- All Articles FTB

FTB Data: County Income Distributions, 2013 September 12, 2016

We discuss the distribution of incomes across almost all of California's counties based on data from 2013 personal income tax returns filed with the state's Franchise Tax Board.

Additional Data: FTB Income Distributions for Each Available County September 12, 2016

In this post, we display graphics displaying the 2013 income before deductions, as reported in state tax data, for each available California county. This post accompanies an explanatory note on these income distributions here.

Some History on April FTB Tax Collections April 18, 2016

To help enhance readers' understanding of how to track April California income tax collections, we offer some data concerning the recent history of the month's tax collections at the California Franchise Tax Board.

FTB Spring 2015 Revenue Exhibit Data Posted May 14, 2015

The Franchise Tax Board has posted its spring "exhibit" data, which contains information used by our office and the administration to understand state income tax collections.

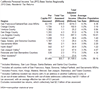

2013 FTB Data: Personal Income Tax Base Varies Regionally April 30, 2015

The Franchise Tax Board has released data on taxes paid and income reported on 2013 California personal income tax returns by county.

FTB December 2014 Revenue Exhibits Posted January 28, 2015

The Franchise Tax Board's twice-yearly revenue exhibits are highly technical, but include key information for those who track and forecast California's state income tax revenues.