Background. In November 2016, California voters approved Proposition 64, which legalized the nonmedical use of cannabis. Proposition 64 created two excise taxes on cannabis: a 15 percent retail excise tax and a cultivation tax. Chapter 56, Statutes of 2022 (AB 195, Committee on Budget) eliminated the cultivation tax on July 1, 2022. This law also requires the administration to increase the retail excise tax rate effective July 1, 2025. The new rate cannot exceed 19 percent. Subject to that cap, the administration must set the new rate at the level that offsets the revenue loss from the elimination of the cultivation tax.

Preliminary Total for Fourth Quarter of 2024: $128 Million. For cannabis excise tax returns filed for the fourth quarter of 2024, the total amount of tax due is $128 million. Preliminary revenues tend to differ modestly from actual revenues for various reasons, such as delays in filing or payment. In this case, however, the preliminary numbers likely understate actual revenues more than usual due to wildfire-related filing delays.

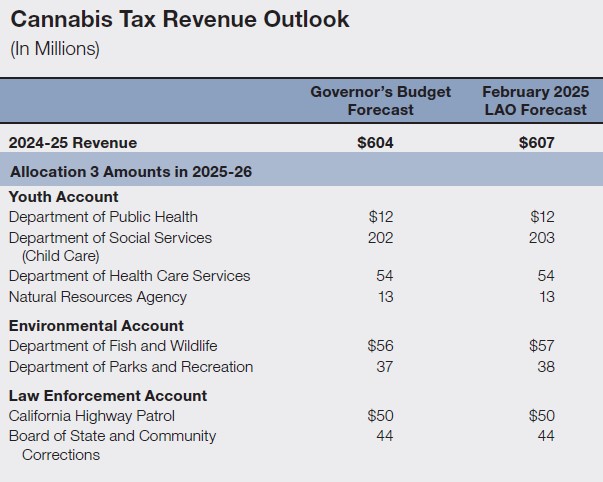

Current LAO Forecast for 2024-25: $607 Million. We currently project cannabis tax revenues of $607 million in 2024-25. This forecast is just $3 million above the January Governor’s Budget forecast. As shown in the figure below, the resulting 2025-26 revenue allocations are nearly identical to the administration’s January projections.

Upcoming Tax Hike Under Current Law. Looking further ahead, our preliminary revenue projection for 2025-26 is $799 million, which is $37 million above the administration’s January forecast. Both our forecast and the administration’s reflect the statutorily required tax increase noted above. Both forecasts assume that this tax hike will reduce the size of the licensed cannabis market. This negative effect, however, likely will offset only a small share of the revenue raised by the tax hike.