- All Articles Property Tax Blog Series

Santa Cruz Libraries: A Case Study in Local Control March 1, 2016

In the mid-1990s, the state allowed Santa Cruz County enterprise districts' property tax revenue to be redirected to a supplemental fund supporting county libraries.

Enterprise Services: Similar Functions, Different Funding February 18, 2016

We explore how the property tax allocation decisions from the mid-1970s affect funding for local airport services even now in the Lake Tahoe region.

Consequences of the Property Tax Allocation System February 10, 2016

This post explores some of the consequences of basing today's local government property tax shares on choices made in the 1970s.

Can Local Governments' AB 8 Shares Change? February 5, 2016

Local governments' shares of the property tax were set by the laws that implemented Proposition 13. In this post, we examine the conditions under which these shares change.

Why the Mid-1970s Play a Large Role in Property Taxes Today January 27, 2016

Why is it that one of the primary factors determining property tax revenues for California local governments is how much that government received in the mid-1970s?

Four Factors Affecting Cities' Property Tax Revenues January 13, 2016

This post, the fourth in our property tax series, discusses the primary factors affecting a city government's proportion of the total property taxes collected within its boundaries.

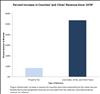

Differences in Property Tax Revenue for Counties, Cities & Special Districts January 6, 2016

We examine the revenue from California's 1 percent property tax that is available for a subset of local governments.

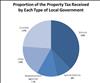

Local Governments' Services & Their Property Tax Revenue December 16, 2015

We discuss the distribution of property taxes to the various types of California local governments.

Understanding Your Property Tax Bill December 9, 2015

What are the different charges on a California property tax bill?