FTB December 2014 Revenue Exhibits Posted

January 28, 2015

The Franchise Tax Board (FTB) is one of California's tax agencies. FTB plays a principal role in administering the income taxes that fund a very large portion of the state budget: the personal income tax (PIT) and the corporation tax (CT).

Revenue Estimating Exhibits. One of the lesser-known roles played by FTB is to assist the Department of Finance (DOF), our office, and other legislative staff and Members by providing income tax data that is essential to making estimates about budgetary revenues and the effects of tax legislation. For our office and DOF, an important FTB function is providing twice-yearly "revenue estimating exhibits" that include various, often highly technical, updates on PIT and CT trends from prior years. FTB recently posted online its most recent exhibits, those from December 2014. (Earlier revenue estimating exhibits are listed on FTB's Reports, Plans, and Statistics webpage under "Revenue Estimating Exhibits.")

Among key pages of the December 2014 exhibits are:

- Exhibit A-3, Page 1 of 2: PIT tax credits with credit amounts over $10 million in 2013. (Separate publications from FTB and DOF display information on other "tax expenditures" for both PIT and CT.)

- Exhibit A-9, Page 1 of 2: Changes in PIT income composition for California resident tax returns from 1988 through 2012.

- This shows, for example, that the "top 5 percent" of PIT returns had adjusted gross income (AGI) of $206,063 or greater in 2012.

- The top 5% reported $463 billion (40%) of $1.14 trillion in total reported AGI in California in 2012.

- The top 5% reported $92 billion (95%) of $97 billion in total reported capital gains income in 2012.

- For the top 5%, the share of their annual reported income made up of capital gains has fluctuated widely from 8.5% in 2009 to up to 30% during the dot-com boom.

- Exhibit A-10, Page 5 of 5: This figure shows that an average of 46.3% of capital gains classified as stock trading gains and reported on California resident tax returns relate to investments held for 2 years or less. This is a key reason why capital gains income taxes fluctuate based on year-to-year trends in stock prices.

- Exhibit B-4, Page 1 of 2: Major CT tax credits.

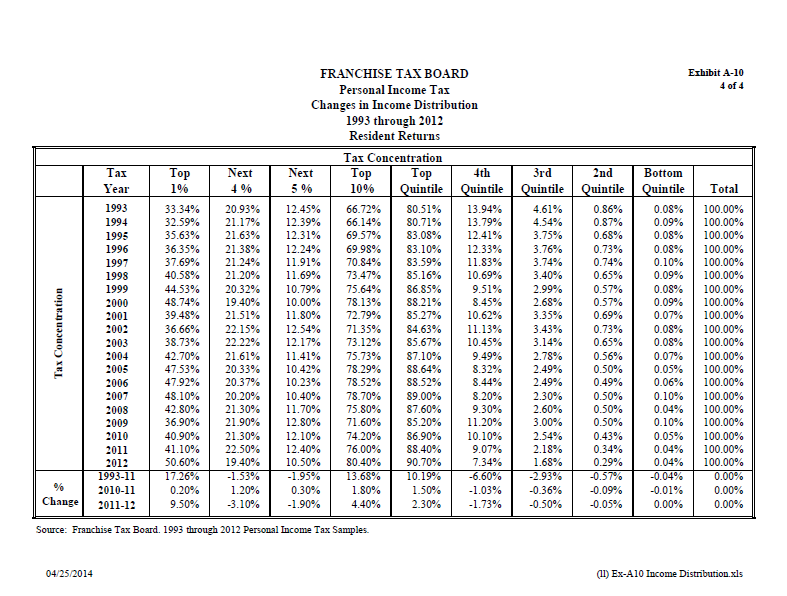

FTB's May 2014 revenue estimating exhibits contain information on the share of the state's PIT paid by the top 1% of PIT filers (see Exhibit A-10, Page 4 of 4, in the May exhibits, as excerpted below).