- All Articles Property Tax

January 2025 Los Angeles Wildfires Impact on Local Property Tax Revenues February 10, 2025

The devastating Los Angeles County fires of January 2025 destroyed thousands of structures, causing significant damage and displacement. This post assesses the implications for property tax revenues. The county faces a $10 billion to $20 billion reduction in assessed property values, estimated to result in a $100 million to $200 million annual property tax revenue loss to affected local governments. The governor's executive order delays tax payments for 218,000 properties until April 2026. By themselves, we expect these delays will have minimal long-term fiscal impacts.

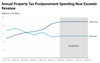

The 2024-25 Budget: Property Tax Postponement Program February 29, 2024

The Governor proposes to use $7.5 million General Fund on a one-time basis to support the Property Tax Postponement (PTP) program. The PTP program has a structural deficit, very low participation, and relatively high administrative costs. We recommend the Legislature (1) direct the State Controller's Office to report at budget hearings to provide an update on the PTP program and (2) consider eliminating the program.

LAO May Outlook: Home Prices May 12, 2019

A summary of the home price growth estimates in our May outlook.

LAO May Outlook: Growth in Assessed Property Values May 12, 2019

A summary of the assessed property value growth estimates in our May outlook.

Were Local School Bond Measures Impacted By Recent Federal Tax Changes? November 30, 2018

We look at data from the 2018 primary and general elections to see if recent federal tax changes had a noticable effect on voters willingness to approve property tax increases to fund school facilities.

Fiscal Outlook: Property Tax Estimates Exceed Budget Expectations November 14, 2018

Our new Fiscal Outlook projects that school property taxes will be higher than assumed in the 2018-19 Budget Act.

Fiscal Outlook: Property Taxes Exceed Budget Expectations November 15, 2017

Our new Fiscal Outlook projects that school property taxes will be notably higher than assumed in the 2017-18 Budget Act.

How Will Aging Baby Boomers Affect Future Property Tax Revenues? June 20, 2017

A coming surge in home sales by aging homeowners should boost local government property tax collections. These gains, however, are likely to be offset by an increase in the transfer of homes from parents to children which, unlike most home sales, does not trigger higher tax payments.

Fiscal Outlook: Examining Property Tax Growth Rates November 16, 2016

We examine reasons behind lower-than-expected growth in assessed property values.

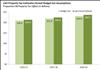

Proposition 13 Report: More Data on California Property Taxes September 22, 2016

We provide additional data on trends in California's property taxes since the passage of Proposition 13 in 1978.

Property Assessment Rules for Businesses September 7, 2016

This blog post explains reassessment requirements for real property, focusing on the reassessment requirements for properties owned by legal entities.

May Revision: Property Tax Estimates May 23, 2016

We discuss our estimates of local property taxes, which affect the state's school funding requirements, as well as the administration's property tax estimates.

Santa Cruz Libraries: A Case Study in Local Control March 1, 2016

In the mid-1990s, the state allowed Santa Cruz County enterprise districts' property tax revenue to be redirected to a supplemental fund supporting county libraries.

Enterprise Services: Similar Functions, Different Funding February 18, 2016

We explore how the property tax allocation decisions from the mid-1970s affect funding for local airport services even now in the Lake Tahoe region.

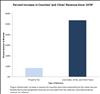

Consequences of the Property Tax Allocation System February 10, 2016

This post explores some of the consequences of basing today's local government property tax shares on choices made in the 1970s.