- All Articles Jobs

Monthly Jobs Report (December) January 30, 2026

Payroll Employment Now Lower Than it Was a Year Ago. California's traditional jobs report shows the state lost 2k jobs in December after gaining 31k jobs in November. The November figures were the first meaningful statewide job gains since May. With this month's figures, the state has technically lost employment overall since a year ago, a first since the pandemic began. Employment numbers from a secondary source, a household survey of workers, have trended more positive since September but are set to be revised substantially with next month's data release.

California Labor Market Showing Broad Signs of Weakness September 30, 2025

The state's topline jobs report paints a worrisome picture about the labor market: businesses have shed 20,000 jobs so far this year and more workers report being unemployed. This post brings in new data, including a rise in layoffs and the number of long-term unemployed workers, moderating recent wage growth, and a hiring slowdown in one key growth sector (government jobs), that show broader signs of softness and raise the possibility that the labor market has weakened further in the past few months.

Early Data Revision Shows No Job Creation During 2024 Q4 June 24, 2025

Since mid-2022, the state's monthly jobs survey has tended to overestimate actual employment growth. The newest incoming data (from the fourth quarter of 2024) show the monthly survey again overstating employment. Specifically, the most recent match to administrative records shows the survey overestimated job creation from last September through December by roughly 100,000 jobs (preliminary survey gain of 102,000 relative to net loss of 1,000 jobs).

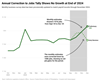

Annual Revision to Monthly Jobs Survey Shows Far Fewer Job Gains in 2024 March 21, 2025

Each year, the U.S. Bureau of Labor Statistics revises the state's jobs numbers to match actual payroll records from businesses. The latest revisions updates the survey data through September 2024 and lowered California job gains from 260k to 60k over the year. The corrected data show the state's labor market grew just 0.3 percent between September 2023 and September 2024, while the preliminary monthly reports had showed the labor market roughly in line with the rest of the country (about 1.5 percent) over that period.

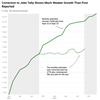

Data Revisions Shows Monthly Survey Again Overstating Job Growth December 16, 2024

Since mid-2022, the state's monthly jobs survey has tended to overestimate actual employment growth. The data revision from the first quarter of 2024 gave some hope that this pattern was correcting, but the newest incoming data show the monthly survey again overstating employment. Specifically, the most recent match to administrative records shows the survey overestimated job creation from March through June this year by roughly 150,000 jobs (preliminary survey gain of 68,000 relative to matched net loss of 78,000 jobs).

California's Private-Sector Labor Market Showing Broad Weakness July 1, 2024

The state's modest job growth over the past two years is a tale of two labor markets. Hiring in public and publicly supported sectors has bouyed job losses in many of the state's high-paying private sectors. While job losses have hit California, nationally these private-sector industries are faring much better.

Newest Early Jobs Revision Shows No Net Job Growth During 2023 June 17, 2024

A newly released "early benchmark" of the official state jobs figures shows that payroll jobs declined by 32,000 from September 2023 through December 2023, whereas the official state tally showed growth of 117,000 jobs over that period. With the fourth quarter early revision, calendar year 2023 shows essentially no net job gains.

Annual Revision Shows State Added Few Jobs Last Year March 13, 2024

Each year, the U.S. Bureau of Labor Statistics revises the state's jobs number to match actual payroll records from businesses. The latest revision lowered its count of California jobs by 1.5 percent. The corrected data show that the state added just 50,000 jobs between September 2022 and September 2023, while preliminary monthly reports had showed the labor market growing by more than 300,000 jobs.

Updated Unemployment Insurance Fund Forecast Shows Structural Deficit January 16, 2024

The administration's most recent Unemployment Insurance (UI) Trust Fund forecast shows that UI benefit payments will exceed state payroll tax receipts by $1.7 billion in 2024, after surpassing receipts by $1.3 billion in 2023. As a result, the state's outstanding UI loan from the federal government is set to increase over the next two years, despite automatic employer payroll tax increases to repay the loan.

Holiday Hiring Sluggish January 3, 2024

October and November holiday season retail job growth remained relatively weak for the second year in a row. One plausible explanation for this weakness might be the continued transition to online holiday shopping, but transportation and warehousing jobs (where goods and packaged and delivered) has also been sluggish this holiday season.

July 2022 Jobs Report August 22, 2022

California added 84,800 jobs in July, about twice the level of recent months. Job gains for June were revised upward as well, from 19k to 37k.

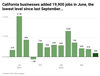

June 2022 Jobs Report July 25, 2022

California businesses added 19,900 jobs in June, about half as much as recent months and the slowest gain since last September.

May 2022 Jobs Report June 20, 2022

California businesses added 42,900 net jobs in May (seasonally adjusted), about the same as April and another month of slower job growth than seen in the past year.

April 2022 Jobs Report May 20, 2022

California employers added 41,400 net jobs in April (seasonally adjusted), the smallest net gain in the past six months.

March 2022 Jobs Report May 11, 2022

California employers added 60,200 jobs net jobs March (seasonally-adjusted), a 4.2 percent increase on an annual basis.