As a result of the COVID-19 pandemic, California has experienced an unprecedented rise in unemployment. Early in the economic downturn, the key measure that captured the impact of the virus on the state’s workers was the number of new unemployment claims being filed each week. At this stage, however, the level of continued claims—the total number of people receiving unemployment benefits each week—is equally important. Should continued claims decline, it could signal that some businesses are bringing workers back and the economy is improving. Should continued claims rise, however, it could signal a continued slowdown in the economy. Note: This post includes data on claims paid under Pandemic Unemployment Assistance (PUA)—a new program that provides unemployment insurance for self-employed workers. We recently became aware of an unknown but potentially large level of fraudulent activity within the program. We therefore caution against drawing conclusions about the labor market from PUA claims data.

Department Not Accepting New Applications During Planned Two-Week Reset. In response the Governor’s Strike Team recommendations to address the backlog of pending claims at the Employment Development Department (EDD), the department has shut down incoming applications for unemployment benefits for two weeks while it redirects experienced staff to working down the backlog. As such, EDD reported zero new applications the week ending September 26 (the first week of the two-week reset). We expect a similar report next week. During the reset period, however, existing claims continue to be processed by experienced EDD staff, as discussed below.

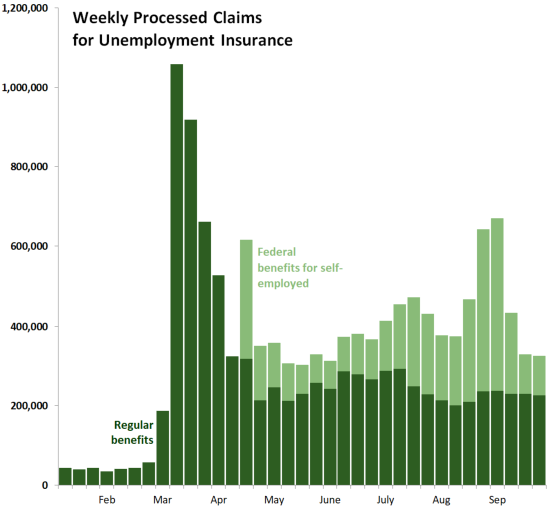

Department Continues to Process Elevated Level of Unemployment Claims. During the first week of the two-week reset, between September 20 and September 26, the department processed 226,176 claims for regular unemployment insurance. This amount is generally consistent with levels seen since the initial pandemic workload peaked and then subsided in late March and early April.

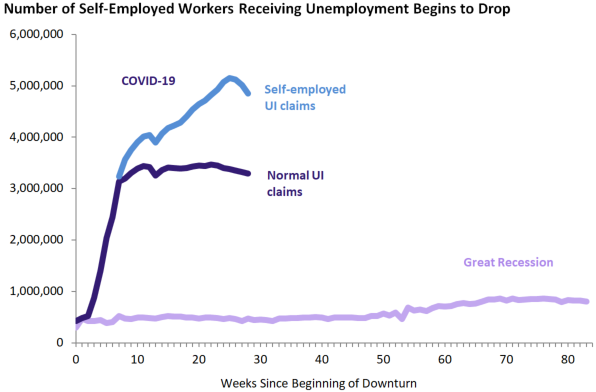

Following New Certification Rules, Caseload for Self-Employment Benefits Begins to Drop. During August and early September, new claims for the federal Pandemic Unemployment Assistance (PUA) program for self-employed workers spiked unexpectedly, as shown in the figure above. To limit potentially fraudulent claims, the administration recently stopped automatically approving backdated PUA claims. Incoming data from the past three weeks suggest this change has discouraged fraudulent claims. First, newly processed PUA claims fell by more than 80 percent over the past three weeks. Second, during last week, benefit payments distributed to self-employed workers declined, falling by more than half from $1.3 billion to less than $600 million. Finally, as shown below, the number of workers receiving self-employment UI benefits also fell by about 10 percent over the past two weeks. Taken together, this information suggests that EDD’s new certification restriction is reducing the volume of new claims and benefit payments. Although it seems plausible, it remains too early to know whether this decline is due primarily to a reduction in fraudulent activity.

Regular Continued Claims Hold Steady at 3.3 Million. As of September 26, California had 3.3 million employees receiving regular unemployment benefits, a slight dip from the level seen in recent weeks. Since the regular claims caseload peaked in mid-August, the number of workers receiving normal UI benefits has fallen by a total of 5 percent.

Third Round of Benefits Paid from New Federal Lost Wages Assistance Program. Benefit payments from the federal Lost Wages Assistance program, which allows states to temporarily increase weekly benefits by $300, were paid out for the third time last week. The state distributed roughly $900 million in federal benefits under this program during the week ending September 26. (This is somewhat less than was distributed during the first two weeks of the program.) This amount corresponds approximately to the third of six weekly add-on benefits approved by the federal government. In total, these payments will go to workers who were unemployed during the weeks ending August 1 through the week ending September 5.