- All Articles Corporation Tax

The 2025-26 Budget: Single Sales Factor for Financial Institutions February 13, 2025

Under current law, most multistate and multinational corporations are required to calculate their California tax liability based on the share of their nationwide sales attributable to California (known as the single sales factor). However, businesses in specific industries have an exemption allowing them to use a three-factor method that equally weights their property, payroll, and sales in California. The Governor's budget proposes to remove this exemption for financial institutions. Our assessment is that there is no clear justification for financial institutions to have an exemption from the single sales factor, either from a fair apportionment or tax incentive perspective. Therefore, our recommendation is that the Legislature approve the Governor's proposal. We also note that although this change may increase state revenues, there is limited support for the notion that a shift to single sales factor apportionment will have significant economic development effects.

The 2024-25 Budget: Temporary Corporation Tax Increases May 17, 2024

The May Revision proposes to temporarily increase corporation tax revenues by limiting the use of business tax credits and net operating loss deductions. This post analyzes those proposals. We think the proposal to limit use of tax credits is worth serious consideration. On the other hand, the proposal to limit net operating loss deductions raises concerns. In response, we suggest the Legislature consider alternative ways to raise revenue should it wish to pursue revenue solutions.

An Update on California Competes March 10, 2023

We look at recent program statistics and research on California Competes.

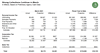

October Tax Collections November 17, 2022

Although October colletions from the state's “big three” tax revenues—personal income, corporation, and sales taxes—came in far ahead of Budget Act assumptions, this is not indicative of better than expected revenue performance for 2022-23 overall. Instead, a closer look at the data shows that the recent trend of revenue weakness continued in October.

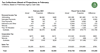

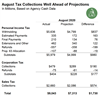

August 2021 State Tax Collections September 20, 2021

Through the first two months of the 2021-22 fiscal year, collections from the state’s three largest taxes are running 20 percent ($3.6 billion) ahead of budget projections.

The 2021-22 Budget: May Revenue Outlook May 17, 2021

This post provides commentary on our May Outlook revenues.

March 2021 State Tax Collections April 28, 2021

March collections from the state’s three largest taxes—the personal income tax, corporation tax, and sales tax—exceeded projections by $2.5 billion (30 percent).

February 2021 State Tax Collections March 22, 2021

February gross revenue collections from the state’s three largest taxes were ahead of budget projections by $1.6 billion (14 percent).

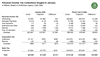

January 2021 State Tax Collections February 12, 2021

Revenue collections through January have been well ahead of projections in the recently released 2021-22 Governor’s Budget. After accounting for changes in constitutionally-required spending, we estimate that these higher-than-expected collections represent a roughly $4 billion increase in discretionary state funding relative to the Governor’s Budget.

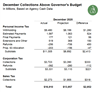

December 2020 State Tax Collections January 20, 2021

December revenue collections from the state’s three largest taxes were ahead of Governor’s Budget projections by $3.0 billion (21 percent).

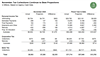

November 2020 State Tax Collections December 16, 2020

November revenue collections from the state’s three largest taxes were ahead of budget projections by $2.4 billion (33 percent).

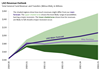

2021-22 Fiscal Outlook Revenue Estimates November 18, 2020

We discuss the main revenue forecast in our 2021-21 Fiscal Outlook.

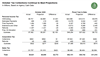

October 2020 State Tax Collections November 13, 2020

October revenue collections from the state’s three largest taxes were ahead of budget projections by $2.8 billion (40 percent).

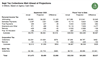

September 2020 State Tax Collections October 19, 2020

September collections from the state’s three largest taxes were ahead of budget projections by $4 billion (42 percent).

August 2020 State Tax Collections September 17, 2020

August revenue collections from the state’s three largest taxes were ahead of budget projections by $1.7 billion (24 percent).