Chapter 1

Key Features of the

2017-18 Budget Package

Chapter 2

Spending by Program Area

October 18, 2017

The 2017-18 Budget

California Spending Plan

(Final Version)

Action on the Coordinated Care Initiative

The Coordinated Care Initiative (CCI) was a joint state‑federal demonstration project implemented beginning in 2012‑13 designed to improve the coordination of health care and long‑term services, as well as reduce the cost of providing care, for seniors and persons with disabilities. As part of the CCI, the state implemented a statewide maintenance‑of‑effort (MOE) for In‑Home Supportive Services (IHSS), thereby limiting counties’ costs for the program. Prior to CCI, counties paid 35 percent of the nonfederal share of IHSS costs. Statute gave the Department of Finance (DOF) the authority to terminate the CCI if it did not generate net General Fund savings. The administration exercised this authority in January, thereby terminating CCI and the IHSS MOE—returning counties to the original 1991 cost‑sharing ratios for IHSS. Although the administration terminated the CCI, as part of the Governor’s January budget proposal, it proposed the continuation of certain components of the CCI. In recognition of the increased cost on counties due to the termination of the IHSS MOE, the Governor’s 2017‑18 May Revision included a proposal for a new, revised county IHSS MOE.

The 2017‑18 Budget Act adopts the Governor’s January proposal for maintaining certain components of the CCI as well as the Governor’s May Revision proposal for a new IHSS cost‑sharing plan. In this section, we describe the continuation of certain CCI components and the new state‑county cost‑sharing arrangement for IHSS.

Continuation of Major Components of the CCI

Efforts to Coordinate Care Maintained. Recognizing the merits of the policy goals behind the CCI, the Governor proposed and the Legislature approved the continuation of major components of the CCI. The 2017‑18 Budget Act continues the following CCI components:

- Two‑Year Continuation of Cal MediConnect. Cal MediConnect is a joint federal‑state demonstration program that integrates Medi‑Cal and Medicare benefits under Medi‑Cal managed care for seniors and persons with disabilities enrolled in both programs who opt to participate in the demonstration. Without this extension, Cal MediConnect would end in January 2018.

- Two‑Year Extension of Mandatory Enrollment of Dual Eligibles in Managed Care for Their Medi‑Cal Benefits. Without this extension, this component of the CCI would end in January 2018.

- Continued Integration of Long‑Term Service and Supports (LTSS) Other Than IHSS Under Medi‑Cal Managed Care. This includes skilled nursing facility care, community‑based adult services, and the multipurpose senior services program (MSSP). Integration of MSSP under managed care will occur in January 2020.

Changes to IHSS Cost Sharing

Rather than return to the original 1991 realignment cost‑sharing ratios for IHSS, the budget package adopts the May Revision proposal to create a new MOE for counties’ share of IHSS costs. The new MOE significantly increases counties’ costs in 2017‑18 relative to 2016‑17. The budget provides ongoing state General Fund support and additional realignment revenue to partially offset this increase. The budget package also requires DOF to reexamine 1991 realignment as part of its 2019‑20 budget proposal. We discuss the specifics of the new MOE, the revenue supporting the new MOE, and other related changes below.

New IHSS MOE

New MOE Uses Historical Cost‑Sharing Ratio. Counties’ new IHSS MOE for 2017‑18 is roughly $1.8 billion (compared to $1.1 billion in 2016‑17). Specifically, the new MOE roughly reflects 35 percent of the nonfederal share of estimated IHSS services costs and 30 percent of the nonfederal share of estimated administrative costs in 2017‑18. These percentages reflect the historical 1991 realignment cost‑sharing ratios for IHSS. (If 2017‑18 actual costs are lower than estimated, the new MOE will be adjusted downwards. If actual costs in 2017‑18 are higher, however, the MOE will not be adjusted upwards.) The enacting statute includes adjustments to the new MOE for the following:

- Wage Costs. The 2017‑18 budget increases the county IHSS MOE by the incremental county share of locally negotiated wage increases. Counties’ share of cost for locally negotiated wages will vary based on certain conditions. (More information on county wage increases and share of cost is discussed below.)

- Administrative Costs. The 2017‑18 spending plan limits the portion of the county MOE obligation that can be met by county administrative costs. To the extent that actual county IHSS administrative costs exceed MOE administrative costs limits, counties are responsible to pay the difference, resulting in total county IHSS costs in excess of their MOE. (The portion of county MOE costs that can be met by administrative costs in 2017‑18 was calculated on a one‑time basis. Moving forward, the state and counties will work together to determine an appropriate budgeting methodology for setting county administrative cost limits.)

- Future Increases in Cost. As shown in Figure 17, the new MOE will be increased in future years by adjustment factors that vary based on the year‑to‑year growth in realignment sales tax revenues, which generally reflect overall economic conditions. In years that realignment revenues decline—like during recessions—there will be no increase to the new MOE and counties’ costs will be the same year to year.

Figure 17

Main Features of the Proposal

|

2017-18 |

2018-19 |

2019-20 |

2020-21 |

2021-22 |

2022-23 And Onwards |

|

|

General Fund support to partially offset increased county IHSS costs |

$400 million |

$330 million |

$200 million |

$150 million |

$150 million |

$150 million |

|

Realignment revenue growth to partially offset increased county IHSS costsa |

All sales tax and VLF growth |

All sales tax and VLF growth |

All sales tax and VLF growth |

All sales tax growth and half of VLF growth |

All sales tax growth and half of VLF growth |

All sales tax growth |

|

Adjustment factor to maintenance of effortb |

0% |

2.5 or 5% |

0, 3.5, or 7% |

0, 3.5, or 7% |

0, 3.5, or 7% |

0, 3.5, or 7% |

|

aA small portion of VLF growth will still be provided to the Child Poverty and Family Supplemental Support Subaccount in 1991 realignment. bStarting in 2018‑19, the adjustment factor will depend on the rate of growth in realignment revenues. If realignment revenues are negative, the adjustment factor will be zero. If the realignment revenues are less than 2 percent, the adjustment factor will be half of the highest possible percentage in that year. If the realignment revenues exceed 2 percent, the adjustment factor will be the highest possible percentage in that year. DOF forecasts the adjustment factor will be 5 percent in 2018‑19 and 7 percent in 2019-20 and 2020-21. |

||||||

|

IHSS = In-Home Supportive Services; VLF = vehicle license fee; and DOF = Department of Finance. |

||||||

Revenues Supporting New MOE

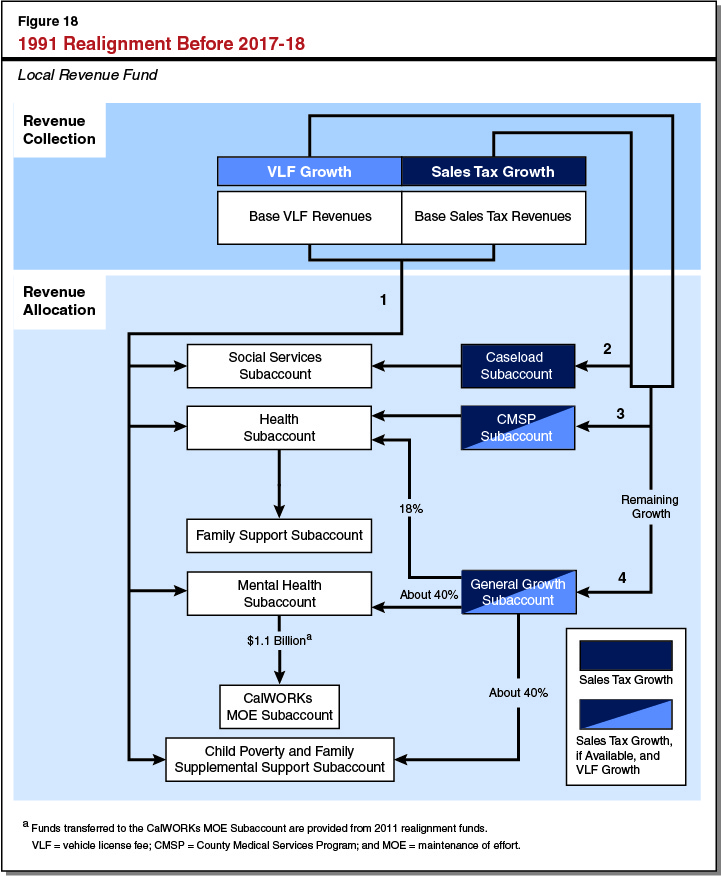

General Fund Support and Additional Realignment Revenues Support New MOE Costs. As seen in Figure 17, General Fund support to offset counties’ costs starts at $400 million in 2017‑18 and goes down to $150 million over several years. In addition, the budget package redirects some 1991 realignment revenues to partially cover increased county IHSS costs. As seen in Figure 18, and described in detail in the box below, under the existing 1991 realignment fiscal structure, IHSS only receives sales tax growth, while vehicle license fee (VLF) growth is provided to other realignment programs. (Other realignment programs also receive sales tax growth when available.) To increase realignment funding for IHSS, the implementing statute redirects VLF growth from other realignment programs to IHSS for five years. For the first three years, almost all VLF revenue growth is redirected to IHSS. In the last two years, half of VLF revenue growth is redirected to IHSS.

How 1991 Realignment Funds Flow Before and After 2017‑18

How Funds Flowed Before 2017‑18. Figure 18 shows how funds flow under 1991 realignment before 2017‑18:

- Step One: Fund the Base. Sales tax and vehicle license fee (VLF) revenues dedicated to 1991 realignment fund the “base.” Generally, the base reflects the funding the realigned programs received in the prior year.

- Step Two: Sales Tax Growth to the Caseload and Social Services Subaccounts. Growth in sales tax revenue funds prior‑year increases in county costs for the Social Services Subaccount programs (through the Caseload Subaccount).

- Step Three: Growth to County Medical Services Program (CMSP). A portion of the remaining sales tax growth (if any) and the growth in the VLF goes to the CMSP, which then is allocated to the Health Subaccount. (The proportion of sales tax and VLF growth allocated to CMSP is based on formulas set in statute.)

- Step Four: General Growth. The remaining growth from the sales tax (if any) and VLF is allocated to the General Growth Subaccount. Of the funds allocated to the General Growth Subaccount, 18 percent goes to the Health Subaccount, roughly 40 percent goes to the Mental Health Subaccount, and the remainder goes to the Child Poverty and Family Supplemental Support Subaccount (hereafter the Child Poverty Subaccount).

In some years, the growth in sales tax revenue is not sufficient to fully fund changes in county costs for social services programs through the Caseload and Social Services Subaccounts (Step Two). As a result, in those years, counties do not receive sufficient funding through 1991 realignment to cover the growth in costs for those programs. Those unmet county costs are carried forward to the next year and any sales tax growth first goes to pay off that balance before paying any new growth. When the cost growth in the Caseload and Social Services Subaccounts equals or exceeds the amount of sales tax growth, the Health, Mental Health, and Child Poverty Subaccounts receive growth only from VLF.

How Things Change in 2017‑18. The 2017‑18 budget package affects Steps Two, Three, and Four (described above) for five years. In particular, rather than only allocating sales tax growth to the Caseload Subaccount, In‑Home Supportive Services (IHSS) also will receive almost all of VLF growth for three years. (A small portion of VLF growth will continue to flow to the Child Poverty Subaccount.) As a result, for three years, Health and Mental Health will receive no growth funds (Steps Three and Four). After three years, half of VLF growth will be allocated to IHSS. At that time, the Mental Health and Health Subaccounts will receive some growth funds. After two years of allocating half of VLF growth to IHSS, the 1991 realignment fiscal structure would revert to its pre‑2017‑18 form. Furthermore, 2016‑17 sales tax growth for Health and Mental Health will be redirected to the Caseload Subaccount.

In addition to allocating VLF growth to the Caseload Subaccount, sales tax growth will be allocated to counties in the year in which it is received to reimburse costs incurred in that year. (As seen in Step Two above, prior to 2017‑18, sales tax growth paid prior year cost increases.) This sales tax payment acceleration will be ongoing.

Despite Additional Revenue, Counties Will Face Some Costs. While these additional sources of revenue significantly reduce the cost increase to counties due to the new MOE, the budget does not cover all of counties’ IHSS costs. Counties will need to find other revenue sources—likely their county general funds—to cover these amounts. The DOF estimates that these costs will be less than $200 million in 2017‑18 and will increase in future years.

Other 1991 Realignment Programs Will Not Receive Any Growth Funding Until 2020‑21. Due to the increased costs in IHSS and redirection of VLF growth, no realignment revenue growth will be available for some other 1991 realignment programs until 2020‑21 (the Child Poverty and Family Supplemental Support Subaccount would continue to receive some VLF growth). The revenue growth these programs received in prior years—VLF revenue growth—will be redirected temporarily to cover IHSS costs (Steps Three and Four in Figure 18). Starting in 2020‑21, VLF growth funding for these programs—Health and Mental Health—will be partially restored. Growth funding from the VLF will be fully restored in 2022‑23 and onwards. Sales tax growth, however, likely will not be provided to these programs for many years. Absent these changes, counties would have received roughly $50 million in VLF growth for Health and Mental Health in 2017‑18 (and these revenues would have grown in the out years). Due to the decreased realignment funding to these programs, counties may have to provide local general fund to support costs in these programs or make program reductions. Any additional county general fund support would be in addition to the increased county costs for IHSS described above.

Other Changes

Changes to Cap on State Participation in IHSS Wages and Benefits. Currently, state participation in total IHSS county wage and benefit costs is capped at $12.10. The 2017‑18 budget package increases the state contribution cap to $1.10 above the state minimum wage once state minimum wage equals or exceeds $12.00. The enacting legislation applies historical state and county cost‑sharing ratios (65 percent state and 35 percent county) for nonfederal wage and benefit costs at or below the state contribution cap. If county wage and benefit levels exceed the state contribution cap, however, counties are fully responsible for the nonfederal portion of wage and benefit costs above the cap. In 2017‑18, counties’ individual MOEs reflect their estimated share of the nonfederal cost of wages and benefits based on their locally negotiated wages. In future years, counties’ MOEs will be increased to reflect their share of cost for any additional locally negotiated wages increases.

Transition Phase for Counties Currently Above $12.10 in IHSS Wages and Benefits. The 2017‑18 budget package institutes a temporary, alternative cost‑sharing structure for wage increases in counties with wages and benefits currently above $12.10. For these counties, the state will share a portion of costs associated with wage increases that, in sum, do not exceed 10 percent of their current wage and benefit level. For example, if a county is currently at $13 the state will participate in wage increases up to an additional $1.30 over the next three years.

County Share of Costs Significantly Less for Local Wage Supplements to the State Minimum Wage. Budget‑related legislation limits the wage and benefit costs for counties with bargaining contracts that provide “local wage supplements.” Specifically, if a county links its local IHSS wage increases to increases in the state minimum wage, this will be considered a local wage supplement. In the first year of a local wage supplement, counties will pay their share of the wage increase and their MOE will increase accordingly. All subsequent local wage supplements will be paid entirely by the state General Fund (as long as wages do not exceed the state cap—minimum wage plus $1.10).

Loans to Counties Facing “Significant Financial Hardship.” In response to the increased costs to counties as a result of the new MOE, the budget‑related legislation allows DOF to provide loans to counties that demonstrate that they are experiencing significant financial hardship. The loans will be low interest (not to exceed the rate earned by the Pooled Money Investment Account) and are not to exceed $25 million statewide annually. Loans are only available through 2019‑20.

Forgiveness for Sales Tax Misallocations. Recently, DOF and others have identified issues in the Board of Equalization’s distribution of sales tax revenue. The enacting MOE statute does not require counties to repay any over‑allocation provided to 1991 realignment through 2015‑16.

Appeals to Public Employment Relations Board (PERB) Available. The 2017‑18 budget package gives counties and unions the ability to appeal to PERB and engage in mediation or a fact‑finding process if a bargaining agreement is not reached by January 1, 2018. In addition, the department shall update the Legislature on the status of all IHSS bargaining contracts by April 1, 2018. This provision is effective until January 1, 2020.

Reexamination of 1991 Realignment. The 2017‑18 budget‑related legislation requires DOF, in consultation with the California State Association of Counties and other affected parties, to reexamine 1991 realignment as part of its development of the 2019‑20 budget. Enacting statute requires DOF to report on a variety of metrics including whether the realigned revenues are sufficient to meet the costs of the programs within 1991 realignment.