This is the seventh blog post in our series California’s Property Tax: Where Does Your Money Go? As we discussed in our earlier post, local governments’ property tax shares were set in the late 1970s. Moreover, these shares only change under certain circumstances (described here). Today’s post explores some of the consequences of basing today’s property taxes on choices made in the 1970s.

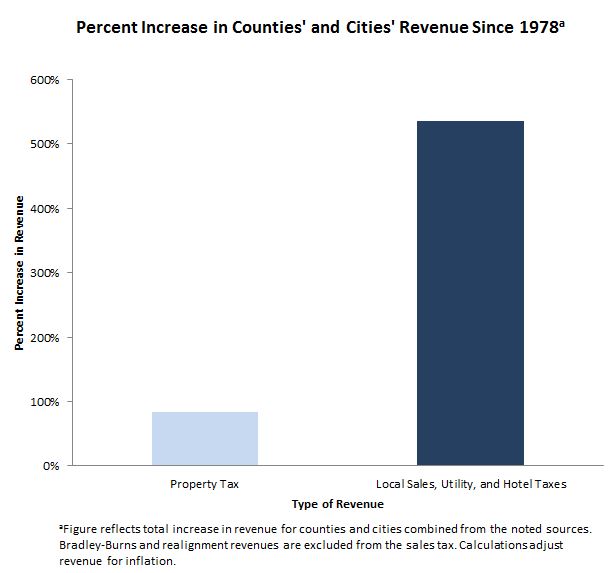

Local Governments Cannot Increase Their Share of the Property Tax to Provide Additional Services. Proposition 13 directed the state to allocate property tax revenue from the 1 percent rate. As we discussed in our earlier post, this took away local governments’ control over their property tax rates. As a result, local governments cannot increase their share of the 1 percent rate in order to provide more services. Moreover, as we discussed in our another post, local governments that offer similar services may receive quite different proportions of the property tax collected within their boundaries. While local governments’ property tax revenue typically increases year-to-year due to increases in assessed value, often these increases are not sufficient to cover the cost of offering additional services or cover the cost of growing expenses. As a result, local governments use other forms of revenue—like local sales, utility, and hotel taxes—to raise additional revenue to offer more services. As shown in the figure below, since the passage of Proposition 13, counties’ and cities’ revenue from these three alternative sources of revenue increased over 500 percent, while property tax revenue increased roughly 80 percent.

Local Governments Can Reduce Their Services and Keep Their Property Tax Shares. Sequoia Health Care District was the first health care district formed in California. Health care districts are a type of special district that provide health care services to their communities, including operating hospitals, skilled nursing facilities, clinics, and ambulance services. From 1950 until 1996, the district operated Sequoia Hospital. When the district ran the hospital, property tax revenue supported the hospital’s operations and patient services. In 1996, the district sold the hospital to a private provider. Today, the district grants the majority of its property tax revenue to other health care organizations in the county. The remaining portion of its property tax revenue supports a few wellness programs, including programs at local schools and a series of courses on living a healthful lifestyle. This year, Sequoia Health Care District expects to receive over $10 million in property tax revenue. Statewide, roughly 20 percent of health care districts use some portion of their revenue to give grants to other service providers in the community.

Seldom Used State Law Allows Local Governments to Lower Their Property Tax Rates Voluntarily. State law allows local governments to reduce their property tax revenue if they so choose. Doing so reduces the local government’s share of the property tax and therefore lowers the property tax rate property owners within the local government’s boundaries pay. This means property owners pay a rate below the 1 percent rate maximum set by Proposition 13.

To receive email notices of future posts in this series, email the LAO's local government analyst, Carolyn Chu.

Follow @LAOEconTax on Twitter for regular California economy and tax updates.