- All Articles Poverty

Census Bureau Poverty Statistics Published September 12, 2017

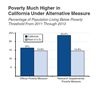

According to the Supplemental Poverty Measure, which considers the cost of housing and other factors, California's poverty levels are much higher than in the rest of the country.

2015 Census Data on Incomes September 15, 2016

We discuss new Census data on a variety of topics, including household incomes.

Poverty in California: Recently Released Census Data September 13, 2016

We discuss a new Census Bureau report on state poverty rates, including its Research Supplemental Poverty Measure.

Data on Real Income Growth Trends by Percentile, 1990-2014 September 6, 2016

We discuss a new piece, published in a major national publication, that uses Census Data to examine changes in real incomes by percentile at the state level between 1990 and 2014.

Census Bureau's Updated Poverty Statistics September 24, 2015

Last week, the U.S. Census Bureau released updated poverty statistics for states indicating that 16.4 percent of Californians—more than 6 million people—were poor in 2014. This poverty rate is down slightly from the 2013 rate of 16.8 percent, but remains higher than in the rest of the U.S.

May Revision: Earned Income Tax Credit Proposal May 17, 2015

We discuss the Governor's May Revision proposal for a state earned income tax credit (EITC).

State and Local Governments With Their Own EITCs January 6, 2015

We provide links to other states' and localities' tax agencies that administer their own EITCs.

Prior California EITC Legislative Proposals December 18, 2014

Bills to create a state EITC in California have been introduced in the Legislature before. None have been enacted into law.

Key Resources Concerning Federal EITC December 18, 2014

We provide information on some key resources concerning the federal earned income tax credit.

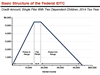

What is the Federal Earned Income Tax Credit? December 18, 2014

The federal EITC is a major tax program whose purpose, over time, has moved toward increasing the rewards for paid work and reducing poverty.

Compared to U.S., California Incomes Higher and More Spread Out December 4, 2014

Incomes are greater for California households than in the rest of the U.S. Incomes are more spread out as well, in that there is a larger gap between high-income and very low-income households.

Poverty Higher in California Than in Rest of U.S. December 4, 2014

Particularly under a newer U.S. government poverty measure, the Research Supplemental Poverty Measure, California's poverty rate is much higher than that of the rest of the country.