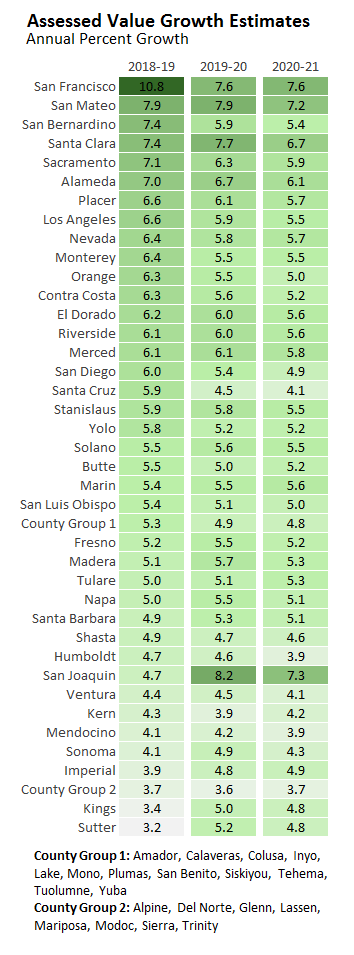

Property taxes are a primary revenue source for cities, counties, special districts and schools. Growth in local government property tax revenue is driven by growth in the taxable value of property—or assessed value. The table below displays our estimates of assessed value growth for 2019-20 and 2020-21 for most counties in the state. Statewide, we anticipate assessed value growth will decline from 6.5 percent in 2018-19 to 6 percent in 2019-20 and further to 5.6 percent in 2020-21. We discuss the methodology used to develop our estimates in this prior post.