- All Articles Silicon Valley

2025 Update: Tech Company Stock Pay Accounts for One-Quarter of Withholding Growth So Far in 2025-26 December 3, 2025

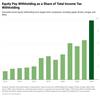

California's technology companies, including Apple, Google, Nvidia, Meta, and Broadcom are the most valuable companies in the world and employ thousands of highly-paid workers in the state. Many employees at these companies receive equity pay, such as stock options and restricted stock units, in addition to their base salary. As we first pointed out two years ago, state income tax withholding on stock pay has grown to more than $10 billion annually due to the AI boom in asset prices for these companies. With updated data through 2025Q3, we now believe growing withholding from these sources accounted for a quarter of the strong income tax withholding growth seen in the first three months of 2025-26.

Update: Tech Company Equity Pay Driving Withholding in 2024 November 20, 2024

California's technology companies, including giants like Apple, Google, Nvidia, and Meta, are some of the most valuable companies in the world and support thousands of high-paying jobs in the state. Many employees at these companies receive equity pay, such as stock options and restricted stock units, in addition to their base salary. As we first pointed out a year ago, state income tax withholding on equity pay has grown notably in recent years due to the AI boom in asset prices for these companies. With updated data from early 2024, we now believe withholding from these sources reached about 10 percent of all income tax withholding during the first half of 2024.

How Does Tech Company Equity Pay Affect Income Tax Withholding? November 16, 2023

California's technology companies, including giants like Apple, Google, Nvidia, and Meta, are some of the most valuable companies in the world and support thousands of high-paying jobs in the state. Many employees at these companies receive equity pay, such as stock options, as part of their compensation. State income tax withholding on this equity pay has grown notably, reaching 6 percent in the last few years. The recent jump in these companies' stock prices, which affects withholding on equity pay, has bolstered otherwise weak income tax withholding during 2023.

Recent Trends in Housing Affordability June 22, 2017

We look at recent trends in housing affordability in some of California's largest metropolitan regions.

October 2016 State Jobs Report December 1, 2016

We recap the October 2016 state jobs data, which was released in November.

September 2016 Jobs Report November 5, 2016

We discuss data from the September 2016 state and metro area jobs report, most of which was released during the month of October.

FTB Data: County Income Distributions, 2013 September 12, 2016

We discuss the distribution of incomes across almost all of California's counties based on data from 2013 personal income tax returns filed with the state's Franchise Tax Board.

Additional Data: FTB Income Distributions for Each Available County September 12, 2016

In this post, we display graphics displaying the 2013 income before deductions, as reported in state tax data, for each available California county. This post accompanies an explanatory note on these income distributions here.

July 2016 State Jobs Report August 31, 2016

We discuss California's July 2016 statewide jobs data, as reported by federal and state labor agencies on August 19, 2016.

June 2016 State Jobs and Other Data August 5, 2016

We discuss the report on California employment and unemployment in June 2016, which was released on July 22, and some more recent data too.

May Revision 2016: Economic Outlook May 15, 2016

We discuss the state's economic outlook, including the administration's assessment of the near-term economic outlook in the Governor's May Revision to his 2016-17 budget proposal.

March 2016 Jobs Report: Unemployment Down, Slow Growth in Payroll Jobs April 15, 2016

We discuss the March 2016 jobs report, released by the California Employment Development Department and the U.S. Bureau of Labor Statistics.

County Economies: California Arguably Doing Better Than Recent Report Suggests January 26, 2016

We discuss a recent National Association of Counties report on county economies.

Dec. 2015 Jobs Report: Continuing Job Growth January 22, 2016

The Employment Development Department (EDD) has released December 2015 preliminary jobs data for California.

November 2015 Jobs Report December 18, 2015

The U.S. Bureau of Labor Statistics and California's Employment Development Department have released preliminary November 2015 jobs data for the state.