Cannabis Tax Revenue Update

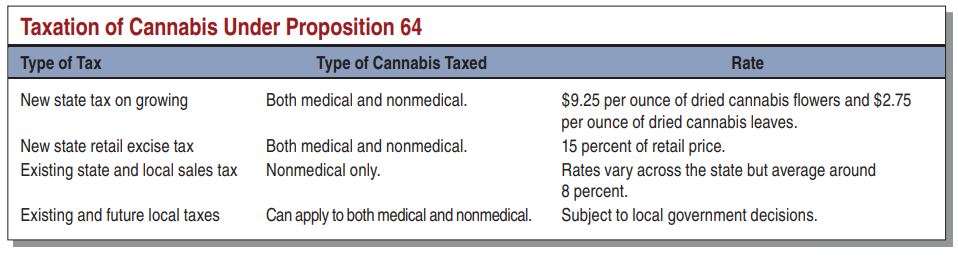

In November 2016, California voters approved Proposition 64, which legalized the nonmedical use of cannabis. As seen in the figure, the state levies two excise taxes on cannabis: a retail excise tax and a cultivation tax. (Local governments may levy additional taxes.) These taxes went into effect on January 1, 2018, and the first payments were due on April 30.

January Revenue Estimates. In its January budget proposal, the administration estimated that 2017-18 cannabis excise tax revenue would total $175 million.

First Quarter Revenue $34 Million. The state collected $34 million in cannabis excise tax revenue in the first quarter of 2018. Based on this quarterly tally, we think that 2017-18 revenue likely will be somewhat lower than the administration’s January estimate.