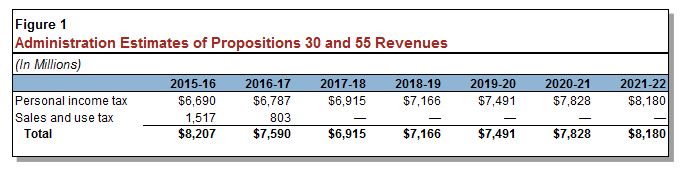

Administration's January 2017 Proposition 30/55 Revenue Estimates

February 7, 2017

The table below shows the administration's January 2017 estimates of revenues from Proposition 30 (2012) and Proposition 55 (2016) taxes. Proposition 55, passed by voters in November, extended through 2030 the Proposition 30 increases in personal income tax rates paid by the highest-income Californians. Proposition 30's statewide quarter-cent sales tax increase, however, expired at the end of 2016.

Proposition 30/55 income taxes are paid by the highest-income Californians, who receive a large portion of their income from volatile capital gains and business sources. While the increased tax rates approved by voters probably add marginally to the state's revenue volatility, it is important to note that the Proposition 30 income taxes make up a relatively small percentage of both the state's personal income tax and overall revenues. Put another way, the personal income tax in California was a fairly volatile revenue source even before Proposition 30, and the measure's tax increases probably have made that tax only marginally more volatile. To address some of this volatility, the Legislature and voters approved Proposition 2 in 2014, a measure that sets aside in budget reserves a portion of personal income taxes paid on capital gains in years when the stock market is strong.

In November, our office's Fiscal Outlook included estimates of state revenues under one scenario assuming continuing economic growth and another scenario assuming a mild recession. As we discussed then, there is no good way to make predictions about the track of the economy more than a year or two in the future. Under our November economic growth scenario, which included more personal income tax revenues (including more capital gains) than the administration now assumes in its projections, our office's Proposition 30 estimates were higher. If a recession or stock market downturn occurs, Proposition 30/55 revenues could fall well below both the administration's estimates and the economic growth scenario figures we released in November. Lower revenues, in turn, typically reduce both required state spending on schools under Proposition 98 and state reserve deposits under Proposition 2, compared to what those requirements would be otherwise.

Follow @LAOEconTax on Twitter for regular California economy and tax updates.