Why is Venture Capital Funding a Useful Economic Indicator?

February 18, 2021

Venture capital (VC) firms raise money from investors which they then use to buy stakes in relatively new, privately held firms. They then usually sell these stakes and distribute the proceeds to their investors when the firm goes public or is bought out by another firm. VC has long been a critical funding source for California’s high technology firms, whose strong growth over the past several years has been fueled by a sustained increase in VC funding.

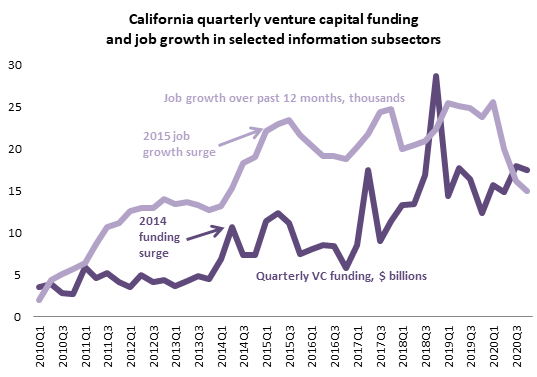

Our office has found a strong correlation between a lagged measure of VC funding and employment growth in the information and professional/technical services sectors which include many of the state’s high-tech firms. This graph shows the relationship between quarterly VC funding and growth in the high-paying and fast-growing software, data processing, and ‘other’ information subsectors. While the correlation is not perfect and job growth fell during the 2020 pandemic, upticks in VC funding have generally preceded upticks in job growth.

Over the longer term, VC funding can significantly impact state revenue through another channel: initial public stock offerings (IPOs) of privately held firms. When a firm goes public through an IPO, its owners and employees will typically realize large gains from stock options, and these gains are taxable as ordinary income under state and federal law. Many California firms that relied on VC funding at various stages of their development went public in 2020, and this contributed to surprisingly strong growth in personal income tax revenue despite the deep recession caused by the pandemic.