- All Articles Tax Expenditures

The 2025-26 Budget: Partial Income Tax Exclusion for Military Retirement Income February 13, 2025

The Governor proposes to exclude from state income taxation up to $20,000 in annual military retirement benefits. The exclusion would be available to individuals with income below $125,000 ($250,000 for joint taxpayers.) Our assessment is that the economic and fiscal rationale for this proposal is weak. Nonetheless, we recognize that other factors often are relevant to the Legislature’s decisions. In assessing the administration’s proposal, the Legislature will need to decide if these other factors are enough to support this tax change. If the Legislature simply wants to provide limited tax relief to veterans, that might also improve veterans’ perceptions of the state, it could adopt the administration’s proposal. If the Legislature instead prefers that this tax expenditure have a clear economic or fiscal rationale, it could reject the administration’s proposal.

Evaluating Tax Policy Changes in the Governor's Budget February 22, 2024

The Governor’s budget includes several proposed tax policy changes. We recommend approving proposals to eliminate certain tax expenditures for fossil fuel companies and conform to federal law on tax deductions for open space and historical preservation. We also suggest, in light of the state’s fiscal situation, seriously considering the proposal to eliminate lenders’ ability to claim tax deductions or refunds for sales tax payments made with bad debt. Finally, we recommend rejecting the proposal to limit the use of net operating loss deductions.

An Update on California Competes March 10, 2023

We look at recent program statistics and research on California Competes.

An Update on California's Film Tax Credit Programs July 22, 2019

We discuss the use of the California film tax credit programs to date.

How Will Aging Baby Boomers Affect Future Property Tax Revenues? June 20, 2017

A coming surge in home sales by aging homeowners should boost local government property tax collections. These gains, however, are likely to be offset by an increase in the transfer of homes from parents to children which, unlike most home sales, does not trigger higher tax payments.

May Revision: Earned Income Tax Credit Proposal May 17, 2015

We discuss the Governor's May Revision proposal for a state earned income tax credit (EITC).

FTB Spring 2015 Revenue Exhibit Data Posted May 14, 2015

The Franchise Tax Board has posted its spring "exhibit" data, which contains information used by our office and the administration to understand state income tax collections.

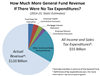

California State Tax Expenditures Total Around $55 Billion February 19, 2015

In response to questions received during a January Senate budget hearing, we examine California's General Fund tax expenditures: tax deductions, credits, exclusions, and the like that reduce revenues below what they would be otherwise.