In November 2016, California voters approved Proposition 64, which legalized the nonmedical use of cannabis. The state levies two excise taxes on cannabis: a retail excise tax and a cultivation tax.

Preliminary Total for Third Quarter of 2021-22: $189 Million. The administration currently estimates that retail excise tax revenue was $156 million and cultivation tax revenue was $33 million in the third quarter of fiscal year 2021-22 (January through March).

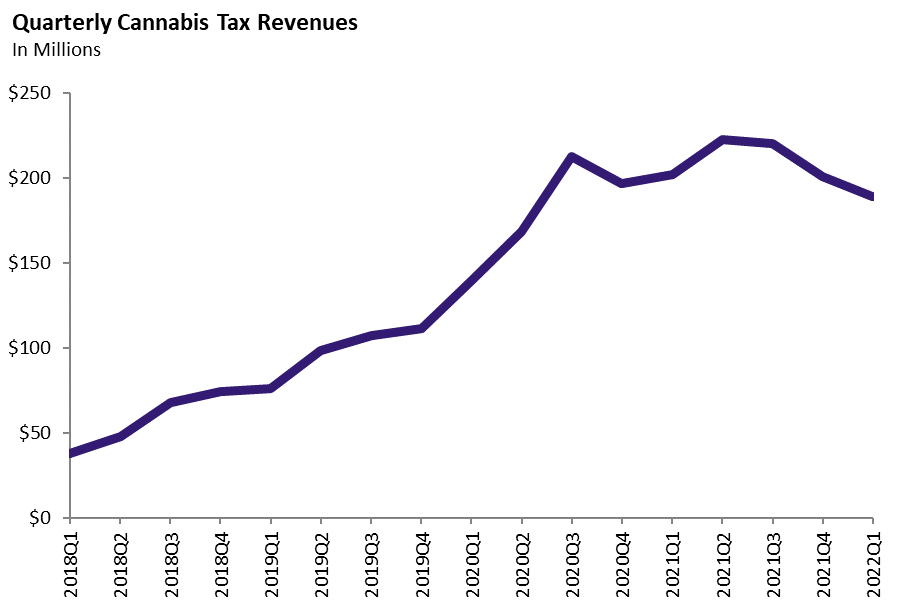

Revenues Flat Over Last Year and a Half. California started issuing licenses and collecting tax revenues from adult-use cannabis businesses in January 2018. As shown in the figure below, state cannabis tax revenues grew very rapidly through the first quarter of the 2020-21 fiscal year (July through September 2020). Since that quarter, however, cannabis tax revenues have not grown at all.

May Revision Proposal Would Set Aside “Excess Revenues.” The Governor’s May Revision includes a proposal that would make several changes to cannabis taxes. One part of the proposal would use 2020-21 cannabis tax revenues to establish a funding target for the programs that receive those revenues. Under the proposal, the state would set aside any 2021-22 revenues that exceed the amount needed to hit this funding target. This money then would be available to help the state meet the funding target in later years.

Unclear if State Will Have Any Excess Revenues In 2021-22. In the first three quarters of 2021-22, cannabis tax revenues are right around three-fourths of the 2020-21 total. With such weak revenue growth, the state might not have any excess revenue to set aside in 2021-22.