patient days (the number of inpatient days, adjusted also to account for the volume of outpatient services provided). This reflects that private insurance plans tend to pay more for services than public programs. These statewide amounts also mask substantial variation among hospitals. For example, some hospitals have a greater share of patients and payments from Medi-Cal, whereas others primarily serve patients with private insurance.

Stakeholders Recently Raised Concerns Around Financial Health of Hospitals. During last year’s budget process, hospital stakeholders raised a number of concerns about the financial position of certain hospitals. While hospitals, on average, remained profitable during the pandemic, in 2022, average profits fell considerably. According to HCAI data, hospital margins (that is, the share of revenues available as profits, after netting out expenses) were 1 percent in 2022, considerably below the level in 2021 (9 percent). The fall in profits was due to expenses growing faster than revenues. News articles around this time also reported that some hospitals had filed for bankruptcy and that several others were in financial distress. In response to the above concerns, the Legislature enacted a few new programs to provide financial relief to hospitals, described further below.

State Recently Established Grant Program to Support Cost of Seismic Upgrades. As part of Chapter 489 of 2021 (SB 395, Caballero), which increased taxes on electronic cigarette products, the state created the Small and Rural Hospital Relief Program. The program provides qualifying hospitals grants to support the cost of seismic upgrades to their facilities. The program specifically is targeted to a hospital that is small, located in a rural area, or is a critical access hospital. Applicants must show that the cost of seismic safety compliance imposes a financial burden that may result in the hospital’s closure, and that such closure would substantially impact access to care in the surrounding community. Funds from the tax increase are continuously appropriated and deposited into the California Electronic Cigarette Excise Tax Fund, of which 10 percent is designated for this program.

State Also Recently Established Loan Program for Financially Distressed Hospitals. As part of early action trailer bill legislation (Chapter 6 of 2023 [AB 112, Committee on Budget]), the Legislature created the Distressed Hospital Loan Program. The program provides interest-free loans to public and private nonprofit hospitals experiencing financial distress. Hospitals that receive loans must begin repayment after the first 18 months and fully repay the loans within 72 months. The legislation also provided $150 million one-time General Fund in 2022‑23 to HCAI for the program.

MCO Tax Package Augmented Support for Hospital Relief Programs. As noted in the “Health Care Workforce Proposals” section of this post, last year’s budget enacted a multiyear plan for the MCO tax. As part of this plan, the Legislature designated $200 million one-time MCO tax funds for HCAI hospital relief programs in 2023‑24. Of this amount, $150 million was allocated to the Distressed Hospital Loan Program (bringing the total one-time amount to $300 million) and $50 million for the Small and Rural Hospital Relief Program (temporarily expanding the program above its ongoing SB 395 revenues). Because the MCO tax was conditioned on receiving federal approval, the funds were not available at the start of the 2023‑24 fiscal year. In the months before receiving federal approval (which happened in late December 2023), the legislation authorized—but did not require—DOF to provide HCAI interest-free loans from the General Fund to enable early implementation.

Implementation Update

Department Began Implementing Loan Program Shortly After Early Action. Not long after the Legislature enacted last year’s early action trailer bill legislation, HCAI began implementing the Distressed Hospital Loan Program. (HCAI contracted with the California Health Facilities Financing Authority to help administer the program.) DOF also provided HCAI a $150 million loan from the General Fund, enabling early implementation of the entire $300 million in program funding. Initial outreach to hospitals began in May and applications were submitted throughout June and July. According to the department, applications were evaluated based on a point system, with higher points awarded to hospitals with worse cash situations, lower profit margins, stronger plans to turnaround their financial situation, and greater service delivery to underserved communities. In late August, HCAI announced the loan recipients, described further below.

Department Has Awarded Loans, With Most Loan Agreements Fully Executed. According to HCAI, there were 30 applicants. Of this number, HCAI initially awarded $292.5 million in loans to 17 hospitals, using the point-based system described earlier. (The remaining $7.5 million will be used to cover administrative costs at HCAI and the California Health Facilities Financing Authority over several years.) Upon becoming eligible for loans, hospitals were required to execute a series of closing documents prior to receiving funds. As Figure 6 shows, while most hospitals have finalized these documents and received their loans, four have not yet completed this process. According to HCAI, some hospitals are involved in bankruptcy court, delaying the timing of when they can approve closing documents. In other cases, HCAI states hospitals are still working with their legal counsel to review the documents. Also, one hospital—Beverly Hospital—declined its loan offer after it was acquired by another private entity.

Figure 6

Most Hospital Loans Have Been Fully Executed

Loan Awarded in Distressed Hospital Loan Program (In Millions)

|

Hospital |

Type |

County |

Loan |

|

Loans Fully Executed |

|||

|

Tri-city Medical Center |

District |

San Diego |

$33.2 |

|

Dameron Hospital Association |

Private |

San Joaquin |

29.0 |

|

El Centro Regional Medical Center |

County |

Imperial |

28.0 |

|

Pioneers Memorial Healthcare District |

District |

Imperial |

28.0 |

|

St. Rose Hospital |

Private |

Alameda |

17.7 |

|

Martin Luther King, Jr. Community Hospital |

Private |

Los Angeles |

14.0 |

|

Chinese Hospital |

Private |

San Francisco |

10.4 |

|

San Gorgonio Memorial Healthcare District |

District |

Riverside |

9.8 |

|

John C. Fremont Healthcare District |

District |

Mariposa |

9.4 |

|

Palo Verde Hospital |

District |

Riverside |

8.5 |

|

Watsonville Community Hospital |

Districta |

Santa Cruz |

8.3 |

|

Ridgecrest Regional Hospital |

Private |

Kern |

5.5 |

|

Totals |

$201.7 |

||

|

Loans Still in Progress |

|||

|

Madera Community Hospital |

Private |

Madera |

$57.0 |

|

Kaweah Delta Health Care District |

District |

Tulare |

20.8 |

|

Hazel Hawkins Memorial |

District |

San Benito |

10.0 |

|

Sonoma Valley Hospital |

District |

Sonoma |

3.1 |

|

Totals |

$90.9 |

||

|

Total Loans Awarded |

$292.5 |

||

|

Declined Loans |

|||

|

Beverly Hospital |

Private |

Los Angeles |

$5b |

|

aPrivate hospital was purchased by a healthcare district in 2023. bAmount was rolled into Madera Community Hospital’s loan. |

|||

Much of Seismic Grant Program Has Yet to Be Implemented. In contrast to its approach for the Distressed Hospital Loan Program, DOF did not authorize a General Fund loan for the expansion of the Small and Rural Hospital Relief Program. Without having immediate access to MCO tax funds, HCAI to date has implemented the program relying solely on SB 395 funds, which have totaled $4.2 million through 2023‑24 (of which $500,000 has been spent on administrative costs). While HCAI has identified 102 hospitals that are potentially eligible for the program, only 30 have initiated the application process, and of this amount, 10 have submitted complete applications. At the time of this analysis, HCAI stated that three applicants have been approved for grants, generally supporting initial project design phases. HCAI indicates that it likely will receive more applications, as well as applications for more costly construction phases, once it is able to make the $50 million in MCO tax funds available for program grants.

Hospital Finances Appear to Be Improving on Average—but Many Hospitals Likely Have Operating Losses. Last year’s actions around hospital relief came at a time when hospital finances appeared to be tighter than in past years, with margins falling in 2022. Preliminary HCAI data suggest that hospital finances may have improved somewhat since then, with average margins ranging from around 2 percent to 5 percent in the first three quarters of 2023 (as of this publication, data on the fourth quarter in 2023 were not available). Whether this improved trend is persisting into 2024 is uncertain, as hospital margins can vary notably quarter to quarter. Also, while the statewide average has improved somewhat, there is substantial variation among hospitals. Some hospitals are faring better than the average and are quite profitable, while others are operating in the red. Moreover, some financially distressed hospitals (including some of the intended loan recipients in the Distressed Hospital Loan Program) stopped operations in 2023 due to bankruptcy, removing them from the statewide average.