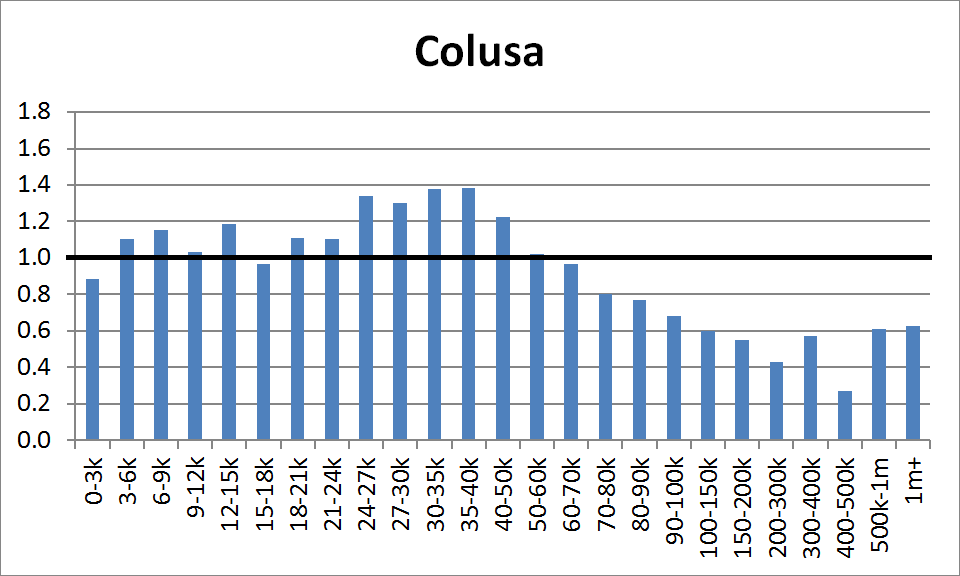

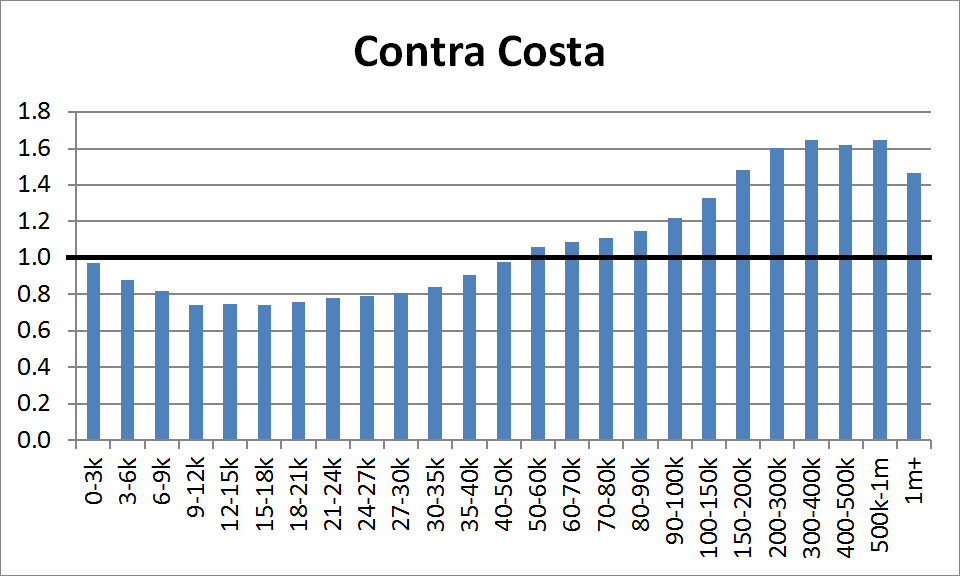

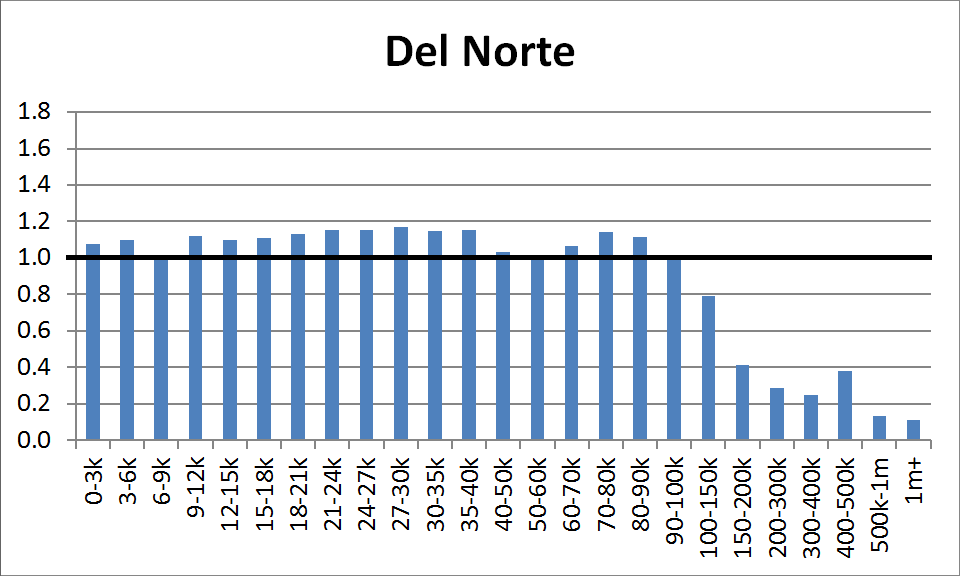

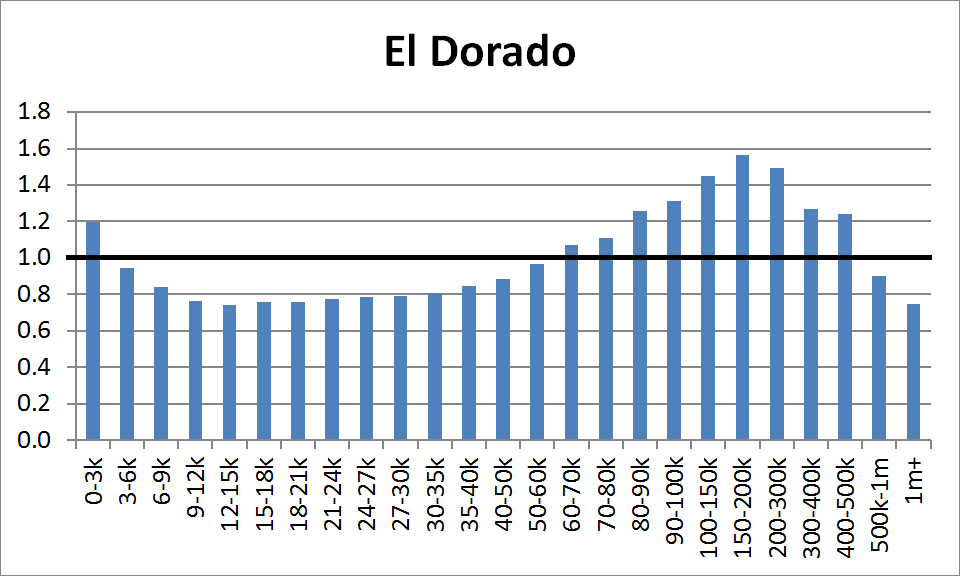

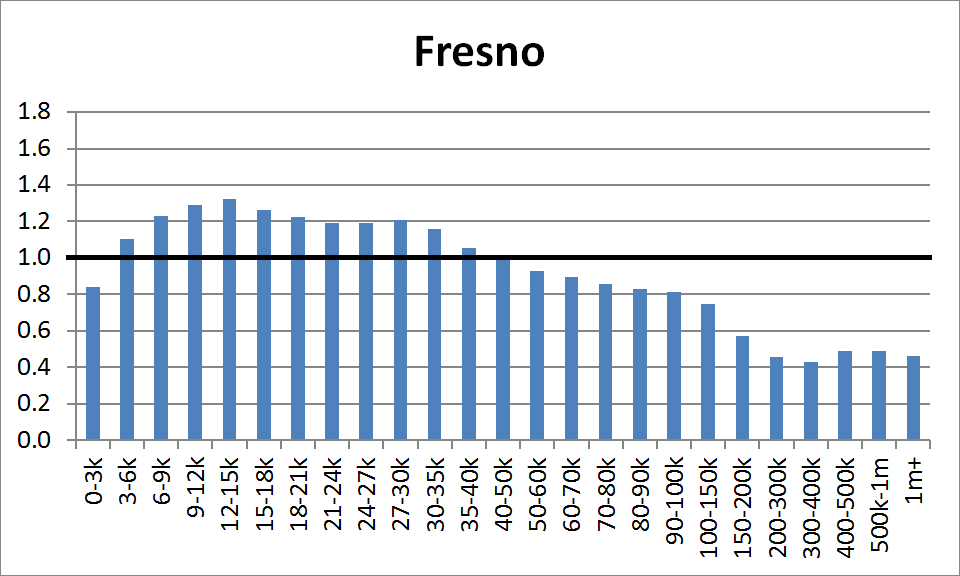

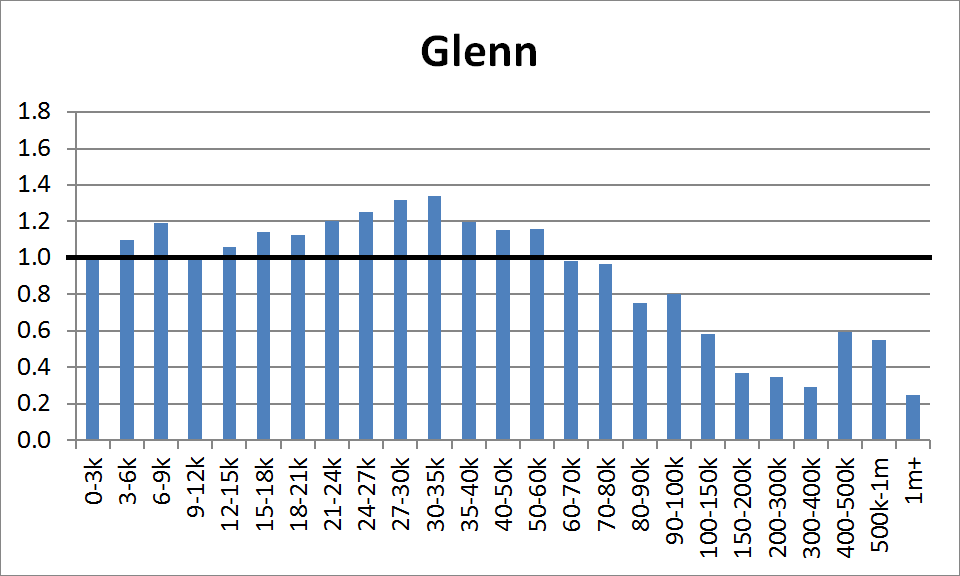

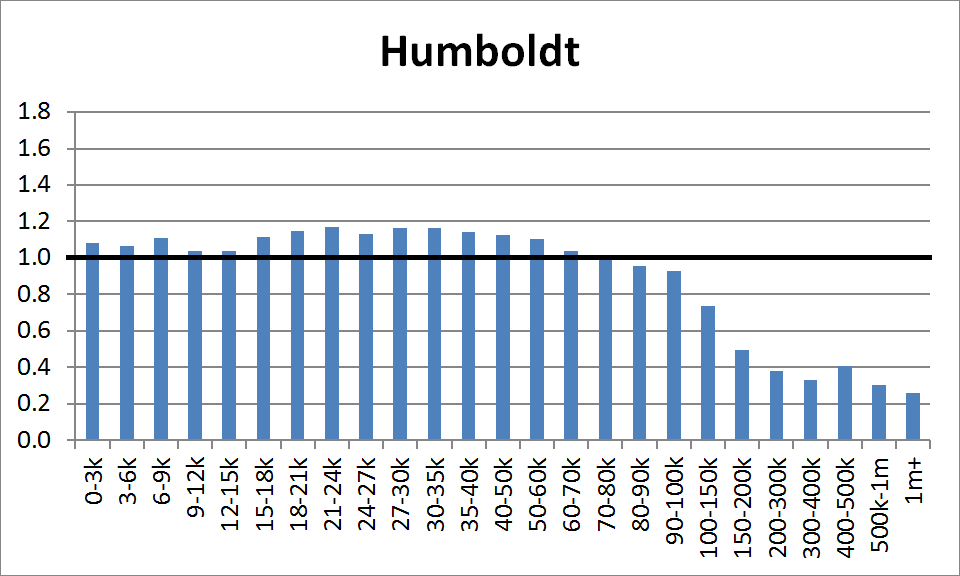

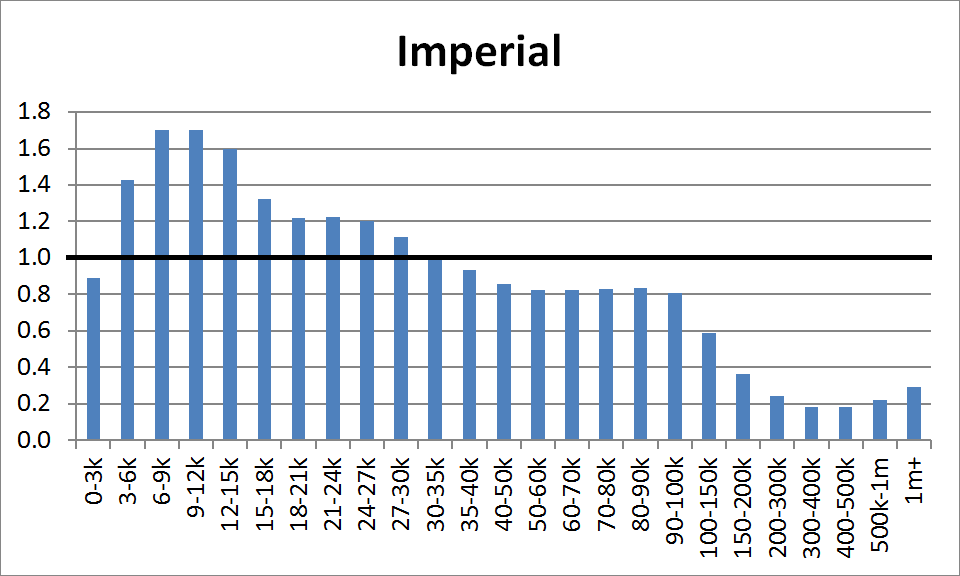

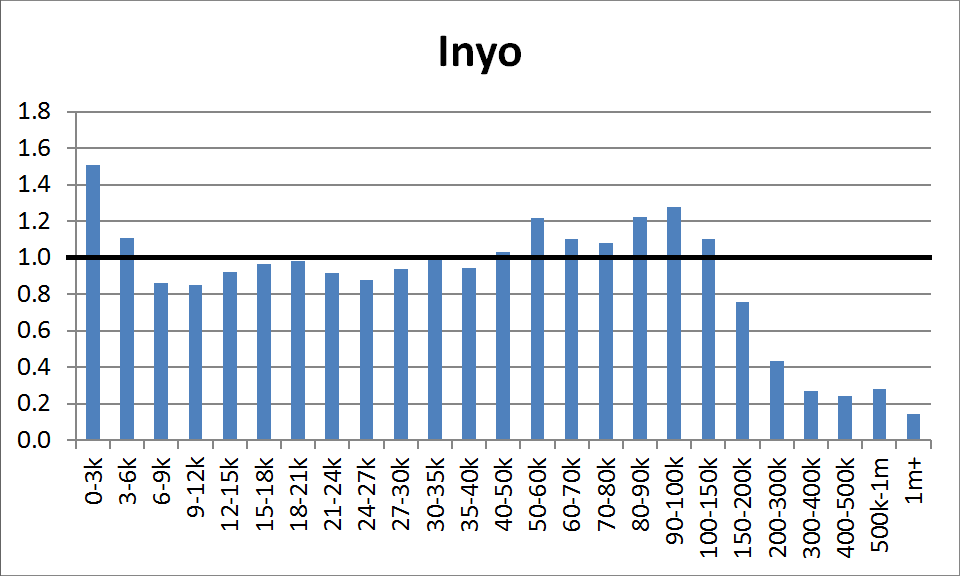

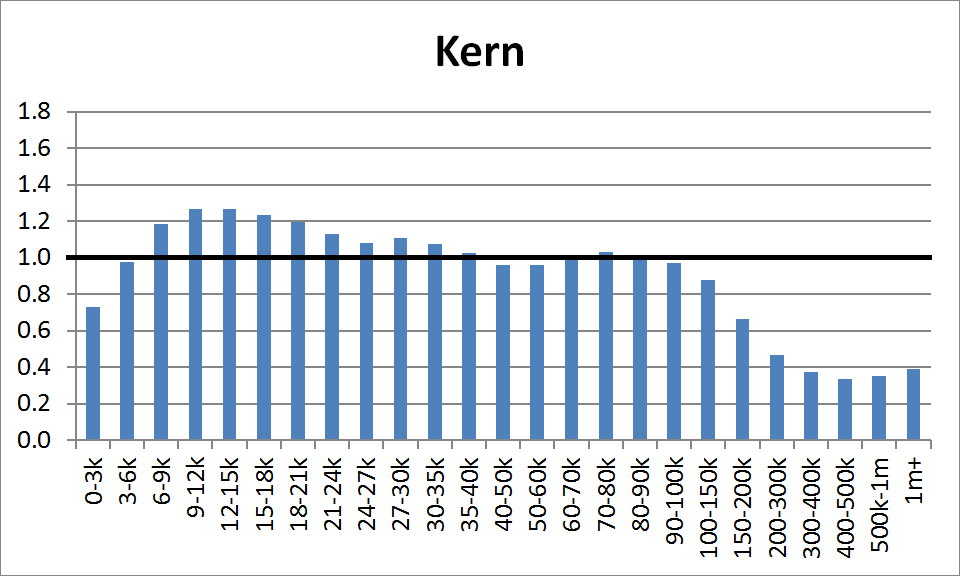

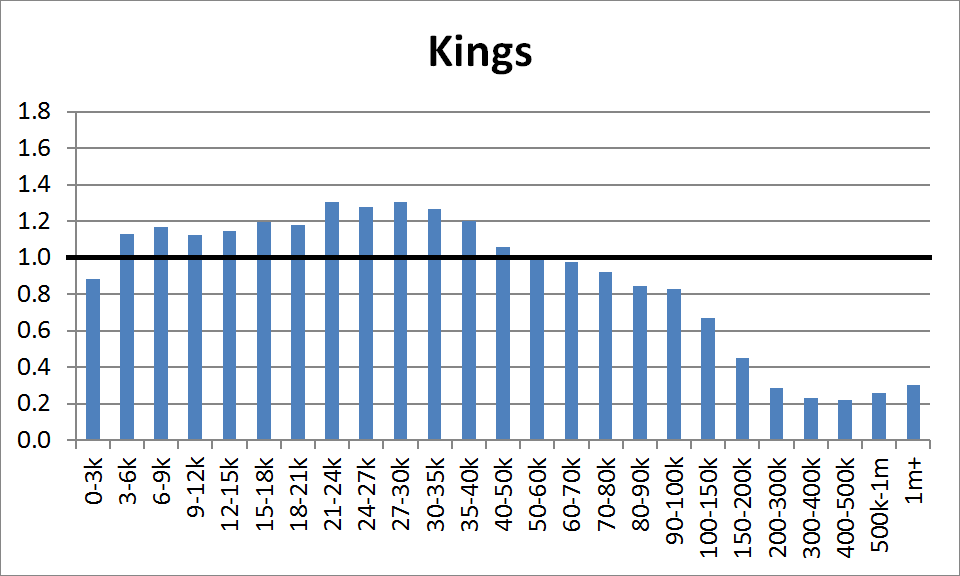

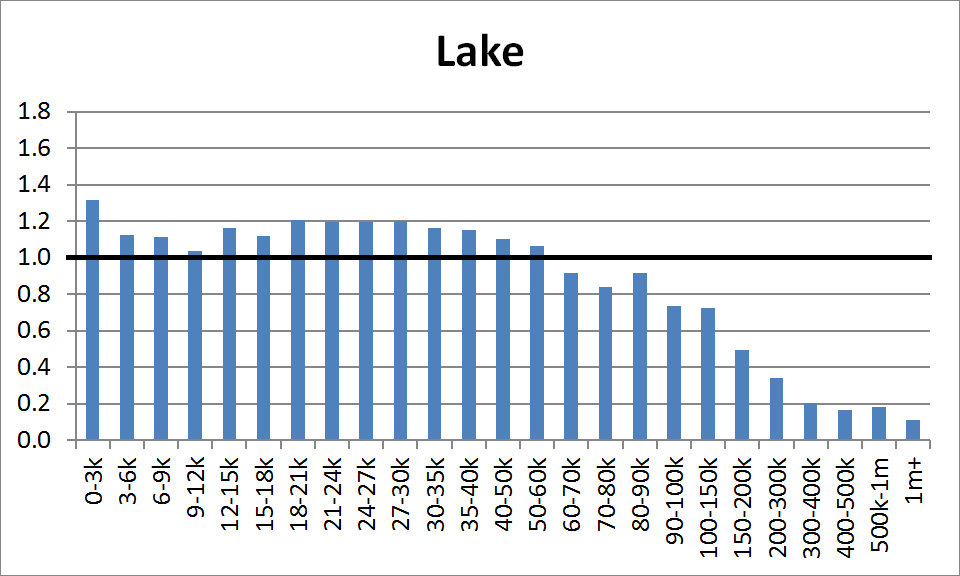

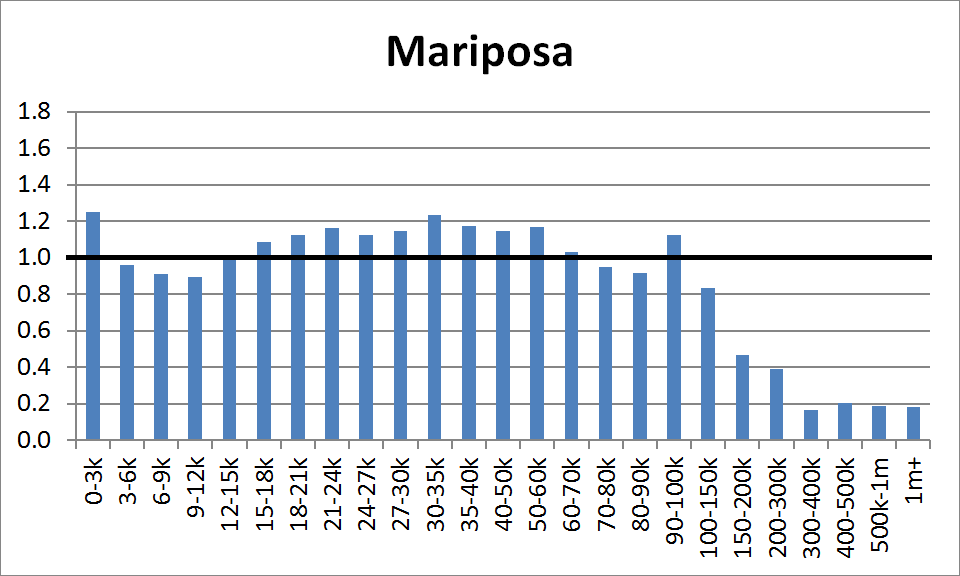

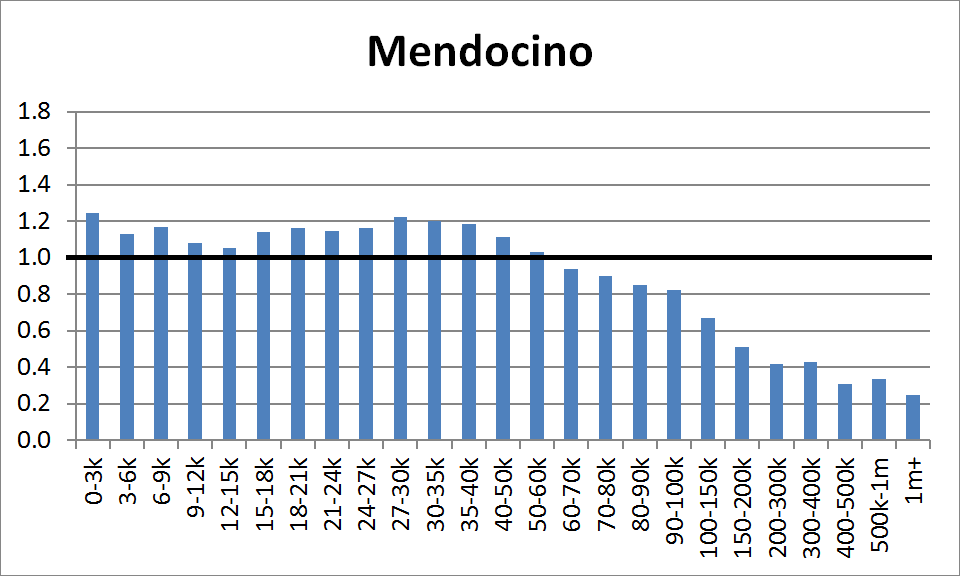

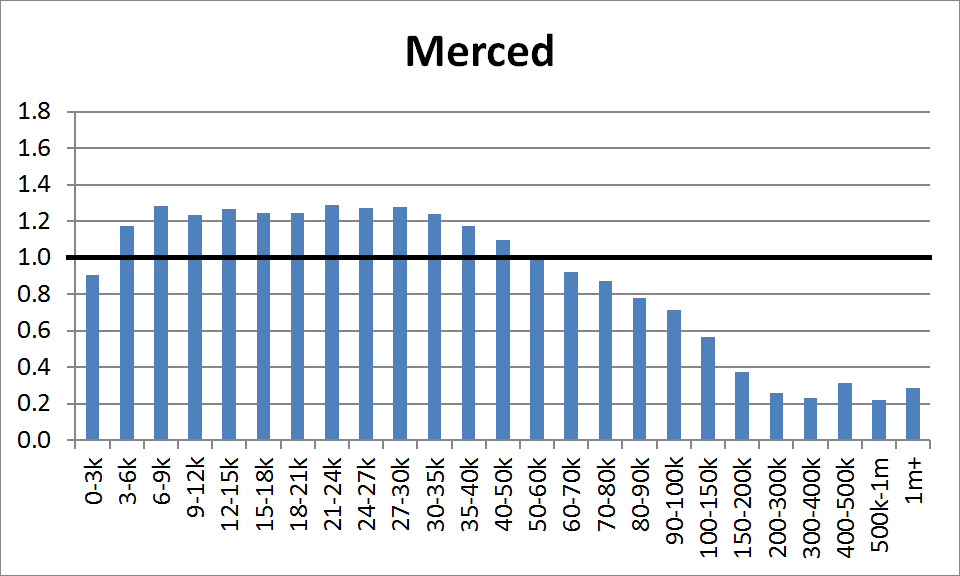

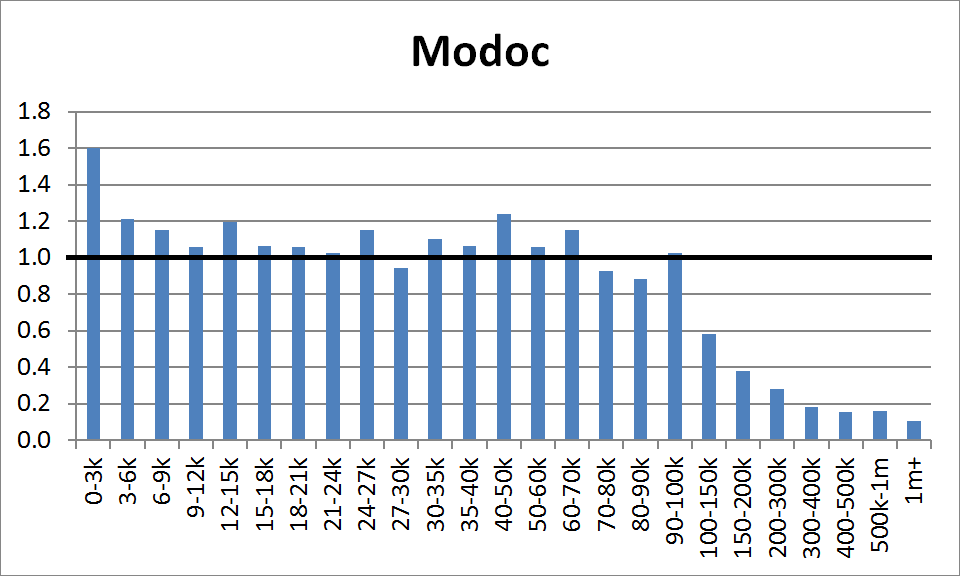

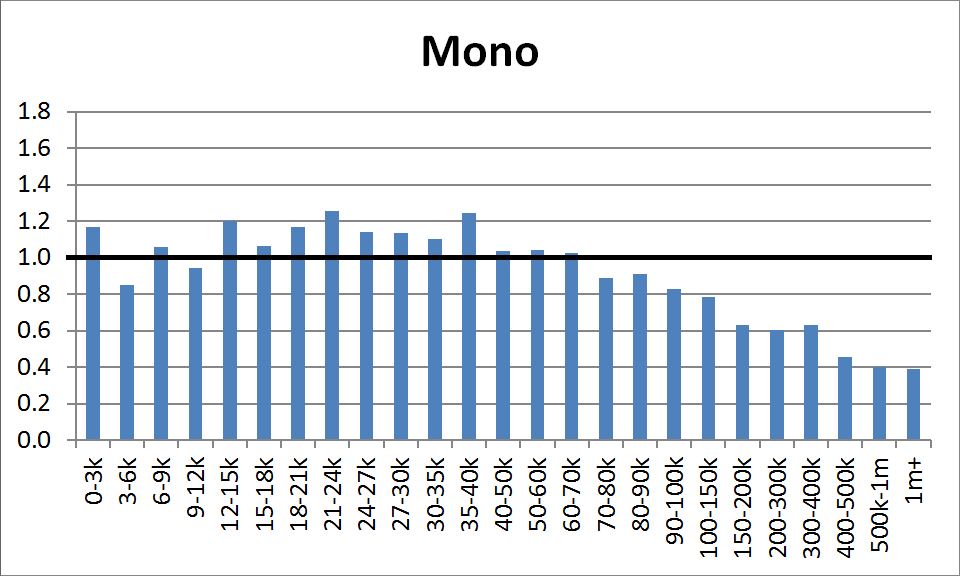

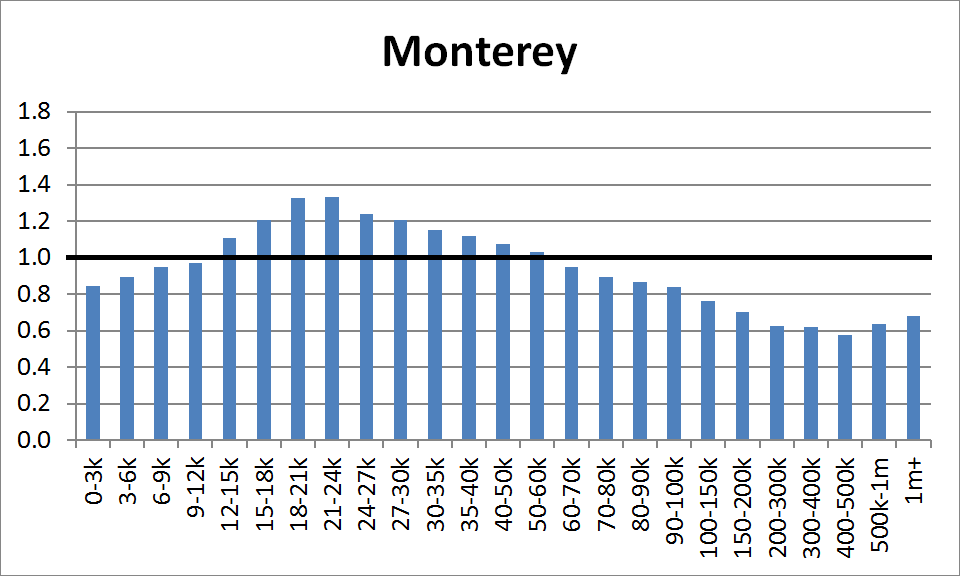

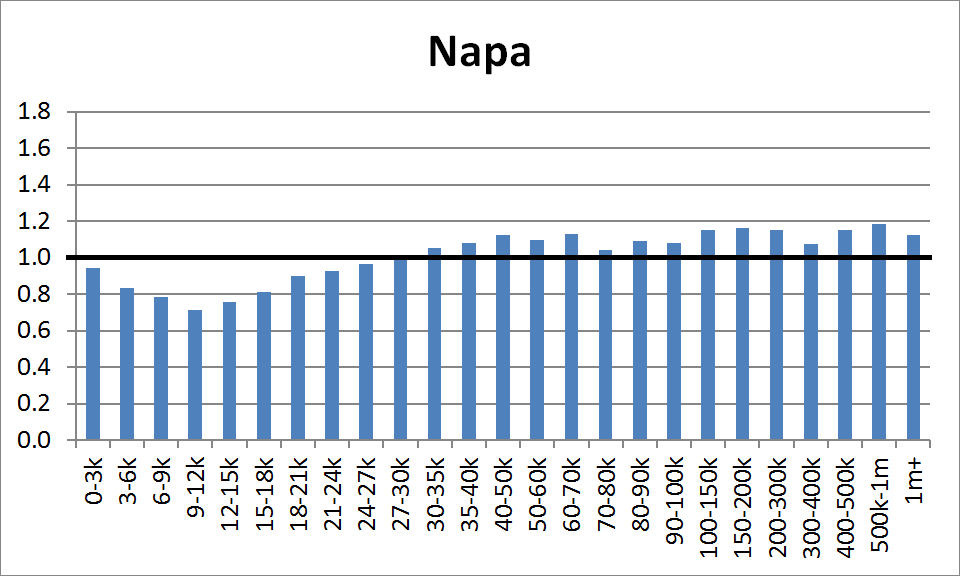

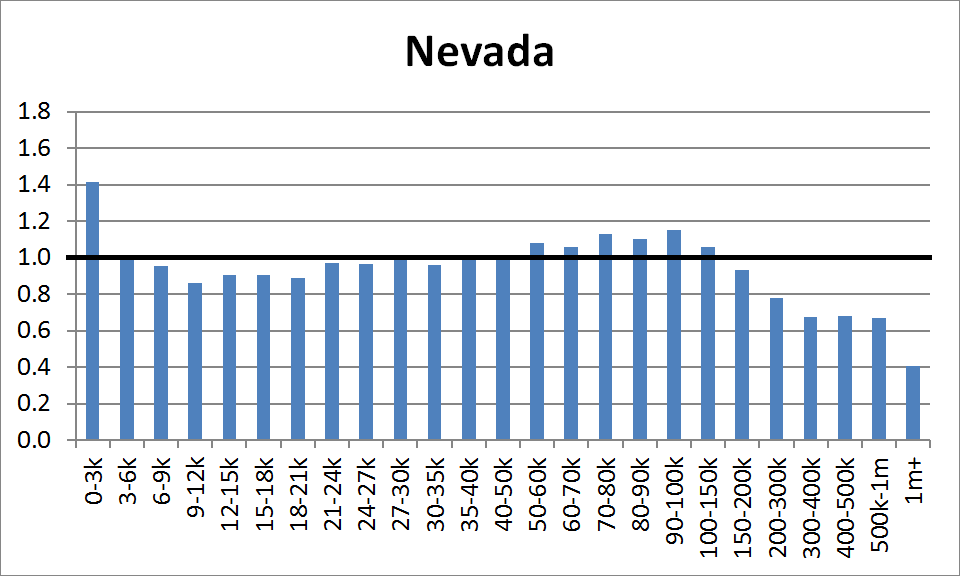

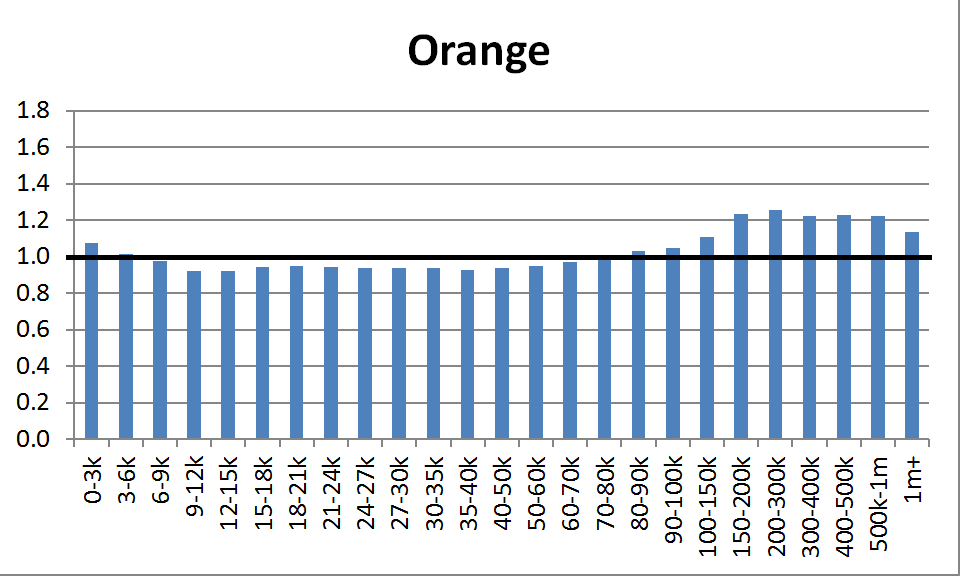

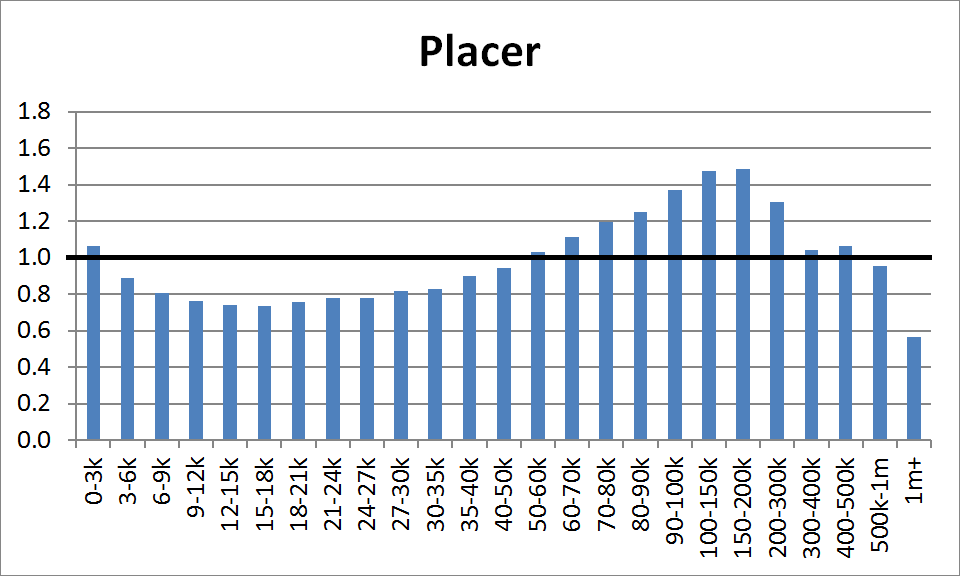

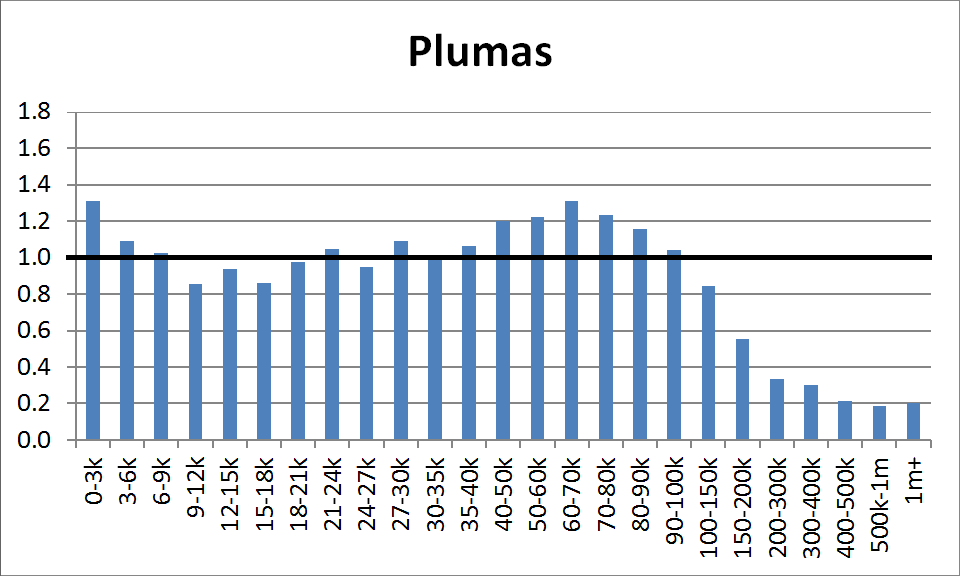

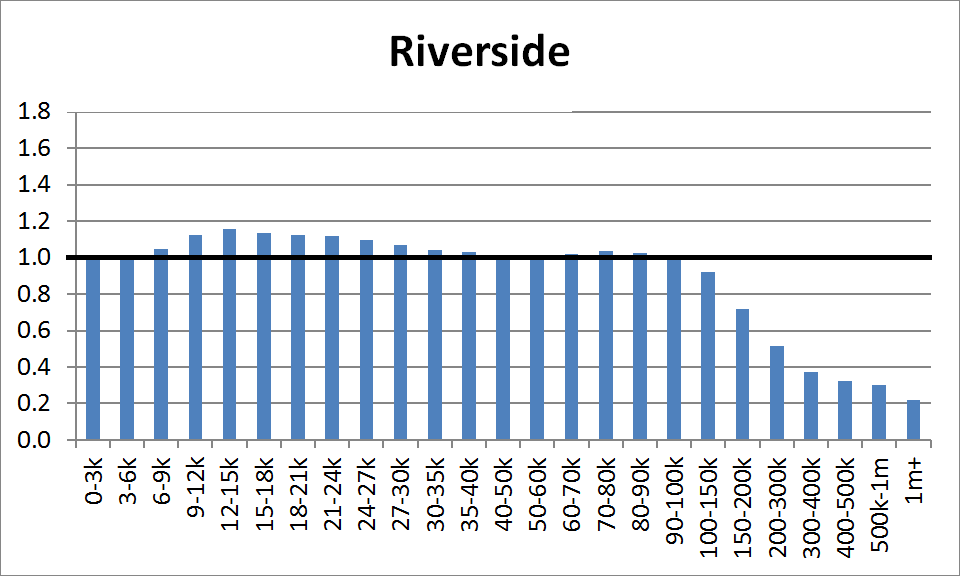

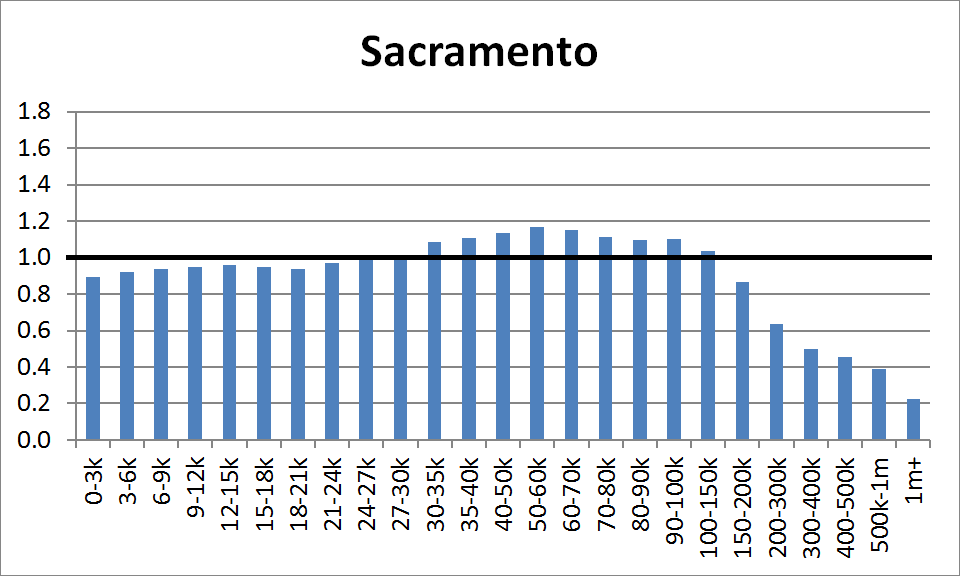

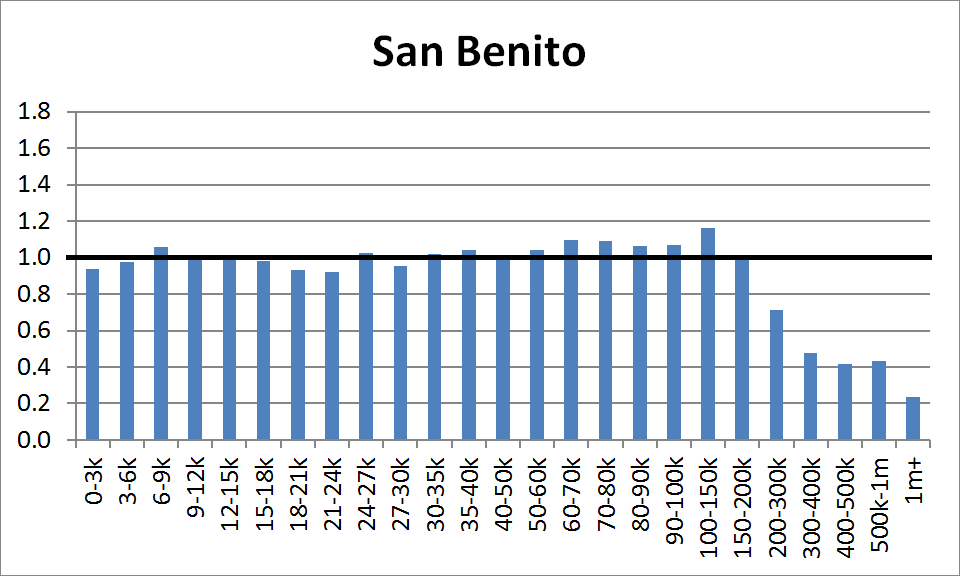

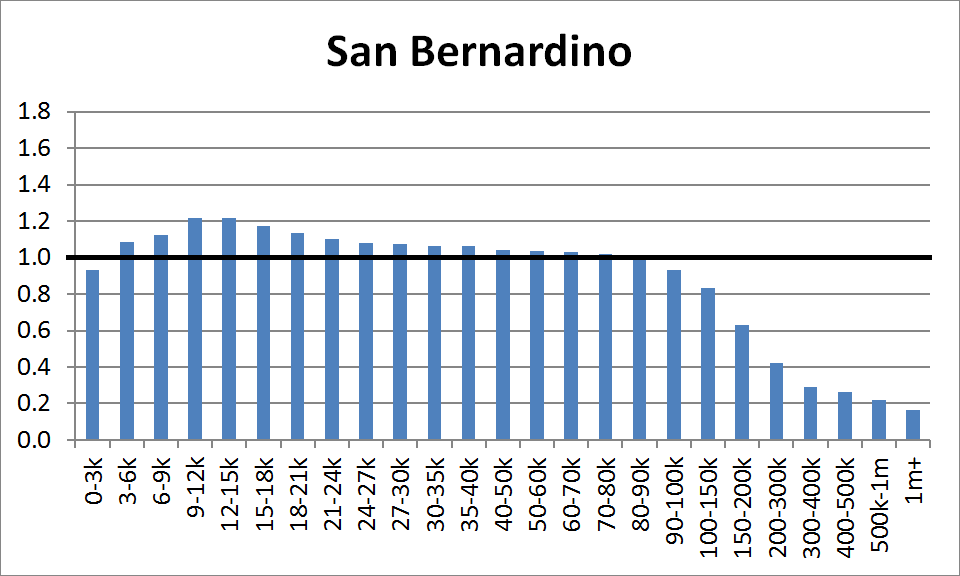

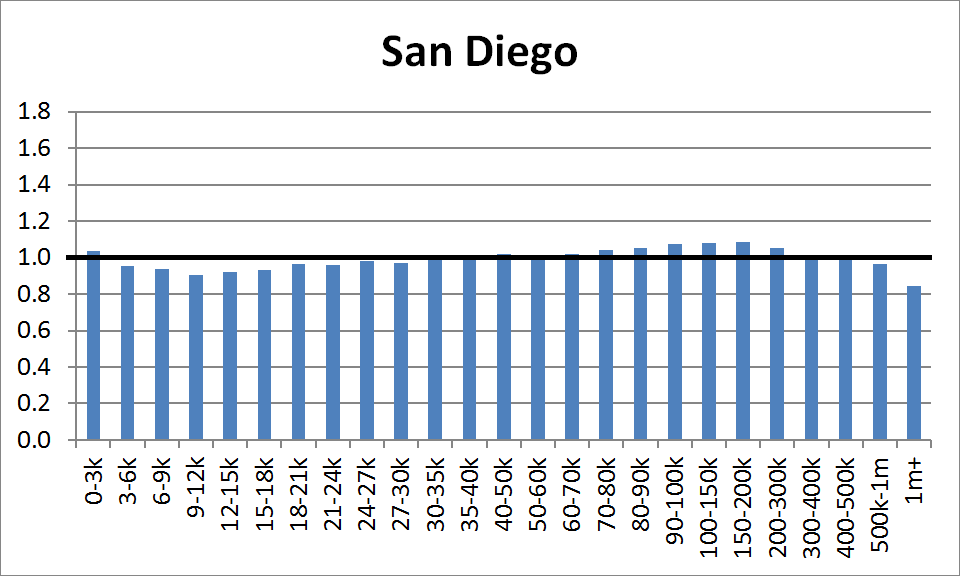

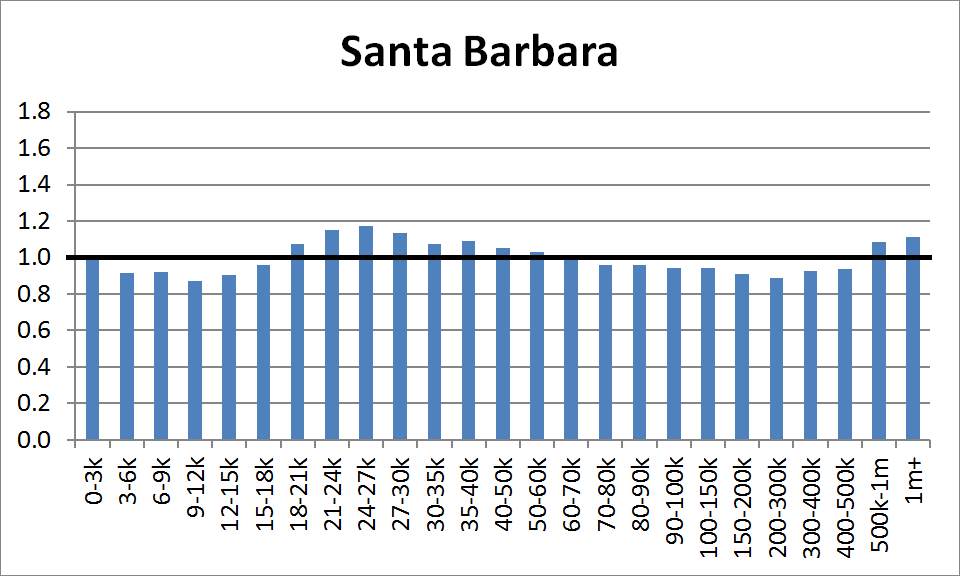

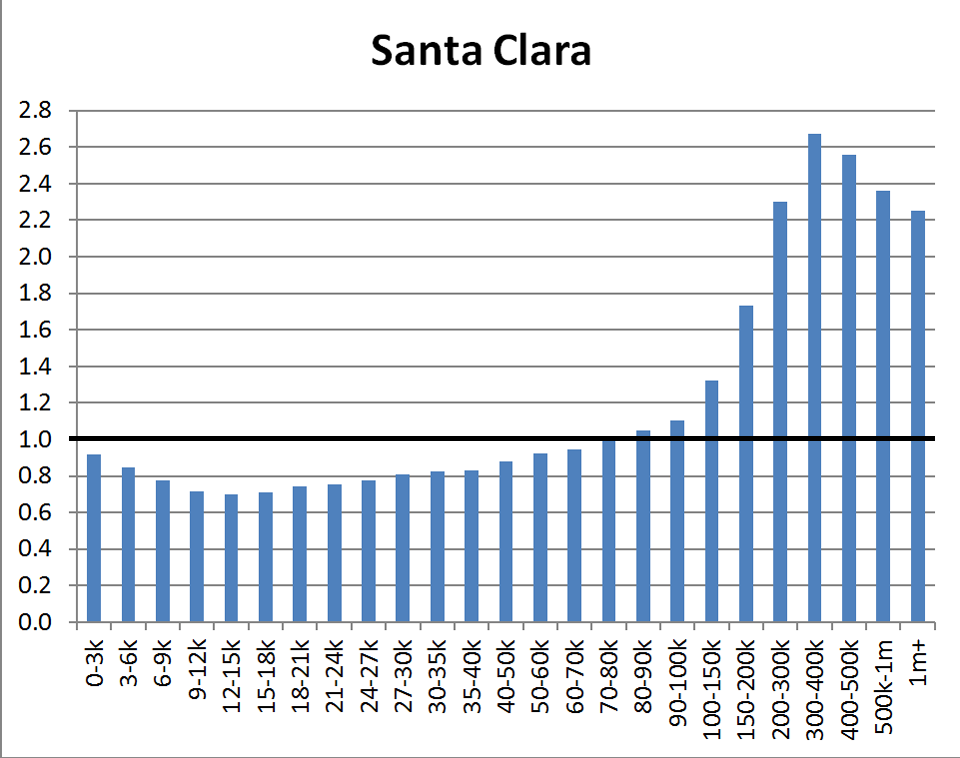

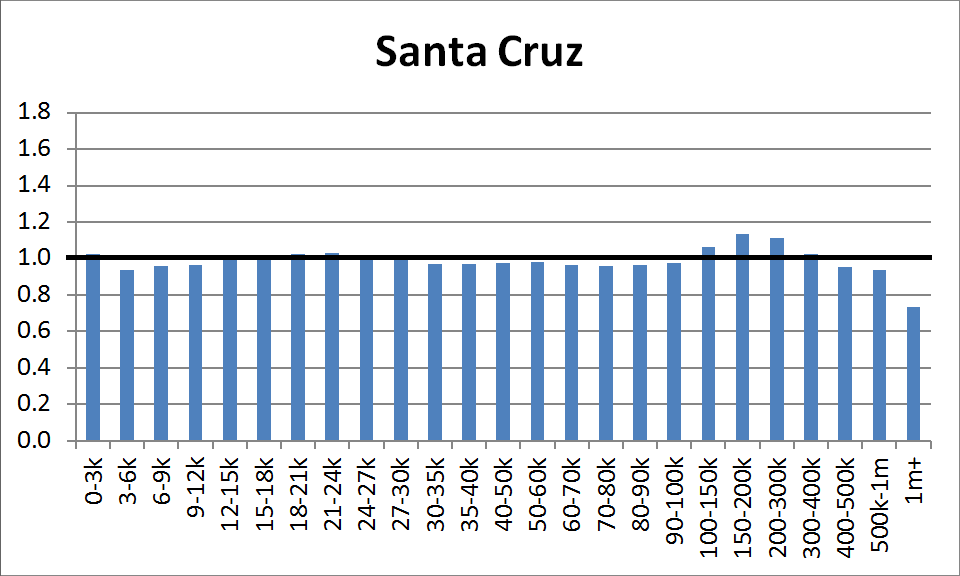

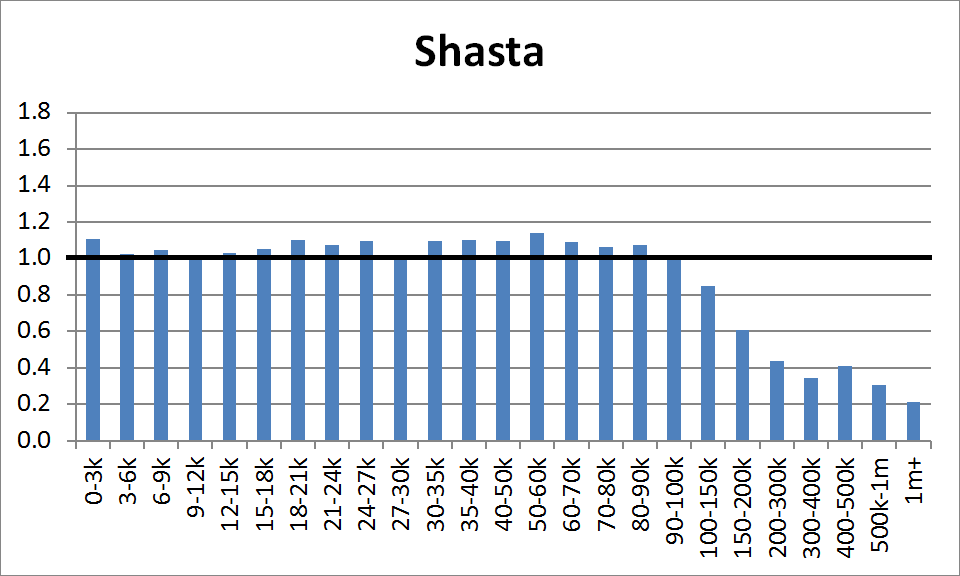

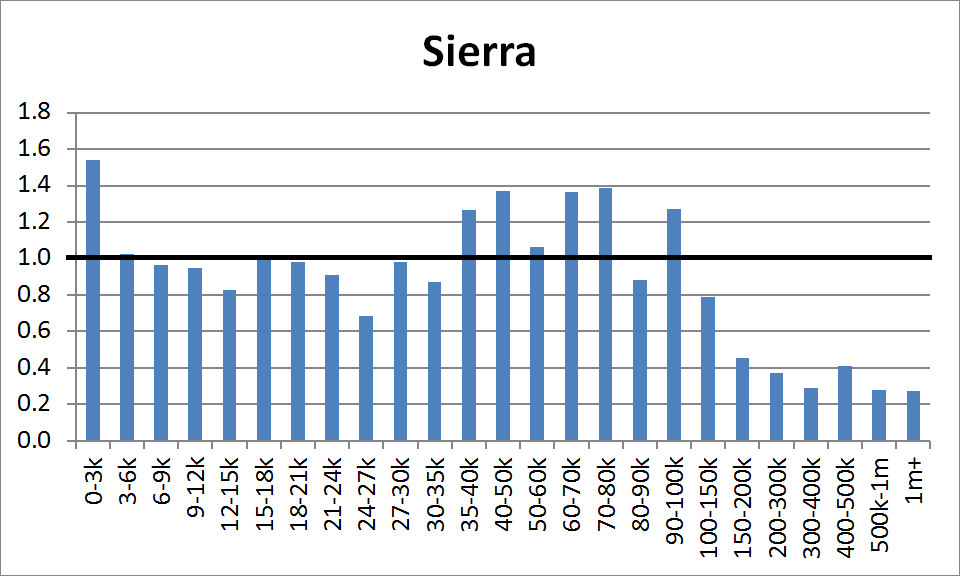

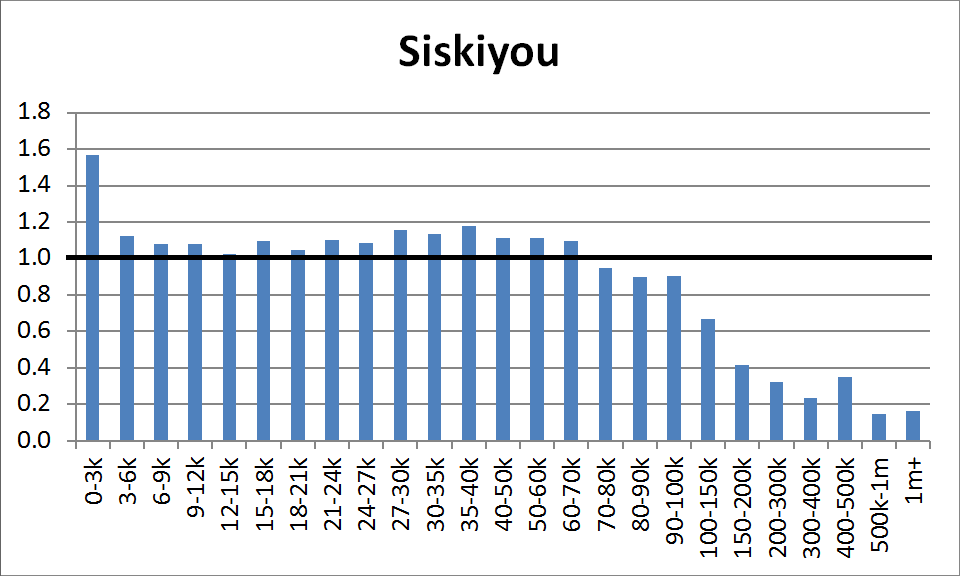

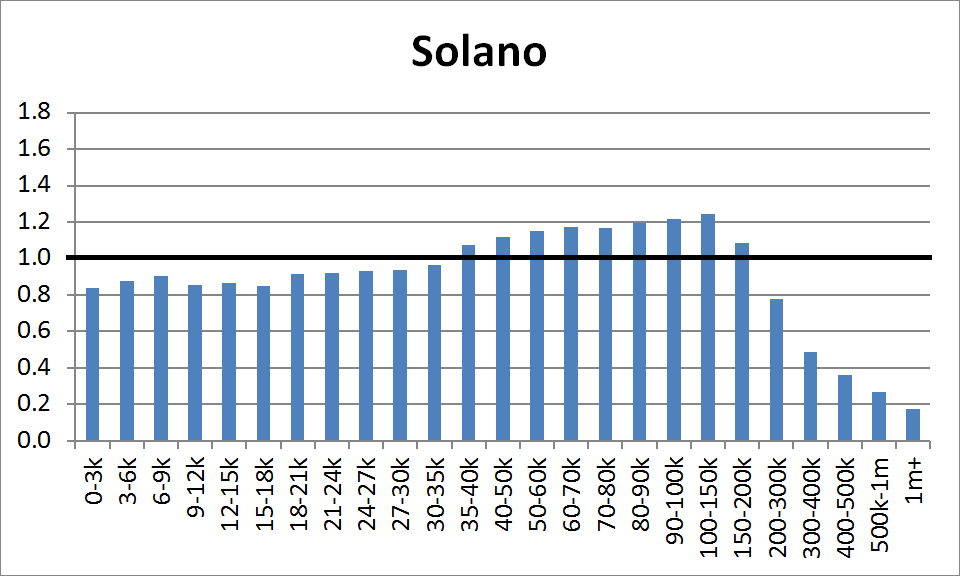

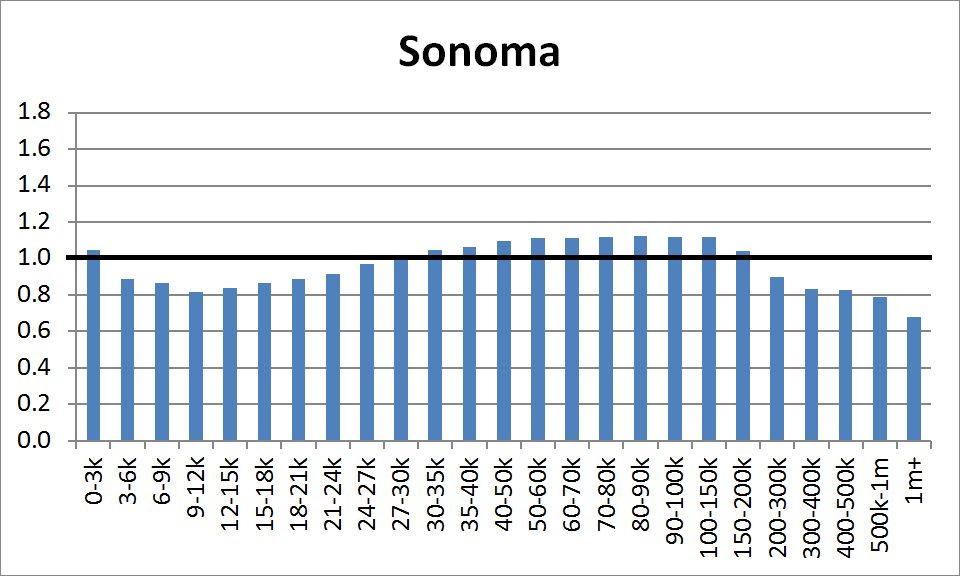

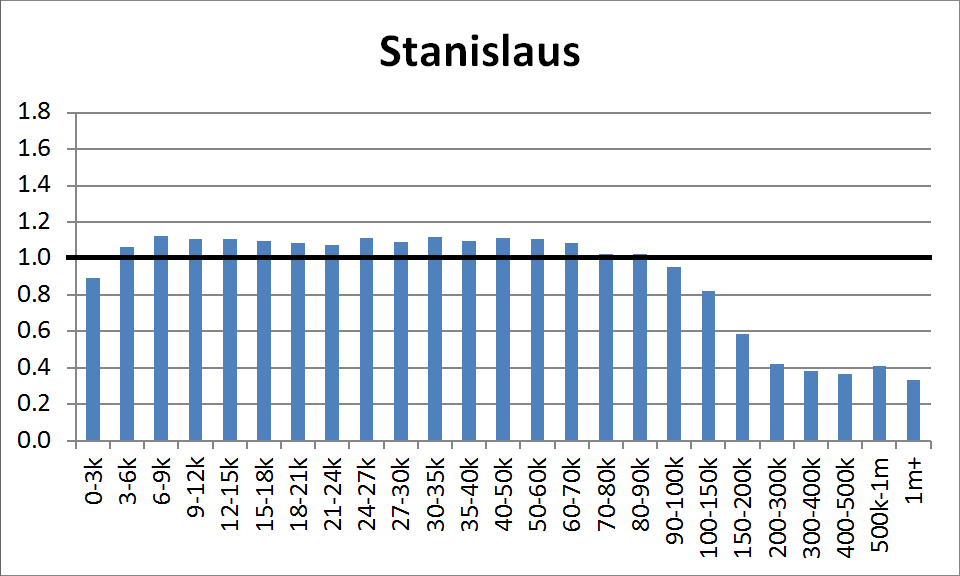

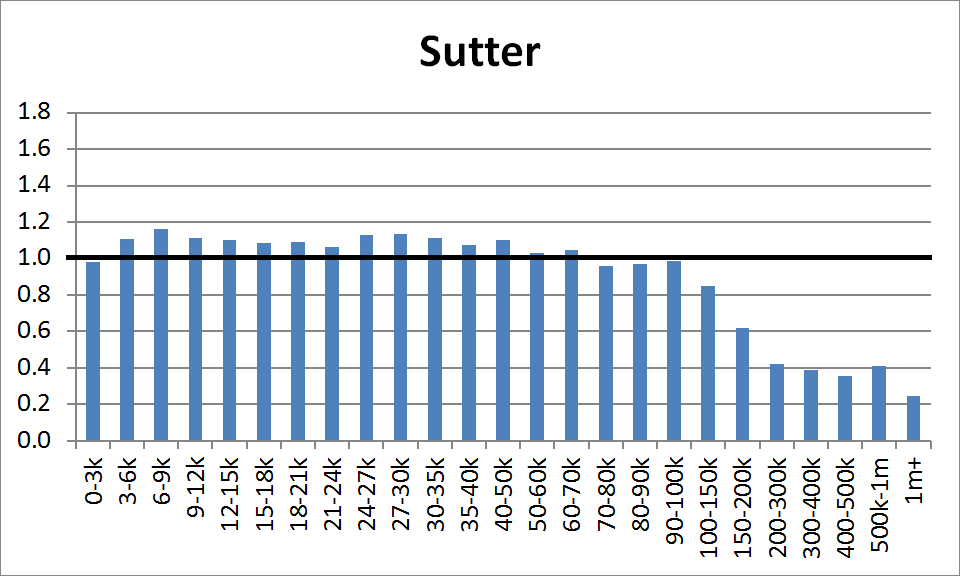

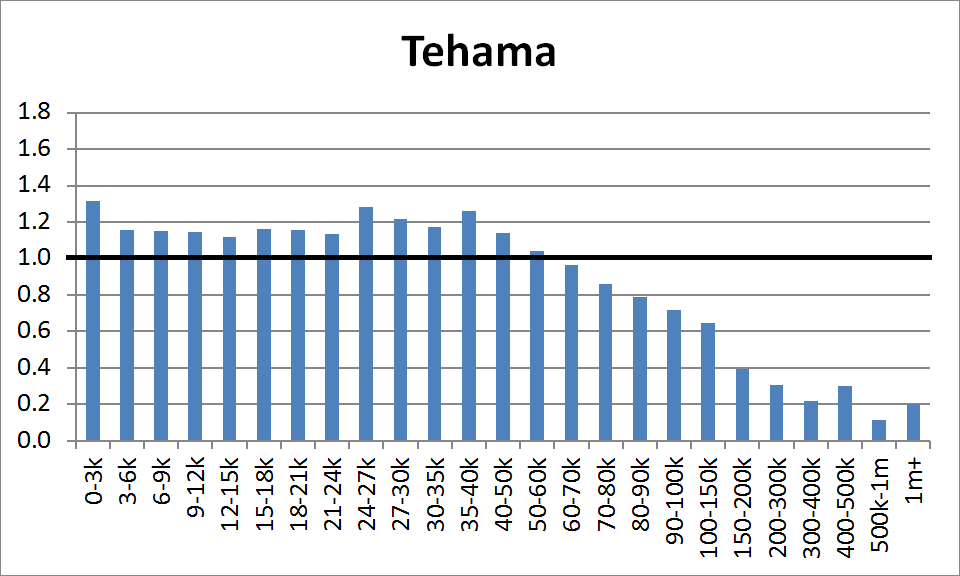

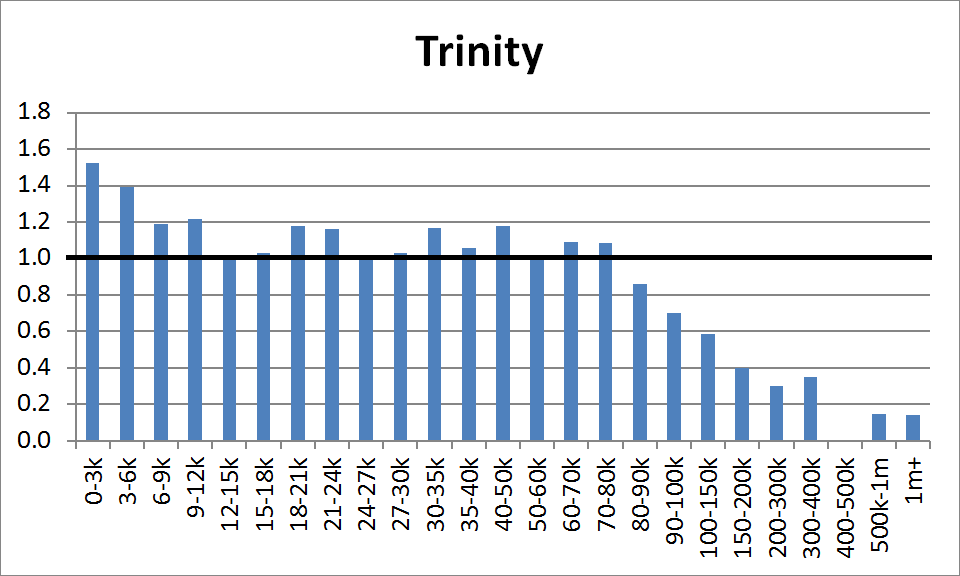

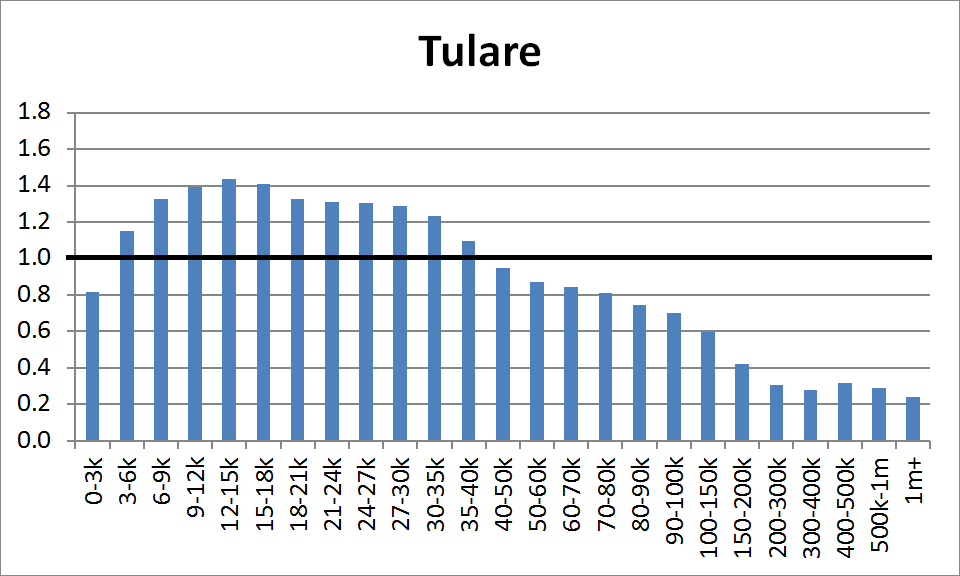

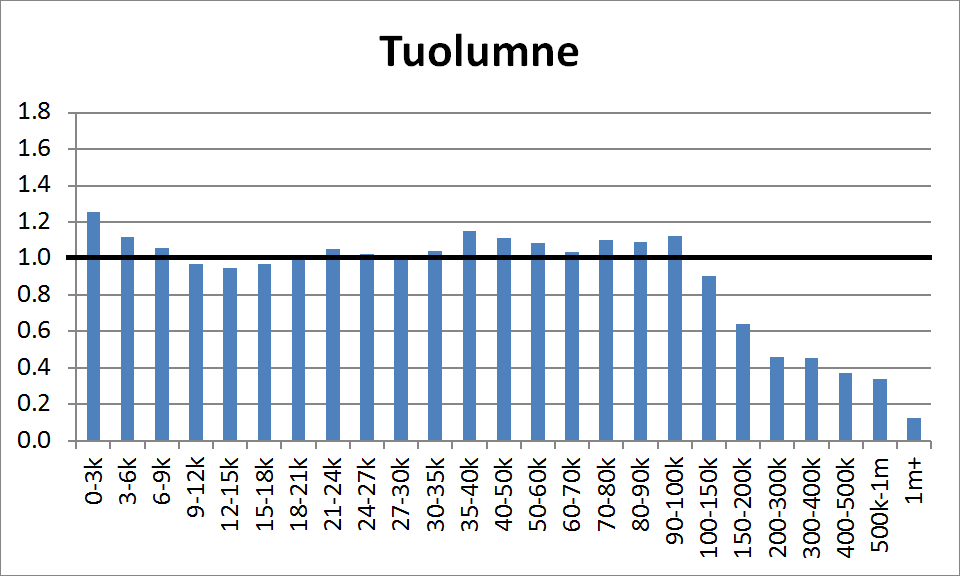

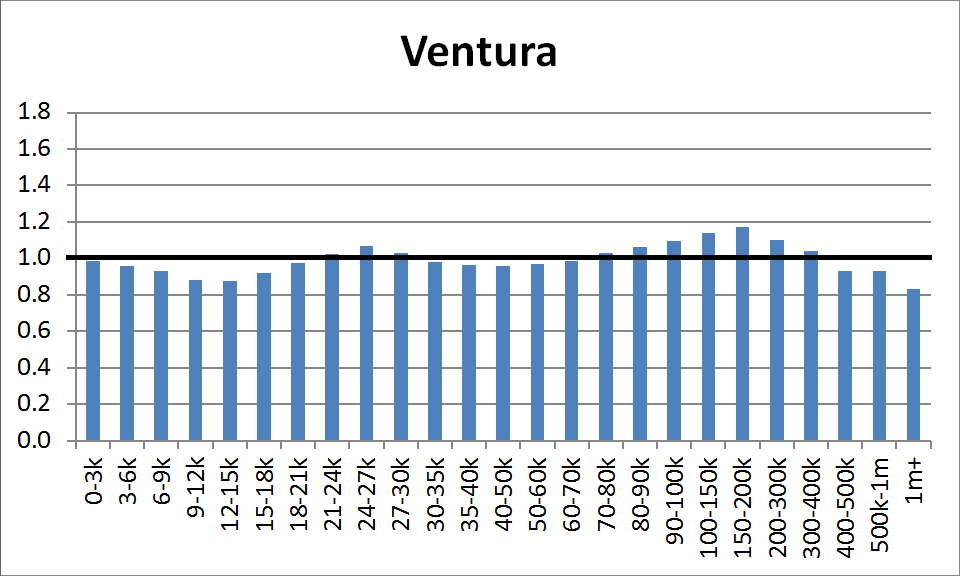

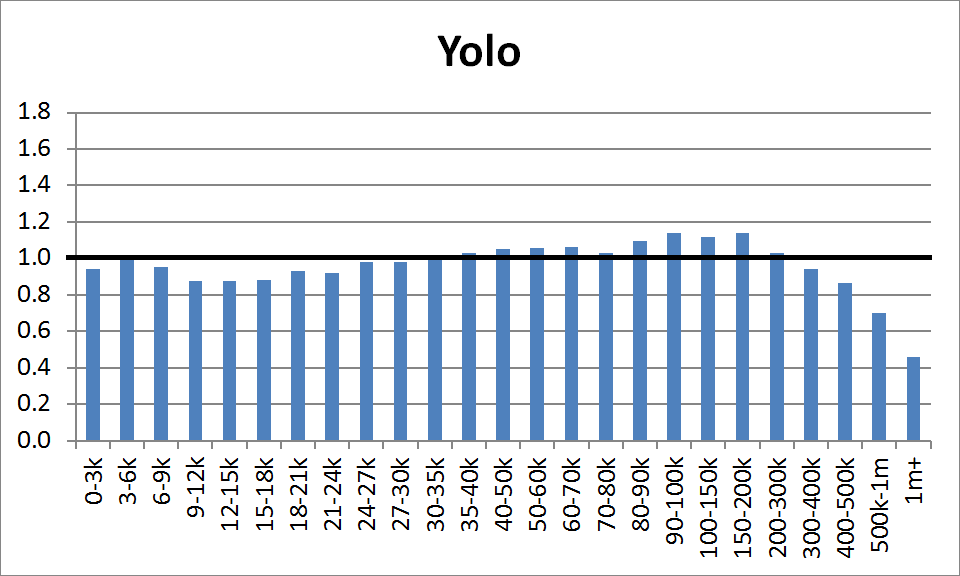

Additional Data: FTB Income Distributions for Each Available County

September 12, 2016

This post is a supplement to our other post here, which concerns income distributions for each California county based on 2013 state Franchise Tax Board (FTB) income tax return data (see Table B-7).

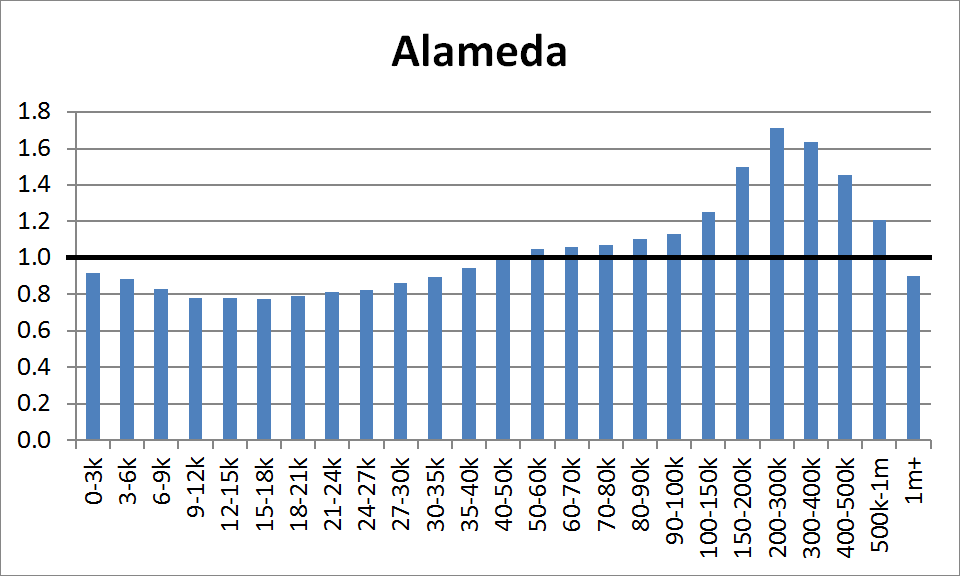

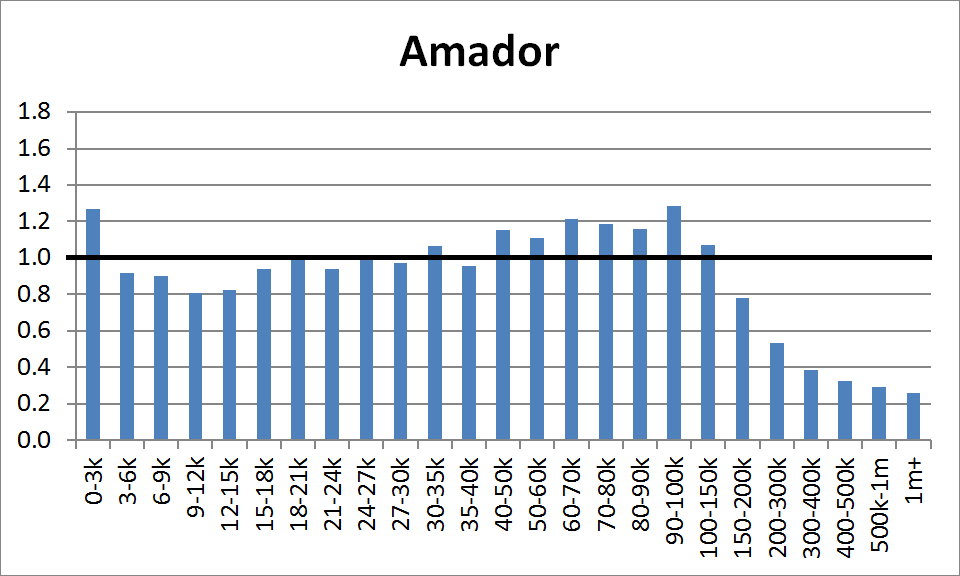

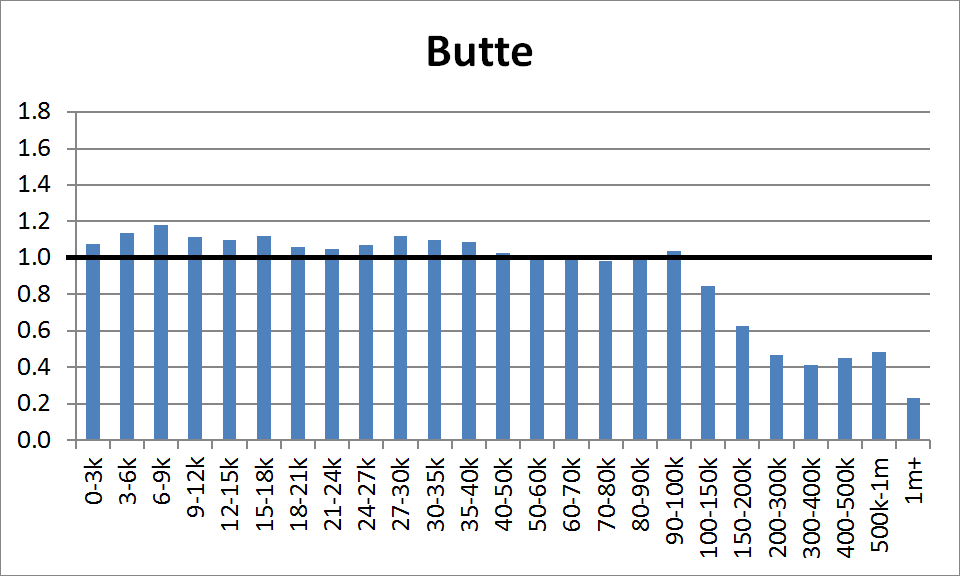

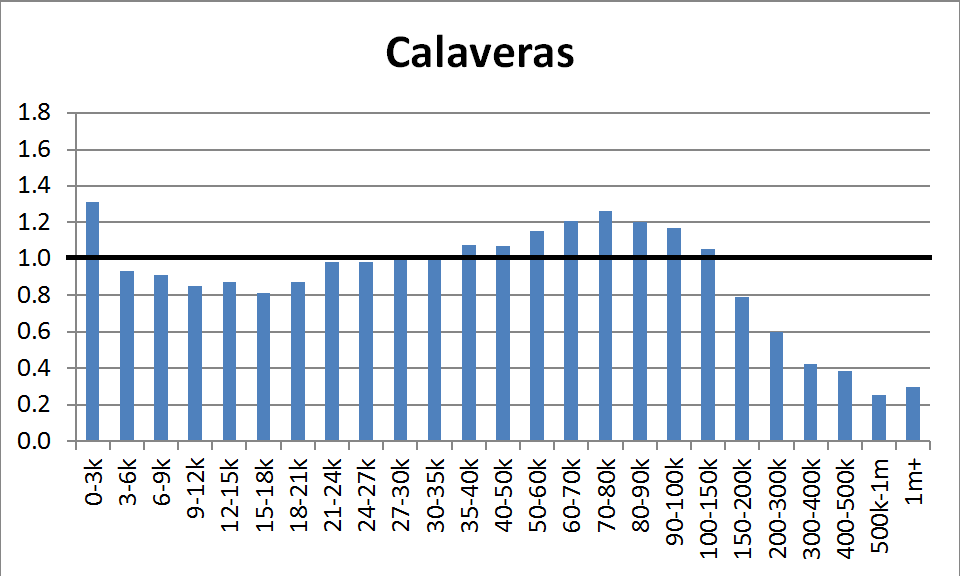

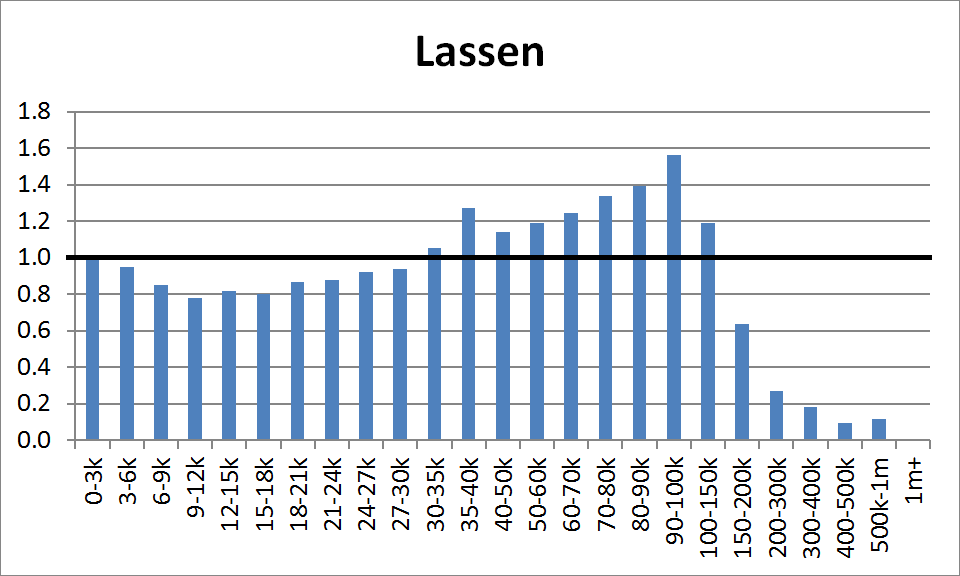

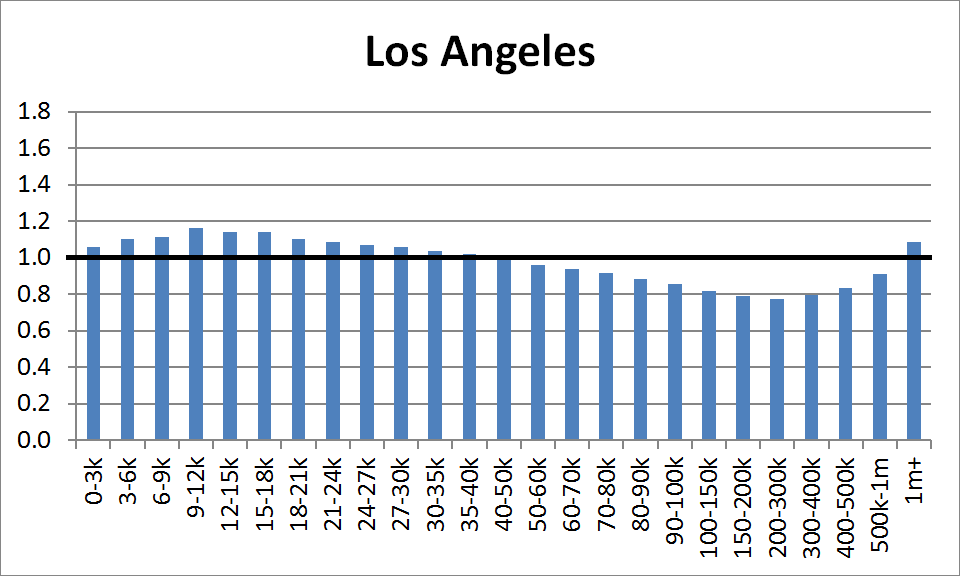

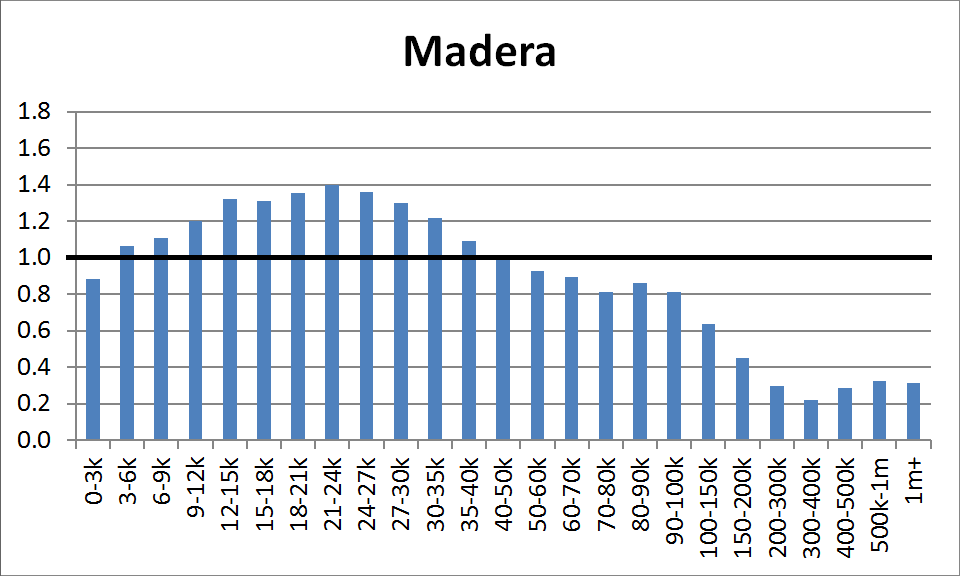

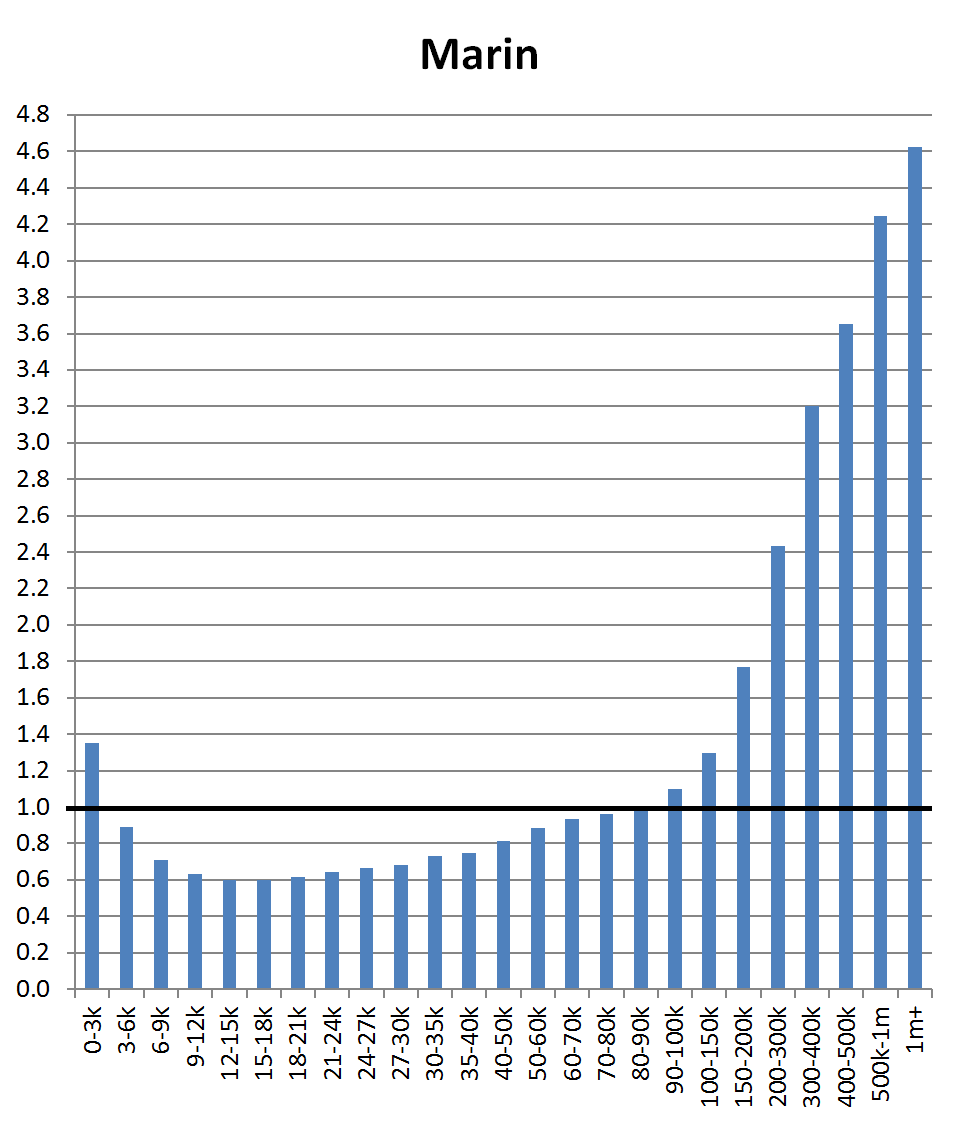

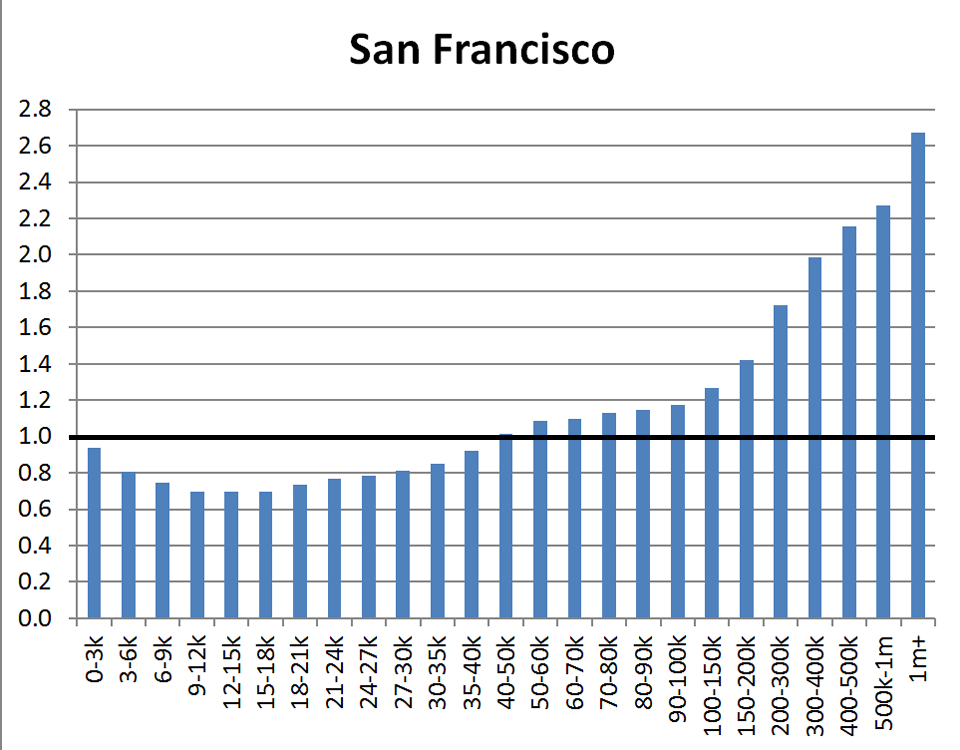

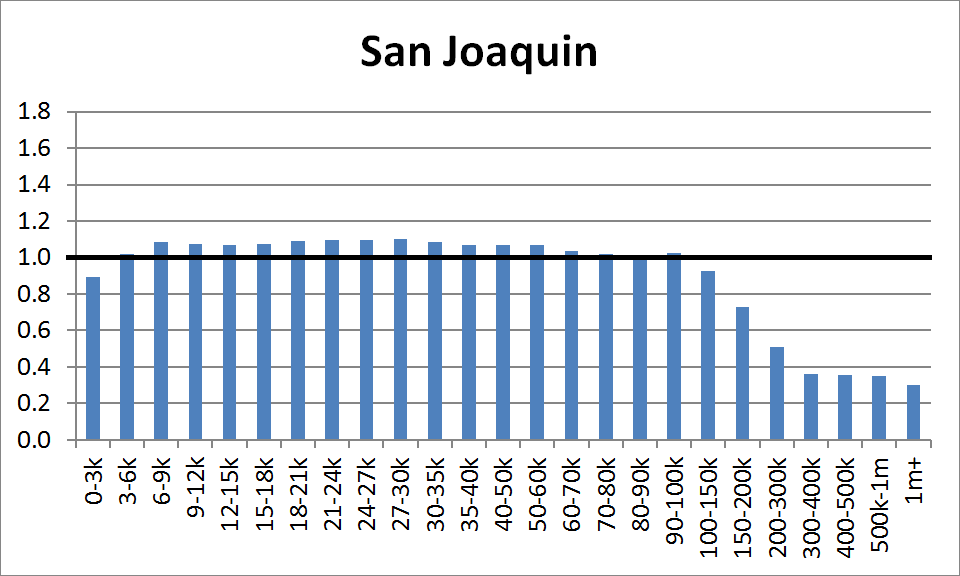

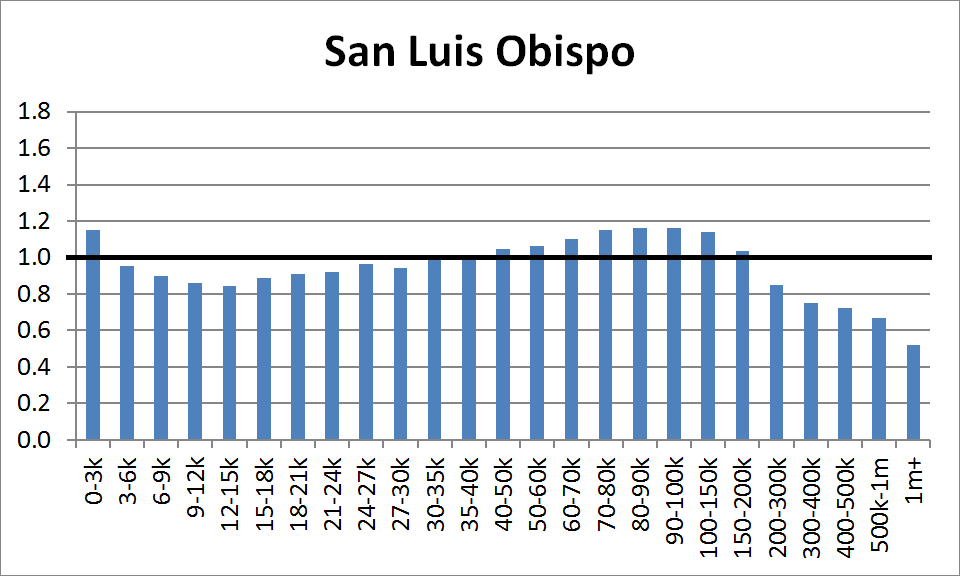

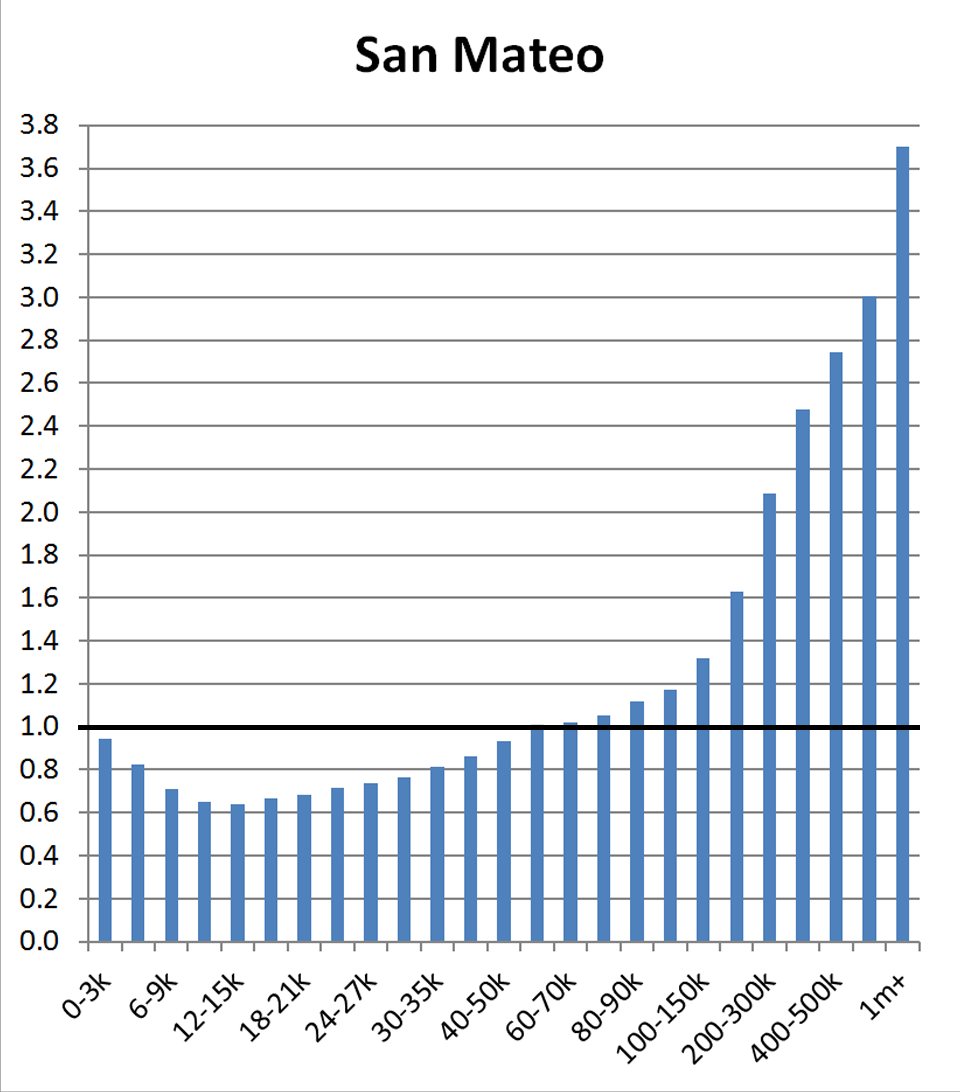

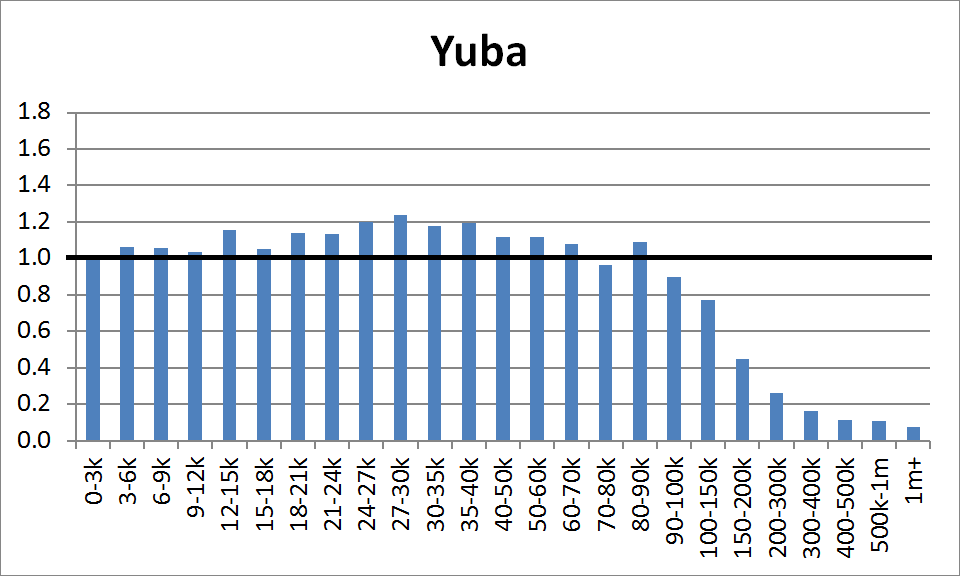

The graphics displayed below compare counties’ income distributions to the statewide distribution based on the 2013 FTB tax return data. These graphics compare the relative frequency of each income bracket in that county compared to its statewide frequency. For example, 5.83 percent of Los Angeles County filers reported income between $50,000 and $60,000 compared to 6.08 percent statewide. Los Angeles County’s relative frequency for the $50,000-$60,000 income bracket is 5.83 divided by 6.08, or 0.96. Because that income bracket is below 1.00, the proportion of Los Angeles County’s 2013 tax returns with income in that bracket is less than that proportion for California as a whole. In other words, tax returns reporting $50,000-$60,000 of income are slightly less common in Los Angeles County as compared to the state as a whole.

Follow @LAOEconTax on Twitter for regular California economy and tax updates.