In November 2016, California voters approved Proposition 64, which legalized the nonmedical use of cannabis. Proposition 64 created two excise taxes on cannabis: a retail excise tax and a cultivation tax.

Recent Changes to State’s Cannabis Taxes. Chapter 56, Statutes of 2022 (AB 195, Committee on Budget) eliminated the cannabis cultivation tax effective July 1, 2022. This law also made retailers (rather than distributors) responsible for paying the retail excise tax starting January 1, 2023. The revenue estimates reported in this post represent the second quarter of cannabis tax revenues without the cultivation tax.

Preliminary Total for Second Quarter of 2022-23: $108 Million. The administration currently estimates that retail excise tax revenue was $108 million in the second quarter of 2022-23 (October through December). As shown in Figure 1 below, retail excise tax revenue has declined for six straight quarters.

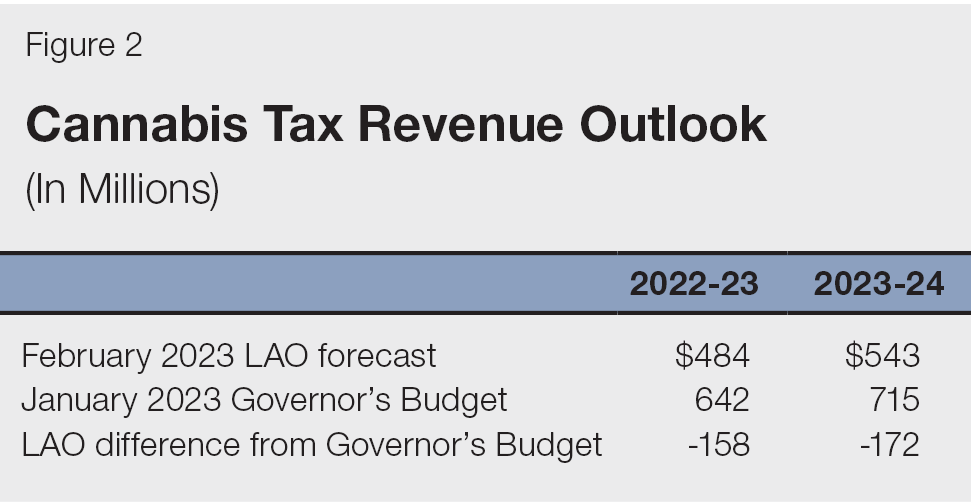

Current LAO Forecast for 2022-23: $484 Million. We currently project cannabis tax revenues of $484 million in 2022-23 and $543 million in 2023-24. As shown in Figure 2 below, our current projection for 2022-23 is $158 million below the administration’s January forecast. The main reason for this difference is the recent quarterly number noted above, which was not available when the administration published its forecast.

Very High Degree of Uncertainty. So far, California’s cannabis tax revenues have been prone to large swings from one quarter to the next, making them much harder to forecast than the state’s other major revenue sources. The most recent policy change noted above--making retailers responsible for paying the tax--creates additional uncertainty. 2022-23 retail excise tax revenues easily could end up much higher or much lower than our forecast.

Weak Cannabis Revenues Could Affect Child Care and Other Programs. Cannabis tax revenues support subsidized child care and various other programs. AB 195 included some provisions intended to maintain a steady stream of funding for these programs, but our current forecast suggests that these provisions might not be sufficient to prevent funding from declining.

Recommend Legislature Ask Administration About Plans. In upcoming budget subcommittee hearings, we recommend that the Legislature ask the administration how it would respond to cannabis tax revenue coming in substantially below its January forecast. We anticipate that the administration will publish its next cannabis tax revenue forecast when it releases the May Revision. Starting this discussion now—rather than waiting until May—would give the Legislature time to consider its own options for responding to declining cannabis tax revenues.