Were Local School Bond Measures Impacted By Recent Federal Tax Changes?

November 30, 2018

In December 2017, Congress passed a package of changes to federal personal income tax and corporation tax laws. Among these changes was a new limit on a widely used personal income tax deduction: the State and Local Tax (SALT) deduction. Under prior law, itemizing taxpayers (about one-third of all taxpayers) could deduct the amounts they paid for local property taxes plus either state income taxes or state and local sales taxes. (Most itemizing taxpayers deduct state income taxes and local property taxes.) Under the new law, these deductions are limited to $10,000 per year beginning in 2018.

Previously, if a taxpayer claimed the SALT deduction, each dollar paid in state income taxes and local property taxes would lead to some amount of federal income tax savings. This, in effect, reduced the taxpayer’s cost of paying state income taxes and local property taxes. Now, state income tax or local property tax payments beyond $10,000 result in no federal income tax savings. This means that taxpayers who pay more than $10,000 in state and local taxes now face a higher cost for any increases in their state income taxes and local property taxes. This could discourage people from taking actions that would increase their state income taxes or local property taxes.

One way this effect could play out is that voters may become less willing to approve local property tax increases to pay for school facilities bonds. Our review of school bond measure outcomes from the 2018 primary and general elections, however, finds little evidence that changes in the SALT deduction affected school bond measure outcomes.

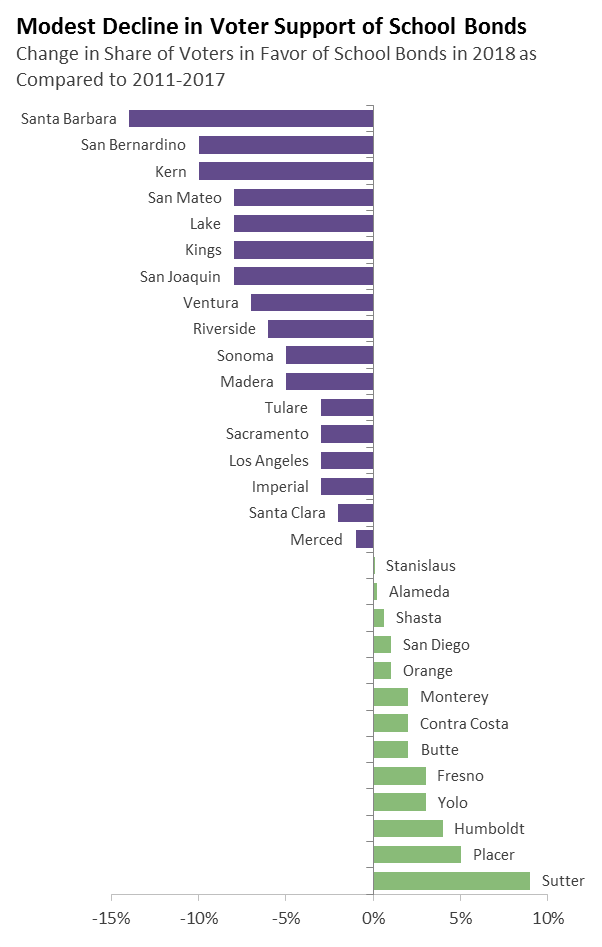

Between 2011 and 2017, voters decided over 550 local school bond measures. Eighty five percent of these measures passed, with an average of 64 percent of voters in favor. (Virtually all of these measures required 55 percent voter approval in order to pass.) In 2018, voters decided 134 measures. Similar to past years, 85 percent of measure passed. There was, however, a slight dip in the share of voters in favor, with the average measure receiving yes votes of 62 percent. This modest decline in voter support can be seen in the graphic below. For 30 counties that had at least one measure during the period 2011-2017 as well as in 2018, the graphic shows the difference between the average share of voters in favor in 2018 and the average share in favor between 2011 and 2017. As the graphic shows, 17 counties had a decline in the share of voters in favor, while 13 counties saw an increase.

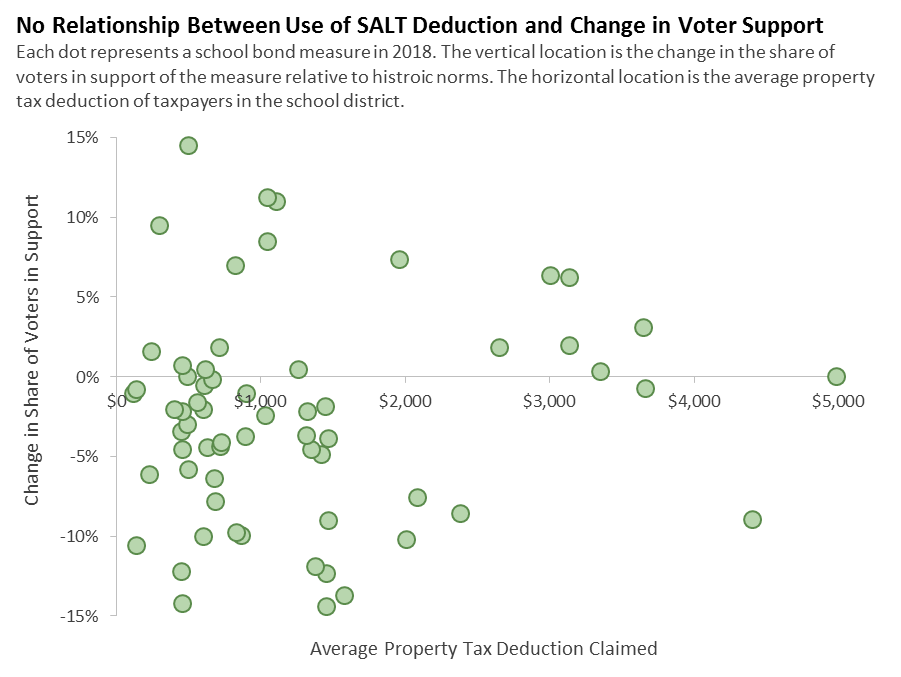

Looking a little more closely at the 2018 bond measure outcomes suggests that the modest decline in voter support was not related to the changes in the SALT deduction. In general, if the decline in support were due to the SALT changes, we would expect to see a larger decline in support in school districts where voters claimed a larger property tax deduction and, therefore, were more likely to be affected by the SALT changes. This does not appear to be the case. The graphic below shows individual school bond measures in 2018, with each dot representing a measure. The vertical location of the dot shows how the share of voters in support changed in 2018 relative to historical norms. (We define the historical norm as the voter support a measure in a district with similar voter demographics and political party registration typically received between 2011 and 2017.) The horizontal location shows the average property tax deduction claimed by taxpayers in the school district. As the graph shows, there appears to be no obvious relationship between changes in voter support and use of the SALT deduction.

One potential reason that the SALT deduction changes do not appear to have affected bond measure outcomes is that it may take more time for taxpayers to learn of the recent changes and adjust their behavior accordingly. Another possible reason is that only a minority California taxpayers were impacted by the changes. About 30 percent of California taxpayers claimed the SALT deduction prior to the change in federal law. Of those that claimed the SALT deduction, only about half paid more than $10,000 in state and local taxes.