- All Articles Revenue Volatility

How Uncertain Are Capital Gains Revenue Estimates? May 20, 2019

We examine historical patterns of financial markets to gauge the range of possible outcomes for capital gains revenue in 2018-19 and beyond.

Gauging Risk in Capital Gains Revenue Estimates February 12, 2019

We examine historical patterns of financial markets to gauge the range of possible outcomes for capital gains revenue in 2018-19 and 2019-20.

Fiscal Outlook: Estimating Capital Gains Revenue November 14, 2018

We discuss our method for estimating capital gains revenue.

Administration's January 2017 Proposition 30/55 Revenue Estimates February 7, 2017

We display the administration's estimates for this revenue source as of January 2017.

May Revision: Capital Gains Estimates May 27, 2016

We discuss the administration's 2016 May Revision capital gains estimates, as well as our office's.

May Revision 2016: Proposition 30 Estimates May 23, 2016

We display the administration's Proposition 30 revenue estimates, as of the 2016 May Revision, as well as our office's estimates.

A Note on Economic Assumptions & State Budget Analyses May 15, 2016

We discuss the ways that economic assumptions affect state budget analyses and how policy makers and others should consider these assumptions.

Fiscal Outlook: Personal Income vs. Income Tax Projections December 11, 2015

We discuss the distinctions between our personal income and personal income tax projections.

The Stock Market Downturn and California's Finances August 28, 2015

We answer some questions we receive about California's budget and the stock market downturn of recent days.

May Revision: LAO Revenue Outlook May 16, 2015

Our office's May Revision revenue outlook anticipates billions of dollars of additional revenues in 2015-16, compared to the administration's updated projections.

FTB Spring 2015 Revenue Exhibit Data Posted May 14, 2015

The Franchise Tax Board has posted its spring "exhibit" data, which contains information used by our office and the administration to understand state income tax collections.

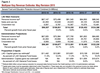

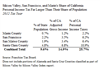

Silicon Valley, San Francisco, & Marin: CA Income Taxes February 4, 2015

A recent report on Silicon Valley discusses the region's economic growth. We consider the role that Silicon Valley, San Francisco, and Marin play in California's main state government revenue source, the personal income tax.

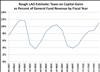

Proposition 2 Attempts to Manage State Revenue Volatility December 8, 2014

Proposition 2, passed by voters in November 2014, includes provisions intended to help manage state budget revenue volatility, principally by requiring certain state revenues to be deposited in budget reserves.

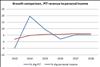

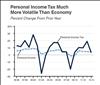

Personal Income Tax Much More Volatile Than Economy December 8, 2014

The state government's largest revenue source, the personal income tax, is much more volatile than "personal income," one key economic statistic that measures the overall size of the economy.

"Top 1 Percent" Pays Half of State Income Taxes December 4, 2014

In 2012, for perhaps the first time in state history, the top 1% of the state's tax filers paid slightly over half of the state's personal income taxes.