Sales Tax Rate Reduction on January 1st. Proposition 30 of 2012 increased the state’s sales and use tax (SUT) and personal income tax rates. The quarter-cent SUT rate created by Proposition 30 will expire on January 1, 2017. As a result, sales tax rates in California—which vary across cities and counties, currently ranging from 7.5 percent to 10 percent—will drop into the 7.25 percent to 9.75 percent range.

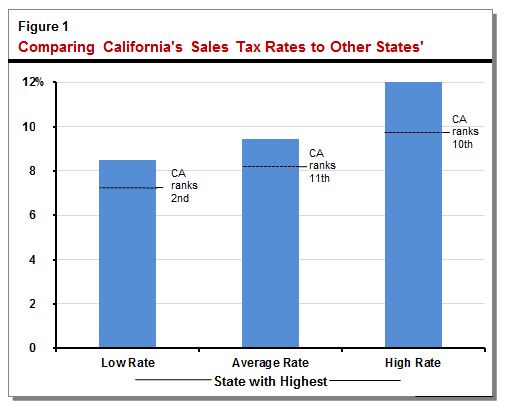

California’s SUT Rates Among Highest in U.S. The figure below compares California’s lowest, average, and highest SUT rates to other states’ rates. Each comparison generates a different ranking for California (ranging from second-highest to eleventh-highest in the nation).

-

California’s Lowest Rate Second-Highest in the Nation. On January 1st, California’s lowest SUT rate will be 7.25 percent. Tennessee’s lowest SUT rate is 8.5 percent—highest in the United States. Washington ranks third with a minimum rate of 7 percent.

-

California’s Average Rate Roughly Eleventh-Highest in the Nation. On January 1st, California’s average SUT rate will be roughly 8.2 percent—similar to the average rate in Arizona. Tennessee has the highest average rate—around 9.5 percent. (These averages weight each local area by population.)

-

California’s Highest Rate Tenth-Highest in the Nation. On January 1st, California’s highest SUT rate will be 9.75 percent, making California tenth in the nation behind Washington. Some parts of Louisiana have 12 percent rates—highest in the U.S.

Many Local Rates Will Increase Later in the Year. In the November 2016 election, voters in many parts of California passed local measures that will increase sales tax rates later in 2017. As a result, California’s average SUT rate will increase to roughly 8.5 percent, and the state’s highest SUT rate will increase to 10.25 percent. The lowest rate will remain 7.25 percent. (These changes could affect California’s rankings to some degree, depending on what happens to rates in other states.)

Follow @LAOEconTax on Twitter for regular California economy and tax updates.