LAO Contacts

- Ann Hollingshead

- Targeted Legislative Augmentations

- Bidusha Mudbhari

- Governor's Office of Business and Economic Development

- Brian Metzker

- Broadband Infrastructure

- California Department of Technology

- Proposed California State Payroll System IT Project

- Chas Alamo

- Labor and Employment

- Jared Sippel

- California Arts Council

- Department of Alcohol and Beverage Control

- Department of General Services

- Governor's Office of Emergency Services

- Luke Koushmaro

- Office of Planning and Research

- Statewide Infrastructure

- Nick Schroeder

- California Department of Veteran Affairs

- State Employee Compensation

- Rachel Ehlers

- Infrastructure Legislation Package

November 8, 2023

The 2023-24 California Spending Plan

Other Provisions

- Broadband Infrastructure

- California Arts Council

- California Department of Technology

- CalVet

- Department of Alcoholic Beverage Control

- Department of General Services

- State Employee Compensation

- Governor’s Office of Business and Economic Development

- Governor’s Office of Emergency Services

- Infrastructure Legislation Package

- Labor and Employment

- Governor’s Office of Planning and Research

- Proposed California State Payroll System Information Technology Project

- Statewide Infrastructure

- Targeted Legislative Augmentations

Broadband Infrastructure

Reflects Changes in Amounts and Sources of Funding From Original 2021-22 Broadband Infrastructure Spending Plan. As part of the 2021-22 spending plan, the administration and the Legislature agreed to spend $6 billion ($1.7 billion General Fund) over three fiscal years (starting in 2021-22) on broadband infrastructure. Since the 2021-22 spending plan, both parties have initiated substantive changes in the amounts and sources of funding from the original broadband infrastructure spending plan. While the total amount of the spending plan has increased by only $623 million, the source of funding for the majority of the spending plan is now General Fund. Out of the revised total $6.62 billion, $3.64 billion is now General Fund, $2.91 billion is federal American Rescue Plan fiscal relief funds, and $73 million is federal Infrastructure Investment and Jobs Act (IIJA) funding. (We provide a breakdown of these totals across the relevant fiscal years and by broadband program or project in Figure 1.) For more information about the revised spending plan, see our March 20, 2023 brief—The 2023-24 Budget: Broadband Infrastructure.

Delays $1.125 Billion in General Fund Appropriations to Future Fiscal Years. To address the budget problem in 2023-24, the spending plan delays $1.125 billion General Fund—$575 million for the Broadband Loan Loss Reserve Fund and $550 million for last-mile projects—from 2022-23 and 2023-24 to 2024-25, 2025-26, and 2026-27. Accounting for these delays, the 2023-24 spending plan appropriates $175 million General Fund for the Broadband Loan Loss Reserve Fund and $253 million General Fund for last-mile projects in 2023-24.

Maintains $550 Million General Fund for Increased Middle-Mile Network Costs. Consistent with the Legislature’s stated goal in Chapter 48 of 2022 (SB 189, Committee on Budget and Fiscal Review), the 2023-24 broadband infrastructure spending plan includes $300 million General Fund in 2023-24 and $250 million General Fund in 2024-25 for additional costs to build, lease, and purchase the state’s middle-mile broadband network.

Appropriates Additional $73 Million From Federal Enabling Middle Mile Broadband Infrastructure Program. On June 16, 2023, the National Telecommunications and Information Administration (NTIA) announced California will receive $73 million for the state’s middle-mile network from the Enabling Middle Mile Broadband Infrastructure Program established pursuant to the IIJA. Chapter 189 of 2023 (SB 104, Skinner) appropriates this funding using a new federal expenditure item for the California Department of Technology (CDT) to receive and expend these funds.

Figure 1 reflects the 2023-24 broadband infrastructure spending plan, incorporating each of the substantive changes in funding amounts and sources across the relevant fiscal years and for each broadband program or project.

Figure 1

2023‑24 Broadband Infrastructure Spending Plan

(In Millions)

|

Program or Project |

Fiscal Year |

Funding Source |

Total Funds |

|

|

General Fund |

Federal Funds |

|||

|

Middle‑Mile Network |

2021‑22 |

$887a |

$2,363b |

$3,250 |

|

2022‑23 |

— |

— |

— |

|

|

2023‑24 |

300 |

73 |

373 |

|

|

2024‑25 |

250 |

— |

250 |

|

|

2025‑26 |

— |

— |

— |

|

|

2026‑27 |

— |

— |

— |

|

|

Subtotals |

($1,437) |

($2,436) |

($3,873) |

|

|

Last‑Mile Projects |

2021‑22 |

$522c |

$550d |

$1,072 |

|

2022‑23 |

125 |

— |

125 |

|

|

2023‑24 |

253 |

— |

253 |

|

|

2024‑25 |

200 |

— |

200 |

|

|

2025‑26 |

200 |

— |

200 |

|

|

2026‑27 |

150 |

— |

150 |

|

|

Subtotals |

($1,450) |

($550) |

($2,000) |

|

|

Broadband Loan Loss Reserve Fund |

2021‑22 |

— |

— |

— |

|

2022‑23 |

— |

— |

— |

|

|

2023‑24 |

$175 |

— |

$175 |

|

|

2024‑25 |

300 |

— |

300 |

|

|

2025‑26 |

275 |

— |

275 |

|

|

2026‑27 |

— |

— |

— |

|

|

Subtotals |

($750) |

(—) |

($750) |

|

|

All Programs and Projects |

2021‑22 |

$1,409 |

$2,913 |

$4,322 |

|

2022‑23 |

125 |

73 |

125 |

|

|

2023‑24 |

728 |

— |

801 |

|

|

2024‑25 |

750 |

— |

750 |

|

|

2025‑26 |

475 |

— |

475 |

|

|

2026‑27 |

150 |

— |

150 |

|

|

Total |

$3,637 |

$2,986 |

$6,623 |

|

|

aPursuant to Control Section 11.96 of the 2022‑23 Budget Act, the Department of Finance shifted $887 million for the middle‑mile network from American Rescue Plan (ARP) fiscal relief funds to General Fund in 2021‑22. bThe remaining $2.363 billion in federal funds for the middle‑mile network in 2021‑22 is state ARP fiscal relief funds. cPursuant to Control Section 11.96 of the 2022‑23 Budget Act, the Department of Finance shifted $522 million for last‑mile projects from ARP fiscal relief funds to General Fund in 2021‑22. dThe remaining $550 million in federal funds for last‑mile projects in 2021‑22 is the state’s allocation from the ARP’s Coronavirus Capital Projects Fund. |

||||

Does Not Reflect Additional Federal Funding for Last-Mile Project Grants and Middle-Mile Network. The 2023-24 broadband infrastructure spending plan does not reflect additional federal funding from the IIJA for broadband infrastructure, specifically last-mile project grants:

-

$1.86 Billion Primarily for Last-Mile Project Grants From IIJA’s Broadband Equity, Access, and Deployment (BEAD) Program. On June 26, 2023, the NTIA announced California will receive $1.86 billion from the IIJA’s BEAD program over the next several fiscal years. These funds are to be used primarily for last-mile project grants, although some funding may be used to build, lease, or purchase middle-mile infrastructure required by last-mile projects to provide broadband internet service. California is expected to receive the first 20 percent of this funding—about $375 million—in 2023-24.

Budget-Related Legislation Creates State Middle-Mile Broadband Enterprise Fund. Chapter 45 of 2023 (AB 127, Committee on Budget) creates the State Middle-Mile Broadband Enterprise Fund to receive fees from internet service providers, government entities, and other users of the middle-mile network. These fees will be used to expand, maintain, operate, and repair the network.

Budget-Related Legislation Requires Leased Broadband Infrastructure Deliver Comparable Speeds as Built Infrastructure Projects. Chapter 45 of 2023 (AB 127, Committee on Budget) also requires that any middle-mile broadband infrastructure that is leased to create the state’s middle-mile network deliver comparable speeds to middle-mile broadband infrastructure built as standalone projects and joint-build construction projects.

Budget-Related Legislation Requires Additional Reporting on Broadband Programs and Projects. Chapter 38 of 2023 (AB 102, Ting) requires CDT to submit biannual reports to the Legislature starting on or before March 1, 2024 with specific information about the middle-mile network. The legislation also requires the California Public Utilities Commission to submit biannual reports to the Legislature starting on or before October 1, 2023 with specific information about last-mile projects funded through the California Advanced Services Fund’s Federal Funding Account. Chapter 45 of 2023 (AB 127, Committee on Budget) also requires CDT to update the middle-mile network map on its website within 60 days of any contract to build or lease middle-mile broadband infrastructure.

California Arts Council

The budget provides $84.5 million to the California Arts Council (CAC), mostly from the General Fund. This is a net decrease of $146.2 million (63 percent) from the revised 2022-23 level. This net change largely reflects the expiration of one-time funds provided in prior years and a reversion of prior-year grant funds to help address the state’s budget problem. We describe these and other funding changes below.

Cultural Districts Spending Reversion. The 2022-23 budget provided $30 million one-time General Fund to support the existing 14 cultural districts and expand the program to support traditionally underserved communities. The budget package reverts $20 million of that amount to help address the state’s budget problem.

Control Section 19.566 Grants. The budget package requires CAC to oversee $43.4 million in grant funds allocated through Control Section 19.566. The funds are generally allocated directly to individual local governments and community-based organizations for specific purposes, such as facility upgrades and arts programming. (For more information, please see the “Targeted Legislative Augmentations” section of this post.)

California Department of Technology

The California Department of Technology (CDT) is the administration’s central information technology (IT) entity with broad authority over most aspects of technology in state government. The spending plan provides CDT with $953 million ($389 million General Fund) in 2023-24.

Funds Middle-Mile Broadband Network Costs and Temporary State Data Center IT Service Rate Changes. Of the $389 million General Fund in 2023-24, $300 million is to fund the state’s middle-mile broadband network, which we discuss in more detail in the “Broadband Infrastructure” section of this post. Of the remaining $89 million General Fund in 2023-24, $31.2 million is appropriated for CDT to continue temporarily mitigating State Data Center IT service rate increases as the department reassesses its current rate structure. For more information about the State Data Center, its rate development process, and the expenditures that are funded by the appropriation, refer to our February 22, 2022 budget and policy post—The 2022-23 Budget: California Department of Technology. (We discuss funding for the California Cybersecurity Integration Center, some of which is allocated to CDT, in the “Office of Emergency Services” section of this post.)

Reduces System Stabilization and Technology Modernization Funding. To address the state’s budget problem, the 2023-24 spending plan reduces 2022-23 appropriations for the department’s system stabilization and technology modernization efforts by $17.5 million General Fund and $21 million General Fund, respectively.

Budget-Related Legislation Amends Information Security (IS) Requirements for “Nonreporting Entities.” Chapter 45 of 2023 (AB 127, Committee on Budget) amends recently chaptered state law (Chapter 773 of 2022 [AB 2135, Irwin]) to transfer oversight of certain IS requirements for nonreporting entities—that is, state entities that are not under the direct authority of the Governor—from legislative leadership to CDT’s Office of Information Security (OIS). These amendments also allow OIS to provide recommendations on how nonreporting entities can improve their IS programs, but does not require the nonreporting entities to accept or follow OIS’ guidance. The 2023-24 spending plan also provides funding for compliance with the amended statute, including $1.5 million General Fund for OIS in 2023-24 and ongoing to offer nonreporting entities IS program audits, if requested. For more information on nonreporting entities’ IS compliance, refer to our March 30, 2023 report—Nonreporting Entities’ Information Security Compliance.

CalVet

The spending plan for the California Department of Veterans Affairs (CalVet) includes $663.6 million ($589.2 million General Fund) in 2023-24, an increase of $116.1 million ($98.5 million General Fund) relative to estimates for 2022-23. General Fund costs in 2023-24 are expected to be offset by $80.6 million from federal reimbursements for Veterans Homes. Most of the year-to-year increase in General Fund expenditures is due to the budget augmentations described below.

Facility Maintenance and Improvement. The below budget augmentations were approved to support facility maintenance and improvement for Veterans Homes and the CalVet Headquarters.

Headquarters Building Electrical Maintenance ($22 Million). The budget provides one-time funding in 2023-24 to repair the electrical system at the CalVet headquarters building to improve safety and electrical capacity to meet the department’s needs.

Yountville Roof Replacement ($15.9 Million General Fund). The budget provides one-time funding for the replacement of five roofs at the Veterans Home of California, Yountville.

Yountville Fire Service Contract ($535,000). The budget provides $535,000 in 2023-24 and $800,000 annually thereafter to fund contracted fire and emergency services coverage at the Veterans Home of California, Yountville. These services are provided by the California Department of Forestry and Fire Protection.

Veterans Homes Operations. The below budget augmentations were approved to support operations of the Veterans Homes.

Increased Support for Nursing Operations ($25 Million). The budget provides ongoing funding to pay for overtime costs and registry costs to provide nursing care to residents of Veterans Homes across California. The funds will be allocated to the CalVet headquarters budget and be distributed to individual Veterans Homes based on specific needs.

Clinical and Operational Workload ($3 Million). The budget provides 15.5 positions and $3 million ongoing to improve oversight and coordination of clinical and operational initiatives in California Veterans Homes.

Initial Support for Yountville Skilled Nursing Facility ($356,000). The budget provides two positions and $356,000 in 2023-24 and ten positions and $1.3 million annually thereafter for the first phase of staffing ramp up of a new skilled nursing facility at the Veterans Home of California, Yountville.

Veterans Services. The below budget augmentations were approved to support specific services provided to veterans and their families by the department.

Veterans Services Division District Office Support ($1.3 Million). The budget provides nine positions and $1.3 million ongoing for staffing needs at three district offices of the department’s Veterans Services Division.

Minority Veterans Unit Workload ($156,000). The budget provides $156,000 in 2023-24 and $150,000 annually thereafter to fund one position to provide services to minority veterans and their families.

Women Veterans Unit Workload ($156,000). The budget provides $156,000 in 2023-24 and $150,000 annually thereafter to fund one position to provide services to veterans and service members who identify as female and their families.

California Central Coast Veterans Cemetery ($95,000). The budget includes one position and $95,000 in 2023-24 and $89,000 annually thereafter to meet service requirements under current law at the California Central Coast Veterans Cemetery.

Other Changes. We describe the other augmentations to the department’s budget below.

Settlement Costs ($8.7 Million). The budget includes one-time funding to pay for legal settlement costs resulting from a settled lawsuit at the Veterans Home of California, Chula Vista.

CalVet Electronic Health Record Project ($2.6 Million). The budget provides $2.6 million in 2023-24 to fund the fourth year of implementation of a new long-term care electronic health record system for Veterans Homes and CalVet Headquarters.

Administrative Support ($1.4 Million). The budget provides ten positions and $1.4 million ongoing for administrative support in the areas of accounting, budgets, and human services.

Website Development and Maintenance ($1 million). The budget provides one-time funding in 2023-24 for contractor services to enhance digital communications through a content management system website.

Department of Alcoholic Beverage Control

The budget provides $102.7 million to the Department of Alcoholic Beverage Control, mostly from the Alcohol Beverage Control Fund, which is supported largely through licensing fees. This is a net increase of $2.7 million (3 percent) from the revised 2022-23 level. This net change primarily reflects the expiration of General Fund support for a licensing fee waiver program authorized in the 2020-21 budget package as well as the augmentations described below.

General Fund Transfer. The budget authorizes the Department of Finance to transfer up to $20.5 million from the General Fund to the Alcohol Beverage Control Fund if revenues to support the special fund are insufficient in 2023-24. The budget also includes provisional language requiring 30-day written notification be provided to the Joint Legislative Budget Committee prior to the authorization of the transfer and that such notification include the fiscal assumptions used to calculate the size of the necessary transfer.

Administrative Support. The budget includes $2.8 million from the Alcohol Beverage Control Fund in 2023-24 (increasing to $3.2 million annually in 2024-25) to provide administrative support to the department’s licensing, enforcement, and education programs. This support includes funding for additional human resources, information technology, and public affairs positions.

Department of General Services

The budget provides $1.3 billion to the Department of General Services (DGS) from various funds, including reimbursements from other state departments. This is a net decrease of $515.7 million (28 percent) from the revised 2022-23 level. This decrease is primarily due to the expiration of one-time funding provided in 2022-23.

Building Maintenance, Upgrades, and Operations. The budget includes augmentations from various funds for building maintenance, upgrades, and operations, including:

-

$22.4 million from the Service Revolving Fund in 2023-24 (increasing to $29.9 million annually in 2024-25) to manage, operate, and maintain the New Richards Boulevard Office Complex and the Joe Serna Jr. California Environmental Protection Agency building.

-

$20.4 million one-time General Fund to repair and replace fire alarm systems at eight state buildings.

-

$12.8 million annually for three years ($11.8 million General Fund and $972,000 Service Revolving Fund) to support the repair and replacement of direct digital control systems in eight state buildings.

-

$11.7 million General Fund in 2023-24—as well as $11.7 million in 2024-25 and $11.6 million in 2025-26—to install electric vehicle charging infrastructure at state-owned and leased facilities throughout the state.

The budget also includes provisional language that directs DGS to report on how it plans to adjust rental rates it charges tenant departments to fully incorporate maintenance needs at DGS-owned and managed buildings.

Reversions. The budget package reverts $113.9 million one-time General Fund included in the 2021-22 and 2022-23 budgets. Specifically, the budget package reverts (1) a total of $88.6 million included in the 2021-22 and 2022-23 budgets for deferred maintenance and direct digital control projects in state buildings and (2) $25.3 million included in the 2022-23 budget for the Water Conservation Grant Program administered by the department’s Office of Sustainability.

State Project Infrastructure Fund (SPIF) Loan. The budget includes a $500 million loan in 2023-24 from the SPIF—a special fund established for the renovation and construction of state buildings—to the General Fund to help address the state’s budget problem. The SPIF will be repaid $300 million in 2024-25 and $200 million in 2025-26.

State Employee Compensation

New Labor Agreements for Most of State Workforce. The Legislature and union members ratified new memoranda of understanding (MOUs) between the state and 14 state bargaining units. These bargaining units include the nine units represented by Services Employees International Union, Local 1000 (Units 1 [Administrative Financial, and Staff Services], 3 [Professional Educators and Librarians], 4 [Office and Allied], 11 [Engineering and Scientific Technicians], 14 [Printing and Allied Trades], 15 [Allied Services], 17 [Registered Nurses], 20 [Medical and Social Services], and 21 [Educational Consultants and Library]) as well as Units 6 (Corrections), 7 (Protective Services and Public Safety), 12 (Craft and Maintenance), 16 (Physicians, Dentists, and Podiatrists), and 19 (Health and Social Services, Professional). These 14 bargaining units and their managers and supervisors account for about 80 percent of the state’s workforce. The agreements with these 14 bargaining units will increase state employee compensation costs directly for the rank-and-file and indirectly for excluded employees affiliated with the bargaining unit for the next few years. The agreements are expected to increase state costs in 2023-24 by $1.5 billion ($902 million General Fund) through increases in pay and other elements of compensation. For more information about these new MOUs, refer to our State Workforce webpages.

Costs Associated With Previously Ratified MOUs. Only one of the state’s 21 bargaining units does not have an active MOU with the state in 2023-24. Specifically, employees represented by Bargaining Unit 10 (Professional Scientist) work under the terms and conditions of an expired MOU. Six bargaining units (Units 2 [Attorney and Hearing Officer], 5 [Highway Patrol], 8 [Firefighter], 9 [Professional Engineer], 13 [Stationary Engineer], and 18 [Psychiatric Technician]) have active agreements that were ratified before 2023. These previously ratified MOUs provide pay increases and other increases in compensation to affected employees in 2023-24. The budget assumes that these provisions will increase state costs in 2023-24 by $397 million ($65 million General Fund). For more information about these new MOUs, refer to our State Workforce webpages.

Rising Costs for Health and Retirement Benefits. In addition to costs resulting from salary and other compensation increases included in ratified MOUs, the state’s costs to fund state employee health, pension, and retiree health benefits are expected to increase in 2023-24 pursuant to existing law.

-

Health. The budget assumes that the state’s health premiums will rise in policy year 2024. The budget assumes that premium growth, excluding new health care costs accounted for in the new MOUs discussed above, will increase state costs in 2023-24 by $61 million ($27 million General Fund). We estimate that the state’s total contributions towards employee health premiums in 2023-24 is about $3 billion.

-

Pension. The state pays a percentage of state employee salaries to fund pension benefits. The exact contribution rate is determined by the board of the California Public Employees’ Retirement System (CalPERS) based on the system’s actuarial valuation and state law. The state’s total contribution to fund CalPERS pension benefits is expected to be $8.5 billion ($4.7 billion from the General Fund) in 2023-24—about $250 million ($107 million General Fund) higher than 2022-23 levels.

-

Retiree Health. Although the state and employees contribute money to prefund retiree health benefits earned today, the state pays for current retirees’ health benefits on a pay-as-you-go basis. This pay-as-you-go cost grows each year as health premiums rise and the number of retired state workers grows. In 2023-24, this cost is expected to be $2.9 billion General Fund, a $246 million increase relative to 2022-23.

Governor’s Office of Business and Economic Development

California Competes

$120 Million for California Competes Grants. The budget allocated $120 million General Fund in 2023-24 for a third year of California Competes grants. Of this amount, $103.2 million is new funding and $16.8 million is savings from 2022-23. California Competes awards income tax credits to attract or retain businesses considering a significant new investment here. The 2021-22 Budget Act established a new California Competes grant program on a year-to-year basis. This grant program is similar to the tax credit program, except that qualified applicants indicate that they would prefer a grant to a tax credit.

Rules Change for Semiconductor Companies. The budget package also removes the cap preventing a grantee from receiving more than 30 percent of the program’s total grants if the grant will be used as a state match to apply for federal incentives for semiconductor research and manufacturing.

Film Tax Credit

Extends Film Tax Credit Program. The budget extends the film tax credit—which awards $330 million in credits annually to motion picture productions—for five years beginning in 2025-26 (Program 4.0). The existing film tax credit (Program 3.0) was set to sunset on June 30, 2025. This new iteration of the program includes set safety provisions under a new pilot program, refundability for tax credits, and new program elements aimed at increasing diversity in California’s film industry.

Makes the Tax Credit Refundable. Program 4.0 makes the tax credit refundable. Production companies can receive a refund for a portion of their credits that exceed their tax liability.

Additional Diversity Efforts. The new 4.0 program makes 4 percent of each credit award contingent on the production company making a “good-faith effort” to meet diversity goals. These diversity goals are set out in diversity workplans submitted by production companies to the California Film Commission. The budget package also expands the Career Pathways Training programs for underserved communities to facilitate entry into the California film industry. Additionally, the budget package adds staff at both the California Film Commission Board and California Film Commission who will be focused on promoting diversity, equity, and inclusion in the film industry.

Governor’s Office of Emergency Services

The budget provides $3.2 billion for the Governor’s Office of Emergency Services (OES), primarily from federal funds and the General Fund. This is a net decrease of $1.2 billion (26 percent) from the revised 2022-23 level. This decrease primarily reflects the net effects of the expiration of one-time funding provided in previous years and various augmentations. The budget also provides $174.7 million in new lease revenue bond authority for the design-build phase of the new Southern Regional Emergency Operations Center.

Emergency Communications and Response. The budget includes augmentations from various funds in support of emergency communications and response, including:

$137.6 million from the State Emergency Telephone Number Account in 2023-24 (decreasing to $91.4 million annually in 2025-26) to support the completion of the California Public Safety Microwave Network and Next Generation 9-1-1 systems, as well as the ongoing maintenance and support of these systems.

$43.3 million General Fund in 2023-24—as well as $41.2 million in 2024-25, $41.7 million in 2025-26, $44.6 million in 2026-27, and $46.6 million in 2027-28—to provide warehouse space, replace expiring emergency supplies (such as personal protective equipment), increase commodity supply for an all-hazard event, and procure logistic support equipment. In addition, the budget reverts $37 million General Fund included in the 2022-23 budget for purchasing additional personal protective equipment that OES reports is no longer needed.

$23.8 million annually from the 988 State Suicide and Behavioral Health Crisis Services Fund to implement Chapter 747 of 2022 (AB 988, Bauer-Kahan), which established the 9-8-8 Crisis Hotline Center to comply with existing federal law and standards governing the National Suicide Prevention Lifeline Network. This funding also replaces $6 million ongoing General Fund provided in the 2022-23 budget to implement federal 9-8-8 requirements.

California Cybersecurity Integration Center (Cal-CSIC). The budget provides $23.2 million General Fund to OES in support of Cal-CSIC. (An additional $5.5 million ongoing General Fund is provided to the California Department of Technology, California Military Department, and California Highway Patrol for their participation in Cal-CSIC.) This funding will provide ongoing resources to support the state’s cybersecurity coordination, intelligence gathering and dissemination, and incident response. In addition, provisional budget language requires OES, in consultation with the other Cal-CSIC partners, to submit a report to the Legislature by February 1, 2025, on (1) the state’s implementation of cybersecurity initiatives and technical capability investments in Cal-Secure (the state’s first five-year information security roadmap) and (2) Cal-CSIC’s goals and activities to address the state’s cybersecurity capability gaps.

Grant Funding. The budget provides one-time General Fund support in 2023-24 for various grant programs. This includes:

$21 million for OES to administer a gun buyback program.

$20 million for the Nonprofit Security Grant Program, which provides funding for security enhancement projects (such as reinforced doors and gates) to nonprofit organizations at risk of hate-motivated violence, such as nonprofits from the Asian American and Pacific Islander; Lesbian, Gay, Bisexual, Transgender, Queer and plus; Black; and Jewish communities.

$15 million for the Multifamily Seismic Retrofit Grant Program to provide financial assistance for seismic retrofitting to owners of multifamily housing at risk of collapse in earthquakes. (The 2022-23 budget package originally specified that the Legislature shall appropriate $250 million one time in 2023-24 for this program. The remaining $235 million is subject to trigger restoration language in the 2023-24 budget. For more on this, please see our report, The 2023-24 Budget: Overview of the Spending Plan.)

$10 million for family justice centers throughout the state to support and provide legal services to victims of domestic violence, intimate partner violence, sexual assault, child abuse, elder abuse, transnational abandonment, and human trafficking.

The budget package also requires OES to oversee $79.9 million in grant funds allocated through Control Section 19.563. The funds are generally allocated directly to individual local governments for specific purposes, such as upgrading emergency-related infrastructure. (For more information, please see the “Targeted Legislative Augmentations” section of this post.)

Infrastructure Legislation Package

Along with the 2023-24 budget agreement, the Legislature adopted a package of six pieces of legislation—five policy bills and portions of one budget trailer bill—aimed at expediting infrastructure projects. (In our companion post, New Infrastructure Legislation: Summary and Issues for Legislative Oversight, we also identify key issues for the Legislature to consider as it oversees the implementation of this legislation.)

Key Components of Infrastructure Legislation Package

As shown in Figure 2, the infrastructure package includes six pieces of legislation. We summarize the key components of this legislation below.

Figure 2

Legislation Included in Infrastructure Package

|

Legislation |

Topic |

|

Chapter 60 of 2023 (SB 149, Caballero) |

CEQA: Judicial Streamlining and Record of Proceedings. Makes certain types of projects eligible for expedited judicial review of CEQA challenges. |

|

Chapter 58 of 2023 (SB 146, Gonzalez) |

Infrastructure Contracting. Expands DWR’s and Caltrans’ authorities to use certain alternative procurement methods. |

|

Chapter 59 of 2023 (SB 147, Ashby) |

Fully Protected Species. Allows CDFW to authorize, under certain circumstances, the incidental take of a species that is designated under law as fully protected. |

|

Chapter 53 of 2023 (SB 124, Committee on Budget and Fiscal Review) |

Green Bank Financing. Authorizes I‑Bank to spend future federal funding that the state might receive through the Climate Catalyst Revolving Loan Fund program. |

|

Chapter 57 of 2023 (SB 145, Newman) |

Caltrans Environmental Mitigation. Makes various changes related to mitigating the environmental impacts of certain types of transportation projects including a potential intercity rail project within the Interstate 15 right‑of‑way. |

|

Chapter 61 of 2023 (SB 150, Durazo) |

Construction Workforce Development. Directs the establishment and funding of a new “high road” construction careers program and requires certain construction contracts to include community benefit provisions. |

|

CEQA = California Environmental Quality Act; DWR = Department of Water Resources; Caltrans = California Department of Transportation; CDFW = California Department of Fish and Wildlife; and I‑Bank = Infrastructure and Economic Development Bank. |

|

California Environmental Quality Act (CEQA) Judicial Streamlining and Record of Proceedings. Chapter 60 of 2023 (SB 149, Caballero) includes various changes related to the judicial review of certain projects under CEQA. First, the legislation creates a process under which eligible projects can apply to the Governor to receive expedited judicial review of CEQA challenges. Under this accelerated process, court challenges—including all appeals—are required to be completed within 270 days, if feasible. (In some cases, court challenges can take several years to be resolved under the typical process.) Qualifying projects include: (1) certain semiconductor and microelectronic projects, (2) up to 20 transportation projects that meet certain criteria, (3) certain water-related projects (excluding the Delta conveyance project), and (4) certain energy infrastructure projects. To be eligible for the expedited process, projects also must meet certain other requirements, such as avoiding or minimizing impacts to disadvantaged communities and emissions of greenhouse gases. The Governor’s authority to certify these projects for expedited review expires on January 1, 2032. Chapter 60 appropriates $1 million from the General Fund on a one-time basis in 2023-24 to the Judicial Council for training in order to implement these changes. Second, the legislation extends the sunset for an existing, similar process from January 1, 2024 to January 1, 2032. Under that process, which has been in place for roughly a dozen years, the Governor may certify certain other types of projects for streamlined review such as mixed-use development projects and stadiums. Third, the legislation includes language aimed at streamlining the preparation of the administrative record in CEQA cases by (1) expanding the lead agency’s authority to prepare the record of proceedings for the court and (2) excluding logistical communications, such as meeting invitations, from the administrative record that must be prepared as part of CEQA legal challenges.

Infrastructure Contracting. Chapter 58 of 2023 (SB 146, Gonzalez) expands the Department of Water Resources’ (DWR’s) and the California Department of Transportation’s (Caltrans’) authorities to use alternative procurement methods through December 31, 2033. Specifically, it authorizes DWR and Caltrans to use the progressive design-build procurement process for the construction of up to eight large public works projects per department. Under the progressive design-build procurement process, a single entity typically designs and constructs a project, and the construction price is determined through negotiation. (The Delta conveyance project and desalination projects are exempted from this authority.) The legislation also authorizes Caltrans to use job order contracting for certain maintenance and other activities. Additionally, this legislation extends and expands the California State Transportation Agency’s (CalSTA’s) existing authority to assume the responsibilities of the federal government for the purposes of compliance with the National Environmental Protection Act—making the authority available through the end of 2033 (rather than January 1, 2025) and allowing it to cover certain local and regional transportation projects in addition to state projects.

Fully Protected Species. Chapter 59 of 2023 (SB 147, Ashby) provides authority through December 31, 2033 for the California Department of Fish and Wildlife (CDFW) to allow—for certain types of projects—the incidental take of a species that is designated under law as fully protected. (Incidental take occurs when a protected animal is unintentionally harmed or killed as a result of a project.) Qualifying types of projects include: State Water Project projects, regional or local water agency infrastructure, certain transportation-related projects like wildlife crossings, and wind and solar photovoltaic projects. (The Delta conveyance project and desalination projects are excluded from this authority.) Additionally, certain conservation, impact minimization, and mitigation conditions must be met for CDFW to approve an incidental take. Furthermore, the legislation removes three species that are either no longer threatened or are presumed extinct from the fully protected designation—the American peregrine falcon, brown pelican, and thicktail chub. Chapter 59 also requires CDFW to develop a plan by July 1, 2024 to assess the population status of each of the remaining fully protected species.

Green Bank Financing. Chapter 53 of 2023 (SB 124, Committee on Budget and Fiscal Review) authorizes the Infrastructure and Economic Development Bank to spend future federal funding that the state might receive through the Climate Catalyst Revolving Loan Fund program. Under the legislation, the funding must meet certain other requirements, including that its use be consistent with the state’s Scoping Plan for Achieving Carbon Neutrality and state law and not require the expenditure of additional state funds. (Chapter 53 is a budget trailer bill and also includes other provisions not related to the infrastructure package.)

Caltrans Environmental Mitigation. Chapter 57 of 2023 (SB 145, Newman) includes provisions related to mitigating the environmental impacts of various types of transportation projects, including a high-speed rail project that has been proposed by a private firm, Brightline West, to be constructed between Southern California and Las Vegas, Nevada. Specifically, the legislation requires Caltrans to ensure that wildlife crossings are built at three priority locations along Interstate 15 if intercity passenger rail is constructed in the right-of-way and allows Caltrans to contract with Brightline West to build the crossings. The legislation further allows Caltrans to use federal and state funds to support the construction of the wildlife crossings. Additionally, Chapter 57 specifies that transportation funding is presumed to provide adequate funding for the long-term maintenance of a habitat connectivity or wildlife corridor structure on the state highway system. Finally, the legislation provides Caltrans—through December 31, 2033—with various new authorities related to purchasing and/or transferring property and credits for environmental mitigation purposes, as well as creating environmental mitigation-related endowments.

Construction Workforce Development. Chapter 61 of 2023 (SB 150, Durazo) requires Caltrans to work with the California Workforce Development Board to establish a new high road construction careers program, which is to be funded with a minimum of $50 million from the federal Infrastructure Investment and Jobs Act. Beginning January 1, 2026, the legislation requires state agencies that enter into construction contracts which are valued at more than $35 million and have project labor agreements to include community benefit provisions—such as partnerships with high road construction careers programs and local hire provisions—in those agreements. Finally, the legislation requires that by March 30, 2024, CalSTA, the Labor and Workforce Development Agency, and the Government Operations Agency must develop recommendations for what terms should be included in construction contracts in order to provide benefits to marginalized and disadvantaged communities.

Labor and Employment

Background

California’s major labor and employment programs provide work-related services and benefits to its residents, enforce its employment laws, oversee its workers’ compensation system, and regulate its workplace safety and health. Many of the work-related services and benefits are funded or required by the federal government, including unemployment insurance (UI) benefits and federal workforce training programs. The labor and employment programs are administered at the state level by the Employment Development Department (EDD), the Department of Industrial Relations, the California Workforce Development Board, and the Agricultural Labor Relations Board. The state’s Labor and Workforce Development Agency oversees these entities and works to set policy and coordinate programs.

Key Budget Actions

Borrows From Disability Insurance Program to Pay Federal UI Loan Interest. The budget agreement includes a $306 million one-time loan from the state’s Disability Insurance Fund to the General Fund. The Disability Insurance fund—officially named the Unemployment Compensation Disability Fund—collects employee-paid payroll taxes used to pay out disability insurance and Paid Family Leave (PFL) benefits. The budget redirects the loaned funds to make the required $306 million interest payment on the state’s outstanding federal UI loan. (Except for two years during the Great Recession when the state also borrowed from the disability program, the state has used the General Fund to make these interest payments.) Under federal law, California must make annual interest payments on roughly $20 billion the state borrowed from the federal government to keep paying UI benefits during the pandemic. Under the budget agreement, the loan from the Disability Insurance fund is to be repaid by the end of 2026-27. The budget language also says that loan should not impact financing of the state’s disability insurance or PFL programs.

Withdraws Second State Payment on Federal UI Loan Principal. The 2022-23 Budget Act included two partial, early payments on the state’s outstanding federal UI loans. An initial payment of $250 million was made in 2022-23 and an additional payment of $750 million was to be made in 2023-24. The recent budget agreement withdraws the second payment amount of $750 million. Under the federal rules, the default method of repayment is an incremental increase in business’ UI payroll taxes over time.

Withdraws UI Financial Assistance for Small Businesses. The 2022-23 Budget Act included $500 million General Fund in 2023-24 to provide small businesses financial assistance to partially offset their increased payroll tax costs related to repaying the federal UI loan. The budget agreement withdraws this proposal.

Reduces or Eliminates Several Recent Labor Initiatives. The 2022-23 budget agreement included ongoing or multiyear funding for several new labor and employment initiatives. See our The 2022-23 Budget: Overview of the Spending Plan for more detail. The 2023-24 budget reduces support for several of these recent initiatives. Affected initiatives include (1) Emergency Medical Technician training grants (reduced by $10 million), (2) the Apprenticeship Innovation Fund (reduced by $20 million), and (3) Youth Leadership Corps (reduced by $5 million).

Continues Funding for State’s New Technology System at EDD. The budget includes $99 million General Fund ($198 million all funds) for year-two development of a new technology system to manage EDD benefits. The system, to be called EDDNext, would replace aging technology the state currently uses to manage the UI program and Disability Insurance/Paid Family Leave (DI/PFL).

Governor’s Office of Planning and Research

The budget provides the Governor’s Office of Planning and Research (OPR) with roughly $1.1 billion in total funds (including $711 million from the Greenhouse Gas Reduction Fund, $378 million from the General Fund, and $29 million from federal funds) and 149.4 positions in 2023-24. Relative to 2022-23, this reflects a decrease of roughly $80 million General Fund and an increase of 34 positions. Most of the decrease in General Fund relative to the prior year is a result of one-time funding provided in 2022-23. These reductions are partially offset by the augmentations discussed below.

Continues Funding for Climate Change-Related Programs at Reduced Level. In recent years, OPR has received notable one-time budget appropriations to administer grant programs responding to the impacts of climate change, including related to extreme heat and local climate resilience planning efforts. The budget continues to provide funding for OPR’s climate change-related programs, but—given the state General Fund shortfall—at lower levels than planned for in previous agreements. Specifically, the budget maintains $263 million in 2022-23 for climate-related programs administered by OPR and the Strategic Growth Council (a reduction of $215 million), and $156 million in 2023-24 (a reduction of $390 million). The 2023-24 amount includes $110 million from the General Fund for the extreme heat and community resiliency center program (a reduction of $15 million relative to what was previously planned). The budget also delays $50 million in General Fund until 2024-25 that was previously planned for 2023-24 for regional climate resilience activities. (Please see our companion post, The 2023-24 California Spending Plan: Resources and Environmental Protection, for a more in-depth summary of these programs and associated changes contained in the budget package.)

Increases General Fund for California Volunteers. California Volunteers operates programs and initiatives to engage Californians in service, volunteering, and civic action. The budget for California Volunteers includes $154 million in total funds in 2023-24—an increase of $19 million compared to 2022-23. In addition, the budget reflects a notable change in funding sources. Specifically, it includes a 65 percent year-to-year drop in federal fund support (from $81 million to $28 million) due to the expiration of limited-term funding, which is more than offset by a 146 percent increase in General Fund support (from $50 million to $123 million). The new General Fund augmentations are to support two programs:

Youth Jobs Corps. The budget provides $78 million General Fund annually for the Youth Jobs Corps beginning in 2023-24. The program was first established in 2021-22 as a 2.5-year program supported by limited-term federal funding. The program has three stated goals: (1) to increase employment for underserved youth across California; (2) to develop meaningful public service career pathways; and (3) to enhance the capacity of local governments to address challenges in the key areas of food insecurity, climate action, and COVID-19 recovery. In order to help address the General Fund shortfall, the budget package also reverted $25 million in one-time monies that had been provided in 2022-23 to support an extended Youth Job Corps summer program.

California Climate Action Corps. The budget provides a total of $9.3 million in ongoing General Fund support for the Climate Action Corps. Previously, the program was supported with limited-term General Fund of $4.7 million annually from 2021-22 through 2025-26. As such, the budget action both doubles the funding for the program and makes it permanent. (In addition, the program receives roughly $3 million annually in federal AmeriCorps funding.) The program provides funding to local “host partner” agencies—including cities, universities, tribes, and community-based organizations—to hire individuals who are at least 18 years of age to serve as fellows for up to 11 months. Fellows organize community volunteer activities related to mitigating and responding to climate change. The funding provides the fellows with a stipend, educational benefits to attend school or repay existing student loans, and training and professional development.

Establishes Information Technology Unit. The budget provides $5.2 million in ongoing General Fund and 15 new positions to establish a new information technology unit within OPR. The unit is intended to support internal departmental oversight and administration of information technology needs. Previously, OPR relied on the information technology unit within the Governor’s Office for such services.

Begins Transition to Civil Service. Historically, OPR has been an extension of the Governor’s Office. However, in recent years, OPR has expanded significantly in size and scope—including administering programs, issuing grants, and implementing legislation. Because of these new responsibilities, OPR is beginning to resemble a more traditional state department in certain ways. As such, the administration is developing a strategy and process to transition OPR staff from exempt positions to civil service status. This includes the addition of 13 new positions in 2023-24 for various activities—primarily to implement new statutory tasks—that have civil service classifications.

Proposed California State Payroll System

Information Technology Project

The State Controller’s Office (SCO) and the California Department of Human Resources (CalHR) are currently planning the replacement of the state’s legacy payroll system—the proposed California State Payroll System (CSPS) information technology (IT) project. The proposed CSPS IT project is currently in Stage 4 (Project Readiness and Approval) of the California Department of Technology’s (CDT’s) Project Approval Lifecycle (PAL)—the state’s IT project approval process. The SCO and CalHR currently expect to complete the PAL process in 2024-25 and begin development and implementation of the project shortly thereafter. The preliminary baseline cost and schedule for the proposed CSPS IT project (provided as part of the Stage 2 Alternatives Analysis) is $767 million General Fund, with a five-and-a-half-year time line to develop and implement the new payroll system.

Reappropriates Funding for System Integrator Costs Approved in 2022-23. The 2023-24 spending plan reappropriates $83.3 million General Fund that was appropriated in 2022-23 for system integrator costs. This funding remains subject to budget act language that requires written notification to the Joint Legislative Budget Committee within 45 days once the project is approved through CDT’s PAL process. (The spending plan also reappropriates $9.2 million [$5.5 million General Fund] that was appropriated in 2022-23 for the Department of the Financial Information System for California [FI$Cal] to plan, develop, and implement interfaces between FI$Cal and the proposed CSPS IT project.)

Appropriates Additional Project Funding, Particularly for Organizational Change Management. The 2023-24 spending plan also includes $49.7 million ($38.1 million General Fund) and 15.5 positions in 2023-24 for the planning, development, and implementation of the proposed IT project. Of the $38.1 million General Fund in 2023-24, $16.8 million General Fund is allocated for organizational change management activities (that is, funding for the Department Agency Readiness Teams) to help state payroll processing departments adopt the new payroll system. As with the system integrator funding, this funding is subject to budget act language that requires written notification to Joint Legislative Budget Committee within 45 days once the project is approved through CDT’s PAL process. Additional budget act language requires SCO, in consultation with CalHR, to identify how much funding is allocated to each payroll processing department in 2023-24.

Statewide Infrastructure

Debt Service

The budget provides $7.3 billion from various funds for debt service payments in 2023-24. This represents an increase of 9 percent compared to 2022-23, mainly due to increases in natural resources, higher education, and transportation-related debt service. This total includes $6.5 billion for general obligation bond debt ($5 billion from the General Fund) and $822 million for lease revenue bond debt ($633 million from the General Fund).

Capital Outlay

Appropriates $2.6 Billion for Capital Outlay in 2023-24. The budget includes a total of $2.6 billion for 93 capital outlay projects. In comparison, the 2022-23 budget package included $7.9 billion for 190 projects. Along with an overall reduction in the number of projects funded, a large part of the year-to-year difference results from a $4.2 billion appropriation in 2022-23 for the high-speed rail project. Figure 3 shows a summary of projects receiving funding listed by administering department. A more comprehensive list of state capital outlay projects approved in the 2023-24 budget is available for download at this link. The 2023-24 funding amount shown in the figure includes $1.4 billion from various higher education fund sources such as revenue bonds and campus reserves, $767 million from the Public Buildings Construction Fund, and $273 million from the General Fund. The remainder consists of various other special funds or combinations of fund sources.

Figure 3

Capital Outlay Appropriations

(Dollars in Millions)

|

Department |

Net 2023‑24 Fundinga |

Number of Projects |

Total Estimated Project Costsa |

|

Education |

|||

|

California State University |

$637 |

8 |

$637 |

|

University of California |

594 |

3 |

594 |

|

California Community Colleges |

158 |

14 |

496 |

|

Department of Education |

5 |

3 |

51 |

|

Criminal Justice and Judicial Branch |

|||

|

Department of Corrections and Rehabilitation |

$462 |

7 |

$1,881 |

|

Judicial Branch |

147 |

5 |

634 |

|

Natural Resources |

|||

|

Water Resources |

$163 |

13 |

$4,790 |

|

Department of Parks and Recreation |

38 |

11 |

78 |

|

Department of Forestry and Fire Protection |

3 |

11 |

691 |

|

Transportation |

|||

|

California Highway Patrol |

$97 |

2 |

$370 |

|

Department of Motor Vehicles |

50 |

3 |

132 |

|

Health and Human Services |

|||

|

Veterans Affairs |

$38 |

2 |

$38 |

|

Department of State Hospitals |

18 |

5 |

117 |

|

Other |

|||

|

Office of Emergency Services |

$176 |

2 |

$183 |

|

Exposition Park |

15 |

2 |

382 |

|

California Department of Food and Agriculture |

3 |

1 |

78 |

|

Statewide Capital Outlay Planning and Studies |

2 |

1 |

2 |

|

Totals |

$2,608 |

93 |

$11,152 |

|

aSome projects include a combination of state and non‑state costs and funding. |

|||

|

Note: Certain capital outlay projects are excluded to avoid double‑counting previously provided funds or because specific data are not available. More information on these exclusions are provided in the text of this post. |

|||

For a variety of reasons, we do not reflect certain capital outlay projects in the above figure or linked table. Specifically, to avoid double-counting previously provided funds or because specific data are not available, we do not include projects for which funding is (1) continuously appropriated, such as some bond funds; (2) reappropriated, which provides additional time for the completion of the project; (3) reverted, if the project has ended or requires modification; (4) previously appropriated but shifted to a different fund source; or (5) provided to support local infrastructure projects. In addition, while the Legislature approves the overall budget for the California Department of Transportation, individual projects generally are approved by the California Transportation Commission rather than through the budget process and therefore have not yet been specified.

Shifts Various Projects From General Fund to Bonds. In order to help address the state budget shortfall, the spending plan adopts the approach of using bond financing—rather than up-front cash from the General Fund, as the administration had originally planned—to fund the next phases of certain capital outlay projects. This includes shifting $3.2 billion in higher education capital projects on California State University and University of California campuses, such as for student housing. A complete list of higher education capital projects with fund shifts can be found here. In addition, the budget uses lease revenue bonds—rather than up-front General Fund, as the administration had originally planned—to fund various phases of field office projects. This includes a total of $542 million for the California Highway Patrol from 2021-22 through 2024-25 ($86 million in 2023-24) and $81 million for the Department of Motor Vehicles from 2021-22 through 2025-26 ($59 million in 2023-24). (Please see our post, The 2023-24 Spending Plan: Transportation, for more detail on those projects.) The administration has not yet identified what fund source it plans to use to pay the future debt service on these lease revenue bonds.

Does Not Include Proposals to Shift Some Project Funding From Bonds to General Fund. The Legislature rejected the administration’s proposals to shift a portion of funding for some projects from lease revenue bonds to cash financing. Specifically, the Legislature rejected proposals to use $402 million General Fund for the Richards Boulevard office complex in the Department of General Services (DGS’s) budget and $89 million General Fund for three courthouses in the Judicial Branch’s budget. The administration proposed the funding shifts because a portion of the bonds for the projects were scheduled to be sold outside the three-year window required for tax-exempt bonds. As a result, the projects will need to use taxable bonds.

Defers Some Projects to Future Years. Due to the constrained budget condition, certain previously planned capital outlay projects have been deferred to future years. These include projects for the Judicial Branch, California Highway Patrol, California Department of Corrections and Rehabilitation (CDCR), California Department of Education, California Department of Forestry and Fire Protection (CalFire), and the Department of State Hospitals. In total, deferring these projects has freed up $855 million General Fund over the next few years. The administration plans to come forward with new proposals to the Legislature in future years in order to resume these projects.

Reduces Funding for Deferred Maintenance. In order to achieve General Fund savings, the budget package reduces funding appropriated in prior years for deferred maintenance by a total of $212 million across various departments. Specifically, the budget reduces deferred maintenance funding by $89 million for DGS, $49.5 million for the Judicial Branch, $31 million for the Department of Parks and Recreation, $30 million for CDCR, and $13 million for CalFire.

Targeted Legislative Augmentations

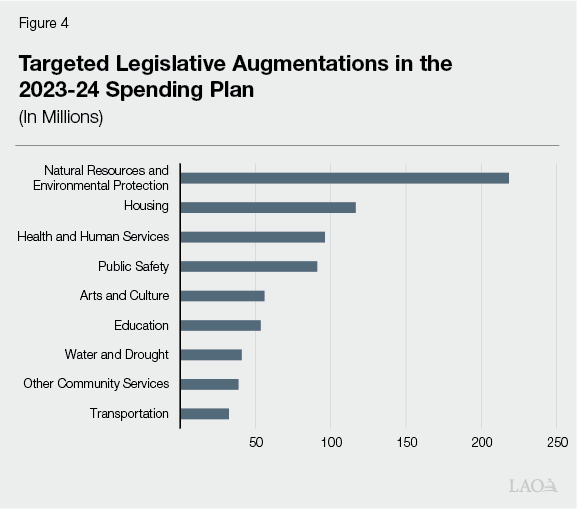

Control Sections 19.561 through 19.569 provide roughly $745 million in appropriations for legislative priorities across a broad range of local activities. (Each subsection is organized by program area and we use those definitions for the figure and discussion below.) The expenditures associated with these augmentations have been initially scored as a set-aside in Budget Item 9901. However, in the Governor’s budget next year, the administration will distribute these costs by department for 2023-24. These departments will, in turn, distribute the funds to local entities for the projects.

Amounts by Area. Figure 4 summaries the amounts allocated by category outlined in the budget bill. Of the total, the largest amounts are dedicated to:

$218 Million for Natural Resources and Environmental Protection (Control Section [CS] 19.651). There are 154 local projects funded in CS 19.561, mostly in the low millions of dollars. These include activities like: improvements to parks and playgrounds (including dog parks), renovation and construction of activity and recreation centers, habitat restoration, and paving and repaving trails and bike trails. Although the amounts are all relatively small, some of the largest projects include: $8 million to Fresno County for the City of Mendota Community Center and $5.6 million to the City of San Diego for the Fleet Center exhibit space.

$117 Million for Housing (CS 19.564). There are 75 local projects funded in CS 19.564, mostly in the range of $1 million to $2 million. These include: construction of affordable and farmworker housing developments, design and planning for new developments, and construction of facilities for individuals experiencing homelessness. Although the amounts for each project are relatively small, some of the largest include: $6.5 million to Lao Family Community Development for infrastructure and improvements for units for people experiencing homelessness, $5 million to Stanislaus County for infrastructure projects in South Modesto, and $5 million to the City of Vista for interim and permanent support housing units.

$96 Million for Health and Human Services. There are 66 local projects funded in CS 19.565, mostly funded at less than $2 million. These include funds for: food access and other basic needs (for example, support to food banks and fresh fruit and vegetable Electronic Benefits Transfer pilots), youth centers, mobile health, drug recovery, and senior assistance and engagement. Although the amounts for each project are relatively small, some of the largest include: $8 million to the nonprofit organization City of Refuge Sacramento to support new housing development, youth engagement, and community engagement programs; $5 million for the Chinese Hospital of San Francisco; and $3 million to Asian Health Services for a hub to provide services to elderly residents in San Leandro.