- All Articles Venture Capital

California Venture Capital Funding, 3rd Quarter 2021 November 5, 2021

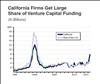

California firms raised $34.4 billion from venture capital funds in the third quarter, a new series record.

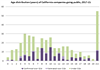

How Long Do Firms Take from Founding to IPO? August 18, 2021

It's most common for a larger firm to go public 8 to 10 years from its founding date.

California Venture Capital Funding, 1st Quarter 2021 June 10, 2021

California companies raised $30.1 billion of venture capital funding in the 1st quarter, a new record.

4th Quarter 2020 Venture Capital Funding Report February 18, 2021

California firms continued to attract VC funding at a strong pace, with $17.4 billion of new commitments in the 4th quarter of 2020.

Why is Venture Capital Funding a Useful Economic Indicator? February 18, 2021

Venture capital is a key funding source for high technology startups and other young firms.

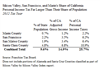

Silicon Valley, San Francisco, & Marin: CA Income Taxes February 4, 2015

A recent report on Silicon Valley discusses the region's economic growth. We consider the role that Silicon Valley, San Francisco, and Marin play in California's main state government revenue source, the personal income tax.

California Gets Very Large Share of Venture Capital Funding December 5, 2014

Venture capital investments play a key role in financing new technology firms. California--especially the Bay Area--receives a very large share of such investments.