This is the eighth blog post in our series California’s Property Tax: Where Does Your Money Go?. Over the past weeks, our posts have described how the property tax decisions of the mid-1970s continue to influence property taxes today. This post explores how those decisions affect funding for local airport services now in one part of the state.

Special districts provide a variety of services to their residents. Often, special districts’ services could alternatively be provided by a city or county. For instance, in the city of Santa Barbara, fire protection is provided by the city. In other parts of Santa Barbara County, however, fire protection is provided by special districts. Below, we examine airport services provided by a special district, a city, and a county.

Two Types of Special Districts. Special districts fall into two categories: enterprise districts and non-enterprise districts. Enterprise districts operate similarly to a business, charging customers for their services, like water. Non-enterprise districts provide more general benefits to the community, like parks. Statewide, roughly one-quarter of special districts can charge fees for their services and therefore are considered enterprise districts. Some of these enterprise districts also receive property tax revenue, which can lower the fees to their customers. In cases where a city or county provides an enterprise service, the city or county can charge fees for those services as well. Cities and counties also have the option of supporting enterprise services with General Fund revenue to lower the fees, similar to an enterprise district receiving property tax revenue.

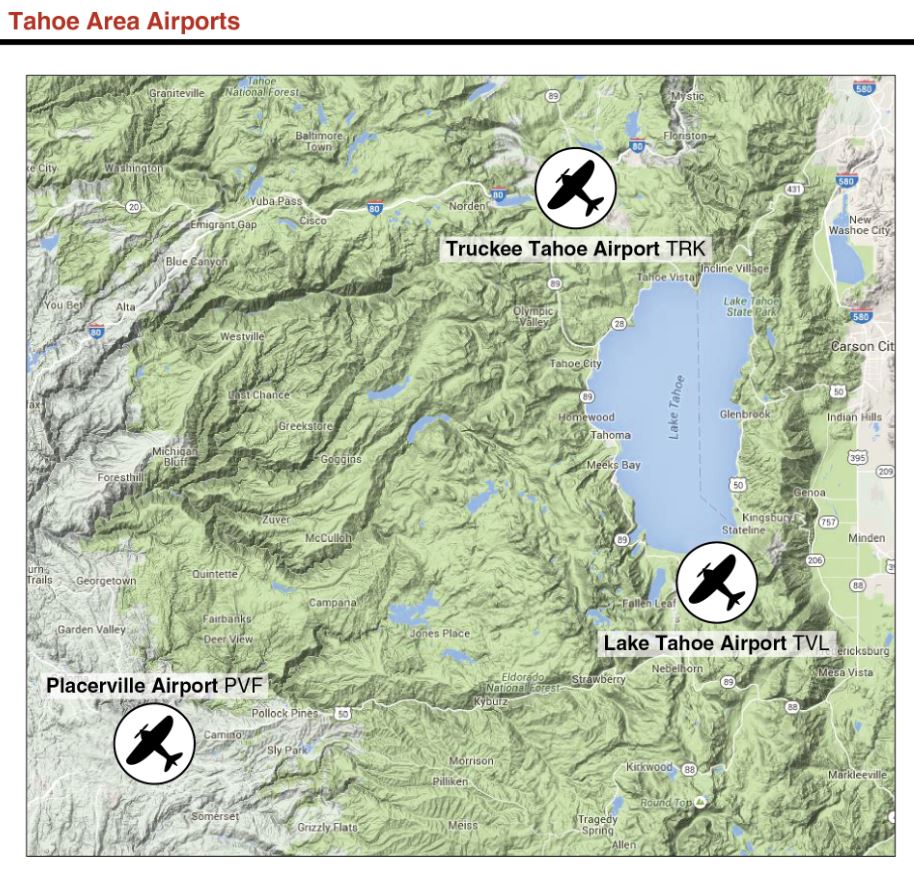

Three Airports Serve the Lake Tahoe Area. As seen in the figure below, Placerville Airport (PVF), Lake Tahoe Airport (TVL), and Truckee Tahoe Airport (TRK) all serve the greater Lake Tahoe area. El Dorado County established both PVF and TVL in 1929 and 1958, respectively. Today, El Dorado County continues to manage PVF, but TVL is operated by the City of South Lake Tahoe. Whereas PVF and TVL are managed by a county and a city, voters in Placer and Nevada Counties established TRK as an enterprise special district in 1958. As an independent special district, TRK is managed by an elected board. (The boundaries of the special district include areas within both Placer and Nevada Counties.)

Map data: Google.

All Three Airports Provide General Aviation Services. General aviation includes all civilian flying except scheduled passenger flights. For example, charter flights are considered general aviation. Generally, the three airports can serve similar aircraft. According to the Federal Aviation Authority, PVF received the most overall traffic last year, averaging 160 landings per day. TRK and TVL airports averaged roughly 100 and 65 landings per day, respectively. Of the three airports, TRK likely receives the most larger aircraft (or jet) traffic, which can require more runway maintenance.

All Three Airports Charge Fees. To support the operations of the airports, all three charge fees to visiting aircraft. The fees include landing fees, hanger fees, tie-down fees, and fuel fees. These fees, however, currently are not sufficient to cover the full cost of operating the airports.

All Three Airports Receive “Outside” Revenue. Because fees do not cover the full cost of operating the airports, each airport receives “outside” revenue. PVF and TVL each receive General Fund revenue from their local governments (as discussed above, PVF is managed by El Dorado County and TVL is managed by the city of South Lake Tahoe). General Fund revenue from their local governments can come from a variety of sources, but counties’ and cities’ primary source of revenue is the 1 percent property tax.

TRK Receives Substantially More Outside Revenue. Over 40 percent—or roughly $4 million—of TRK’s revenues are from property taxes. (TRK receives significant property tax revenue because it is a special district that levied a property tax rate prior to Proposition 13 and therefore continues to receive a share of the 1 percent rate today.) In contrast, PVF and TVL receive less than 10 percent of their revenue—roughly $40,000 and $100,000, respectively—from their local governments’ General Funds. While TRK receives property tax revenue directly, PVF and TVL must compete with the other services offered by their local governments for support. That is, the property tax revenue El Dorado County and South Lake Tahoe receive support a broad range of services—not just the airports. Thus, El Dorado County and South Lake Tahoe must weigh providing more General Fund support to their airports against other municipal services to their residents. Because TRK does not compete for its property tax in this way, the district can use its property tax revenue to lower fees or update equipment and facilities more frequently. On the other hand, because TRK receives a share of the 1 percent property tax, there is slightly less property tax revenue available for other local governments in Placer and Nevada Counties.

Residents Cannot Easily Shift Property Tax Revenue. As we discussed in our earlier post, the property tax revenue local governments receive largely is based on the property taxes they levied in the mid-1970s. Today, there are some mechanisms by which local governments’ shares of the property tax can change. Residents cannot easily make these changes directly, however. Rather, to shift a portion of a special district’s property taxes to another local government likely would require a change in state law. These kinds of changes to state law are infrequent, but can happen. We will discuss one such example in a future post.

To receive email notices of future posts in this series, email the LAO's local government analyst, Carolyn Chu.

Follow @LAOEconTax on Twitter for regular California economy and tax updates.