LAO Contact

Ann Hollingshead

Update (9/11/24): Managed care organization tax increase corrected in Appendix 1 (Figure 4) and Appendix 2 (Figure 1).

Update (10/2/24): Figure 8 has been updated for final actions.

September 6, 2024

The 2024‑25 Budget

Overview of the Spending Plan

- Introduction

- The Budget Problem

- Budget Condition

- Evolution of the Budget

- Major Features of the 2024‑25 Spending Plan

- Appendix

Introduction

Each year, our office publishes the California Spending Plan to summarize the annual state budget. This publication provides an overview of the 2024‑25 Budget Act, gives a brief description of how the budget process unfolded, and then highlights major features of the budget approved by the Legislature and signed by the Governor. All figures in this publication reflect actions taken through early July 2024, but we have updated the narrative to reflect actions taken later in the legislative session. In addition to this report, we have released a series of issue‑specific, online posts that give more detail on the major actions in the budget package.

The Budget Problem

In this section, we present our estimates of the budget problem the Legislature addressed in the 2024 budget package. The state faced a budget problem, or deficit, this year. The estimates of the budget problem in this section are predicated on the administration’s June 2024 revenue projections and spending proposals. Our analysis also focuses on the three‑year budget window under consideration: 2022‑23 through 2024‑25.

What Is a Budget Problem? In the context of budget development, a budget problem occurs when estimated resources are insufficient to cover the costs of currently authorized services. Under the State Constitution, a budget problem must be solved, for example, by increasing revenues or reducing spending.

$55 Billion Budget Problem

Budget Package Addressed a $55 Billion Budget Problem. We estimate the Legislature addressed a $55 billion budget problem in the 2024‑25 budget package. This budget problem is essentially unchanged compared to the one addressed by the Governor in the May Revision ($55 billion). That said, our estimate of the budget problem is higher than the figure cited by the administration ($47 billion). The reasons for this difference are the same as those we cited in our analyses of the Governor’s budget and May Revision. The main driver of differences is our differing treatment of baseline spending for schools and community colleges. (For more information on this and other differences, see: The 2024‑25 Budget: Initial Comments on the Governor’s May Revision.)

How the Spending Plan Addresses the Budget Problem

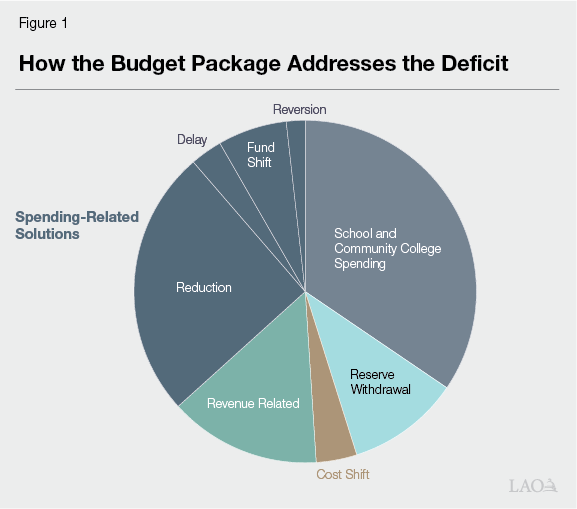

The state has several types of solutions—or options—for addressing a budget problem, but the most important include: reserve withdrawals, spending reductions, revenue increases, and cost shifts (for example, between funds). Figure 1 summarizes the budget solutions that the budget package used to address the $55 billion budget problem. Spending‑related solutions (including both school and community college spending and other spending) total $39 billion and represent about 70 percent of the total solutions. Spending‑related solutions include reductions, fund shifts, delays, and reversions. In addition, the budget package includes about $6 billion in reserve withdrawals, $2 billion in cost shifts, and about $8 billion in revenue‑related solutions. The remainder of this section describes each of these solution types in more detail. Appendix 1 and 2, available online, list all of the solutions by area.

Spending‑Related Solutions ($20 Billion)

The budget package includes $20 billion in spending‑related solutions (excluding school and community colleges spending, which is described later in this section). Spending‑related solutions in the budget window include: $16 billion one time or temporary and $4 billion ongoing, which grow to about $6 billion over time.

Reductions ($14 Billion). Under our definition, a spending reduction occurs when the state reduces spending relative to what was established under current law or policy. More colloquially, these are spending cuts. We estimate the budget package includes about $14 billion in spending‑related reductions. Of this total, about $10 billion in spending reductions are one time or temporary and $4 billion are ongoing, which grow to $6 billion over time. Some of the largest reductions include: $2 billion in ongoing reductions to state operations; about $1.7 billion in various adjustments related to past allocations for disaster response, including for fires, floods, and the pandemic; and a nearly $500 million reduction to the learning‑aligned employment program.

Fund Shifts ($4 Billion). Fund shifts are budget solutions that use other fund sources—for example, special funds—to pay for a cost typically incurred by the General Fund. These shifts reduce expenditures from the General Fund as they simultaneously displace spending that these other funds otherwise would have supported. As a result, we consider these to be a type of spending‑related solution because they typically result in lower overall state spending, inclusive of all funds. We estimate the budget package includes $3.6 billion in fund shifts. This primarily includes General Fund costs that have been shifted to the Greenhouse Gas Reduction Fund (GGRF), federal funds, and other special funds. The budget also shifts some General Fund costs for child care to Proposition 64 and federal funds.

Delays ($2 Billion). We define a delay as an expenditure reduction that occurs in the budget window (2022‑23 through 2024‑25), but has an associated expenditure increase in a future year of the multiyear window (2025‑26 through 2027‑28). That is, the Legislature has moved the spending to a year in the near future. (We do not categorize a proposal as a delay if it would shift the cost outside of the multiyear window) Nearly $2 billion of the budget package’s spending‑related solutions are delays. (As a result, proposed spending is higher in the out‑years.)

Reversions ($1 Billion). Costs for state programs sometimes come in lower than the amount that was appropriated. This often occurs, for example, when the state overestimates uptake in a new program or as a routine matter in programs where spending is uncertain due to factors like caseload. When actual state costs are below budgeted amounts, a reversion occurs after a period of time—typically, three years. The reversion returns the unspent funds to the General Fund. This year’s budget package accelerates some reversions that would have otherwise occurred in the future and proactively reverts certain funds that otherwise are continuously appropriated (which has the effect of realizing savings from the unspent funds that would not otherwise occur). While not all of these amounts represent lower state spending over the long term, they do result in savings today at a cost of forgone savings in the future. As a result, we count them as spending‑related solutions. We estimate the budget package includes nearly $1 billion in reversions.

Reserve Withdrawals ($6 Billion)

Budget Stabilization Account ($5 Billion). Proposition 2 (2014) governs deposits into and withdrawals from the state’s general‑purpose constitutional reserve—the Budget Stabilization Account (BSA). Under these rules, the state can make withdrawals from the constitutionally required balance of the BSA in a fiscal emergency, which occurs when estimated resources for the upcoming year are insufficient to cover the costs of the previous three enacted budgets, adjusted for inflation and population. When a budget emergency is declared, the state can withdraw up to half of the constitutional balance of the BSA. (The Legislature also can withdraw the entire “discretionary” balance of the BSA at any time, which are amounts that were deposited into the fund on top of Proposition 2 requirements.) The Governor issued a budget emergency proclamation on June 26, 2024. The budget package suspends the BSA deposit for 2024‑25 and uses a withdrawal of about $5 billion from the fund to cover a part of the budget problem.

Safety Net Reserve ($1 Billion). The budget package withdraws the entire balance of the Safety Net Reserve—$900 million. The Safety Net Reserve was designed to help cover costs of increasing caseload in Medi‑Cal and the California Work Opportunity and Responsibility to Kids (CalWORKs) program in the event of an economic downturn.

Cost Shifts ($2 Billion)

The budget package includes slightly more than $2 billion in cost shifts. We define cost shifts as budget actions that achieve savings in the present, but result in a binding obligation or higher cost for the state in a future year. In that way, these actions can be similar to borrowing, but are often not explicitly structured as such. For example, major categories of cost shifts include: an additional $1.7 billion in special fund loans to the General Fund and $400 million in savings generated by extending the repayment schedule for some existing loans.

Revenue‑Related Solutions ($8 Billion)

We estimate the May Revision includes nearly $8 billion in revenue‑related solutions. The largest revenue solution is a temporary increase in corporation tax revenues by about $6 billion in 2024‑25. This is generated by not allowing (1) any businesses to use tax credits to reduce their taxes by more than $5 million and (2) businesses with $1 million or more in income to use net operating loss (NOL) deductions. These limits apply to tax years 2024, 2025, and 2026. The budget package also creates a new mechanism for taxpayers to recoup these temporary tax increases as tax refunds in future years. In addition, the May Revision includes a proposal to increase the managed care organization (MCO) tax and use the nearly $2 billion in increased revenues to offset General Fund costs.

School and Community College Spending ($19 Billion)

Suspends Proposition 98 Requirement and Reduces Spending ($13 Billion). Proposition 98 (1988) sets a minimum funding requirement for schools and community colleges using a series of formulas in the State Constitution. The state meets the requirement through a combination of state General Fund and local property tax revenue. For 2023‑24, the budget invokes a provision allowing the state to suspend the minimum requirement with a two‑thirds vote of each house of the Legislature. It then reduces spending on schools and community colleges by $8.3 billion relative to the level otherwise required that year. Separate from this action, the budget makes a $2.6 billion reduction attributable to 2022‑23. This reduction does not require suspension because funding remains above the minimum requirement that year. (The budget also contains numerous actions—primarily reserve withdrawals—to insulate school and community college budgets from these reductions.) Both of these reductions lower the Proposition 98 requirement on an ongoing basis, though the suspension creates an obligation to increase funding more quickly in the future. The combined effect of these reductions—including their effect on 2024‑25—is to reduce General Fund spending by $12.7 billion over the 2022‑23 through 2024‑25 period.

Accrues Cost of Previous Payments to Future Fiscal Years ($6 Billion). The budget introduces a new type of fiscal maneuver that accrues $6.2 billion in previous school and community college payments to future fiscal years. Specifically, the state will not recognize these payments as a cost to the General Fund in the year it provided them (2022‑23). Instead, it will recognize the cost in equal installments over ten years, beginning in 2026‑27. These costs, when recognized, will be attributed to the non‑Proposition 98 side of the state budget. Though not formally structured as borrowing, the maneuver is similar to the state taking an internal loan from its cash reserves. The maneuver does not delay or reduce any payments to schools or community colleges. It also does not reduce the Proposition 98 funding requirement moving forward. It will, however, reduce funding available for other state programs over the next ten years.

Budget Condition

In this section, we describe the overall condition of the General Fund budget, the condition of the school and community college budget, and state appropriations limit (SAL) estimates under the spending plan. As is the case in the previous section, all of the figures here use the administration’s budget estimates as of June 2024.

General Fund

Figure 2 summarizes the condition of the General Fund under the revenue and spending assumptions in the June 2024 budget package, as estimated by the administration. The state would end 2024‑25 with $3.5 billion in the Special Fund for Economic Uncertainties (SFEU). (The SFEU is the state’s operating reserve and essentially functions like an end‑of‑year balance.)

Figure 2

General Fund Condition Summary

(In Millions)

|

2022‑23 |

2023‑24 |

2024‑25 |

|

|

Prior‑year fund balance |

$63,751 |

$47,119 |

$13,444 |

|

Revenues and transfers |

178,557 |

189,399 |

212,139 |

|

Expenditures |

195,189 |

223,075 |

211,504 |

|

Ending fund balance |

$47,119 |

$13,444 |

$14,078 |

|

Encumbrances |

$10,569 |

$10,569 |

$10,569 |

|

SFEU Balance |

$36,550 |

$2,875 |

$3,509 |

|

Reserves |

|||

|

BSA |

$21,708 |

$22,559 |

$17,633 |

|

SFEU |

36,550 |

2,875 |

3,509 |

|

Safety net |

900 |

900 |

— |

|

Total Reserves |

$59,158 |

$26,334 |

$21,142 |

|

SFEU = Special Fund for Economic Uncertainties and BSA = Budget Stabilization Account. |

|||

General Fund Reserves $21 Billion Under Spending Plan. As mentioned earlier, the budget package uses $5 billion from the BSA and $900 million from the Safety Net Reserve to help address the budget problem. This means the state would end 2024‑25 with $21 billion in General Fund reserves.

Proposition 98 Reserve Has Small Balance. As required by the State Constitution, the budget also withdraws the entire balance from the Proposition 98 Reserve ($8.4 billion) in 2023‑24 to supplement the funding provided to schools and community colleges. In 2024‑25, the budget begins to build back the Proposition 98 Reserve by making a discretionary deposit of nearly $1.1 billion.

Revenues. Figure 3 displays the administration’s revenue projections as incorporated into the June 2024 budget package. As the figure shows, revenues from the state’s three major sources are expected to grow from 2023‑24 to 2024‑25, including with 5 percent growth in the personal income tax, the state’s single largest revenue source. The reason the state faces a budget problem this year, despite growing revenues in the budget year, is that revenue shortfalls relative to past estimates have occurred in the prior year and current year.

Figure 3

General Fund Revenue Estimates

(Dollars in Millions)

|

Revised |

Enacted |

Change From 2023‑24 |

|||

|

2022‑23 |

2023‑24 |

Amount |

Percent |

||

|

Personal income tax |

$100,451 |

$111,203 |

$116,556 |

$5,353 |

5% |

|

Sales and use tax |

33,324 |

33,320 |

34,045 |

725 |

2 |

|

Corporation tax |

36,337 |

33,282 |

42,557 |

9,274 |

28 |

|

Total, Major Revenue Sources |

$170,111 |

$177,805 |

$193,158 |

$15,352 |

9% |

|

Insurance tax |

$3,707 |

$3,905 |

$4,016 |

$110 |

3% |

|

Other revenues |

5,409 |

6,788 |

7,004 |

216 |

3 |

|

Transfers and loans |

‑670 |

900 |

7,961 |

7,061 |

784 |

|

Totals, Revenues and Transfers |

$178,557 |

$189,399 |

$212,139 |

$22,739 |

12% |

|

Note: Reflects administration estimates of budget actions taken through July 1, 2024. |

|||||

Spending. Figure 4 displays the administration’s June 2024 estimates of total state and federal spending in the 2024‑25 budget package. As the figure shows, the spending plan assumes total state spending of $295 billion in 2024‑25. This is $31 billion lower than to the 2023‑24 level, and includes a 19 percent decrease in special fund spending and a 5 percent decrease in General Fund spending. Declines in state spending this year are generally attributable to the state’s budget problem. (The “Major Features” section of this report also describes some of the major discretionary spending choices and budget solutions reflected in the spending plan.)

Figure 4

Total State and General Fund Expenditures

(Dollars in Millions)

|

Revised |

Enacted |

Change From 2023‑24 |

|||

|

2022‑23 |

2023‑24 |

Amount |

Percent |

||

|

General Fund |

$195,189 |

$223,075 |

$211,504 |

‑$11,571 |

‑5% |

|

Special funds |

74,899 |

103,594 |

83,985 |

‑19,609 |

‑19 |

|

Budget Totals |

$270,089 |

$326,668 |

$295,489 |

‑$31,179 |

‑10% |

|

Bond funds |

$3,951 |

$5,319 |

$2,373 |

‑$2,946 |

‑55% |

|

Federal funds |

139,741 |

162,163 |

152,988 |

‑9,176 |

‑6 |

|

Note: Reflects administration estimates of budget actions taken through July 1, 2024. |

|||||

Bond Funds. The state is seeking approval of two bond measures on the November 2024 ballot: Proposition 2 and Proposition 4. Proposition 2 would allow the state to borrow $10 billion to build new facilities and renovate existing facilities at school districts and community colleges. The cost to repay this bond would be about $500 million each year for 35 years. Proposition 4 would allow the state to borrow $10 billion to pay for various natural resources and climate activities. The cost to repay this bond would be about $400 million each year for 40 years. The cost to repay both bonds would total about $900 million each year. (New bond spending that would occur as a result of these measures are not part of the estimates in Figure 4.)

School and Community College Budget

Reflects Decrease in Funding Compared With Previous Budget Estimate. Compared with the estimate the state made in June 2023, the June 2024 budget reflects a $9.8 billion decrease in Proposition 98 funding across the 2022‑23 through 2024‑25 period (Figure 5). This reduction consists of an $11.7 billion decrease in state General Fund, partially offset by a $1.9 billion increase in local property tax revenue. Most of the General Fund reduction is attributable to the suspension of the Proposition 98 funding requirement in 2023‑24.

Figure 5

School and Community College Funding Levels

Under Proposition 98

(In Millions)

|

2022‑23 |

2023‑24 |

2024‑25 |

Totals |

|

|

June 2023 |

||||

|

General Fund |

$78,117 |

$77,457 |

$79,739 |

$235,314 |

|

Local property tax |

29,241 |

30,854 |

31,881 |

91,977 |

|

Totals |

$107,359 |

$108,312 |

$111,621 |

$327,291 |

|

June 2024 |

||||

|

General Fund |

$73,946 |

$67,095 |

$82,612 |

$223,653 |

|

Local property tax |

29,774 |

31,389 |

32,670 |

93,834 |

|

Totals |

$103,720 |

$98,484 |

$115,283 |

$317,487 |

|

Change From June 2023 |

||||

|

General Fund |

‑$4,172 |

‑$10,362 |

$2,873 |

‑$11,661 |

|

Local property tax |

532 |

535 |

789 |

$1,856 |

|

Totals |

‑$3,639 |

‑$9,827 |

$3,662 |

‑$9,804 |

Withdraws Funding From State School Reserve to Mitigate Funding Drop. Proposition 2 established a constitutional reserve account for school and community college funding and set forth rules requiring deposits and withdrawals under certain conditions. One of these rules requires the state to withdraw the entire balance of $8.4 billion in 2023‑24 to address the drop in funding that year. The budget uses this funding to compensate for the reduction in state General Fund. In 2024‑25, the budget begins to build back the reserve by making a discretionary deposit of nearly $1.1 billion.

Scores Savings Related to Attendance and a Few Other Adjustments. The state allocates most funding to schools based on their average daily attendance. In response to significant declines in attendance over the past several years, the state adopted a series of policies temporarily funding school districts based on the attendance they reported prior to the COVID‑19 pandemic. For 2024‑25, the budget assumes savings of $1.8 billion as these higher pre‑pandemic attendance levels phase out of district funding calculations. In addition, the budget obtains $1.2 billion in savings by (1) deferring some payments from 2024‑25 to 2025‑26, (2) reducing funding for State Preschool that is expected to go unused, and (3) repurposing certain unspent appropriations from previous years. Under the Constitution, the state must dedicate all of these savings to other school and community college purposes.

Funds Small Cost‑of‑Living Adjustment (COLA) for Existing Programs. After accounting for the reduction in overall funding, reserve withdrawals and deposits, cost savings, and various other baseline adjustments, the state has $1.5 billion available to augment school and community college programs. The budget allocates most this amount to cover a 1.07 percent COLA for existing programs. Most of the remaining funds are allocated to cover enrollment‑ and caseload‑driven increases in a few specific areas.

The State Appropriations Limit

Under Proposition 4 (1979), the Constitution limits how the state can use revenues that exceed a certain limit—a set of formulas known as the SAL. The SAL was recently an important constraint in the budget process and has impacted the Legislature’s budget decisions. For the last couple of years, however, the SAL has not been salient to the budget process. This is because declines in revenues have meant the state has more room under the limit. Figure 6 provides an overview of the SAL estimates in this year’s budget. As the figure shows, the state is expected to have room across all years in the budget window, including $31 billion in 2022‑23, $21 billion in 2023‑24, and $16 billion in 2024‑25.

Figure 6

State Appropriations Limit (SAL) Estimates

(In Billions)

|

2022‑23 |

2023‑24 |

2024‑25 |

|

|

SAL Revenues and Transfers |

$212.2 |

$227.6 |

$247.5 |

|

Exclusions |

‑107.4 |

‑106.5 |

‑115.9 |

|

Appropriations Subject to the Limit |

$104.8 |

$121.0 |

$131.7 |

|

Limit |

$135.7 |

$141.5 |

$147.6 |

|

Room/Negative Room |

$30.8 |

$20.5 |

$15.9 |

|

Excess Revenues? |

No |

||

|

Note: Reflects administration estimates of budget actions taken through July 1, 2024. |

|||

Evolution of the Budget

This section provides an overview of the 2024‑25 budget process. Figure 7 contains a list of the budget‑related legislation passed on or before July 2, 2024.

Figure 7

Budget‑Related Legislation Passed On or Before

July 2, 2024

|

Bill Number |

Chapter |

Subject |

|

Budget Bills and Amendments |

||

|

AB 107 |

22 |

2024‑25 Budget Act |

|

AB 106 |

9 |

Amendments to the 2022‑23 Budget Act and 2023‑24 Budget Act |

|

SB 108 |

35 |

Amendments to the 2024‑25 Budget Act |

|

SB 109 |

36 |

Amendments to the 2023‑24 Budget Act |

|

Early Action Trailer Bills (Passed Before June 1, 2024) |

||

|

SB 136 |

6 |

Managed care organization tax |

|

Other Trailer Bills Passed On or Before July 2, 2024 |

||

|

AB 160 |

39 |

Managed care organization tax |

|

AB 161 |

46 |

Human services |

|

AB 162 |

47 |

Developmental services |

|

AB 166 |

48 |

Housing |

|

AB 168 |

49 |

Public safety |

|

AB 169 |

50 |

Public safety: juvenile justice |

|

AB 170 |

51 |

Courts |

|

AB 171 |

52 |

Employment |

|

AB 173 |

53 |

Transportation |

|

SB 153 |

38 |

Education finance |

|

SB 154 |

27 |

Education finance: Proposition 98 suspension |

|

SB 155 |

71 |

Higher education |

|

SB 156 |

72 |

Resources |

|

SB 159 |

40 |

Health |

|

SB 163 |

73 |

Early learning and childcare |

|

SB 164 |

41 |

State government |

|

SB 167 |

34 |

Taxation |

|

SB 174 |

74 |

Resources |

|

SB 175 |

42 |

Taxation |

|

Note: This figure includes budget bills and trailer bills identified in Section 39.00 in the 2024‑25 Budget Act that were passed by the Legislature on or before July 2, 2024. Ordered by bill number. |

||

Governor’s January Budget Proposal

Governor’s Budget Addressed a $58 Billion Budget Problem. In January, we estimated that the administration solved a budget problem of $58 billion. (Our estimate of the Governor’s budget deficit was larger than the administration’s estimate—$38 billion—largely due to differences in what we considered to be baseline changes. This basic difference persisted throughout the budget season.) The Governor’s budget solutions focused on spending. Spending‑related solutions (including both school and community college spending and other spending) totaled $41 billion and represented nearly three‑quarters of the total. In addition, the Governor’s budget included $13 billion in reserve withdrawals, which represented about half of the reserve total; $4 billion in cost shifts; and about $400 million in revenue‑related solutions.

The Governor’s Budget Planned for Significant Future Budget Deficits. The Governor’s budget included the administration’s estimates of multiyear revenues and spending. Under those projections, the state would have faced operating deficits of $37 billion in 2025‑26, $30 billion in 2026‑27, and $28 billion in 2027‑28. (Our office also projected the budget’s multiyear position in December. The administration’s deficit estimates were very similar to our December projections of the budget’s multiyear position.)

Early Action Package

In April, the Legislature passed an early action package that reduced the size of the budget problem by $17.3 billion (Chapter 9 of 2024 [AB 106, Gabriel]). Across the three‑year budget window, the early action package included $12.9 billion in spending‑related solutions and $4.4 billion in cost shifts (see above for our definitions of these terms). Some the largest of these actions included: $4 billion in fund shifts and revenue increases in the MCO tax package, about $1.6 billion in General Fund savings generated by deferring June 2025 payroll into July 2025, and $1.3 billion in savings generated by reallocating an existing 2023‑24 California Public Employees’ Retirement System payment made under Proposition 2. A complete list of the early action solutions are available in Appendix 3.

Governor’s May Revision

We Estimated Governor Addressed a $55 Billion Budget Problem. In April, the Legislature took early action on a number of budget items. This early action package reduced the budget problem from January by $17 billion. However, erosions to the administration’s revenue forecast—which declined by $12 billion—plus increases to baseline costs, including in Medi‑Cal, nearly entirely offset this reduction. As a result, at the May Revision, we estimated that the budget problem was $55 billion under the administration’s estimates and assumptions, only slightly lower than the budget problem estimated in January.

Governor Proposed Addressing This Deficit by Adjusting Spending. The May Revision proposed primarily solving the budget problem by adjusting spending. Spending‑related solutions (including both school and community college spending and other spending) represented nearly 90 percent of the total solutions. Of this total, $22 billion were related to school and community college funding changes and $16 billion were spending reductions, while the remaining solutions comprised other types, like fund shifts. Compared to January, the Governor proposed that the state use much less in reserves. Specifically, the Governor reduced total reserve withdrawals from $13 billion proposed in January to $4 billion in May.

May Revision Included More Emphasis on Addressing Multiyear Deficits, Particularly in 2025‑26. In addition to solving the budget problem in the budget window, the Governor’s May Revision proposed actions to also close the budget gap in 2025‑26, including a sizeable reserve withdrawal in that year. (The administration emphasized that the state was solving the budget problem across two years.) On a multiyear basis, under both our office’s and the administration’s projections, the state would face smaller operating deficits under the May Revision compared to January. Our office concluded that, under the May Revision, the budget was likely balanced, particularly in the near term.

Legislature’s Budget

The Legislature passed an initial budget on June 15, 2024. The main structural difference between the legislative package and the May Revision was that the legislative package started the proposed limitation on NOLs and tax credits one year earlier—resulting in roughly $5 billion in additional revenue. The Legislature’s budget used that additional budget capacity to reject some of the Governor’s spending solutions and/or provide other augmentations. Those spending augmentations included, for example: $1 billion for Homeless Housing, Assistance, and Prevention (HHAP) Program Round 6; about $800 million to undo reductions to the Middle Class Scholarship program; roughly $600 million to undo a delay to the implementation of Department of Developmental Services service provider rate reform; and $400 million for legislative district requests. The legislative package also included a large number of other smaller changes across a variety of programs. The legislative package used slightly more (nearly $1 billion) in general purpose reserves than the May Revision.

Final Budget Package

The Legislature passed an amended budget act and associated trailer bills on June 26, 2024. The Legislature also took some additional actions later in the legislative session, which are listed in Figure 8. The next section of this report describes the major features of the final budget package.

Figure 8

Budget‑Related Legislation Passed After July 2, 2024

|

Bill Number |

Chapter |

Subject |

|

Budget Bills and Amendments |

||

|

AB 180 |

995 |

Amendments to the 2024‑25 Budget Act |

|

AB 157 |

994 |

Amendments to the 2024‑25 Budget Act |

|

AB 158 |

996 |

Amendments to the 2022‑23 Budget Act and 2023‑24 Budget Act |

|

Trailer Bills |

||

|

AB 218 |

1002 |

Oil and gas |

|

AB 176 |

998 |

Education finance |

|

AB 177 |

999 |

Health |

|

AB 178 |

1000 |

Resources |

|

AB 179 |

997 |

State government |

|

AB 181 |

1001 |

Bargaining unit agreements |

|

Note: This figure includes budget bills and trailer bills identified in Section 39.00 in the 2024‑25 Budget Act that were passed by the Legislature after July 2, 2024. Ordered by bill number. |

||

Major Features of the 2024‑25 Spending Plan

This section briefly describes the major spending actions in the 2024‑25 budget package, including some actions that were part of the early action package. We discuss these and other actions in more detail in a series of online publications.

K‑14 Education

Funds Modest COLA and a Few Smaller Augmentations. The state calculates the statutory COLA each year based on a price index published by the federal government. For 2024‑25, the budget provides $1 billion to cover a 1.07 percent COLA for existing school and community college programs. For schools, the budget also provides an increase of $300 million ($179 million ongoing and $121 million one time) to cover cost increases related to universal school meals. For community colleges, the budget also provides (1) $50 million ongoing for caseload increases in the Student Success Completion Grant program and (2) $25 million ongoing to increase enrollment by 0.5 percent.

Implements Small Payment Deferral. The budget reduces spending in 2024‑25 by deferring $487 million in payments to 2025‑26. Of this deferral, half applies to schools and half applies to community colleges. The state will implement the deferral by delaying a portion of the payment districts ordinarily would receive in June 2025 to July 2025. The law allows school districts to be exempt from this deferral (meaning they would receive all of their funding on time) if they can show the delay would cause fiscal insolvency. The purpose of the deferral is to reduce spending in 2024‑25 to the minimum level required by Proposition 98.

Resources and Environment

Changes to Multiyear Climate‑Related Budget Packages. To help address the budget problem, the spending plan makes a number of changes to one‑time and temporary funding that was agreed to in previous budgets for climate, resources, and environmental programs. Specifically, the budget agreement both reduces program support and shifts planned funding from the General Fund to the GGRF, as well as delays the timing for some planned expenditures. These changes have the cumulative effect of lowering planned non‑Proposition 98 General Fund spending for these packages by roughly $6.4 billion across the six‑year period spanning 2021‑22 through 2026‑27. (This total excludes an additional $2.3 billion in budget solutions resulting from reductions and fund shifts to environmental programs that were not included as part of these thematic packages.) While the spending plan includes less spending than previous budgets initially agreed upon for several activities—such as related to water, extreme heat, and coastal resilience—a heavy reliance on shifting from General Fund to GGRF across multiple years allows it to maintain the majority of overall intended funding for most of the original thematic climate‑related packages. In total, the spending plan maintains a total of $29 billion for these packages across a seven‑year period (2021‑28), which represents 79 percent of the original multiyear planned amounts ($36 billion).

Some Notable New Fire Response and Other Spending. Despite the budget condition, the spending plan does include some significant new spending for environment‑related activities, including from the General Fund. In particular, it provides $199 million ($197 million from the General Fund) and 338 positions in 2024‑25 to begin implementing a shift to a 66‑hour workweek for firefighters at the California Department of Forestry and Fire Protection (CalFire), as contemplated in a 2022 memorandum of understanding (MOU) between the state and the firefighter union. (CalFire’s current workweek is 72 hours.) As of the budget act, the costs of implementing the shift were anticipated to rise to $770 million ($756 million General Fund) on an ongoing annual basis and 2,457 permanent positions by 2028‑29. After approving the budget act, the Legislature ratified an MOU between the state and the union representing CalFire that includes additional provisions to implement the 66‑hour duty week. The terms of this agreement will increase these costs as the reduction in duty week hours is put in place beyond the amounts envisioned in the budget act. The budget package also includes $94 million in one‑time General Fund for flood prevention activities, $65 million in one‑time GGRF for projects at the Salton Sea, and roughly $45 million in ongoing General Fund to make recent temporary expansions of CalFire hand crews permanent.

State Operations

Unallocated Reduction to State Operations Expenditures. The budget assumes that the Department of Finance identifies and implements $2.2 billion in ongoing reductions to General Fund state operations expenditures beginning in 2024‑25. While this reduction generally is unallocated, the budget explicitly requires that $392 million of the total reduction be applied to the California Department of Corrections and Rehabilitation (CDCR).

Reduction to State Positions. The budget assumes that sufficient positions are held vacant in order to revert $762.5 million to the General Fund in 2024‑25. Beginning in 2025‑26, the budget assumes that this reduction is achieved by permanently reducing the number of state positions.

Reorganizes the Governor’s Office of Planning and Research (OPR). The budget package reorganizes the activities formerly housed under OPR. First, it establishes the Governor’s Office of Service and Community Engagement which now will house California Volunteers programs and the Office of Community Partnerships and Strategic Communications. Second, it transfers a zero‑emission vehicle program and the California Jobs First program to the Governor’s Office of Business and Economic Development and the Precision Medicine Program to the Health and Human Services Agency. Finally, it maintains the remaining OPR programs in the newly renamed Governor’s Office of Climate and Land Use Innovation. The budget does not include additional funding to implement these changes.

Health

Changes to MCO Tax Package. Last year’s budget renewed a tax on health plan enrollment known as the MCO tax. It extended this tax through 2026. The net revenue generated by the tax was to (1) help offset General Fund spending in Medi‑Cal and (2) augment funding for Medi‑Cal and other health programs. Recognizing the substantial budget problem facing the state, this year’s spending plan makes three key changes to this package. First, it increases the tax rate on health plan enrollment in Medi‑Cal, generating more net revenue to the state ($2.8 billion through 2024‑25 and $7.1 billion through 2026‑27). Second, it notably reduces how much tax revenue is used for augmentations, instead using more money to help offset General Fund spending ($3.5 billion through 2024‑25 and $7.7 billion through 2026‑27). Third, it changes which Medi‑Cal services and health programs receive augmentations and delays the start of some funding increases to 2026. As a result of these actions, the revised MCO tax package provides a substantial budget solution to the state ($6.3 billion through 2024‑25 and nearly $15 billion through 2026‑27).

Transportation

Changes to Multiyear Transportation Infrastructure Package. To address the General Fund shortfall, the budget makes a few reductions to spending agreed to in prior years as a multiyear transportation infrastructure package. Specifically, the budget cuts $400 million from the Active Transportation Program, $200 million planned for grade separation projects, and $75 million from the Highways‑to‑Boulevards Pilot Program. (The budget package also reduces $96 million in General Fund that had been provided outside of the transportation infrastructure package for projects at the Port of Oakland.) The spending plan includes additional changes to transportation expenditures that do not affect planned funding totals. These include delaying the timing of when some funding will be provided (including for the Zero‑Emission Transit Capital Program established as part of the 2023‑24 budget package) and shifting funding from the General Fund to GGRF and the State Highway Account (including a total of $1.3 billion across the competitive‑based and formula‑based Transit and Intercity Rail Capital Programs shifted to GGRF).

Universities

Base Funding Increases for Universities in 2024‑25, Decreases in 2025‑26. The budget plan increases base General Fund support for the University of California (UC) and the California State University (CSU) by a total of $468 million (approximately 5 percent) in 2024‑25. The universities may use these base augmentations for any operating cost, including increases in employee salaries and benefits. Provisional language requires the universities to report to the Legislature by December 31, 2025 on how they used these funds. These ongoing increases are partly offset by one‑time base General Fund reductions totaling $200 million in 2024‑25. In a related budget action, the state plans to reduce ongoing base General Fund support for UC and CSU by a total of $774 million in 2025‑26. These reductions are part of a broader action to reduce state operations spending across agencies by 7.95 percent.

Out‑Year Base Augmentations for Universities Are Deferred. Under the budget agreement, the state plans to defer UC and CSU base augmentations over the subsequent two years. Specifically, the state plans to delay base university augmentations totaling $493 million from 2025‑26 until 2026‑27. In 2026‑27, the state plans to provide these base augmentations, as well as one‑time back payments to compensate for the forgone funds in the previous year. The state then plans to defer the same amount ($493 million) from 2026‑27 until 2027‑28. This UC EdBudget table and this CSU EdBudget table (both online) show all base increases, decreases, and deferrals under the budget agreement.

State Sets Enrollment Growth Expectations for UC and CSU. The state expects UC and CSU to enroll more resident undergraduate students over the next few years. In 2024‑25, UC is to increase by 2,927 full‑time equivalent (FTE) students (1.4 percent) and CSU is to increase by 6,338 FTE students (1.9 percent). UC is to continue growing its resident undergraduate enrollment by 1.4 percent annually through 2026‑27. CSU is to grow by 3 percent in 2025‑26. Although UC’s and CSU’s base augmentations are to cover most of the associated cost, the budget includes $31 million in 2024‑25 specifically for UC to replace 902 FTE nonresident undergraduate students with resident students at the Berkeley, Los Angeles, and San Diego campuses (combined). Provisional language authorizes the administration to reduce funding proportionally if any of these UC or CSU enrollment expectations are not met. This EdBudget table shows enacted higher education enrollment levels. (As is the case with the base augmentations, the state plans to defer the UC nonresident replacement funding for 2025‑26.)

Housing and Homelessness

Eliminates Most Remaining One‑Time Funding for Housing. Previously enacted budgets authorized significant, albeit primarily one‑time and temporary, funding for housing and homelessness, including authorizing some spending actions for 2024‑25. The 2024‑25 spending plan reduces much of the one‑time, unspent funding for several major housing programs by a total of $1.4 billion General Fund. Examples of the programs with the largest reductions include the Foreclosure Intervention Housing Preservation Program ($400 million General Fund), Infill Infrastructure Program ($235 million General Fund), and CalHome ($153 million General Fund). Although the Governor’s budget proposal initially included reductions that would essentially eliminate state funding for the Multifamily Housing Program (proposed reduction of $250 million General Fund), Housing Navigator and Maintenance Program (proposed reduction of $13.7 million), and Regional Early Action Planning program ($300 million proposed reduction), the final budget did not include reductions of this magnitude. Instead, smaller than proposed reductions were made to the Multifamily Housing Program ($10 million General Fund reduction) and the Regional Early Action Planning Program ($40 million General Fund reduction), and no reductions were made to the Housing Navigator and Maintenance Program.

Provides New, One‑Time Augmentations for Certain Homelessness Programs. The 2024‑25 budget includes $1 billion General Fund for a sixth round of local funding for the HHAP Program. Additionally, the 2024‑25 budget includes $150 million for the Encampment Resolution Funding program. The spending plan includes budget‑related legislation aimed to increase oversight and accountability for both programs. At a high level, this legislation will require the reporting of additional performance measures, ongoing monitoring by the Department of Housing and Community Development, and increased reporting requirements for all recipients. Finally, the 2024‑25 budget continues the recent practice of providing an additional $500 million for the state Low‑Income Housing Tax Credit Program. (Because these credits would not be claimed until the housing units are complete, the General Fund impact of these tax credits will occur in a few years.)

Child Care

Funds New Child Care Slots and Modifies Multiyear Expansion Plan. The budget package includes $229 million ($117 million General Fund and $111 million federal funds) for 11,000 new center‑based child care slots beginning October 1, 2024. These slots will have full‑year costs of $305 million beginning in 2025‑26. The budget also modifies and adds into statute details related to the multiyear slot expansion plan. (In 2021‑22, the Legislature and Governor agreed to add 206,500 child care slots by 2025‑26. Full implementation was delayed to 2026‑27 in the 2023‑24 budget.) Specifically, trailer legislation indicates intent to add 44,000 slots in 2026‑27 and 33,000 slots in 2027‑28 to fully meet the goals of the expansion plan.

Public Safety

Various Public Safety Reductions. The budget reflects numerous reductions to General Fund spending on public safety programs. Notable examples include:

- $169 million (increasing to $225 million in 2025‑26 and ongoing) in reductions to CDCR associated with prison capacity deactivations. This consists of (1) $77 million (increasing to $132 million) from the planned deactivation of Chuckawalla Valley State Prison in Blythe, (2) $82 million from the deactivation of 42 housing units across 11 state prisons, and (3) $10 million (increasing to $11 million) related to reduced administrative costs resulting from these and previous deactivations.

- $97 million in ongoing reductions to trial court operations funding.

- $93 million in one‑time reductions to Governor’s Office of Emergency Services grant programs. This includes (1) $45 million from the Prepare California community hardening grant program, (2) $21 million from a gun buyback program, (3) $15 million from the Seismic Retrofitting Program for Soft Story Multifamily Housing, and (4) $12 million from the California Wildfire Mitigation home hardening program.

Appendix

Note: In the online version of this report, we include a series of Appendix tables that have detailed information on the budget solutions reflected in the 2024‑25 Budget Act as well as early action taken in the legislative session.