Chapter 1

Key Features of the

2017-18 Budget Package

Chapter 2

Spending by Program Area

October 18, 2017

The 2017-18 Budget

California Spending Plan

(Final Version)

Other Provisions

Earned Income Tax Credit (EITC)

State EITC Adopted in 2015. The EITC is a personal income tax (PIT) credit that is intended to reduce poverty among California’s poorest working families by increasing their after‑tax income. California adopted the state EITC in the 2015‑16 budget package. The state EITC builds on the similarly structured federal EITC. The budget package modifies the existing EITC in two ways.

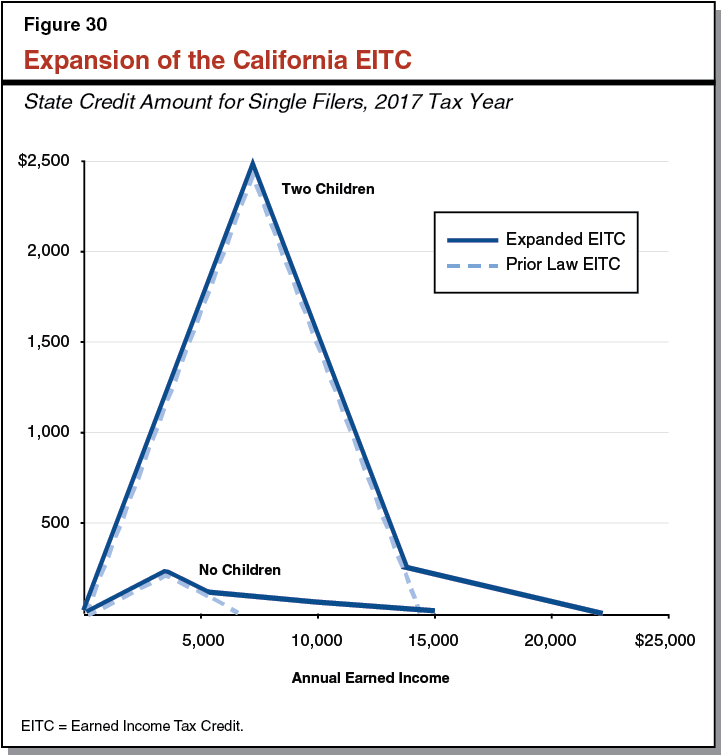

Expanded to Higher Income Families. Figure 30 shows the amount of credit available to single filers under the prior law EITC and the expanded EITC structures. As shown in the figure, the prior law state EITC focused on families with the lowest incomes. Specifically, the credit phased out at $6,892 for single filers with no qualifying children and $14,529 for single filers with two children. (The Franchise Tax Board [FTB] annually adjusts these amounts for inflation.) The 2017‑18 budget plan expands income eligibility to $15,009 for filers with no children and $22,310 for filers with two qualifying children. Generally, the expanded EITC keeps the structure at the lower end of the income range, but phases out the credit more slowly for those tax filers with relatively higher annual incomes. The administration assumes that this provision of the expanded state EITC will extend eligibility to approximately 800,000 additional tax filers and reduce PIT revenues by roughly $70 million in 2017‑18.

Expanded to Include Self‑Employment Income. Previously, the state EITC was limited to wage income subject to withholding. This meant that, under prior law, several hundred thousand self‑employed tax filers were ineligible to claim the prior California EITC. The 2017‑18 budget plan expands the state EITC to include self‑employment income. Because it can be more difficult for tax agencies to verify self‑employment income than wages, the budget plan directs FTB to take measures to prevent improper payments. The administration estimates this provision of the EITC expansion will reduce revenues by an additional $70 million, for a total reduction in PIT revenues of about $140 million in 2017‑18.

Statewide Infrastructure

Debt Service. The budget provides $8.1 billion from various funds for debt service payments in 2017‑18. This represents an increase of 5 percent from 2016‑17, which primarily reflects additional debt service costs related to bonds issued for K‑12 education, judicial branch, and criminal justice projects. The total includes $7.1 billion for general obligation bonds ($4.8 billion from the General Fund), and $1 billion for lease revenue bonds ($642 million from the General Fund).

Employee Compensation

Labor Agreements Increase State Annual Costs. The state now has active memoranda of understanding with all 21 state rank‑and‑file employee bargaining units. These agreements include provisions that will significantly increase state annual costs for years to come to fund scheduled employee pay increases, the state’s contributions to prefund retiree health benefits as a percentage of pay, increases in health care costs, and other benefit cost increases. In 2017‑18, the budget assumes that state costs to pay for salary and benefits (excluding retirement benefits) for rank‑and‑file employees and their managers will increase by $1.2 billion ($598 million General Fund).

State Pensions

State Annual Contributions to CalPERS Expected to Increase. At its December 2016 meeting, the California Public Employees’ Retirement System (CalPERS) board voted to change a key assumption used in calculating how much money employers and employees must contribute to the pension system each year. Specifically, the board voted to lower the discount rate from 7.5 percent to 7.0 percent over the next three years. This lower discount rate means that CalPERS calculations of plan assets and liabilities will assume investments have lower returns. By assuming less money comes into the system through investment gains, the state will be required to contribute more money over the next few decades to pay for higher normal costs and a larger unfunded liability. In 2017‑18, the budget assumes the state contributes about $5.2 billion (about one‑half General Fund) to pay for non‑higher education state employee pension costs. (In addition to pension costs, the budget assumes the state spends about $2 billion in 2017‑18 to pay for health benefits received by retired state employees.)

Makes Loan‑Funded $6 Billion Supplemental Payment to CalPERS. In addition to the pension costs discussed above, the budget package makes a one‑time $6 billion supplemental payment to CalPERS to reduce the state’s unfunded liabilities associated with pension benefits earned by current and past state employees. To make this payment, the budget uses a loan from the state’s cash balances in the Pooled Money Investment Account, the state’s checking account. Over the long term, this plan is expected to reduce annual state pension costs—relative to what they otherwise would be—by lowering employer contributions.

Budget Plan Begins Repaying the Loan in 2017‑18. Under the plan laid out in the budget package, the General Fund and special funds with pension liabilities would share the costs of repaying the loan with interest. In 2017‑18, the budget makes an initial repayment of $146 million from the General Fund, which is counted toward annual required debt payments under Proposition 2 (2014). Under the plan, special funds will repay the General Fund in future years for their respective shares of this repayment.

Funding for Information Security

Strengthens Information Security Across Various Departments. The 2017‑18 spending plan provides $4 million from the General Fund ($13.9 million total funds) and 58 positions across 12 departments to address identified information security vulnerabilities. The resources will support various approaches to strengthening information security based on the specific security vulnerabilities identified by each of the departments. For example, departments will establish continuously operating security centers to monitor threats, develop mitigation plans to reduce the risk of threats, and establish department policies and procedures to achieve security compliance and train staff on information security procedures.

State Board of Equalization (BOE)

Narrowed BOE’s Duties. The 2017‑18 budget package removed most of BOE’s administrative and appellate functions. BOE will retain its constitutionally assigned duties, which are:

- Adjustment of property tax assessments.

- Assessment of property taxes on certain types of property.

- Assessment and collection of excise taxes on alcoholic beverages.

- Assessment of the insurance tax.

Assigned Duties to Two New Entities. Starting on July 1, 2017, the new California Department of Tax and Fee Administration assumed administrative responsibilities for all of BOE’s tax and fee programs except those listed above. Starting on January 1, 2018, the new Office of Tax Appeals will assume appellate responsibilities for those programs and for taxes administered by FTB. Staff and funding supporting the transferred functions also will move to these new entities.

Cannabis Regulation

In 2015, the Legislature passed three state laws (Chapter 688 [AB 243, Wood], Chapter 689 [AB 266, Bonta], and Chapter 719 [SB 643, McGuire])—known collectively as the Medical Cannabis Regulation and Safety Act (MCRSA)—to provide a statutory framework for the state to regulate the cultivation and sale of medical cannabis. In November 2016, voters approved Proposition 64, which legalized the use of cannabis for nonmedical purposes by adults age 21 and over, (2) created a new regulatory structure for the licensing and enforcement of nonmedical cannabis similar to the one created for medical cannabis under MCRSA, (3) included new excise taxes on medical and nonmedical cannabis cultivation and retail sales to be administered by the Department of Tax and Fee Administration (previously BOE), and (4) created a new state entity—the Cannabis Control Appeals Panel (Appeals Panel)—to hear licensing appeals. Under these laws, state regulation of commercial cultivation and retail sales of medical and nonmedical cannabis would begin January 2018.

Additional Funding for Multiple Departments. The budget provides 373 new positions and $101 million mostly from the Cannabis Control Fund—using loans from the General Fund—as well as various other special funds for cannabis regulation‑related activities. Of this amount, $95 million is provided on a three‑year, limited‑term basis and $6 million is provided on a one‑year, limited‑term basis. Figure 31 summarizes the allocation of these additional resources across nine state departments. As shown in Figure 31, this is in addition to the baseline funding of $23 million initially provided in the 2016‑17 budget. The $101 million increase mainly supports (1) licensing and enforcement activities for medical and nonmedical cannabis by the Department of Consumer Affairs (DCA), the California Department of Food and Agriculture (CDFA), and the Department of Public Health (DPH); (2) development and implementation of cannabis‑related information technology (IT) systems by DCA, CDFA, and DPH; and (3) efforts to reduce the environmental impacts of cannabis cultivation by the Department of Fish and Wildlife and the State Water Resources Control Board. The budget package also includes provisional language that (1) allows DCA and DPH to augment their resources upon notification to the Joint Legislative Budget Committee and (2) requires DCA, CDFA, and DPH to provide quarterly briefings on their cannabis‑related IT projects.

Figure 31

Summary of Cannabis-Related Funding in 2017-18

(In Millions)

|

Department |

Funding Level |

Primary Responsibilities |

||

|

Base |

Augmentation |

Total |

||

|

Food and Agriculture |

$3.4 |

$28.6 |

$31.9 |

|

|

Consumer Affairs |

4.1 |

26.4 |

30.5 |

|

|

Fish and Wildlife |

5.8 |

17.2 |

23.0 |

|

|

State Water Resources Control Board |

6.7 |

9.8 |

16.5 |

|

|

Public Health |

2.5 |

10.6 |

13.1 |

|

|

Highway Patrol |

— |

3.0 |

3.0 |

|

|

Tax and Fee Administration |

— |

2.7a |

2.7 |

|

|

Pesticide Regulation |

0.7 |

1.3 |

2.0 |

|

|

Cannabis Control Appeals Panel |

— |

1.0 |

1.0 |

|

|

Totals |

$23.1 |

$100.6 |

$123.8 |

|

|

aDepartment will redirect similar amount of existing resources to administer cannabis taxes. |

||||

Budget Trailer Legislation. The budget package makes various statutory changes largely intended to bring MCRSA and Proposition 64 into conformity and address various other issues related to the implementation of medical and nonmedical cannabis regulations. Some of the major provisions of Chapter 27 of 2017 (SB 94, Committee on Budget and Fiscal Review)—amended by Chapter 253 of 2017 (AB 133, Committee on Budget)—provide the following:

- Allows for Vertical Integration, Including Self‑Distribution. Generally allows for entities to hold multiple license types (such as cultivation, distribution, and retail), with the exception of testing laboratories. Also includes language intended to prevent monopolies.

- Creates System for Verification of Local Permission to Operate. Requires state licensing authorities to communicate with local governments to determine whether an applicant for licensure is compliant with local ordinances.

- Addresses Testing and Quality Assurance. Includes various provisions related to the testing and quality assurance process, including creating a quality assurance compliance monitor employed by DCA to conduct random quality control inspections and verify compliance with state standards.

- Amends Tax Collection Provisions. Requires all the cannabis excise taxes—including the excise taxes on cultivation and retail sales—to be remitted by the cannabis distributor. Clarifies that this tax collection will happen when the product enters the commercial market (after the product complies with quality assurance). Also specifies that the excise tax on retail sales shall be collected based on the average market price rather than on gross receipts.

- Addresses Challenges of Cannabis‑Related Cash Payments. Requires the Secretary of Business, Consumer Services, and Housing to work with various entities to ensure that there is a safe and viable way to collect cash payments for taxes and fees related to cannabis. Requires the establishment of a state office to collect fees and taxes in the County of Humboldt, Trinity, or Mendocino.

Sacramento Infrastructure Projects

State Project Infrastructure Fund (SPIF) Transfers. In adopting the 2016‑17 budget package, the Legislature established the SPIF and provided $1.3 billion from the General Fund to the SPIF over two years—$1 billion that was appropriated in 2016‑17 and an additional $300 million to be provided in 2017‑18. This funding was expected to fund three projects in Sacramento: (1) a new building at the current Food and Agriculture Annex site on O Street (O Street Building), (2) a new Resources Building, and (3) either replacement or renovation of the State Capitol Annex. These three buildings reflect the first step of the administration’s larger regional strategy to expand and improve state office buildings in the Sacramento area over the next ten years.

The 2017‑18 budget transfers $851 million of the $1 billion that was appropriated to the SPIF in 2016‑17 to the General Fund. The budget also approves the use of an equivalent amount of lease revenue bonds to finance the construction of the O Street and new Resources buildings. The budget package also eliminates the $300 million transfer from the General Fund to the SPIF that was scheduled for 2017‑18.

Printing Plant Demolition. The budget provides $909,000 from the General Fund to complete preliminary plans for a project to demolish the state’s existing printing plant. The total cost of the demolition is estimated to be $16.4 million. Once the existing printing plant is demolished, the Governor plans to develop the site into a new state office building consistent with his plans for state office buildings in the Sacramento region described above.

Department of Food and Agriculture

The budget plan includes $525 million from various funds for support of CDFA in 2017‑18. This is a net increase of $74 million, or 16 percent, from the revised 2016‑17 spending level. The net increase is mainly due to increased spending of (1) $21.2 million for various pest prevention programs, and (2) $28.6 million for cannabis‑related regulatory activities (discussed in more detail elsewhere in this section).

Pest Prevention Staffing Increase. The budget includes a total of $4.4 million ($1.8 million General Fund and $2.6 million Department of Food and Agriculture Fund) in 2017‑18, increasing to $5.4 million ($1.9 million General Fund, $2.9 million Department of Food and Agriculture Fund, and $570,000 reimbursements) annually beginning in 2018‑19, to enhance various elements of the Plant Health and Pest Prevention Services (PHPPS) division’s pest prevention program. CDFA will establish 190.5 permanent positions (25.5 new positions and 165 positions shifted from temporary to permanent status) in 2017‑18 and an additional 3.5 permanent positions in 2018‑19.

The budget plan also provides $1.8 million in federal funds for 20 positions to enhance the PHPPS division’s exotic pests mitigation capabilities by establishing emergency plant health response teams.

Asian Citrus Psyllid (ACP) and Pierce’s Disease. The budget includes a one‑time increase of $10 million from the General Fund to expand the state’s response to ACP—an insect that spreads the disease Huanglongbing to citrus trees. The budget also includes a one‑time increase of $5 million from the General Fund to expand the Pierce’s Disease Control Program to address the disease’s impact on grapevines.

Office of Emergency Services (OES)

The budget provides OES with $1.3 billion (more than three‑quarters from federal funds) in 2017‑18. This is a net decrease of $114 million, or about 8 percent, compared to the estimated spending level for 2016‑17. (Most of this decrease is related to the completion of the Proposition 1B bond program.)

Disaster‑ and Drought‑Related Local Assistance. The budget provides an additional (1) $28.4 million from the General Fund for California Disaster Assistance Act (CDAA) to provide disaster‑related assistance to local communities, such as for the 2017 winter storms and for the removal of dead and dying trees that pose a risk to public infrastructure; (2) $25 million from the Greenhouse Gas Reduction Fund for grants to local fire departments in high fire‑risk areas; and (3) $6.5 million from the General Fund on a one‑time basis for OES to provide temporary water to communities that continue to suffer from effects of the drought. (The fire and drought funding provided in the budget are described further in the “Resources and Environmental Protection” section of this report.)

Victim Services and Other Non‑Disaster Related Local Assistance. The budget provides an additional $17 million on a one‑time basis to various victims programs operated by OES. This includes (1) $10 million from the General Fund for a Homeless Youth Housing Program, as well as provisional language specifying how the funding shall be used; (2) $5 million from the General Fund for the Human Trafficking Victim Assistance Program, which provides grants to providers of comprehensive services for victims of human trafficking; and (3) $2 million ($1.5 million from the General Fund and $500,000 from the Anti‑Terrorism Fund) for the Nonprofit Security Grant Program, which provides grants to nonprofits at high risk of terrorist attack to pay for physical security enhancements. The budget also modifies the funding level for various other local assistance programs operated by OES that have historically been funded by the State Penalty Fund. (The changes to State Penalty Fund‑related programs are described in greater detail in the “Judiciary and Criminal Justice” section of this report.)

Department of Consumer Affairs

The budget provides DCA with $653 million. This is a net increase of $13 million, or about 2 percent, compared to the estimated spending level for 2016‑17. This includes $30.5 million for regulation of commercial medical and nonmedical cannabis as described in an earlier section of the report.

BreEZe. The budget provides a total of $19.8 million on a one‑time basis in 2017‑18 from various DCA special funds for the BreEZe project. The BreEZe project was proposed to be an integrated, web‑enabled enforcement and licensing information technology (IT) system that would replace various systems that have been in place at all of the entities within DCA. It was proposed to be completed in three phases (or “releases”), with roughly half of the entities in the third release. In 2015, the state decided to cancel the project after the second release. The funding provided will support 43 positions and various contract and other costs related to maintaining the BreEZe IT system for the first two releases.

California Military Department (CMD)

The budget provides CMD with $184 million, about two‑thirds from federal funds. This is a net reduction of $29 million, or about 13 percent, compared to the estimated spending level for 2016‑17. The budget for CMD also includes $142 million in lease revenue bond authority to construct a new headquarters facility. The total estimated cost of the project—including previously funded acquisition and performance criteria phases—is $159 million. The project will consolidate headquarters staff that are currently divided among three leased buildings in the Sacramento region and address the security deficiencies of those facilities.

Labor Programs

Interest Payment for Federal Unemployment Insurance (UI) Loan. California’s UI trust fund reserve was exhausted in 2009, requiring the state to borrow from the federal government to continue payment of UI benefits. The balance of California’s outstanding federal loans is declining and is estimated to be $1.4 billion at the end of 2017. The state is required to make annual interest payments on these federal loans. The 2017‑18 spending plan includes $52 million from the General Fund to make the interest payment due in the fall of 2017. The federal loans are projected to be fully repaid in 2018.

Increased Funding for Labor Law Enforcement. The spending plan includes an increase of $4.6 million from special funds in 2017‑18 and 31 positions, growing to an ongoing amount of $11 million (special funds) and 82.5 positions by 2019‑20, for the Division of Labor Standards Enforcement (DLSE) within the Department of Industrial Relations (DIR). This significant increase in funding and positions is intended to allow DLSE to expand efforts to enforce wage and hour requirements in labor law.

Funding for Implementation of Recent Workers’ Compensation Reforms. The spending plan includes an increase of $14.7 million from special funds in 2017‑18 ($13.6 million ongoing) and 73 positions for the Division of Workers Compensation in DIR to implement the provisions of recent legislation related to workers’ compensation—Chapter 852 of 2016 (AB 1244, Gray) and Chapter 868 of 2016 (SB 1160, Mendoza). Funding will be primarily used to support activities related to (1) a new process for suspending certain medical providers, including those convicted of fraud, from the workers’ compensation system; (2) a new process for staying claims for payment (liens) of medical providers that have been indicted or charged with fraud; and (3) various changes to “utilization review” practices that workers’ compensation insurance providers and employers use to ensure that injured employees receive treatment that is consistent with treatment guidelines and to limit overutilization of medical services.

One‑Time Funding for Employment Services for Supervised Populations. The spending plan includes $2 million on a one‑time basis from the General Fund for the Employment Development Department to support the Supervised Populations Workforce Training Grant program. Funding will be distributed based on a competitive application process to local grantees that provide workforce training for supervised populations (such as individuals on parole or probation).

Department of Veterans Affairs

The spending plan for the California Department of Veterans Affairs (CalVet) includes $391 million from the General Fund in 2017‑18, a decrease of $13 million over revised estimates for 2016‑17. This amount is expected to be offset by $75 million from federal reimbursements for Veterans Homes.

Changes to Veterans Homes Admissions and Level of Care Services. The State of California runs eight residential Veterans Homes designed to serve older or disabled veterans, whose needs range from independent living with minimum supervision to advanced medical care for residents with significant disabilities. State law and regulations prioritize certain veterans for admissions, including Medal of Honor recipients, homeless veterans, and former prisoners of war. The budget plan expands priority admissions to veterans with a 70 percent or higher service‑connected disability. These veterans, if placed in certain levels of care in the Veterans Homes, receive an increased federal reimbursement rate. There is potential for increased revenues to the state resulting from the increased admission of veterans with a higher federal reimbursement rate. The legislation also specifies legislative intent that any increased revenues resulting from these changes remain in the CalVet budget. However, the exact amount and timing of the increased revenue is uncertain.

Capital Outlay. The 2017‑18 budget includes funding for various capital outlay projects in CalVet, using a combination of funding sources:

- Veterans Home of California, Yountville. The 2017‑18 spending plan provides a total of about $40 million in lease revenue bonds, Veterans Homes bonds, and federal funds to renovate the steam distribution and chilled water system and upgrade the central power plant in the Yountville Veterans Home.

- Southern California Cemetery. The 2017‑18 spending plan includes $5 million from the General Fund for the construction of a Southern California Veterans Cemetery, with $500,000 of the funding being used to conduct preliminary studies of a potential cemetery site.

- Central Coast Veterans Cemetery. The 2017‑18 spending plan provides $1.5 million from the General Fund to expand the existing Central Coast Veterans Cemetery, estimated to result in about 3,700 in‑ground burial sites.

Housing

Increases Funding for Housing Programs. The budget provides $28.25 million for various housing‑related programs: $20 million for local navigation centers, which provide temporary housing and case management for homeless individuals; $8 million for affordable housing for homeless and low‑income individuals and families in Los Angeles; and $250,000 for migrant worker housing in Napa County.

Housing Package. In September, the Legislature passed a package of bills aimed at ameliorating the state’s housing crisis. The package includes two new sources of funding for affordable housing programs. First, the package creates a $75 charge on certain real estate documents. The bulk of the proceeds would be allocated to cities and counties to fund affordable rental and ownership housing for low‑income and middle‑income households. Second, the package places a $4 billion general obligation bond on the November 2018 ballot. Should voters approve the bond, $1.5 billion of the funds will go to low‑income multifamily housing, $1 billion to veterans’ housing assistance, and the remainder divided amongst various programs to fund a variety of housing and related infrastructure. The housing package also includes a variety of bills aimed at making it easier for housing developments to gain local approval. Changes include requiring streamlined approval of certain multifamily housing in localities failing to meet state housing goals and strengthening rules that prohibit localities from denying or scaling back projects that comply with local land use rules.

Sales and Use Tax (SUT) Exemption

Since 2014, California has exempted certain sales of manufacturing or research and development (R&D) equipment from the General Fund portion of the SUT. Assembly Bill 395 expands this exemption to new types of equipment and businesses, effective January 1, 2018. It also delays the exemption’s expiration date from 2022 to 2030. The administration estimates that the expansion of the exemption will reduce General Fund SUT revenue by $45 million in 2017‑18 and $89 million on an ongoing basis. Assembly Bill 395 and AB 131/SB 116 establish an annual transfer from the Greenhouse Gas Reduction Fund to the General Fund that would offset this revenue loss.