LAO Contact

October 17, 2019

The 2019‑20 Budget: California Spending Plan

Education

- Proposition 98

- K-12 Education

- California Community Colleges

- District Pension Costs

- Early Education

- California State University

- University of California

- Student Financial Aid

- Crosscutting Issues

This post summarizes the state’s 2019‑20 spending package for education programs. It is part of our Spending Plan series, which contains posts focused on each major sector of the state budget. This education-focused post begins by covering the Proposition 98 minimum guarantee and overall Proposition 98 spending. It then covers spending for K-12 education, the California Community Colleges (CCC), pensions for school and community college staff, child care and preschool, the California State University (CSU), the University of California (UC), student financial aid, and crosscutting education initiatives. The EdBudget part of our website contains dozens of tables providing more detail about the 2019‑20 education budget package.

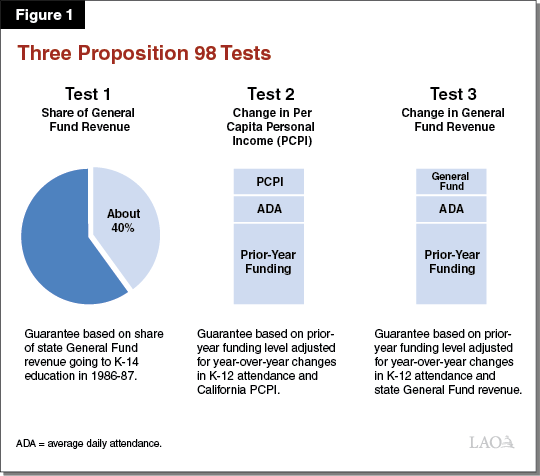

Proposition 98

Proposition 98 Establishes Minimum Funding Level. This minimum funding requirement is commonly called the minimum guarantee. The minimum guarantee is calculated by comparing three main formulas or “tests” (Figure 1). Each test takes into account certain inputs, such as state General Fund revenue, per capita personal income, and K-12 student attendance. The state can choose to fund at the minimum guarantee or any level above it. It also can suspend the guarantee with a two-thirds vote of each house of the Legislature. The state meets the guarantee through a combination of state General Fund and local property tax revenue.

Minimum Guarantee and Proposition 98 Spending for 2017‑18 Revised Down From June 2018 Estimates. Figure 2 compares estimates of the minimum guarantee and Proposition 98 spending in the June 2018 to June 2019 budget plans. Compared to the June 2018 budget plan, the 2017‑18 guarantee has dropped by $158 million, mainly due to downward revisions of some Proposition 98 inputs and certain prior-year adjustments carrying forward. Test 2 remains operative for 2017‑18. Total Proposition 98 spending has decreased by $42 million due to minor adjustments involving the Local Control Funding Formula (LCFF) and community college apportionments. The net effect of these adjustments is that Proposition 98 spending for 2017‑18 is $117 million above the minimum guarantee.

Figure 2

Tracking Changes in the Minimum Guarantee and Spending

(In Millions)

|

2017-18 |

2018-19 |

||||||

|

June 2018 |

June 2019 |

Change |

June 2018 |

June 2019 |

Change |

||

|

Minimum Guarantee |

$75,618 |

$75,459 |

-$158 |

$78,393 |

$78,146 |

-$247 |

|

|

Spending |

|||||||

|

Proposition 98 spending |

$75,618 |

$75,576 |

-$42 |

$78,393 |

$78,146 |

-$247 |

|

|

Settle-up payment for LCFF |

— |

— |

— |

— |

368 |

368 |

|

|

Total |

$75,618 |

$75,576 |

-$42 |

$78,393 |

$78,514 |

$121 |

|

|

LCFF = Local Control Funding Formula. |

|||||||

Minimum Guarantee for 2018‑19 Also Revised Down but Spending Increases Slightly. For 2018‑19, the guarantee has dropped $247 million from the June 2018 estimate, but Test 2 still remains operative. The downward revision in the guarantee mainly reflects updated data showing year-over-year declines in student attendance and an associated “hold harmless” provision no longer being operative. The June 2019 budget plan reduces school spending to this lower level but avoids any reductions to school programs by providing a $368 million settle-up payment to cover estimated program costs. Including the settle-up payment, total Proposition 98 spending is up $121 million over the June 2018 level. This higher level allows the state to cover various minor cost increases related to LCFF and community college apportionments.

2019‑20 Spending Is Up $2.9 Billion Over Revised 2018‑19 Level. Total Proposition 98 funding for 2019‑20 is $81.1 billion, an increase of $2.9 billion (3.7 percent) from the revised 2018‑19 level (Figure 3). This funding level equals the estimate of the minimum guarantee. Test 1 is the operative test in 2019‑20, with the General Fund component of the guarantee equating to about 40 percent of state General Fund revenue. Local property tax revenue increases $1.5 billion from 2018‑19 to 2019‑20. The primary factor explaining this increase is projected growth in assessed property values. The property tax increase accounts for about half of the increase in the overall minimum guarantee.

Figure 3

Proposition 98 Funding by Segment and Source

(Dollars In Millions)

|

2017-18 |

2018-19 |

2019-20 |

Change From 2018-19 |

||

|

Amount |

Percent |

||||

|

K-12 Education |

|||||

|

General Funda |

$47,194 |

$48,327 |

$49,322 |

$994 |

2.1% |

|

Local property tax |

19,644 |

20,645 |

21,921 |

1,276 |

6.2% |

|

Subtotals |

$66,839 |

$68,973 |

$71,243 |

$2,270 |

3.3% |

|

California Community Colleges |

|||||

|

General Fund |

$5,757 |

$6,117 |

$6,193 |

$75 |

1.2% |

|

Local property tax |

2,980 |

3,056 |

3,244 |

188 |

6.2% |

|

Subtotals |

$8,737 |

$9,173 |

$9,437 |

$264 |

2.9% |

|

Proposition 98 Reserve Depositb |

— |

— |

$377 |

$377 |

— |

|

Totals |

$75,576 |

$78,146 |

$81,056 |

$2,910 |

3.7% |

|

General Fund |

$52,951 |

$54,445 |

$55,891 |

$1,446 |

2.7% |

|

Local property tax |

22,625 |

23,701 |

25,166 |

1,464 |

6.2% |

|

aIncludes funding for instruction provided directly by state agencies and the portion of State Preschool funded through Proposition 98. bConsists entirely of General Fund. |

|||||

Spending Package Includes $852 Million in One-Time Funds. The budget plan includes two sources of one-time Proposition 98 funding. The largest source is settle-up funding related to meeting the minimum guarantee in prior years. Specifically, the state makes a $687 million payment, eliminating all Proposition 98 settle-up obligations. (Most of the payment is related to meeting the guarantee for 2009‑10, with smaller amounts attributable to meeting the guarantees for 2011‑12, 2013‑14, 2014‑15, and 2016‑17.) The budget package scores $391 million of the settle-up payment as a Proposition 2 debt payment. The other source of one-time Proposition 98 funding is $165 million in unspent funds appropriated as part of previous budgets. The budget allocates the combined $852 million in one-time funds for (1) covering LCFF costs ($368 million in 2018‑19 and $250 million in 2019‑20), (2) providing a property tax backfill for San Francisco Unified ($149 million), and (3) supporting various smaller initiatives (totaling $85 million).

State Makes First Ever Deposit Into Proposition 98 School Reserve. Proposition 2 (2014) established a constitutional reserve account within Proposition 98. The purpose of this reserve is to set aside some Proposition 98 funding in relatively strong fiscal times to mitigate funding reductions during economic downturns. The 2019‑20 budget makes the first ever deposit into this account. The $377 million deposit is mainly the result of capital gains being relatively strong and certain other required commitments being fulfilled for the first time. The deposit creates an operating surplus within the Proposition 98 budget. The budget, however, uses $256 million in one-time funds to pay for ongoing costs, thereby reducing the size of the operating surplus from $377 million to $121 million.

Budget Plan Makes Two Other Changes Affecting Proposition 98 Calculations on an Ongoing Basis. The budget shifts funding for part-day State Preschool programs operated by certain entities (nonprofit agencies, county welfare departments, and cities) from the Proposition 98 to non-Proposition 98 side of the budget. This shift means that all part-day and full-day State Preschool funding for these entities will come from the non-Proposition 98 side of the budget. (Preschool programs operated by schools and community colleges remain funded within Proposition 98.) In tandem with this shift, the minimum guarantee is “rebenched” down by $309 million in 2019‑20 (reflecting the cost of the programs being shifted after accounting for statutory caseload and inflation adjustments). Separate from this shift, the budget repeals the Proposition 98 true-up account. The state created this account in 2018‑19 as a way to adjust school funding automatically when estimates of the prior-year minimum guarantee changed. The revisions in the 2019‑20 budget plan call for the state to continue making upward funding adjustments when the guarantee rises but not downward adjustments when the guarantee drops.

K-12 Education

Per-Student Funding Increases 3.1 Percent. The budget package includes $71.2 billion in Proposition 98 funding for K-12 education in 2019‑20—$2 billion (2.9 percent) more than the 2018‑19 Budget Act level. The budget increases funding per student by $363 (3.1 percent) over the 2018‑19 Budget Act level, bringing Proposition 98 funding per student up to $12,007. As Figure 4 shows, the budget includes a total of $3 billion in new Proposition 98 spending for K-12 education. This new spending is from a combination of 2018‑19 and 2019‑20Proposition 98 spending, reappropriations from unspent prior-year funds, and settle-up funds. We describe the major K-12 education changes below.

Figure 4

Changes in K-12 Education Proposition 98 Spending

(In Millions)

|

Action |

Amount |

|

|

Changes in Ongoing Spending |

||

|

Local Control Funding Formula |

Provides 3.26 percent COLA to schools’ general purpose funding and adjusts for changes in student attendance. |

$1,959.3 |

|

Preschool-aged children with disabilities |

Provides grants to school districts for every three- and four-year old they serve who has a disability. |

492.7 |

|

SELPA funding |

Increases special education funding for the lowest funded SELPAs to the statewide target rate. |

153.0 |

|

Select categorical programs |

Provides 3.26 percent COLA to special education, child nutrition, mandates block grant, services for foster youth, adults in correctional facilities, and American Indian education. |

140.9 |

|

After School Safety and Education |

Increases the funding rate for after school programs from $8.19 to $8.87 per student per day. |

50.0 |

|

County offices of education |

Adjusts for MSA increases, provides a 3.26 percent COLA for those counties funded at their formula targets, and funds more district support. |

44.2 |

|

Other |

Provides $300,000 ongoing to add Cal Grant reporting requirements to the mandates block grant. Also provides $178,000 in 2019-20 ($154,000 ongoing) to the San Joaquin County Office of Education to maintain the School Accountability Report Card and School Dashboard databases. |

0.5 |

|

Subtotal |

($2,840.6) |

|

|

One-Time Initiatives |

||

|

Property tax backfill |

Backfills San Francisco Unified School District for previous misallocation of local property tax revenue. |

$149.1 |

|

Classified School Employee Summer Assistance Program |

Provides state matching funds for classified employees who opt to withhold a portion of their income earned during the school year to be paid out in the summer. |

36.0 |

|

Three 2018-19 initiatives |

Shifts funding from the non-Proposition 98 to Proposition 98 side of the budget. Involves facility projects at the San Francisco Unified and Sweetwater Union High school districts as well as funding for suicide prevention training. |

7.7 |

|

Operating grants for two fiscally distressed districts |

Provides special grants to Inglewood Unified School District ($3.6 million) and Oakland Unified School District ($514,000). |

4.1 |

|

Standardized school district accounting system |

Funds the next phase of an IT project to upgrade the electronic system that schools use to report their revenues and expenditures to the state. |

3.0 |

|

Southern California Regional Occupational Center |

Provides third of four installments to support general operations at the center. |

2.0 |

|

Basic aid districts backfill |

Backfills basic aid districts experiencing lower funding levels due to recent wildfires. |

2.0 |

|

School meal programs |

Reimburses schools closed due to disaster for salaries and other costs associated with operating school meal programs. |

0.7 |

|

Homeless student services |

Backfills San Diego Unified School District for temporary loss of federal funding for homeless student services. |

0.5 |

|

Breakfast After the Bell |

Provides grants to cover costs associated with starting or expanding programs serving breakfast after the school day starts. |

0.5 |

|

Translations |

Provides $24,000 to translate the School Accountability Report Card and School Dashboard into Vietnamese, Mandarin, and Filipino. They are currently available in English and Spanish. |

— |

|

Subtotal |

($205.7) |

|

|

Total |

$3,046.3 |

|

|

COLA = cost-of-living adjustment; SELPA = Special Education Local Planning Area; MSA = minimum state aid; and IT = information technology. |

||

Funds COLA for LCFF. The budget provides $2 billion for a 3.26 percent cost-of-living adjustment (COLA) to LCFF. In total, the 2019‑20 budget provides $63 billion in LCFF funding. Of this amount, $51.4 billion is base funding, $6.4 billion is supplemental grant funding, $3.6 billion is concentration grant funding, and the remaining $1.6 billion is for various add ons.

Establishes New LCFF COLA Rules. Trailer legislation includes notable action relating to the LCFF COLA—adding a provision that automatically reduces the COLA rate under certain conditions. Specifically, in years in which growth in the Proposition 98 minimum guarantee is insufficient to fund the traditional LCFF COLA (which is based on the state and local government price index), the LCFF COLA is to be reduced to fit within the guarantee.

Provides State Funding for Preschool-Aged Children With Disabilities for First Time. Federal law requires public schools to begin providing special education services to all children with disabilities upon their third birthday. Despite this requirement, the state historically has not provided special education funding for three- and four-year olds. The budget provides $493 million to school districts for this purpose. We estimate this equates to about $9,500 per three- and four-year old with a disability.

Addresses Historically Low-Funded Special Education Regions. Most state special education funding is provided to Special Education Local Plan Areas (SELPAs) based on the total number of students they serve. (Most SELPAs are regional collaborations of neighboring districts, county offices of education [COEs], and charter schools, though some consist of only a single large district.) Each SELPA receives a unique per-student rate linked to certain historical factors. In 2018‑19, these per-student rates varied from less than $500 to more than $900. The budget provides $153 million to bring low-funded SELPAs to the statewide target rate of $577 per student. This rate is roughly equivalent to the 75th percentile of current rates.

Ongoing Special Education Augmentations Contingent on Future Legislative Reforms. Trailer legislation specifies that the additional funding provided in 2019‑20 for preschool-aged children with disabilities and historically low-funded regions will only become ongoing if the Legislature makes statutory changes next year that are designed to improve the academic outcomes of students with disabilities. The specific reforms are to be determined collaboratively by the Legislature and Department of Finance (DOF), but trailer legislation specifies the changes may include: a reconsideration of the role of SELPAs, expansion of inclusive instructional practices, additional state and regional support for addressing disproportionality (when certain groups of students have relatively high identification, placement, and discipline rates), and review of special education funding allocations.

Also Increases COE Funding. The budget includes several augmentations for COEs. One is an augmentation of $21 million for the 23 COEs that benefit from minimum state aid allocations. Another is a net $13 million augmentation to make baseline adjustments relating to updated student attendance estimates and cover a 3.26 percent COLA for the 25 (out of 58) COEs that have formula allocations equal to (rather than above) their targets. Additionally, the 2019‑20 budget provides a $10 million augmentation for COEs to support more districts identified for targeted assistance. In total, COEs are budgeted to receive $1.2 billion in formula funding and related add ons (such as minimum state aid). Of this total, $487 million is generated for general district support, $259 million is generated for alternative education, $75 million is for targeted district support, and the remaining $336 million is for various add ons.

Funds Additional Full-Day Kindergarten Facility Grants. In addition to Proposition 98 funding, the budget includes several K-12 augmentations from other fund sources (Figure 5). Most notably, the budget includes $300 million one-time non-Proposition 98 General Fund for a second round of facility grants to promote more full-day kindergarten programs. The grants are available through 2021‑22. As with the first round of grants (funded in 2018‑19), the second-round grants are available for constructing new or renovating existing classrooms. Likewise, funding priority is still given to districts that have a high share of low-income students and face challenges raising their local match. The second-round grants, however, differ in several ways from the first-round grants. First, the new facility grants are limited to districts converting their part-day programs to full-day programs for the first two years (through 2020‑21). Second, the new grants provide a more generous 75 percent state match (with districts facing challenges raising their local match still able to qualify for state funding covering all project costs). Third, districts may now use project savings for professional development or instructional materials to support full-day programs in addition to other facility purposes. Lastly, any new classrooms built using either round of facility grants will not factor into districts’ eligibility for funding under the School Facility Program.

Figure 5

Other Changes in K-12 Education Spending

Various Fund Sources a (In Millions)

|

Action |

Amount |

|

|

Full-Day Kindergarten Facility Grants |

Provides additional facility grants to promote more full-day kindergarten programs. |

$300.0 |

|

Educator Workforce Investment Grants |

Supports statewide resources and professional development opportunities for teachers and paraprofessionals. |

37.1 |

|

21st Century California School Leadership Academy (ongoing) |

Funds professional development opportunities for principals and specified school leaders. Federally funded. |

13.8 |

|

Broadband Infrastructure Grants |

Creates grants to expand fiber broadband at schools considered poorly connected. |

7.5 |

|

California Subject Matter Projects |

Funds ongoing teacher professional development in specified subject areas. |

6.7 |

|

Special Education Teaching Performance Assessment |

Funds development of a portfolio-based assessment for prospective special education teachers. Funding is from the Test Development and Administration Account. |

1.2 |

|

Administrator-to-teacher ratio |

Allows the Los Angeles Unified School District to avoid fiscal penalties otherwise associated with exceeding the statutory maximum ratio of school administrators to teachers. |

— |

|

Total |

$366.3 |

|

|

aUnless otherwise noted, funding is (1) non-Proposition 98 General Fund and (2) one time. Figure excludes funding provided for school pensions. |

||

Establishes Two Notable Professional Development Initiatives. The budget includes $37.1 million (one-time non-Proposition 98 General Fund) for professional development for teachers and paraprofessionals. Of the amount, $10 million and $5 million, respectively, are reserved for activities focused on English learners and students with disabilities. The remaining funding supports professional development on other topics, including social-emotional learning, improving school climate, ethnic studies, and computer science. The budget also includes $13.8 million (ongoing federal funds) to establish the 21st Century California School Leadership Academy. This funding is to provide professional development for principals and specified school leaders. Professional development may focus on supporting effective instruction, promoting inclusive practices, addressing performance gaps, and engaging parents/guardians. Priority for professional development may be given to districts and COEs flagged for differentiated assistance under the statewide system of support. For both initiatives, the California Department of Education (CDE) and the California Collaborative for Educational Excellence are to award funds on a competitive basis.

Supports New and Ongoing CDE Workload. The budget provides CDE with 17.5 additional positions and an associated $3.8 million augmentation ($3.3 million non-Proposition 98 General Fund and $500,000 federal funds) for accommodating new workload. Of the $3.8 million, 52 percent is ongoing and 48 percent is one time or limited term. The new ongoing workload includes providing technical assistance to districts with poor outcomes for students with disabilities and supporting implementation of the state and federal accountability systems. It also includes more monitoring of nonpublic schools that provide special education services, reviewing district plans for providing behavioral restraints to students in danger of harming themselves or others, coordinating services for homeless youth, providing technical assistance to COEs for developing local interagency plans for the care of foster youth, and reviewing district waivers for a reduction in student attendance following emergencies, among others. The most notable changes to one-time workload are updating instructional guidance for several academic subjects, developing best practices for reviewing school safety plans, and coordinating statewide computer science efforts. A list of all new K-12 workload for the department is on our EdBudget website.

Provides Third Installment of Proposition 51 (2016) Bond Funding for School Facilities. The budget package also includes bond funding for school facilities. Specifically, the state plans to issue $1.5 billion of the $7 billion in Proposition 51 general obligation bonds for schools facilities in 2019‑20. This is about 2.5 times more than the amount of Proposition 51 school bonds the state issued each of the past two years (about $590 million). The budget also provides an ongoing augmentation of $1.2 million (Proposition 51 funds) for the Office of Public School Construction to hire ten additional staff to process the associated increase in school facility applications. As of April 30, 2019, the Office of Public School Construction had received requests for new construction and modernization funding totaling $6.2 billion, exceeding the $6 billion authorized for these purposes. For charter school facilities, nearly all of the $500 million in authorized bond funding also already has been committed. For career technical education projects, however, approximately $250 million of the $500 million in authorized Proposition 51 funding remains available. The state generally funds school facility requests on a first-come, first-serve basis.

California Community Colleges

Per-Student Funding Increases 3.8 Percent. The budget package includes $9.4 billion in Proposition 98 funding for CCC in 2019‑20—$264 million (2.9 percent) more than the 2018‑19 Budget Act level. The budget increases funding per full-time equivalent (FTE) student by $305 (3.8 percent) over the 2018‑19 Budget Act level, bringing Proposition 98 funding per FTE student up to $8,351. As Figure 6 shows, the budget includes a total of $405 million in new Proposition 98 spending for community colleges. This new spending is from a combination of 2019‑20 Proposition 98, settle-up, and reappropriated funds. We describe the major community college changes below.

Figure 6

Changes in Community College Proposition 98 Spending

2019-20 Proposition 98, Settle-Up, and Reappropriated Funds (In Millions)

|

Action |

Amount |

|

|

Ongoing |

||

|

Apportionments |

Provides $230 million for a 3.26 percent COLA and $25 million for 0.55 percent systemwide enrollment growth. |

$255 |

|

College Promise fee waivers |

Expands program based on estimated cost of waiving second-year enrollment fees for first-time, full-time students without financial need. |

43 |

|

Student support programs |

Provides 3.26 COLA to Adult Education, Extended Opportunity Programs and Services, Disabled Students Programs and Services, Apprenticeship Programs, CalWORKs student services, mandates block grant, Fund for Student Success, and campus child care support. |

30 |

|

Student Success Completion Grants |

Funds caseload increases. |

18 |

|

Student homelessness |

Provides funding for colleges to provide homeless students with rental subsidies and wraparound services through ongoing partnerships with experienced community organizations. |

9 |

|

Veterans resource centers |

Increases ongoing support services for veterans, with funding distributed to interested colleges based on the number of enrolled veterans. |

5 |

|

Foster care education program |

Provides $400,000 to offset a reduction in available federal funding. |

— |

|

HBCU Transfer Program |

Provides $81,000 to increase program outreach activities. |

— |

|

Subtotal |

($360) |

|

|

One Time |

||

|

Deferred maintenance and instructional equipment |

Provides funding for a variety of one-time activities, including scheduled maintenance, special repairs, and replacement of instructional equipment and library materials. |

$13 |

|

Reappropriations |

Reappropriates unused funds originally provided in 2016-17. |

11 |

|

Veterans resource centers |

Provides funding to expand centers at three specific colleges. |

5 |

|

Workforce development grants |

Provides funding to improve workforce development programs at five specific colleges. |

5 |

|

Hunger-free campus |

Provides grants to colleges that provide food to students and help students enroll in the state’s food assistance program. |

4 |

|

Re-entry programs for formerly incarcerated students |

Provides grants for colleges to improve their support services for currently and formerly incarcerated students. |

4 |

|

Teacher credentialing pilot |

Funds pilot program for up to three community colleges to partner with a four-year institution to provide access to teacher credentialing programs in rural areas. |

2 |

|

Palo Verde child development center |

Funds development of a new child development center. |

1 |

|

Mendocino College construction trades |

Provides startup funds for a construction trades program at Mendocino College. |

1 |

|

College-based food programs |

Provides $500,000 for a systemwide assessment of college-based food programs. |

1 |

|

Subtotal |

($45) |

|

|

Total |

$405 |

|

|

COLA = cost-of-living adjustment and HBCU = historically black colleges and universities. |

||

Notable Augmentation Provided for Community College Apportionments. The budget includes $230 million to provide the statutory 3.26 percent COLA for apportionments. The budget also provides $25 million for 0.55 percent enrollment growth systemwide. After incorporating a 0.05 percent increase in baseline enrollment, the budget supports enrollment growth of 0.6 percent, representing about 6,700 FTE, over the revised 2018‑19 level.

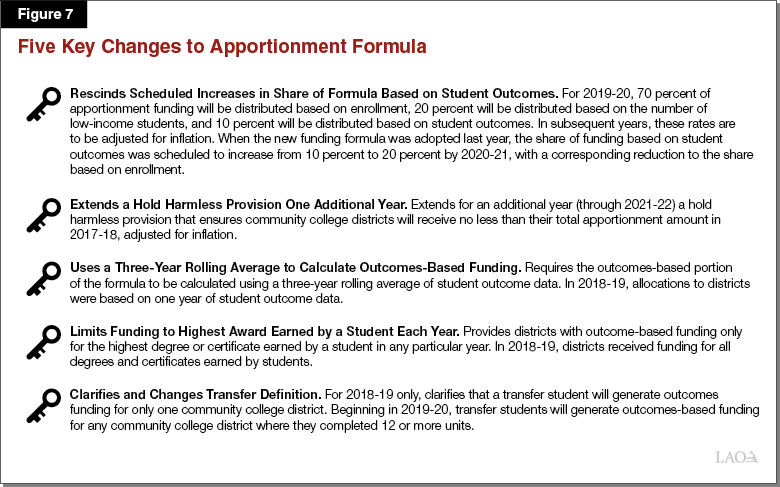

Five Key Changes Made to Apportionment Formula. As Figure 7 shows, the budget package makes five major changes to the community college apportionment formula. These changes are implemented such that they have no net fiscal effect on apportionment costs in 2019‑20.

Expands College Promise Funding. The budget provides $43 million ongoing to expand the program. Under the College Promise program, community colleges receive funds they may use for a broad range of purposes, including enrollment fee waivers for first-time, full-time students without financial need. (A separate program waives enrollment fees for CCC students with financial need.) This augmentation is based on the estimated cost of waiving second-year enrollment fees for qualifying students.

Supports Many One-Time Initiatives. The budget includes $34 million in settle-up funds for a variety of one-time initiatives. Among the more notable one-time augmentations is a total of $4.5 million to improve workforce development programs at five specific colleges—Bakersfield College ($1 million), Fresno City College ($1 million), Modesto Junior College ($1 million), San Bernardino Valley College ($1 million), and Norco College ($500,000). The budget also includes a total of $4.9 million to expand veterans resource centers at Sacramento City College ($2.4 million), Mira Costa College ($1.5 million), and Norco College ($1 million).

Funds Four New Chancellor’s Office Positions. The budget includes $516,000 ongoing non-Proposition 98 General Fund for four new positions at the CCC Chancellor’s Office—two accountants, one information security officer, and one position to assist with monitoring the fiscal health of community college districts.

Authorizes 59 Community College Facility Projects. The budget authorizes $48 million in Proposition 51 bond funds for the preliminary plans and working drawings of 39 new capital outlay projects. The Legislature adopted all projects the Chancellor’s Office recommended for inclusion in the 2019‑20 budget. According to the Chancellor’s Office, 3 of these projects are to address seismic or infrastructure risks, 15 projects are to increase instructional capacity, 15 are to modernize instructional space, and 6 are to complete campus build-outs. The budget also provides $487 million in Proposition 51 bond funds to continue 14 projects initially approved in 2017‑18 and 6 projects initially approved in 2018‑19. These funds are allocated for construction and equipment (if applicable), plus working drawings for one project that did not previously receive funding for that phase. A list of all new and continuing projects is on our EdBudget website.

District Pension Costs

School and Community College Employees Participate in One of Two Pension Systems. Community college faculty, school teachers, administrators, and other certified school employees (such as school librarians and counselors) earn pension benefits through the California State Teachers’ Retirement System (CalSTRS). Classified school employees (such as clerical and janitorial staff) earn pension benefits through the California Public Employees’ Retirement System (CalPERS). Employer contribution rates have been rising in both retirement systems. The effect of the rate increases differs somewhat between the segments given the composition of their staff. For school districts, about 70 percent of their pension costs are for CalSTRS contributions, with 30 percent for CalPERS contributions. For community college districts, about 55 percent of their pension costs are for CalSTRS contributions, with 45 percent for CalPERS contributions.

Notable Actions Taken Involving District Pension Costs. To address rising pension costs, the budget package makes two types of payments toward districts’ CalSTRS and CalPERS pension costs:

-

Supplemental Payments. As the top portion of Figure 8 shows, the 2019‑20 budget package includes a total of $2.3 billion in supplemental payments to address school and community college districts’ CalSTRS and CalPERS unfunded liabilities. (The package includes other payments to address the state’s unfunded retirement liabilities, which we describe in the “Debt and Liabilities” post of the Spending Plan series.)

-

Supplanting Payments. The package includes a total of $850 million to provide school and community college districts with rate relief in 2019‑20 and 2020‑21. The state provides this rate relief by supplanting what districts otherwise would have paid toward pensions those two years.

Whereas the supplemental CalSTRS and CalPERS payments reduce pension costs over the long run (akin to paying principal on a mortgage), the rate relief payments do not reduce long-run costs. Instead, these payments reflect a shift of cost from districts to the state (akin to the state paying a portion of districts’ mortgage payments).

Figure 8

Budget Includes Significant Spending Relating to School Pensions

State Payments Made on Behalf of School and Community College Districts (In Millions)

|

Supplemental |

Supplanting |

|

|

CalSTRS |

$1,640 |

$606 |

|

CalPERS |

660 |

244 |

|

Total |

$2,300 |

$850a |

|

aOf this amount, $350 million is provided in 2020-21 ($250 million for CalSTRS and $100 million for CalPERS). |

||

Payments Reduce Contribution Rates. Figure 9 shows the anticipated effect of both types of payments on school and community college districts’ pension contribution rates. The immediate rate relief payments are expected to reduce districts’ CalSTRS and CalPERS contribution rates by about 1 percentage point in the near term (2019‑20 and 2020‑21). Though lower than they otherwise would have been, districts’ contribution rates continue to increase each year over the 2018‑19 through 2020‑21 period. After 2020‑21, the ongoing benefit of the unfunded liability payments begin to be realized, with an estimated reduction in districts’ future contribution rates of 0.30 of a percentage point. Savings to school districts from these payments will continue for nearly three decades.

Figure 9

Budget Package Reduces Districts’ Pension Contribution Rates

Employer Contribution Rates as a Percentage of Salary a

|

2018-19 |

2019-20 |

2020-21 |

2021-22 |

2022-23 |

2023-24 |

|

|

CalSTRS |

||||||

|

Previous projection |

16.28% |

18.13% |

19.10% |

18.40% |

18.40% |

18.40% |

|

Revised projection |

16.28 |

17.10 |

18.40 |

18.10 |

18.10 |

18.10 |

|

Difference |

— |

-1.03% |

-0.70% |

-0.30% |

-0.30% |

-0.30% |

|

CalPERS |

||||||

|

Revised projection |

18.06% |

20.73% |

23.60% |

24.90% |

25.70% |

26.40% |

|

Revised projection |

18.06 |

19.72 |

22.70 |

24.60 |

25.40 |

26.10 |

|

Difference |

— |

-1.01% |

-0.90% |

-0.30% |

-0.30% |

-0.30% |

|

aReflects actual rates for 2018-19 and 2019-20 and projections thereafter. Projections are based on actuarial assumptions. Actual rates will vary from projections based on investment returns and other factors. For CalSTRS, the employer contribution rate is fixed through 2020-21. |

||||||

Early Education

Budget Act Provides $5.6 Billion for Early Education Programs. Of this amount, $2.4 billion is for preschool and transitional kindergarten programs, $2.6 billion is for other child development programs, and $642 million is for support programs. As Figure 10 shows, the 2019‑20 Budget Act augments these programs by a total of $963 million (21 percent) from the revised 2018‑19 level. Non-Proposition 98 General Fund covers the bulk of this increase. Additional federal funds and Proposition 64 funds, offset by a decrease in Proposition 98 General Fund, comprise the rest of the increase.

Figure 10

Child Care and Preschool Budget

(Dollars in Millions)

|

2017-18 |

2018-19 |

2019-20 |

Change From 2018-19 |

||

|

Amount |

Percent |

||||

|

CalWORKs Child Care |

|||||

|

Stage 1 |

$323 |

$291 |

$325 |

$34 |

11.8% |

|

Stage 2 |

504 |

581 |

615 |

33 |

5.7 |

|

Stage 3 |

339 |

457 |

503 |

46 |

10.0 |

|

Subtotals |

($1,167) |

($1,329) |

($1,442) |

($113) |

(8.5%) |

|

Non-CalWORKs Child Care |

|||||

|

General Child Care |

$340 |

$412 |

$522 |

$110 |

26.6% |

|

Alternative Payment Program |

292 |

427 |

536 |

109 |

25.4 |

|

Bridge program for foster children |

20 |

41 |

54 |

13 |

33.0 |

|

Migrant Child Care |

35 |

40 |

45 |

5 |

11.8 |

|

Care for Children with Severe Disabilities |

2 |

2 |

2 |

—a |

2.6 |

|

Subtotals |

($349) |

($922) |

($1,158) |

($236) |

(25.6%) |

|

Preschool Programs |

|||||

|

State Preschool—full day |

$738 |

$804 |

$883 |

$79 |

9.9% |

|

State Preschool—part day |

503 |

538 |

548 |

10 |

1.8 |

|

Transitional Kindergarten |

796 |

847 |

873 |

26 |

3.1 |

|

Preschool QRIS Grant |

50 |

50 |

50 |

— |

— |

|

Subtotals |

($2,086) |

($2,239) |

($2,354) |

($115) |

(5.1%) |

|

Support Programs |

$91 |

$144 |

$642 |

($498) |

(345.3%) |

|

Totals |

$3,693 |

$4,634 |

$5,597 |

$962 |

20.8% |

|

Funding |

|||||

|

Proposition 98 General Fund |

$1,918 |

$2,063 |

$1,846 |

-$216 |

-10.5% |

|

Non-Proposition 98 General Fund |

746 |

1,496 |

2,432 |

936 |

62.6 |

|

Proposition 64 Special Fund |

— |

— |

80 |

$80 |

— |

|

Federal CCDF |

635 |

755 |

931 |

176 |

23.3 |

|

Federal TANF |

388 |

311 |

294 |

-18 |

-5.7 |

|

Federal Title IV-E |

5 |

10 |

13 |

3 |

35.3 |

|

aLess than $500,000. |

|||||

|

QRIS = Quality Rating and Improvement System; CCDF = Child Care and Development Fund; and TANF = Temporary Assistance for Needy Families. |

|||||

Subsidizes Care for More Children. The budget provides $301 million for additional child care and preschool slots. Figure 11 shows the slot increases by program. Notably, the budget makes 11,307 Alternative Payment (AP) slots ongoing. These slots were initially added in 2018‑19 on a limited-term basis. The budget also provides $93 million ($80 million Proposition 64 revenue and $13 million federal funds) for 9,461 additional AP slots. The budget provides $50 million non-Proposition 98 General Fund for 3,086 additional General Child Care slots, with the intent to sustain these slots with growth in Proposition 64 revenue in future years. It also provides $31 million non-Proposition 98 General Fund for 10,000 new full-day State Preschool slots at non-local education agencies starting April 1, 2020.

Figure 11

Changes in Child Care and Preschool Spending

2019-20 (In Millions)

|

Action |

Amount |

|

|

Slots |

||

|

Alternative Payment |

Converts 11,307 slots from temporary to ongoing. |

$102.3 |

|

Alternative Payment |

Adds 9,461 slots starting July 1, 2019. |

93.3 |

|

General Child Care |

Adds 3,086 slots July 1, 2019. |

50.0 |

|

State Preschool |

Adds 10,000 full-day slots at non-LEAs starting April 1, 2020. |

31.4 |

|

State Preschool |

Annualizes cost of 2,959 slots for LEAs initiated April 1, 2019. |

26.8 |

|

Non-CalWORKs |

Reduces slots by -0.68 percent for projected decrease in birth-through-four population. |

-15.6 |

|

Foster Bridge |

Adds 1,014 slots July 1, 2019. |

10.0 |

|

Alternative Payment |

Annualizes cost of 2,100 slots initiated September 1, 2018. |

3.2 |

|

Subtotals |

($301.4) |

|

|

Reimbursement Rates |

||

|

Cost-of-living adjustment |

Provides a 3.26 percent increase to certain child care and preschool programs. |

$75.0 |

|

Adjustment factors |

Annualizes cost of increases to certain adjustment factors initiated January 1, 2019. |

50.2 |

|

Subtotals |

($125.1) |

|

|

Other |

||

|

Infrastructure initiative |

Provides grants over four years to construct or renovate child care facilities. |

$263.0 |

|

Workforce development initiative |

Provides grants over four years to enhance the child care and preschool workforce. |

195.0 |

|

CalWORKs Stage 1 rules |

Provides full-time care and verifies eligibility only once each year. |

56.4 |

|

CalWORKs child care |

Makes caseload and average cost of care adjustments to Stages 1, 2, and 3. |

55.4 |

|

Transitional Kindergarten |

Adjusts for attendance and increase in LCFF funding rate. |

25.9 |

|

Collective bargaining |

Requires the sharing of information about family child care home and license-exempt providers with certain organizations for the purpose of future collective bargaining. |

10.0 |

|

Early education data |

Funds improvements to CDE’s early education data system. |

10.0 |

|

Inclusive early education initiative |

Funds grants to increase access to early education programs for children with disabilities. Grants may be used for workforce development, equipment, and facilities. |

10.0 |

|

Planning initiative |

Funds research to inform early education master plan. |

5.0 |

|

Early Childhood Policy Council |

Creates a 27-member council to provide early education recommendations to the Governor, Legislature, and Superintendent of Public Instruction. |

2.2 |

|

New facility |

Supports construction of child care facility in Reseda. |

1.5 |

|

Other |

Makes conforming and technical changes. |

-98.4 |

|

Subtotals |

($536.0) |

|

|

Totals |

$962.5 |

|

|

LEA = local education agency; LCFF = Local Control Funding Formula; and CDE = California Department of Education. |

||

Supports Higher CalWORKs Child Care Costs. The budget package provides $112 million ongoing for expected cost increases in California Work Opportunity and Responsibility to Kids (CalWORKs) child care. Of this increase, $56 million is due to changes in the rules applying to CalWORKs Stage 1 families. Specifically, the budget package makes all Stage 1 families eligible for full-time child care and verifies their eligibility for care only once each year (rather than continually throughout the year). The rest of the increase is due primarily to the escalating effect of changes the state made to Stages 2 and 3 eligibility a few years ago.

Funds a Few Rate Increases. The budget provides $75 million to fund a 3.26 percent COLA for non-CalWORKs child care programs and the State Preschool program. The budget also includes $50 million to annualize the cost of increases in certain adjustment factors initiated January 1, 2019. Chapter 51 of 2019 (SB 75, Committee on Budget and Fiscal Review) extends two of these adjustments factors (for children with exceptional needs and children with severe disabilities) to part-day State Preschool. The budget did not include additional funding for extending these adjustment factors, with the expectation that the higher ongoing cost could be funded annually from program savings.

Provides Substantial One-Time Funding for Child Care Facilities and Workforce. The budget provides $263 million for facility grants. Providers can use the facility grants to renovate or construct new child care facilities, with the goal of serving additional children or addressing health and safety issues. Of the $263 million, $179 million is available in 2019‑20, with the remainder of funds allocated over the following three years ($20 million in 2020‑21 and $32 million each in 2021‑22 and 2022‑23). The budget also provides $195 million for workforce development grants. These grants are intended to (1) increase the number of child care and preschool workers and (2) increase the education and training of these workers. Providers can use the grant funds to cover tuition costs, offer stipends, or pay for substitute teachers, among other things. Of the $195 million, $129 million is available in 2019‑20, with the remaining funds to be allocated evenly over the following three years ($22 million each year).

Other Notable Early Education Augmentations. The budget includes $10 million one time to update CDE’s early education data system. It also includes $10 million one time for an initiative intended to support future collective bargaining among family child care homes and license-exempt providers. This initiative requires specified state agencies to share certain information about these providers with qualifying organizations. In addition, the budget provides $5 million one time to assist with the development of an early learning and care master plan. In developing the master plan, the Health and Human Services Agency is to contract with at least one research entity to produce at least one report by October 1, 2020. The report must study several specified areas, including revenue options for expanding current programs, statewide facility needs, and the need for early learning and care among eligible families. The budget also provides the Health and Human Services Agency $2.2 million annually for three years to run an Early Childhood Policy Council. The council is to provide recommendations to the Governor, Legislature, and Superintendent of Public Instruction on early education issues.

State Preschool Eligibility Changes. Chapter 51 makes notable eligibility changes to State Preschool. First, Chapter 51 allows State Preschool providers to enroll children from non-working families in the full-day program after all interested and eligible children from working families have been enrolled. Second, certain State Preschool providers may enroll four-year olds who are otherwise ineligible for the program (after serving all interested, eligible children). Specifically, these providers must operate within the attendance boundary of a public school where at least 80 percent of students qualify for free or reduced-price meals.

Increase for State Operations. The budget includes $2.8 million ongoing to increase the number of CDE staff working on early learning programs. About half of the increase is for implementing new initiatives, expanded programs, and additional requirements included in the 2019‑20 budget package. Roughly one-third of the funds are to increase the frequency of CDE’s onsite reviews of providers. The remaining funds are for regulatory work, implementing the Inclusive Early Education Expansion program (created last year), and adding early education-focused staff within the Fiscal and Administrative Services Division.

California State University

$8 Billion Total Core Spending on CSU in 2019‑20. Of this amount, $4.7 billion (58 percent) is state General Fund, $3.3 billion (41 percent) comes from student tuition and fee revenue, and $64 million (0.8 percent) is other state funding (primarily lottery revenue). Core spending increases by 8.1 percent over 2018‑19. The increase consists mostly of higher General Fund support, with a small increase in tuition revenue due to enrollment growth. Tuition charges are intended to remain flat from 2018‑19 to 2019‑20.

Provides Sizeable Ongoing General Fund Increase. The top part of Figure 12 shows all General Fund ongoing augmentations for CSU. These augmentations include a total of $252 million for compensation increases—including salary costs for represented and nonrepresented employees, pension costs, and higher retiree health care costs—and other operational cost increases. In addition, the budget provides $85 million to serve 10,000 (2.6 percent) more resident undergraduate FTE students in 2019‑20 compared with 2018‑19 and $45 million for the Graduation Initiative (bringing total ongoing funding for this initiative to $243 million). The budget includes provisional language requiring CSU to earmark at least $35 million of its base funding to increase the number of tenure-track faculty above the 2018‑19 level. Outside of CSU’s main appropriation item, the budget provides $7 million ongoing to the Department of Social Services for contracts with external groups to provide legal services to undocumented and immigrant students and employees at CSU campuses.

Figure 12

Changes in California State University General Fund Spending

2019-20 (In Millions)

|

Action |

Amount |

|

|

Changes in Ongoing Spending |

||

|

Compensation and other operational costs |

Covers the following increases: salaries for represented and nonrepresented employees, health care costs for active employees, a portion of retirement costs, minimum wage costs, and costs to operate new facilities. |

$193.0 |

|

Enrollment growth |

Funds 2.6 percent growth (10,000 additional resident FTE undergraduate students). |

85.0 |

|

Graduation Initiative |

Funds more course sections, support services, and other campus priorities. |

45.0 |

|

Pension costs |

Adjusts for higher CalPERS employer contribution rates. |

39.3 |

|

Retiree health benefit costs |

Adjusts for higher CalPERS retiree health benefit costs. |

19.8 |

|

Rapid rehousing program |

Funds wraparound services, emergency grants, and rental subsidies for housing-insecure students. |

6.5 |

|

Project Rebound |

Provides various support services for formerly incarcerated students. |

3.3 |

|

COLA for Capital Fellows program |

Funds 3.3 percent COLA for legislative, executive, and judicial fellows. |

0.1 |

|

Subtotal |

($392.0a) |

|

|

One-Time Initiatives |

||

|

Deferred maintenance/campus child care facilities |

Funds maintenance projects identified by CSU and submitted to the state for approval. Alternatively, can be used to expand child care facilities for student parents. |

$239.0 |

|

Graduation Initiative |

Funds student success initiative (on top of ongoing funding). |

30.0 |

|

Student Basic Needs Partnerships |

Provides funds to campuses to create and expand partnerships with local and nonprofit entities serving hunger- and housing-insecure students. |

15.0 |

|

Science and Technology Policy Fellows program |

Provides funds for a nonprofit organization that places science fellows in legislative offices. |

11.5 |

|

Summer-term financial aid |

Provides grants covering tuition costs during the summer term. |

6.0 |

|

Child care center at the Channel Islands campus |

Provides funds to build a child care center that also will serve as lab space for the campus’ early childhood education program. |

5.0 |

|

New campus studies |

Funds study examining potential need for and feasibility of new campuses located in Chula Vista, Concord, Palm Desert, San Joaquin County, and San Mateo County. |

4.0 |

|

Center to Close Achievement Gaps |

Provides funding for a new center charged with identifying and disseminating best practices regarding closing K-12 achievement gaps. |

3.0 |

|

Council on Ocean Affairs, Science, and Technology |

Supports network of faculty and student researchers focused on ocean and coastal issues. |

3.0 |

|

Speech language pathology graduate programs |

Provides supplemental funding to expand enrollment slots in graduate-level speech language pathology programs. |

3.0 |

|

First Star foster youth cohort at the Sacramento campus |

Funds one cohort of high school foster youth over a four-year period. |

0.7 |

|

Mervyn Dymally Institute at the Dominguez Hills campus |

Supports the public policy center, which focuses on issues affecting the African American community. |

0.7 |

|

Mixed-use housing planning funds at the San Jose campus |

Supports planning of a housing project on the site of the existing state-owned Alfred E. Alquist Building. Project would house students and faculty. |

0.3 |

|

Subtotal |

($321.2) |

|

|

Total |

$713.2 |

|

|

aIn addition, the budget provides $7 million ongoing General Fund to the Department of Social Services for provision of legal services to undocumented and immigrant students and employees at CSU campuses. |

||

|

FTE = full-time equivalent and COLA = cost-of-living adjustment. |

||

Funds Many One-Time Programmatic Initiatives. The bottom part of Figure 12 shows all the one-time General Fund spending for CSU. These one-time initiatives include $30 million for the Graduation Initiative (on top of the ongoing funding provided for initiative) and $15 million for the Basic Needs Partnerships initiative, which is focused on supporting food and housing insecure students.

Also Provides $239 Million One Time for Deferred Maintenance and Requires Long-Term Maintenance Plan. This amount is part of a package of deferred maintenance spending across numerous state agencies. (We describe the package further in the “Infrastructure” post of this series.) Provisional language gives CSU the option to use these funds for deferred maintenance or to expand on-campus child care facilities to support student parents. Either way, before releasing the funds to CSU, DOF must provide a list of proposed projects to the Joint Legislative Budget Committee (JLBC) for review. In addition, supplemental report language requires CSU to submit by January 1, 2021 a report on the size of its deferred maintenance backlog, a ten-year plan to eliminate the backlog, an estimate of how much would need to be spent annually to prevent the backlog from growing in the future, and an estimated cost to renovate its state-supported buildings with poor seismic ratings.

Authorizes CSU to Fund 12 Facility Projects. The 2019‑20 state cost of these projects totals $996 million. The associated annual debt service is estimated to be about $70 million. CSU indicates it will support debt service using existing funds. A list of the authorized projects is on our EdBudget website.

University of California

$9.7 Billion Total Core Spending on UC in 2019‑20. Of this amount, $3.9 billion (41 percent) is state General Fund, $5.3 billion (55 percent) is student tuition and fee revenue, and $422 million (4 percent) is from other revenue sources (including overhead on state and federal research grants and lottery funds) that UC allocates for its education programs. Core spending increases 3.3 percent over 2018‑19. The increase is supported mostly from higher General Fund support, additional nonresident tuition revenue, and an increase in resident tuition revenue due to enrollment growth. As with CSU, systemwide tuition and fee charges are intended to remain flat in 2019‑20.

Provides $120 Million Ongoing General Fund Increase for UC Operational Costs. As the top part of Figure 13 shows, the largest ongoing increase is for compensation and operational cost increases. The approved amount is connected to a budget request made by the UC Board of Regents in November 2018. According to the Regents, the funds will be used for utility and equipment cost increases ($41 million), salary increases for core-funded represented employees ($30 million), employee health benefits ($21 million), pension cost increases ($20 million), and retiree health benefit cost increases ($7 million). The budget does not specifically fund salary increases for nonrepresented employees at UC, which include ladder-rank faculty and most staff.

Figure 13

Changes in University of California General Fund Spending

2019-20 (In Millions)

|

Action |

Amount |

|

|

Changes in Ongoing Spending |

||

|

Operational costs |

Funds cost increases in utilities, equipment, health benefits, pensions, and represented employee salaries. |

$119.8 |

|

Enrollment growth in 2020-21 |

Funds 4,860 resident undergraduate students (2.6 percent growth over 2018-19). |

49.9 |

|

Grants for physician residency programs |

Holds UC harmles for making funding for grants ongoing ($40 million) and maintains 2018-19 level of grant funding ($1.3 million). |

41.3 |

|

Student food and housing initiatives |

Funds campus-based food pantries, food benefit coordinators, and other related initiatives. |

15.0 |

|

Enrollment growth in 2018-19 |

Funds 1,000 resident students (an extra 0.5 percent growth over 2017-18). |

10.0 |

|

Student mental health services |

Funds additional on-campus psychiatrists and counselors. |

5.3 |

|

Student rapid rehousing |

Funds wraparound services, emergency grants, and rental subsidies for housing-insecure students. |

3.5 |

|

Subtotal |

($244.8) |

|

|

One-Time Initiatives |

||

|

Deferred maintenance |

Funds maintenance projects identified by UC and submitted to the state for approval. |

$143.5 |

|

Extended education |

Supports development and marketing of new bachelor’s degree and workforce certificate programs. |

15.0 |

|

Conservation genomics |

Supports UC Los Angeles-led natural resource management research. |

10.0 |

|

Charles R. Drew University |

Funds enrollment growth ($5 million) and upgrades to academic facilities ($2.5 million). |

7.5 |

|

Outreach |

Funds college outreach to high schools where at least 75 percent of students are low-income, English learners, and/or foster youth. |

6.0 |

|

UC/CSU Collaborative for Neurodiversity and Learning |

Funds collaborative in Los Angeles area focused on new special education diagnostic and intervention services. |

6.0 |

|

Summer-term financial aid |

Provides grants covering tuition costs during the summer term. |

4.0 |

|

Firearm safety training |

Supports UC Davis-led program. |

3.9 |

|

UC San Francisco Dyslexia Center |

Funds pilot on new special education diagnostic services. |

3.5 |

|

UC Los Angeles Ralph J. Bunche Center |

Supports education and research on African Americans. |

3.5 |

|

Equal employment opportunity |

Supports strategies to increase the diversity of new faculty hires. |

2.5 |

|

UC Los Angeles Latino Policy and Politics |

Supports research, public service, and advocacy on Latinos. |

2.5 |

|

UC Berkeley Asian American and Asian Diaspora Studies Department |

Supports education and research on Asian Americans. |

2.0 |

|

UC Davis Wildlife Health Center |

Supports network of rescuers of stranded marine mammals. |

2.0 |

|

UC Berkeley Statewide Database |

Supports management of redistricting database. |

1.9 |

|

UC Berkeley Labor Center |

Funds research on various labor-related issues. |

1.5 |

|

UC Berkeley Marcus Foster Doctoral Fellowship |

Provides financial aid to underrepresented education doctoral students. |

1.2 |

|

UC Davis Bulosan Center |

Supports research, education, and advocacy on Filipino Americans and the Philippines. |

1.0 |

|

UC Berkeley Underground Scholars |

Supports efforts to recruit and retain formerly incarcerated students. |

0.3 |

|

UC Davis School of Veterinary Medicine |

Supports development of a management tool for wild horse populations. |

0.2 |

|

Subtotal |

($217.9) |

|

|

Total |

$462.7 |

|

Provides $60 Million Ongoing for Enrollment Growth. Of this amount, $50 million is for UC to grow resident undergraduate enrollment by 4,860 FTE students (2.6 percent) in 2020‑21 over the 2018‑19 level. The associated General Fund rate is $10,217 per student. UC anticipates enrolling about half of this growth in 2019‑20 and the remaining growth in 2020‑21. The remaining $10 million provides funding for enrollment growth in 2018‑19 above previously budgeted amounts (at a General Fund rate of $10,000 per student).

Two Other Notable Ongoing Increases. First, the state provides $41.3 million General Fund relating to Proposition 56 grants for physician residency programs. Of this amount, $40 million effectively holds UC operations harmless for making the residency grant funding ongoing and $1.3 million ensures that residency grant funding can remain at $40 million despite a slight drop in expected Proposition 56 funds. Second, the budget provides $24 million to expand a variety of student food, housing, and mental health initiatives.

Funds Many One-Time Initiatives. The bottom part of Figure 13 shows all the one-time General Fund spending for UC. These one-time initiatives include $15 million for UC to develop new extended education programs. According to the administration, the overall intent of the funding is to create new bachelor’s degree completion programs for students with some college but no degree, expand existing nondegree programs, and provide outreach. Provisional language conditions the release of the funds on UC submitting a more formal budget and implementation plan to JLBC and DOF. The remaining initiatives include augmentations for specific academic departments, the Charles R. Drew University, outreach, student financial aid and other student services, as well as funding for new programs to improve special education practices in elementary and secondary schools.

Provides $179 Million One Time for Deferred Maintenance and Requires Long-Term Maintenance Plan. This action also is part of the package of statewide deferred maintenance spending. Of the amount, $144 million is one-time General Fund, of which $5 million is earmarked for a systemwide infrastructure condition assessment. The remaining $35 million is for UC bonds approved by the state through the capital outlay process established by Chapter 50 of 2013 (AB 94, Committee on Budget). UC will repay the debt service associated with the $35 million in bond funds (estimated to be $2.5 million annually starting in 2023‑24) with its ongoing General Fund support. As with CSU, the Legislature also adopts supplemental reporting language directing UC to develop a long-term maintenance and seismic renovation plan.

Authorizes Eight Capital Outlay Projects. Six of these projects were approved by the state through the same capital outlay process referenced above. These projects, which total $178 million in 2019‑20 state costs, are for constructing new facilities and renovating existing facilities at several UC campuses and agricultural research and outreach sites. UC will repay the associated debt service (estimated to be $13 million annually starting in 2023‑24) with its ongoing General Fund support. The remaining two projects are authorized by provisional language in the budget act. Specifically, the budget authorizes UC to undertake medical school projects at UC Riverside and UC Merced. UC Riverside currently has a medical school, whereas UC Merced does not have one. According to the administration, UC will provide more detail on the projects’ scope and cost at a later date. Provisional language states legislative intent for the General Fund to pay the associated debt service costs. A list of all the projects is on our EdBudget website.

Student Financial Aid

$2.8 Billion Total Spending on California Student Aid Commission (CSAC) in 2019‑20. As Figure 14 shows, $1.8 billion (62 percent) is supported by state General Fund, $1.1 billion (37 percent) is federal Temporary Assistance for Needy Families (TANF) funding, and $27 million (1 percent) is from state special funds and reimbursements. Spending from these sources increases a net of $416 million (17 percent) from the revised 2018‑19 level. Year over year, General Fund increases by $422 million, TANF funds decrease by $6 million, and special funds and reimbursements increase by $126,000.

Figure 14

California Student Aid Commission Budget

(Dollars in Millions)

|

2017-18 |

2018-19 |

2019-20 |

Change From 2018-19 |

||

|

Amount |

Percent |

||||

|

Spending |

|||||

|

Local assistance |

|||||

|

Cal Grants |

$2,105 |

$2,266 |

$2,557 |

$291 |

12.8% |

|

Middle Class Scholarships |

100 |

107 |

110 |

3 |

3.0 |

|

Golden State Teacher Grant Program |

— |

— |

90a |

90 |

— |

|

Child Savings Account Grant Program |

— |

— |

25a |

25 |

— |

|

Student Opportunity and Access Program |

8 |

8 |

18b |

10 |

126.6 |

|

Chafee Foster Youth Program |

13 |

18 |

18 |

—c |

—c |

|

Other programsd |

8 |

8 |

4 |

-4 |

-48.6 |

|

Subtotals |

($2,234) |

($2,407) |

($2,822) |

($415) |

(17.2%) |

|

State operations |

$16 |

$21 |

$23 |

$1 |

6.0% |

|

Totals |

$2,249 |

$2,428 |

$2,844 |

$416 |

17.1% |

|

Funding |

|||||

|

General Fund |

$1,185 |

$1,336 |

$1,757 |

$422 |

31.6% |

|

Federal TANF |

1,043 |

1,066 |

1,060 |

-6 |

-0.6 |

|

Other federal funds and reimbursements |

16 |

21 |

21 |

—c |

0.6 |

|

College Access Tax Credit Fund |

5 |

6 |

6 |

— |

— |

|

aOne time. bConsists of $8 million ongoing and $10 million one time. cLess than $500,000 or 0.5 percent. dIncludes Assumption Program of Loans for Education, California Military Department GI Bill Awards, Cash for College, Child Development Teacher/Supervisor Grants, Every Kid Counts, John R. Justice Program, Law Enforcement Personnel Dependents Scholarships, and State Nursing Assumption Program of Loans for Education. |

|||||

|

TANF = Temporary Assistance for Needy Families. |

|||||

Overall Cal Grant Spending Up Notably. As Figure 15 shows, the CSAC budget includes $293 million in ongoing spending increases and $131 million in one-time initiatives. These spending increases are offset by the removal of $9 million in prior-year one-time funds. Almost the entire ongoing increase is for the Cal Grant program, with the budget providing $143 million for Cal Grant baseline adjustments and a combined $147 million for Cal Grant policy changes. The policy changes consist of:

-

$97 million to cover more of student parents’ living costs at the public segments. Cal Grant A and B student parents will be eligible for a maximum annual nontuition award of $6,000, whereas Cal Grant C recipients will be eligible for a maximum annual nontuition award of $4,000.

-

$42 million to increase the number of Cal Grant competitive awards for students who do not qualify for entitlement awards (typically older students). Trailer legislation also extends eligibility for competitive awards to students who are exempt from nonresident tuition because of their prior attendance at a California high school, community college, or adult school. This group of students (commonly referred to as AB 540 students) includes undocumented students.

-

$9 million to create the Cal Grant B Service Incentive Grant, which will provide maximum annual nontuition awards of $3,000 for up to 2,500 AB 540 students at the public and private nonprofit segments who fulfill a community service requirement.

Figure 15

Changes in California Student Aid Commission Spending

2019-20 (In Millions)

|

Action |

Amount |

|

|

Changes in Ongoing Spending |

||

|

Cal Grant baseline adjustments |

Funds 5.4 percent projected increase in recipients and 0.8 percent projected increase in average award amount. |

$143.1 |

|

Cal Grant awards for student parents |

Increases nontuition award amounts for CCC, CSU, and UC Cal Grant recipients with dependent children. |

96.6 |

|

Cal Grant competitive awards |

Increases number of new competitive awards authorized annually from 25,750 to 41,000. |

41.8 |

|

Cal Grant B Service Incentive Grant |

Provides nontuition awards for up to 2,500 AB 540 students. Each recipient must perform 300 hours of community service. |

9.0 |

|

Other adjustments |

Funds caseload changes in Middle Class Scholarship and six other financial aid programsa |

2.2 |

|

State operations |

Funds two positions for institutional support, one position for executive office support, and one for implementation of student parent awards. |

0.4 |

|

Subtotal |

($293.1) |

|

|

One-Time Initiatives |

||

|

Golden State Teacher Grants |

Provides $20,000 scholarships for up to 4,487 teacher preparation students who commit to working in specified subject areas and schools. |

$89.8 |

|

Child Savings Accounts |

Provides grants to local entities to support new and existing college savings initiatives for children. |

25.0 |

|

Cal-SOAP |

Supports K-12 outreach activities, including the creation of a new outreach consortium in the Inland Empire. |

10.0 |

|

Grant Delivery System modernization |

Funds second year of IT project to replace the system used to administer financial aid programs. |

6.2 |

|

Other state operations |

Funds implementation of recent financial aid changes impacting student parents and foster youth. |

0.4 |

|

Subtotal |

($131.3) |

|

|

Total |

$424.5 |

|

|

aOther programs consist of Assumption Program of Loans for Education, California Military Department GI Bill Awards, Chafee Foster Youth Program, John R. Justice Program, Law Enforcement Personnel Dependents Scholarships, and State Nursing Assumption Program of Loans for Education. |

||

|

Cal-SOAP = California Student Opportunity and Access Program and IT = information technology. |

||

The budget package also gives the private nonprofit segment one additional year to meet a Cal Grant requirement relating to admitting a specified number of students with associate degrees for transfer. If the requirement is not met, then the maximum award for all Cal Grant recipients at that segment will be reduced by about $1,000.

Creates Scholarship for Students in Teacher Preparation Programs. The budget provides $90 million one time to establish the Golden State Teacher Grant Program. This program will provide scholarships to students in teacher preparation programs who commit to teaching for four years in certain subject areas (including science, technology, engineering, and math; special education; bilingual education; and multiple subject instruction) at a school with a high percentage of teachers working on emergency permits. Scholarship recipients must agree to repay their awards if they ultimately do not fulfill their teaching commitment.

Creates Two College Savings Programs. One of the programs is to be administered by CSAC. For this initiative, the budget includes $25 million one time for grants to local entities to administer college savings programs. The budget also provides $25 million one time to the Scholarshare Investment Board (under the State Treasurer’s Office) to establish the California Kids Investment and Development Savings Program. Under this program, the state will deposit at least $25 into a college savings account for each child born on or after July 1, 2020, subject to available funding. Once the child enrolls in college, the state will pay the deposit and any investment earnings directly to the college for the child’s education expenses.

Other Notable CSAC Augmentations. The budget also provides:

-

$10 million one time to expand the California Student Opportunity and Access Program, an outreach program that provides college readiness and financial aid awareness activities for low-income K-12 students.

-

$6 million one time to continue the Grant Delivery System Modernization project, which will replace the system CSAC uses to process financial aid applications, make aid offers, and manage payments.

-

$400,000 ongoing, $404,000 one time, and four CSAC positions to enhance institutional support and executive office support, as well as implement the recent financial aid changes impacting student parents and foster youth.

Crosscutting Issues

Augments Funding for Student Mental Health Services Across the Segments. The budget includes $60 million Mental Health Services Act funds for student mental health services. Of this amount, $50 million ($40 million one time and $10 million ongoing) is for a competitive grant program awarded to partnerships between county providers and K-12 education agencies. The remaining funding goes directly to CCC ($7 million one time) and CSU ($3 million one time) for on-campus student mental health services. (As we described earlier, the budget provides UC $5.3 million ongoing General Fund to increase student mental health services.)

Initiates an Integrated Education Data System. The budget appropriates $10 million one-time non-Proposition 98 General Fund to the Office of Planning and Research (OPR) for initial work related to developing an integrated education data system. Of this amount, $4.3 million is for work group planning and matching student records between K-12 and higher education. The work group is to consist of a total of 15 representatives from specified education and other departmental agencies. The work group is tasked with studying and making recommendations on development of the system. The director of OPR, or a designee, is charged with leading the work group, as well as contracting with an outside “planning facilitator” to support the group. The planning facilitator must submit specified reports to the Legislature and DOF that detail the work group’s advice on matters such as the type of data system to create and protocols for protecting student privacy and addressing security risks. The budget package gives CCC, CSU, and UC until 2020‑21 to begin linking their data with K-12 data using statewide student identifiers (or SSIDs). The remaining $5.7 million is available to implement the initial build-out of the data system, contingent on approval of an expenditure plan by JLBC and DOF.