In November 2016, California voters approved Proposition 64, which legalized the nonmedical use of cannabis. The state levies two excise taxes on cannabis: a retail excise tax and a cultivation tax.

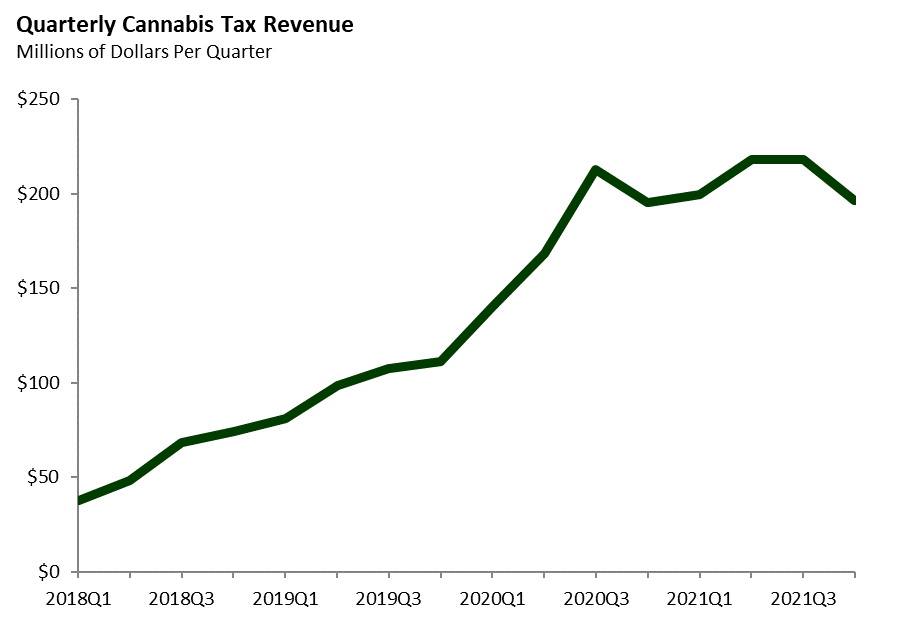

Preliminary Total for Second Quarter of 2021-22: $196 Million. The administration currently estimates that retail excise tax revenue was $157 million and cultivation tax revenue was $39 million in the second quarter of fiscal year 2021-22 (October through December). This revenue estimate is lower than the revised numbers for each of the three prior quarters.

Cannabis Tax Revenue Growth Has Slowed. Based on the administration’s current estimate, cannabis tax revenue in the first two quarters of 2021-22 was just 1.6 percent higher than in the first two quarters of 2020-21. This weak growth rate stands in stark contrast to the rapid revenue growth that occurred in the first few years of cannabis licensing.