Revenue from taxation of capital gains is a major component of state personal income tax collections, making up 16 percent of total projected personal income tax revenues for 2018-19. Capital gains depend heavily on movements in financial markets. As such, capital gains revenue is extremely volatile and difficult to predict. In any given year, there is significant risk that capital gains revenue could fall below budgetary expectations. (Some of this volatility is absorbed by the Proposition 2, which allocates a portion of capital gains revenues to debt repayments and reserves.)

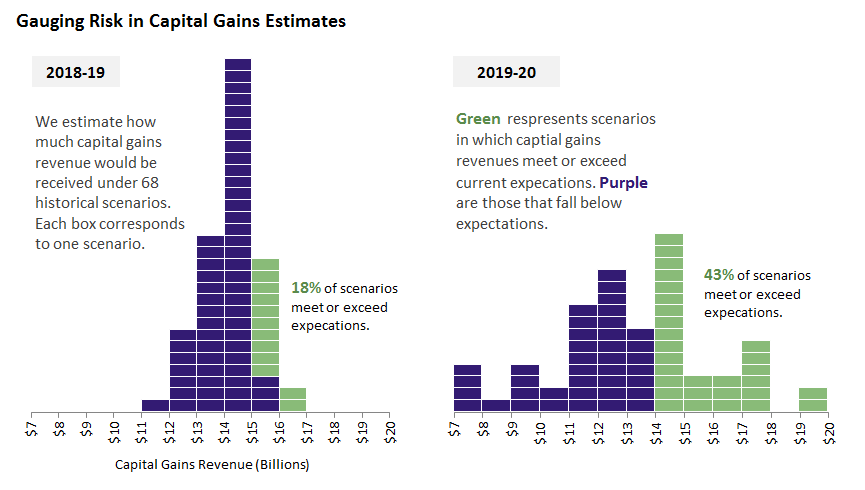

Recognizing the inherent risk of capital gains revenue assumptions, we examined the historical pattern of financial markets in an attempt to gauge the range of possible outcomes for capital gains revenue in 2018-19 and 2019-20. Specifically, we tried to answer the question: how much capital gains revenue would be received if stock prices over the rest of 2019 and 2020 follow the patterns of previous historical periods? That is, how much capital gains revenue would there be if stock prices move as they did during the corresponding period in 1950 to 1951, 1951 to 1952, etc.? Our analysis covers 68 historical periods in total. We then compare the results from each period to capital gains revenue assumptions in the 2019-20 Governor’s Budget. The results are shown in the graphic below. This analysis reflects actual stock prices through February 8, 2019.

As we discussed in our Overview of the Governor’s Budget, the Governor’s Budget revenue estimates were prepared before a significant drop in stock prices at the end of 2018. As a result, it is not surprising that our analysis suggests that there is a low likelihood that capital gains revenue will meet expectations in 2018-19. Revenues met or exceeded expectations in only one out of five historical scenarios. Chances of hitting the 2019-20 assumptions appear to be somewhat better, with around 40 percent of historical scenarios meeting or exceeding expectations. Nonetheless, there appears to be a significant risk that capital gains revenue will fall below Governor’s Budget assumptions in both 2018-19 and 2019-20. Capital gains revenues fall more than $500 million below expectations in two-thirds of scenarios for 2018-19 and half of scenarios for 2019-20.