Summary. The May Revision anticipates a funding shortfall for programs supported by cannabis tax revenues. Our new revenue estimates are slightly higher, yielding a slightly smaller funding shortfall.

Background. In November 2016, California voters approved Proposition 64, which legalized the nonmedical use of cannabis. Proposition 64 created two excise taxes on cannabis: a retail excise tax and a cultivation tax.

Preliminary Total for Third Quarter of 2022-23: $104 Million. The administration currently estimates that retail excise tax revenue was $104 million in the third quarter of 2022-23 (January through March). The revised estimate for the second quarter of 2022-23 (October through December) is now $128 million, substantially higher than the $108 million preliminary estimate announced in February.

Last Quarter’s Cannabis Sales Higher Than They Appear. Chapter 56, Statutes of 2022 (AB 195, Committee on Budget) made retailers (rather than distributors) responsible for paying the retail excise tax starting January 1, 2023. In this initial quarter under the new policy, retailers sold many cannabis products that they had bought from distributors in prior quarters, so they already had paid the excise tax on those products. To avoid charging the same tax twice, the state allows retailers to claim credits for such pre-2023 tax payments. The $104 million net revenue number results from a gross tax liability of $129 million, combined with $25 million of credits for taxes already paid. The gross number more closely reflects the amount of cannabis retail sales that actually occurred in that quarter.

Short-Term Revenue Trend Unclear. As described above, excise tax payments now occur at a later point in the cannabis supply chain. As a result, comparisons between last quarter and earlier quarters are difficult to interpret. Such comparisons include quarterly growth rates and quarterly revenue trend graphs, such as those displayed in our prior revenue updates. Nevertheless, now that cannabis excise taxpayers have filed returns for three of the four quarters of 2022-23, we are starting to get a clearer sense of the revenue total for the fiscal year.

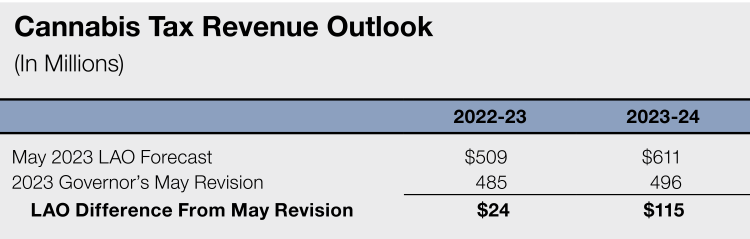

Current LAO Estimate for 2022-23: $509 Million. We currently project cannabis tax revenues of $509 million in 2022-23 and $611 million in 2023-24. As shown in the figure below, our current projection for 2022-23 is $24 million above the administration’s May Revision forecast for 2022-23. Notably, however, it is $133 million below the January Governor’s Budget estimate.

May Revision Anticipates Funding Shortfall for Programs Supported By Cannabis Tax Revenues. Cannabis tax revenues support subsidized child care and various other programs. AB 195 established a “baseline” level of annual funding for these programs and included some mechanisms intended to maintain funding at the baseline. Most notably, AB 195 appropriated $150 million General Fund to backfill funding shortfalls if cannabis revenues came in lower than expected in 2022-23 or 2023-24. The May Revision assumes that the administration would use the entire $150 million to backfill funding shortfalls resulting from low 2022-23 revenues. Even under this assumption, funding still would fall $102 million short of the baseline.

Slightly Smaller Funding Shortfall Under LAO Estimates. As noted above, our 2022-23 revenue estimate is $24 million higher than the May Revision. Under our forecast, if the administration used the entire $150 million backfill right away, funding would fall $78 million short of the baseline.