Background. In November 2016, California voters approved Proposition 64, which legalized the nonmedical use of cannabis. Proposition 64 created two excise taxes on cannabis: a retail excise tax and a cultivation tax. Chapter 56, Statutes of 2022 (AB 195, Committee on Budget) eliminated the cultivation tax on July 1, 2022.

Preliminary Total for Third Quarter of 2024: $148 Million. The administration currently estimates that retail excise tax revenue was $148 million in the third quarter of calendar year 2024 (July through September). The revised estimate for the second quarter of 2024 (April through June) is $158 million, slightly higher than the $154 million preliminary estimate announced in May.

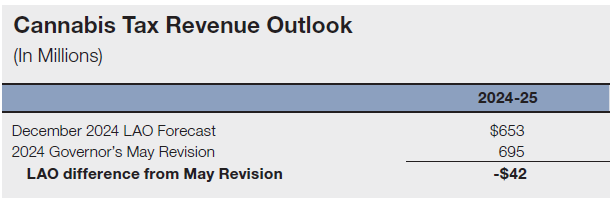

Current LAO Estimate for 2024-25: $653 Million. We currently project cannabis tax revenues of $653 million in 2024-25. As shown in the figure below, this forecast is $42 million below the budget package assumption for 2024-25.

Upcoming Tax Hike Under Current Law. The statute that eliminated the cultivation tax also requires the administration to increase the retail excise tax rate—currently 15 percent—effective July 1, 2025. The new rate cannot exceed 19 percent. Subject to that cap, the administration must set the new rate to offset the revenue loss from the elimination of the cultivation tax. Our next revenue update—likely in late February—will include a forecast for 2025-26 that reflects this statutorily required tax increase.