- Overview

- Department of Developmental Services

- CalWORKs

- Food Assistance

- Aging-Related Issues

- Update on Home- and Community-Based Services Spending Plan

- Child Welfare

- Department of Child Support Services

LAO Contact

- Ginni Bella Navarre

- Deputy Legislative Analyst: Human Services and Governance

- Angela Short

- Child Welfare

- Department of Child Support Services

- Sonia Schrager Russo

- CalWORKs

- Food Assistance

- Juwan Trotter

- Aging-Related Issues

- Update on Home- and Community-Based Services Spending Plan

- Karina Hendren

- Department of Developmental Services

October 2, 2024

The 2024-25 California Spending Plan

Human Services

CalWORKs

The California Work Opportunity and Responsibility to Kids (CalWORKs) program provides cash assistance, child care, and employment services to low-income families with children.

Spending Plan Overview

Budgeted CalWORKs Spending Increases by About 1 Percent in 2024-25. As shown in Figure 1, the spending plan provides almost $7 billion (total funds) to support the CalWORKs program in 2024-25, an increase of about $96 million (1 percent) relative to estimated spending in 2023-24. The year-over-year increase reflects projected increases in CalWORKs caseload and grants, offset by multiple reductions (described below).

Figure 1

CalWORKs Funding Sources

(Dollars in Millions)

|

2023‑24 Revised |

2024‑25 Appropriated |

Change From 2023‑24 |

||

|

Amount |

Percent |

|||

|

Federal TANF block grant funds |

$2,575 |

$3,282 |

$707 |

27% |

|

— |

671 |

671 |

— |

|

General Fund |

1,215 |

644 |

‑571 |

‑47 |

|

Realignment funds from local indigent health savings |

786 |

684 |

‑102 |

‑13 |

|

Realignment funds dedicated to grant increases |

1,108 |

1,167 |

59 |

5 |

|

Other county/realignment funds |

1,216 |

1,218 |

2 |

— |

|

Totals |

$6,900 |

$6,995 |

$96 |

1% |

|

aTANF carry forward is a non‑add line item for display purposes only. This amount is included in Federal TANF block grant funds. |

||||

|

TANF = Temporary Assistance for Needy Families. |

||||

Year-Over-Year Swings in General Fund Are Largely Due to Technical Adjustments. CalWORKs is partially funded by the federal Temporary Assistance for Needy Families (TANF) block grant. California receives $3.7 billion in TANF funds annually, over $2 billion of which is spent on CalWORKs (the remainder helps fund aid for some low-income college students and various, small human services programs). To receive its annual TANF grant, the state must spend a maintenance-of-effort (MOE) amount from state and local funds to provide services for families eligible for CalWORKs. This MOE amount is approximately $3 billion annually and can be spent directly on CalWORKs or other programs that meet federal requirements. To ensure California meets the MOE requirement and maximizes the usage of TANF funds each year, the administration makes technical adjustments as needed, shifting costs (within or outside of CalWORKs) from the General Fund to TANF or vice versa. The year-over-year changes in CalWORKs General Fund and TANF funds (shown above in Figure 1) are largely due to these adjustments. These changes are therefore larger in percentage than the year-over-year change in total CalWORKs funds (an increase of 1 percent).

Provides Almost $1.7 Billion for CalWORKs Administration and Support Services. The state provides counties with a “single allocation” to cover most costs associated with CalWORKs aside from cash assistance. Counties can shift the single allocation funding between supported functions, including CalWORKs administration and employment services. Single allocation funding generally is adjusted with caseload changes, decreasing when caseload is projected to decrease and increasing when caseload is projected to increase. As shown in Figure 2, the spending plan provides $1.66 billion for the single allocation (total funds), which represents a 3 percent decrease from 2023-24. The reduction is largely due to the decrease in eligibility administration funding (resulting from the expiration of a one-time $55 million augmentation and lower than previously projected caseload in 2023-24), offset by an increase in employment services funding (due to a projected increase in employment services caseload in 2024-25).

Figure 2

CalWORKs Budget Summary

All Funds (Dollars in Millions)

|

2023‑24 |

2024‑25 |

Change From 2023‑24 to 2024‑25 |

||

|

Amount |

Percent |

|||

|

Number of CalWORKs Cases |

348,621 |

354,772 |

6,151 |

2% |

|

Cash Grants |

$4,186 |

$4,305 |

$119 |

3% |

|

Single Allocation |

||||

|

Employment services |

$1,159 |

$1,217 |

$59 |

5% |

|

Cal‑Learn case management |

12 |

12 |

— |

2 |

|

Eligibility determination and administration |

541 |

432 |

‑109 |

‑20 |

|

Subtotals |

($1,711) |

($1,661) |

(‑$50) |

(‑3%) |

|

Stage 1 Child Care |

$550 |

$568 |

$18 |

3% |

|

Other Allocations |

||||

|

Home Visiting Program |

$78 |

$85 |

$7 |

9% |

|

Housing Support Program |

95 |

95 |

— |

— |

|

Expanded Subsidized Employment |

104 |

97 |

‑7 |

‑7 |

|

Family Stabilization |

55 |

71 |

16 |

30 |

|

Mental Health and Substance Abuse Services |

100 |

93 |

‑8 |

‑8 |

|

Subtotals |

($433) |

($441) |

($8) |

(2%) |

|

Othera |

20 |

20 |

— |

— |

|

Totals |

$6,900 |

$6,995 |

$96 |

1% |

|

aPrimarily includes various state‑level contracts. |

||||

Projects Caseload to Grow Following Historic Decline. CalWORKs caseload and costs generally increase during and following economic recessions, and decrease during economic expansions. The public health emergency and subsequent recession caused by COVID-19 represented a deviation from this historic norm, with caseload decreasing from about 360,000 in March 2020 to about 285,000 in the fall of 2021. However, caseload has increased since fall 2021 to over 350,000 in early 2024. The 2024-25 spending plan anticipates this upward trend to continue, with caseload forecasted to average about 355,000 households per month in 2024-25, representing an increase of about 2 percent compared to 2023-24.

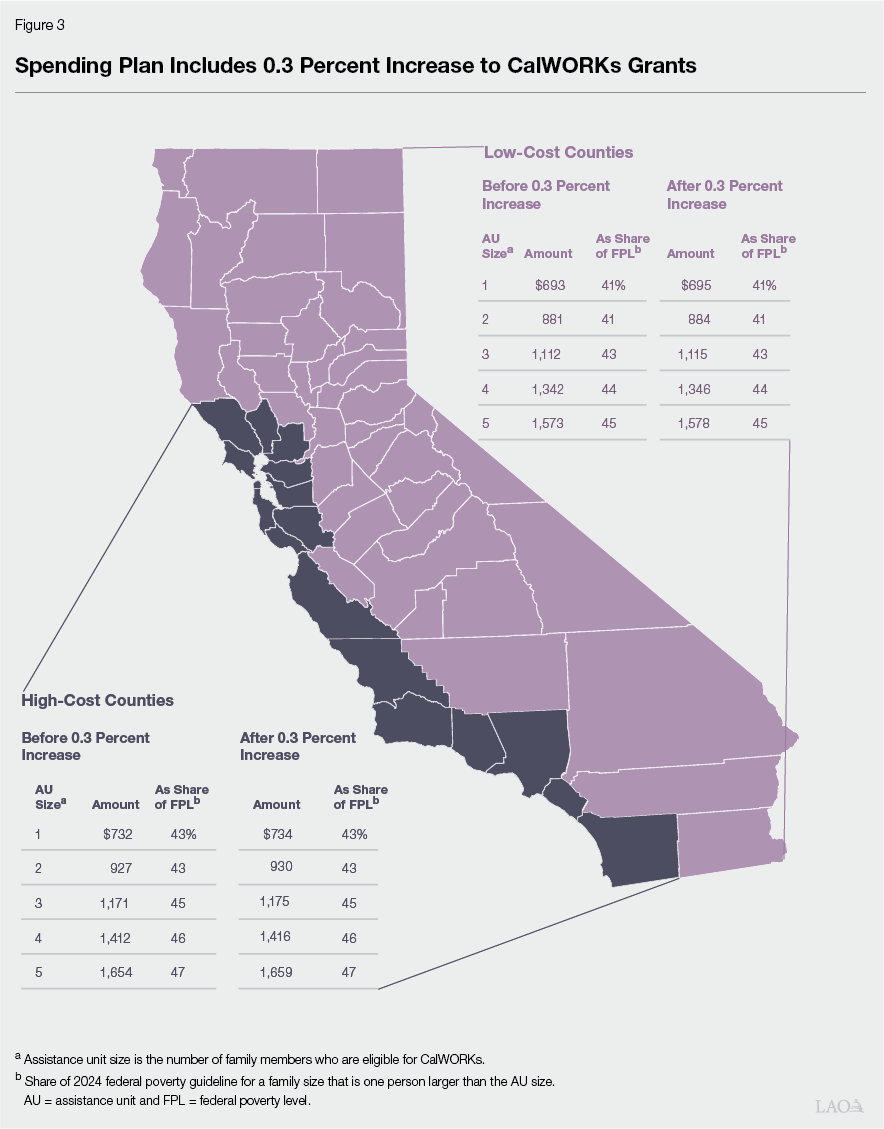

Increases Maximum Monthly Cash Grants. The 2024-25 Budget Act includes $10.5 million for an ongoing maximum grant increase of 0.3 percent, effective October 2024. The 0.3 percent increase will be funded with revenues in the Child Poverty and Family Supplemental Support Subaccount (part of 1991 realignment). Figure 3 shows the 0.3 percent increase will raise grants for all assistance unit (AU) sizes in high-cost counties to between 43 percent and 47 percent of the federal poverty level for a family one person larger than the AU size, and to slightly lower levels for families in lower-cost counties.

CalWORKs Budget Solutions

Enacts Budget Solutions. As our recent publication The 2024-25 Budget: Overview of the Spending Plan notes, this year’s spending plan enacts a number of reductions, delays, and other solutions intended to help balance General Fund revenues and expenditures. Four solutions are in the CalWORKs program. As Figure 4 shows, CalWORKs budget solutions total $146 million in 2024-25. We describe each solution in more detail below.

Figure 4

CalWORKs Budget Solutions

(In Millions)

|

Reductions |

2023‑24 |

2024‑25 |

2025‑26 |

|

Employment services intensive case management |

— |

$47 |

$47 |

|

Expanded subsidized employment |

$30 |

37 |

— |

|

Mental health and substance abuse services |

30 |

37 |

26 |

|

Home visiting program |

30 |

25 |

25 |

|

Totals |

$90 |

$146 |

$98 |

Employment Services Intensive Case Management. Counties receive additional employment services funding through the single allocation for “intensive cases,” or families requiring exceptional support to overcome barriers to employment. According to the administration, in recent years, about 10 percent of CalWORKs cases have been considered intensive. The 2021-22 spending plan provided additional funding to expand the availability of intensive case management and begin increasing the budgeted county staff hours per intensive case (thereby increasing the funding counties received for intensive cases). The number of staff hours budgeted per intensive case was designed to ramp up over four years, beginning at 6.25 hours (per month per case) in 2021-22 and increasing by 1.25 hours (per month per case) annually until 2024-25. In 2023-24, the number of hours budgeted for intensive cases was 8.75 hours (per month per case) and was scheduled to increase to ten hours in 2024-25. The 2024-25 spending plan places an ongoing hold on this increase.

According to the administration, holding the budgeted number of hours at 8.75 hours (per month per intensive case) in 2024-25 and ongoing will result in annual savings of about $47 million General Fund (as compared to what would have been spent with the increase). The spending plan adopts trailer bill language to implement this reduction, making a future increase to ten budgeted hours subject to an appropriation by the Legislature. Counties will receive $472 million for the currently budgeted 8.75 hours (per month per intensive case) in 2024-25 (through the single allocation), which represents a 5 percent increase as compared to most recent 2023-24 estimates. The increase is driven by projected growth in the intensive caseload.

Expanded Subsidized Employment (ESE). The ESE program provides optional funding to counties (above what is provided in the single allocation) for local subsidized employment programs and partnerships. Counties may fully or partially subsidize the wages of some CalWORKs recipients for six months to a year—making it less costly for an employer to hire a CalWORKs participant compared to a non-CalWORKs participant. The 2024-25 spending plan reduces ESE funding on a short-term basis—by $30 million in 2023-24 and $37 million in 2024-25—to hold ESE funding to the approximate 2022-23 spending level. With these reductions, the spending plan provides about $97 million for ESE in 2024-25.

Additionally, the spending plan adopts trailer bill language that requires the California Department of Social Services (CDSS) to include data on ESE employers by county and ESE participant outcomes after program exit in its annual CalWORKs summary (to the extent data are available and reportable).

Mental Health and Substance Abuse Services. Counties receive funding to provide mental health and substance abuse services to CalWORKs welfare-to-work participants to remove employment barriers or facilitate participation in welfare-to-work activities. The spending plan reduces funding for CalWORKs mental health and substance abuse services by $30 million in 2023-24, $37 million in 2024-25, and $26 million in 2025-26. According to the administration, the limited-term reduction is intended to more closely align funds for mental health and substance abuse services to actual utilization of these services and avoid adverse impacts for parents and families served. With these reductions, the spending plan provides about $93 million for CalWORKs mental health and substance abuse services in 2024-25.

Home Visiting Program (HVP). The CalWORKs HVP is a voluntary program that aims to improve the outcomes of CalWORKs participants who are pregnant or have children under 24 months of age through evidence-based home visiting models. The spending plan reduces HVP funding by $30 million in 2023-24 and by $25 million in both 2024-25 and 2025-26. According to the administration, this limited-term reduction is intended to more closely align funds to utilization of HVP services and avoid adverse impacts for families and children served. With these reductions, the spending plan provides about $85 million for HVP in 2024-25.

Modifies Early Action Single Allocation Reversion. The early action package included a partial reversion of $336.6 million in unspent single allocation funds from the 2022-23 Budget Act. However, in May 2024, the administration determined (based on updated expenditure data) the $336.6 million reversion exceeded the amount available for reversion by $136.6 million. Therefore, the spending plan provides an augmentation of $136.6 million (in 2023-24) to address the erosion to the Early Action reversion.

Withdraws $900 Million From Safety Net Reserve. The spending plan withdraws the full balance ($900 million) of the Safety Net Reserve. The administration indicates the withdrawal is to maintain program benefits and services for the Medi-Cal and CalWORKs programs.

Pilot Programs

Provides Funding for Federal TANF Work Outcomes Pilot. The federal Fiscal Responsibility Act of 2023 allows up to five states to participate in a six-year pilot program to test alternative outcome metrics (in lieu of the existing work participation rate). The pilot is expected to launch on October 1, 2024 and states will have the opportunity to apply to participate (see our previous analysis for more information on the pilot). The spending plan requires CDSS, after consulting with stakeholders, to apply to participate in the pilot program; states the Legislature’s intent to continue to reimagine CalWORKs; and authorizes CDSS to consider certain program changes, such as repealing the county share of the federal work participation rate penalty and aligning sanctions with minimum federal requirements. CDSS is required to report to the Legislature by January 10, 2025 with necessary statutory changes and comprehensive cost estimates to implement any policy changes as part of the pilot program. Additionally, the spending plan allows the Department of Finance to increase CDSS’s budget for state operations by up to $2.4 million for associated costs if California is selected to participate in the pilot.

Extends Time Line and Provides Additional Funding for Guaranteed Income Pilots. The 2021-22 Budget Act established and provided $35 million General Fund for Guaranteed Income (GI) pilot programs. CDSS, which oversees the GI pilot programs, awarded grants to seven entities to administer pilot programs providing unconditional, individual, regular cash payments intended to support the basic needs of recipients. CDSS prioritized funding for pilot programs serving California residents aging out of extended foster care at or after 21 years of age or who are pregnant. Originally, the GI pilot was scheduled to end on July 1, 2026. However, the spending plan extends the pilot to January 1, 2028. According to the administration, the extension will help ensure CDSS and the entities administering the pilot programs have sufficient time to complete the pilots and the associated statutorily required evaluation.

The spending plan also approves $5 million one-time General Fund in 2024-25 for new GI pilot programs prioritizing aging Californians. CDSS will use the $5 million to provide grants to entities serving lower-income Californians 60 years of age or older.

Other Efforts

Allows for Increased Homelessness and Housing Data Sharing Across Programs. The spending plan permits the Interagency Council on Homelessness to, upon request, share personally identifiable, individual-level data from the Homeless Data Integration System with an agency or department that is a member of the council for purposes of measuring housing instability and examining the effectiveness of and need for housing, homelessness, and other antipoverty programs in California. All data-sharing shall comply with the Information Practices Act of 1977. The spending plan indicates the Legislature’s intent for this data-sharing to be used to measure point-in-time data and trends in homelessness, housing instability, and utilization of housing services amongst individuals and families in CDSS programs, including CalWORKs.

Requires Updates on Electronic Benefit Transfer (EBT) Card Replacement Time Line. The spending plan includes supplemental reporting language requiring CDSS to provide updates to the Legislature on the schedule for EBT card replacement, how the implementation is minimizing risk for consumers, and the interaction of state and federal funds.