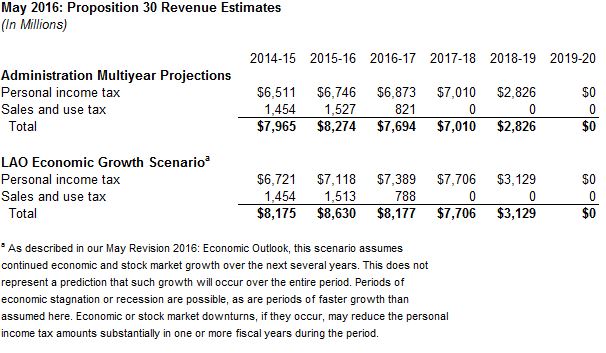

LAO and Administration Estimates Through 2019-20. The figure above displays the current estimates of the administration and our office for revenues of Proposition 30 (2012) through 2019-20. The Proposition 30 sales tax rate increase expires at the end of this year (thereby providing half a year of revenue in 2016-17 and no revenue in 2017-18 or thereafter). Under current law, the measure's income tax rate increases on high-income Californians expire at the end of 2018, essentially providing half a year of revenue in 2018-19 and no revenue in 2019-20 or thereafter.

In Reality, Likely Will Be More Volatile Than These Estimates. Both of these estimates reflect scenarios that assume gradual growth in the economy and slow growth in stock prices through 2020. Such scenarios generally would cause Proposition 30 income taxes to grow gradually over time. In reality, economic and stock market performance probably will be more volatile, such that Proposition 30 income taxes will "rise or fall each year depending on trends in the stock market and the economy," as we noted in our earlier analysis of the initiative proposal to extend the taxes. Therefore, in any given year in the future, Proposition 30 personal income taxes could be billions more or less than displayed above.

Both LAO and Administration Multiyear Budget Outlooks Assume Expiration of Proposition 30. Proposition 30 revenues represent a portion of General Fund revenues (which include Education Protection Account revenues) displayed in administration and LAO General Fund revenue summaries here and here. Both the administration's multiyear budget forecast and our office's multiyear economic growth scenario outlook assume the expiration of Proposition 30 as scheduled in current law.

LAO Changes Compared to Prior Proposition 30 Estimates. Compared to past estimates, our office's Proposition 30 estimates have increased for some of the fiscal years displayed following a review of Franchise Tax Board data through 2013, Department of Finance estimates, and our own estimating methodology.

Follow @LAOEconTax on Twitter for regular California economy and tax updates.